Costing Methods

Assignment 1 – Cost Accounting

DBSM703 – Business Financial Principles and Techniques

13 November 2014

Fringy Costing and Absorption Costing ( Questions 1 & A ; 2 )

Definition.

Fringy Costingis a method for calculating costs which takes into history merely the varying costs involved in the fabrication procedure.Absorption bingis a bing method which considers all costs involved in the production regardless of its nature whether it is variable or fixed cost. ( Averkamp H. , 2014 )

Differences.

The two methods can be distinguished from each other through several noteworthy differences. First is through its cost concentration. Fringy costing is chiefly concerned about variable costs while soaking up bing considers all fixed and variable costs incurred by the organisation through all its activities.

Second, is through its usage. Fringy costing is used by organisations to help them in determination devising and concern planning. Through its elaborate presentation of costs or disbursals, companies will be able to carefully analyze its procedures to assist them place countries for betterment and for entire quality direction. Absorption costing is used chiefly for external fiscal and income revenue enhancement coverage. It is besides a tool for the organisation in showing the existent rating refering its overall operation ( involves stock list, fixed and variable costs, etc. ) to their investors. ( Averkamp H. , 2014 )

Similarities.

Both accounting system are effectual in showing the existent rating of an organisation with respects to its operation by avoiding use and misdeclaration of net income or loss by the company. The two system are besides similar through its intervention of fabrication and non-manufacturing costs.

3. Three Major Influences in Pricing Decision

Customer Demand.

Demand is really of import in all the major concern activities of the company from the sourcing of natural stuffs, merchandise design and fabrication. For illustration, there is a really high demand from clients for high quality public presentation autos. For auto fabrication companies, this demand would imply sourcing high quality stuffs, and more comprehensive production and proving procedure to guarantee merchandise quality which would besides take to higher monetary values. However, it is really of import that despite of the rise in production disbursals, companies should work their best non to monetary value their merchandise above the market for them to stay competitory. To be able to make that, companies need to regularly behavior market research, studies, selling and progress concern planning to assist the company design its fabrication procedure that will enable them to supply quality merchandises at a sensible monetary value. ( Hilton )

Costss.

In most instances, companies monetary value their merchandise based on its production costs. For illustration, in the fabrication of high-quality public presentation autos, the chief determiner of monetary value would be the sum of cost incurred in its production per unit. Again, to stay competitory and guarantee profitableness, the company should find how much markup they are traveling to bear down on top of the production cost and in consideration of other indirect costs involved ( keeping costs, selling and other disbursals ) . ( Hilton )

Actions of Rivals.

To stay competitory, the company should ever be on the sentinel on its rivals activities. In the illustration given above, if a rival lowers down the monetary value of its high-quality public presentation auto, it is really of import that the company do the same to avoid the hazard of losing its portion in the market. However, the company should exert cautiousness in following the actions initiated by its rivals. In this facet, it is really of import for the company to specify its merchandise and highlight its strong points ( engineering and stuffs used, proficient specifications, safety characteristics, etc. ) to separate their merchandise from that of their rivals therefore supplying them certain purchase to warrant their pricing. ( Hilton )

Political, legal and repute.

Legal factorimpact the pricing of trade goods because of the demand for companies to subject to the demands of the jurisprudence. Some concern Torahs were crafted to forestall companies from conspiring among themselves to pull strings monetary values and take advantage of consumers. Examples are the Oil Deregulation Law to forestall forming of trusts by crude oil companies and the Anti-trust Law to modulate competition and prevent monopoly.Political landscapein a state where the concern operates besides straight affects the pricing of goods and services. For illustration, in New Zealand due to the force per unit area brought by the extended lobbying of rights group, environmental and wellness militants the authorities was forced to pass and go through a measure that would enforce higher revenue enhancements on baccy and intoxicant merchandises ensuing to steeper monetary values of the said trade goods.Reputebesides affect merchandise pricing particularly to those companies who have already established a solid repute for bring forthing quality and high public presentation merchandises. Companies like Apple usually set a higher monetary value whenever they launch a new merchandise to the market regardless of competition. ( Hilton )

4. Cost Object

Cost object is an accounting term used to mention to any point or merchandise that has a cost of its ain. The term may be used for points whose cost can be calculated through estimations, direct measuring or market rating. ( Schmidt, 2014 )

Examples of cost object includes:

- Servicess– Car care or fix service that has a specific cost for every service done.

- Merchandise– A bike. The cost for its development, design and production can be measured straight.

- Undertakings– A building undertaking with a specified cost for substructure design and execution.

- Departments– Marketing Department for which the cost of all its activities like promos and advertizement is specified.

