Introduction to Strategy Management

Strategy direction is defined as the organisation is analyze, do determinations and take actions in making and prolonging competitory advantages in the market. In doing a new scheme or keep old scheme to accomplish the missions or ends in order to last at competitory and globalize universe, the organisation or the director demand to entree and roll up micro and macro environments information for analyze it. After analyzed the concern environments, the organisation or the director will do determinations or set up new be aftering or new scheme based on the result of analysis so take actions to accomplish the missions or ends.

Business environment is of import to the organisation in analyze and entree for research intent in the competition rival houses. Aswathappa ( 2009, p. 6 ) indicates competition benefits rival houses will construct new capableness, new client satisfaction criterions and do the leaders in the organisation go proactive in planning and accomplishing the mission or mark.

At this clip, the assignment’s inquiries will be covered Public Bank Group’s mission, scheme, construction and its competition with compared other two banks’ competition. The Public Bank Group is founded by Tan Sri Dato’ Sri Dr. Teh Hong Piow at 1996. Over 47 old ages, now it is become the 3rd largest banking group in Malaysia and listed on the Main Board of the Bursa Malaysia Securities with the market capitalisation of RM68.67 billion at the terminal of 2013. Besides, The Public Bank Group is ranked as 2nd among all public listed companies on the Bursa Malaysia Securities. The concerns of The Public Bank Group is concentrating on the retail consumer banking concern with taking market portions in funding for residential belongingss, commercial belongingss and rider vehicles in term of selling the unit trust financess. ( Annual Report Public Bank, 2013, p. 17 )

In Section 1 is to analyse the linkage between mission and scheme of the Public Bank Group implemented. In Section 2 is to entree the organisational construction of The Public Bank Group’s subdivision at Jalan Yang Kolsam in how effectual of the construction to present the construction and service to clients. In Section is to entree, analyze and sort the competition arise between Public Bank, Maybank and RHB. In Section 4 is present elaborate decision and recommendations to the Public Bank Group for betterment on their scheme and planning in order to accomplish the corporate mission.

Mission and Strategy of Public Bank Group

Entrepreneur in its website provinces that mission is a sentence or a short written statement to depict the company’s competitory advantage, concern ends and doctrines. ( 2014, pp. 1 ) A good mission can guarantee and assist employees to understand the doctrine, ends and aims of the organisation they are worked at and this lead good public presentation of employees in the present and future. Meanwhile, the scheme that established by the organisation will assist the employee to heighten their planning in accomplishing the mission. As stated by D. Flouris and L. Oswald ( 2006, p. 1 ) , before the scheme is established, it is influenced by outside forces every bit good as internal values, the company’s civilization and besides its capablenesss.

Mission of Public Bank Group

As stated in Annual Report of The Public Bank Group ( 2013, p. 5 ) , the mission of Public Bank Group is ‘To prolong the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia’ .

Strategy used by The Public Bank Group

The scheme of The Public Bank Group used is growing scheme which is corporate scheme. In Public Bank Homepage stated in page of Corporate Profile ( 2014, pp. 10 ) described that The Public Bank Group’s growing scheme is aim to drive concern growing and increase its market portion in retail banking by delivered consistent service to run into the demands of its clients with well-established client service substructure. Brinkman et Al. ( 2010, p. 48 ) defined the growing scheme is the purpose to increase the sum of concern by spread outing the market it serves.

To run into client demands, the Public Bank Group has been used internal development as their manner of deliver scheme to their staffs by supplying preparation in order to accomplish mission of the Public Bank Group. In fact, the bank has been organized the particular preparations to over 90 % of client service representatives at the front office. ( Public Bank 2007 Annual Report, 2007, p. 11 )

The non-executive president of the Public Bank Group, Tan Sri Dato’ Sri Dr. The Hong Piow stated that ( cited in Public Bank 2013 Annual Report, 2013, p. 77 ) the front office staffs are specially trained, the clients are merely need to wait the counter responds to them for 2 proceedingss which the criterion set by the Public Bank Group to present services. In fact, the Public Bank Group is awarded and certified fiscal establishment under ISO 9001:2008 for the “Provision of Customer Service in Loan Delivery” and “Provision of Customer Service at Front Office” .

