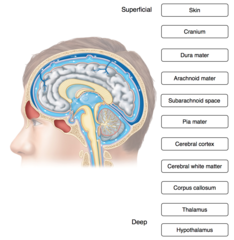

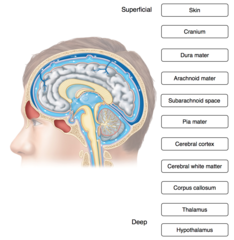

Place the following items associated with the brain in order from superficial to deep.

Complete each sentence describing the structures and functions of the cerebrum.

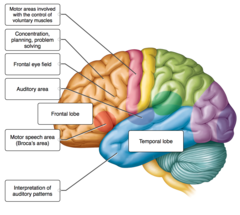

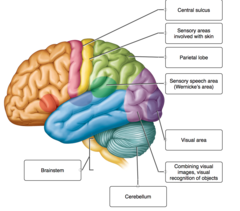

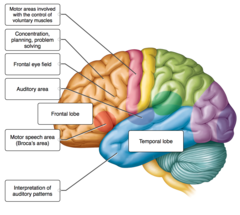

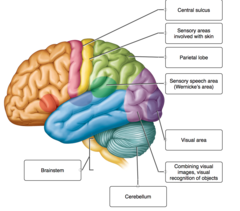

Consider a situation in which a stroke or mechanical trauma has occurred, resulting in damage one of the areas of the brain indicated in the image. Drag and drop each label, identifying the cerebral area that, if injured, would result in the functional disturbance described.

The labels list functions of various areas of the cerebrum. Place each label on the appropriate cerebral lobe.

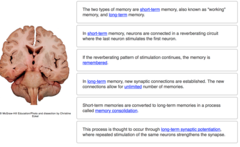

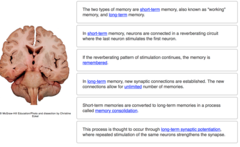

Complete the following sentences describing various aspects of memory.

The limbic system interprets sensory impulses from the receptors associated with which sense?

smell

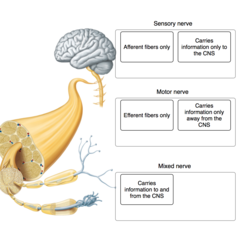

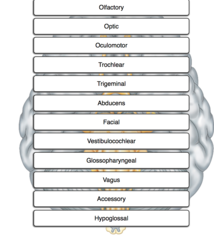

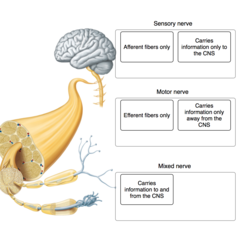

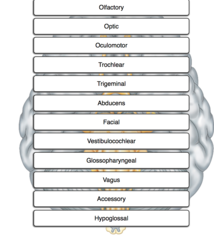

Determine whether the following descriptions apply to sensory nerves, motor nerves, or mixed nerves (both sensory and motor).

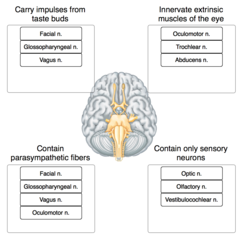

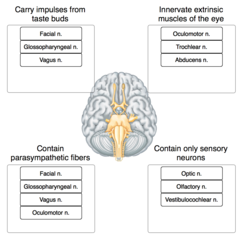

Place each cranial nerve label in the appropriate category, describing its function.

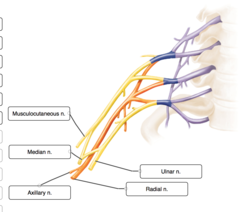

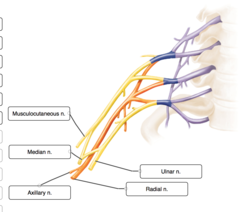

Label the terminal branches of the brachial plexus.

Label the structures of the central nervous system and their protective structures.

Complete the sentences describing the ventricles and spaces associated with CSF in the central nervous system.

Label the internal structures of the cerebrum and other major parts of the brain.

Label the indicated lobes of the cerebrum and the functional areas of the cerebral cortex.

Label the indicated brain structures, cerebral lobes, and functional areas of the cerebral cortex.