( Schmidt, 2014 )

5. Direct and Indirect Cost

Definition.

Direct Costare costs that can be easy linked to a cost object.Indirect Costare costs that are related but can non be easy and accurately linked to the cost object eventhough the cost is incurred in bring forthing the merchandise. ( Jan, 2013 )

There are several factors impacting the categorization of costs. They are Materiality, Function and Information Gathering Technology.

Materiality.

The categorization of costs as direct or indirect depends on the part, relevancy, impact and existent value of the cost to the terminal merchandise. The greater the cost, the easier it is to set up the nexus to the concluding merchandise. ( eFinanceManagement.com, 2014 )

Function.

Another factor that affects the categorization of costs is on how the cost was used in relation to the major concern activities of the company like in research and development, production, distribution, merchandising and disposal. ( Vivekanand, 2014 )

Information assemblage engineering.

The uninterrupted promotion in information engineering paved the manner for the development of package application that helps company easy hint costs. Nowadays, large companies emphasize the importance of information direction and coverage system as an effectual method that enables them to decently follow the smallest of costs. ( eFinanceManagement.com, 2014 )

-

Opportunity Cost

Opportunity costis the income or value that a company or individual gives up in favour of one peculiar determination. ( InvestingAnswers.com, 2014 ) For illustration, in the forenoon you have two picks to assist you kickstart your twenty-four hours. One is to imbibe cup of java or to eat an apple. For you both has its benefits, java for your caffeine demands and apple as a healthy option. You choose java over apple. By taking java, the benefit to your wellness that you can acquire by eating the apple becomes your chance cost.

To avoid what economic experts says as “decision doing pitfalls” , it is really of import for directors to take into consideration chance cost or make a simple cost-benefit analysis in order for them to get at an intelligent determination. ( UKEssays.com, 2014 ) Opportunity cost is besides really of import in assisting companies evaluate their determinations for future considerations particularly when the alternate determination they give up turns out to be the better option. ( InvestingAnswers.com, 2014 )

-

Management By Exception And Variance Analysis

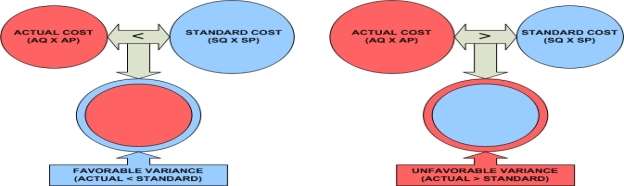

Management by exclusionis a direction manner that focuses on the countries of the organisation whose programs are non working harmonizing to outlook. The end is to supply immediate attending to the job by concentrating company resources like clip, money and attempt to assist them strategically address the issue or job. ( BusinessDictionary.com ) Most companies were able to place specific countries in their concern that are non working harmonizing to program with the aid of discrepancy analysis. Variance analysis is a method used by organisations in finding the difference between the criterion cost and the existent cost. The higher the discrepancy between the criterion and existent cost agencies that an country in an organisation is non executing as planned. ( Ahmed, 2014 )

-

Standard Costing and Its Importance in Planning and Control

Standard Costrefers to the cost determined by the direction based on available information refering direct labour, stuffs and fabricating operating expense. This cost would function as the benchmark for the company’s disbursement in relation to its existent concern operation. Standard costing is really of import because it helps direction in puting their budget, better understand the disbursals that would concern their operation, and most of all for finding its jutting income. During existent operation, standard bing provides an avenue for feedback to the direction in instances where discrepancies arise between the criterion and existent cost. It allows them to instantly concentrate their attending in countries where there are big divergences in existent cost against the standard cost to assist maintain the operation on path and as planned. ( Averkamp H. , 2014 )

-

Discrepancy Analysis and Continuous Improvement

Discrepancy analysis provides information that helps direction step the existent public presentation of different countries in their organisation against outlook. ( AC & gt ; SC = Unfavorable Variance ; AC & lt ; SC = Favorable Variance ) . Unfavorable discrepancy means that if left unchecked the company is most likely non to accomplish its mark. It is really of import for direction to be able to place the implicit in causes of negative discrepancies and instantly implement matching solutions or action to turn to the issue. Through informed determination devising and acquisition from the errors that gives rise to unfavourable discrepancies, the direction will be able to avoid/prevent the same job in the hereafter. Favorable discrepancy usually means that everything is traveling harmonizing to program and if the operation remains on path, the company is good on its manner to accomplishing or even transcending its outlook. However, positive discrepancies still need to be investigated to assist the direction understand the grounds that led to favourable discrepancies and to set in topographic point some steps that will let them to farther better and retroflex their success every bit frequently as possible. ( cba.winthrop.edu )