The ISO 9001:2008 which is client service bringing criterions that awarded to the Public Bank Group is showing the ability of the bank itself is functioning their clients with systematically and high service quality. Consequently, the Public Bank Group and its full subdivisions wherever there are located besides supplying a good confidence to their client who anticipating high systematically of client experience while they are come ining the subdivisions to acquire service. Continuous preparation and staff development plans provided by the bank will maintain the accomplishment to be uphold in the competitory border.

Summary of the linkage between mission of and scheme of the Public Bank Group

As a consequence, the Public Bank Group has been achieved ISO enfranchisement for their high quality of client service which the scheme established for client delay for 2 proceedingss standard for the service from the front office staffs where this is efficient and the high client satisfactions lead them to accomplish another award as Most Profitable Company in the Finance Sector 2013 and 2011 ( Public Bank 2013 Annual Report, 2013, p. 47 ) where this is one of the Public Bank Group’s mission as ‘to sustain the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia’ .

Organizational construction design of The Public Bank Group

Making an organisational construction is an of import portion on presenting the scheme or communicating with efficaciously. Hull in Forbes web sites province that it’s of import for enterprisers or the concerns to make a defined construction at the early, even if the concern is merely one adult male store. ( 2013, pp. 3 )

In fact, organisational construction will assist we all to understand assorted occupation descriptions no affair there is merely one adult male store or many employees in an organisation. Besides, it helps the determination shaper won’t design an organisational construction where the place rubric or occupation descriptions clash together. Defined and clearly organisational construction is to guarantee all employees can see the image as a whole and make back their ain functions and duties.

An effectual organisational construction will ease intrapreneurship between employees and employers. Besides, the effectual organisational construction besides helps lucubrate effectual scheme for the sections or units to accomplish the mission or ends with expected consequence. ( Varbanova, 2013 ) The design of organisational construction besides impacting the line of authorization and communicating between disposal officers and officers. ( Sekhar, 2010, p. 72 )

Organizational construction design consist of six elements which are specialisation, departmentalization, concatenation of bid, span of control, grade of centralisation and formalisation.

Customer Structure of Public Bank Branch Jalan Yang Kalsom

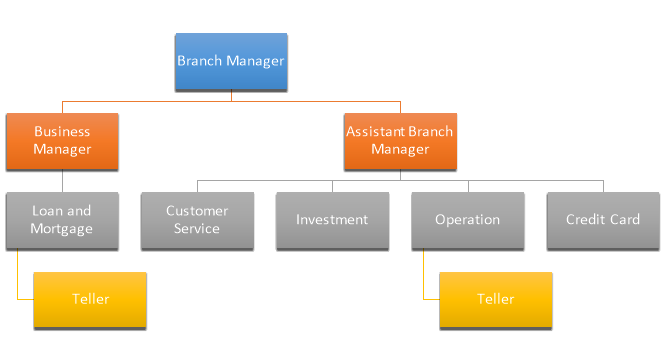

Organizational construction that used by Public Bank subdivision at Jalan Yang Kalsom, Ipoh, Perak is client construction chart. Harmonizing to Brinkman et Al. ( 2010, p. 80 ) , they indicate a client construction is designed and organized based on the client. This client construction besides called as market construction, it allows the directors responsive to the demands or demands of clients and give authorization to let directors make determination in response to customers’ altering demands. ( Chapter 10 Managing Organizational Structure and Culture, n.d. )

Figure 1:Customer construction of Public Bank Branch at Jalan Yang Kalsom ( Own Adaptation, 2014 )

As illustrated on above, subdivision director is ranked highest place in the Public Bank Branch Jalan Yang Kalsom. The subdivision director will in-charge the concluding determination for the way and planning for the peculiar subdivision. Following, will be the concern director and helper subdivision director.