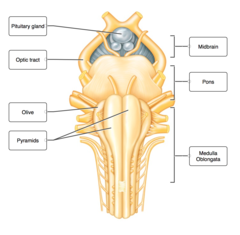

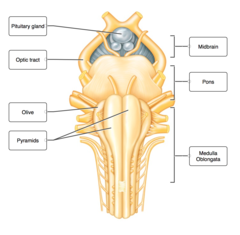

Label the anterior view of the brainstem.

Label the posterior view of the brainstem.

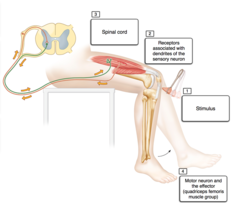

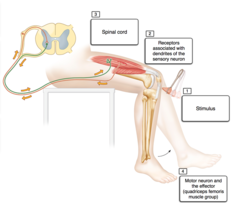

Place in order the structures and/or events associated with the patellar reflex.

Place cranial nerves in numerical order, beginning with cranial nerve (CN) I.

The image depicts an example of the autonomic nervous system and an example the somatic motor system. Identify each of the examples. Then, for each label, determine whether it describes the autonomic nervous system or the somatic motor nervous system, and drag it into the appropriate box .

The labels list functions associated with one of the two branches of the autonomic nervous system. Drag and drop each label into the appropriate box, identifying which division of the autonomic nervous system is responsible for the given function.

Label the general pattern of neurons and neurotransmitters associated with the autonomic nervous system.

The medulla oblongata is continuous caudally with the

Spinal cord

The primary function of the cerebellum is

Coordination of motor activity

Emotional responses are regulated in the

Hypothalamus

Respiration is regulated in the

Medulla oblongata

Gyri are characteristic of the

Cerebrum

Which meningeal layer follows the surface contours of the brain and spinal cord?

Pia mater

Separation of the periosteal and meningeal layers of dura mater forms

Dural venous sinuses

The subarachnoid space lies between the

Arachnoid mater and pia mater

The periosteal layer of dura mater is adherent to the

Inner surface of the skull

The subarachnoid space contains

Cerebrospinal fluid

Simple spinal reflexes occur independent of the brain.

True

Sensory stimuli enter the spinal cord via

Afferent axons

A simple spinal reflex typically involves how many neurons?

3

Interneurons are located in the

Spinal cord

Sensory receptors are found

Throughout the body

Aging of the brain begins

before birth.

Most cerebrospinal fluid is secreted from the choroid plexuses in the

lateral ventricles.

The simplest level of CNS function is the

spinal reflex.

A traumatic brain injury (TBI) results from

mechanical force.

The function of the cerebral association areas is

all of the above.

Melinda has Parkinson disease. Her movements are slowing and she has difficulty initiating voluntary muscular actions. The region that is affected in her brain is the

basal ganglia.

Basal ganglia are located in the ______ and ______.

deep regions of the cerebral hemispheres; aid in control of motor activities

Which of the following terms and definitions is correct?

Cerebral cortex-a thin layer of gray matter forming the outermost part of the cerebrum

Cerebrospinal fluid

all of the above.

The central nervous system (CNS) consists of

the brain and spinal cord.

The fourth ventricle is in the

brainstem

The part of the brain that coordinates voluntary muscular movements is the

cerebellum

Over the course of several months, Morris has experienced difficulty speaking coherently, clumsiness, muscle fasciculations, and increasing weakness in his limbs. These symptoms are most consistent with those of

amyotrophic lateral sclerosis.

Which lobe of your brain are you using when you answer this question?

Frontal

Spina bifida is a(n)

all of the above.

If the area of the cerebral hemisphere corresponding to Broca’s area is damaged,

motor control of the muscles associated with speech is lost.

Brain waves are recordings of activity in the

cerebral cortex.

The consequence of sensory nerve fibers crossing over is that the

right hemisphere of the cerebrum receives sensory impulses originating on the left side of the body and vice versa.

Aphasia is loss of the ability to

speak

Injury to the visual cortex of the right occipital lobe can cause

partial blindness in both eyes.

Which of the following are descending tracts in the spinal cord?

Rubrospinal

A lumbar puncture is

a test of the pressure that the cerebrospinal fluid is under.

Bob witnesses an auto accident and impulses from the ___________ division of the autonomic nervous system increase his heart rate.

sympathetic

Cerebrospinal fluid is produced by ______ and it __________.

choroid plexuses in the ventricles; protects the brain from blows to the skull

Remember! This essay was written by a student

You can get a custom paper by one of our expert writers

Order custom paper

Without paying upfront