-

Job Costing V. Procedure Costing

Job Costing is a bing method being used by companies bring forthing alone merchandises where the cost is measured depending on the production demands ( Materials, Labor, etc. ) of each merchandise or unit produced. Procedure Costing is an accounting method used by companies involved in mass production of indistinguishable merchandises and utilizing an established or fixed fabrication procedure where unit cost can be calculated by spliting the entire cost with the entire measure produced. ( Heisinger & A ; Hoyle, 2014 )

The followers are the differences between procedure costing and occupation costing:

- Application.Procedure bing determines the cost of the entire figure of units produced by batch. Job costing is used to find the cost of every merchandise or unit produced.

- Merchandise Cost.In procedure costing costs are assigned to the procedure while in occupation costing costs are assigned to occupations.

- Time Frame.Procedure costing has a period for which costs are accumulated while occupation costing has no clip frame. In occupation costing, costs are computed after each occupation is completed.

- Unit of measurement Cost Information.In procedure costing, units cost is derived based on the production cost study (Entire Cost ( Variable & A ; Fixed ) / Entire No. of Unit of measurements Produced = Unit Cost) . In occupation costing, unit cost is determined based on the entire cost of the occupation per unit.

( Accountlearning.blogspot.co.nz, 2014 ) ( Heisinger & A ; Hoyle, 2014 )

-

Job Cost Sheet

| ABC Toys Pty Ltd | |||||||

| Job Cost Sheet | |||||||

| Job Number | GB 45 | Date Initiated | 1-May | ||||

| Department | Production Department | Date Completed | 15-May | ||||

| Item | Barbie Doll Boxes | Unit of measurements Completed | 200 | ||||

| Direct Material | Direct Labor | Manufacturing Operating expense | |||||

| Req. No. | Sum | Time Sheet No. | Hourss | Sum | Hourss | Rate | Sum |

| 88 | $ 378.00 | 51 | 20 | $ 420.00 | 20 | $ 5.00 | $ 100.00 |

| 92 | $ 80.00 | ||||||

| $ 458.00 | 20 | $ 420.00 | |||||

| Cost Summary | Unit of measurements Shipped | ||||||

| Direct Materials | $ 458.00 | Date | Number | Balance | |||

| Direct Labor | $ 420.00 | 31-May | 100 | 100 | |||

| Manufacturing Operating expense | $ 100.00 | ||||||

| Entire Cost | $ 978.00 | ||||||

| Unit Product Cost | $ 4.89 | ||||||

*$ 978.00/200 Units = $ 4.89 per unit

-

Procedure Costing

| Mixing Department | Bottling Department | Entire Cost | |

| Direct Materials | 17,000 | 5,000 | 22,000 |

| Direct Labor | 5,000 | 1,000 | 6,000 |

| MOH | 10,000 | 2,000 | 12,000 |

| Entire Production Cost | 32,000 | 8,000 | 40,000 |

| Unit of measurements produced | 1,250 Liters | 5,000 Bottles | |

| Cost per bottle | $ 8.00 |

40,000/5000bottles = $ 8.00 / bottle

- SMK Pharmaceutical production cost for April

| Debit | Recognition | |

| Inventory- Mixing Dept

Natural Materials Wagess MOH

Inventory- Bottling Dept Natural Materials Wagess MOH

Inventory-Finished goods WIP |

32000

8000 40000 |

17000

5000 10000 5000 1000 2000 40000 |

13. Duty Centre

A duty Centre is a unit in an organisation tasked with a specific set of responsibilities to assist the organisation efficaciously exercising control over their concern and to assist them accomplish both their long term and short term end. Normally there are four duty centre in every organisation ( Cost Center, Profit Center, Revenue Center and Investment Center ) . Each centre is headed by a director. ( Barnat, 2014 )

Cost Center.A cost Centre is responsible for pull offing costs. There are two type of cost under cost Centre. They are Engineered Cost and Discretionary Cost Centre. Engineered costs are those cost that can easy be linked with the cost Centre ( direct labour, direct stuffs and fabricating operating expense ) . Discretionary costs are costs that are allocated by the direction on a discretional footing ( administrative cost, research and development, allowances, etc.) ( Barnat, 2014 )

Net income Centre.The net income Centres are like independent concerns within the organisation. They are given autonomy in pull offing their ain personal businesss from the strategic reconciliation of gross revenues and disbursals up to executing a more elaborate direction map like assisting maintain quality, mensurating employee’s productiveness against pay, pull offing overhead disbursals and everything that they can command within their unit. ( Barnat, 2014 )

Gross Centre.The exclusive duty of gross Centre is to bring forth gross for the company through gross revenues of goods or services. Most organisations set periodic gross revenues mark ( day-to-day, hebdomadal, monthly, etc. ) that whether surpassed or missed service as an index of the public presentation of the unit director or the gross Centre. An illustration of gross Centres are the mercantile establishment stores by fabricating companies. The chief focal point of these stores is to sell company merchandises with small or no consideration at all on costs and selling. ( Wikipedia.org, 2014 )

Investing Centre.The duty of Investment Centre is to bring forth returns of investing through effectual plus direction, increased gross revenues public presentation and the proper direction of cost and disbursals.

Bibliography

- Accountlearning.blogspot.co.nz. ( 2014 ) . Retrieved November 12, 2014, from Accountlearning.blogspot.co.nz: hypertext transfer protocol: //accountlearning.blogspot.co.nz/2010/10/differences-between-process-costing-and.html

- eFinanceManagement.com. ( 2014 ) . Retrieved November 9, 2014, from eFinanceManagement.com: hypertext transfer protocol: //www.efinancemanagement.com/costing/costing-terms/211-direct-and-indirect-costs

- InvestingAnswers.com. ( 2014 ) . Retrieved November 9, 2014, from InvestingAnswers.com: hypertext transfer protocol: //www.investinganswers.com/financial-dictionary/stock-market/opportunity-cost-2560

- UKEssays.com. ( 2014 ) . Retrieved November 9, 2014, from UKEssays.com: hypertext transfer protocol: //www.ukessays.com/essays/economics/the-importance-of-opportunity-cost-in-decision-making-economics-essay.php

- Wikipedia.org. ( 2014 ) . Retrieved November 10, 2014, from Wikipedia.org: hypertext transfer protocol: //en.wikipedia.org/wiki/Management_by_exception

- Wikipedia.org. ( 2014 ) . Retrieved November 14, 2014, from Wikipedia.org: hypertext transfer protocol: //en.wikipedia.org/wiki/Revenue_center

- Ahmed, S. ( 2014, March 31 ) .Accounting4Management.com. Retrieved November 2014, 2014, from hypertext transfer protocol: //www.accounting4management.com/variance_analysis_management_by_exception.htm

- Averkamp, H. ( 2014 ) .AccountingCoach.com. Retrieved November 12, 2014, from AccountingCoach.com: hypertext transfer protocol: //www.accountingcoach.com/standard-costing/explanation

- Averkamp, H. ( 2014 ) . www.accountingcoach.com. Retrieved November 7, 2014, from www.accountingcoach.com: hypertext transfer protocol: //www.accountingcoach.com/blog/absorption-costing

- Barnat, R. ( 2014 ) .Strategic-Control.24xls.com. Retrieved November 13, 2014, from Strategic-Control.24xls.com: hypertext transfer protocol: //www.strategic-control.24xls.com/en204

- BusinessDictionary.com. ( n.d. ) . Retrieved November 12, 2014, from BusinessDictionary.com: hypertext transfer protocol: //www.businessdictionary.com/definition/management-by-exception-MBE.html

- cba.winthrop.edu. ( n.d. ) . Retrieved November 12, 2014, from cba.winthrop.edu: cba.winthrop.edu/alvisc/acct.309/spring2009/costacctg13_sm_ch07.doc

- Heisinger, K. , & A ; Hoyle, J. ( 2014 ) .Cataog.FlatworldKnowledge.com. Retrieved November 12, 2014, from Cataog.FlatworldKnowledge.com: hypertext transfer protocol: //catalog.flatworldknowledge.com/bookhub/reader/4402? e=heisinger_1.0-ch04_s01

- Hilton, R. W. ( n.d. ) . www.inkling.com. Retrieved November 9, 2014, from www.inkling.com: hypertext transfer protocol: //www.inkling.com/read/managerial-accounting-ronald-hilton-9th/chapter-15/major-influences-on-pricing

- Jan, I. ( 2013 ) .Accountingexplained.com. Retrieved November 9, 2014, from Accountingexplained.com: hypertext transfer protocol: //accountingexplained.com/managerial/costs/direct-and-indirect-costs

- Schmidt, M. ( 2014, November 4 ) . www.business-case-analysis.com. Retrieved November 9, 2014, from www.business-case-analysis.com: hypertext transfer protocol: //www.business-case-analysis.com/cost-object.html

- Vivekanand. ( 2014 ) .Scribd.com. Retrieved November 9, 2014, from Scribd.com: hypertext transfer protocol: //www.scribd.com/doc/16651347/CAS-1-Classification-of-Cost