Business Manager is in-charge on the loan and mortgage unit. In the other manus, Assistant Branch Manager is in-charge on the client service unit, investing unit, operation unit and recognition card unit. For an illustration, a client will use loan for his house so the client will be served by officer at loan and mortgage unit. This will take the high satisfaction of client which stimulated houses to seek for more originative ways to function client better.

The advantages of client construction chart are helps the organisation to develop a better apprehension of the clients and the types of client that functioning and this enable the organisation to hold better run intoing the demands of clients. In order to run into the demands of client, the employee of Public Bank is concentrating on their ain section where will convey more effectual and efficient of servicer bringing.

Besides, the client construction chart enables the organisation to react the inquiries or questions from client with faster velocity. With the faster respond to the questions from client will convey high client satisfaction with high outlook, so that this besides run intoing the aims and mission that practiced by The Public Bank Group.

This type of construction, client construction chart is suited to be used in subdivisions with assorted clients where they can merely concentrate on their clients with high velocity of reacting. This besides enables employee authorization to line staff or front office staff to do determination in reacting on the changing of client demands and penchant of clients.

Summary of Customer Structure Chart of Public Bank

As presented by Public Bank Group, they are utilizing client construction chart in their subdivision at Jalan Yang Kalsom. One of the advantages of client construction chart can enables directors or front office staffs to react the altering demands of clients and this let Public Bank Group achieved its corporate doctrine where Public Bank Group are cares their client by supplying gracious and efficient client service in every facets of their concerns. By authorising front office staffs to do determination in reacting the demands of client besides brings originative and advanced solutions to work out jobs or questions.

Competition arise between Public Bank Group, Maybank and RHB Bank

In this subdivision, I will utilize Michael Porter’s Five Forces theoretical account to entree and analyse the competition arise between Public Bank, Maybank and RHB Bank with five elements. Brinkman et Al. ( 2010, p. 185 ) argues the five elements of Michael Porter’s Five Forces theoretical account are rivalry among bing rivals, menaces of new entrants, dickering power of providers, dickering power of purchasers and menace of replacement merchandises or services. The account of each component is described as follows:

- Menaces of new entrants:New entrants of an industry will convey new capacity and a desire to derive market portion which will set force per unit area on the current market to set more attempts in investing to cut down the market portion being shared by new entrants and convey competition to the market.

- Dickering power of providers:The powerful provider able to capture their ain values to the company by bear downing higher monetary values on the natural stuffs and switching costs to the peculiar industry or company. Powerful provider besides can squash profitableness out of industry which is unable to increase its ain monetary values freely. The providers for Bankss are recognition market or depositors which save their money in the bank salvaging histories.

- Dickering power of purchasers:Powerful clients are opposite of powerful provider which able to capture more their ain values to the company by coercing down the monetary values of the merchandises or services and able to demand higher quality or services. Buyers are powerful when they have the negotiating purchase which related to the industry because purchasers are the 1 who sensitive with the monetary values. The purchasers for Bankss are loaner, creditors and public which borrow money from Bankss and return money to the Bankss by installment with involvement charged.

- Menaces of replacement merchandises or services:A replacement merchandises or services are executing the same or similar map as industry merchandise but with different agencies. For illustration, electronic mail is a replacement for express mail. WeChat voice message is a replacement for call service provided by telecommunication company.

- Rivalry among bing rivals:Ad runs, monetary value discounting, service betterment and launching or publicity of new merchandises is familiar signifiers in competition among bing rivals. Slow growing of industry is precipitating the competition for the markt portion and the profitableness of a company is depending on strength of compete and the footing of way or ends to vie.

Table 1:Michael Porter’s Five Forces Model for Public Bank, Maybank and RHB Bank ( Own Adaptation 2014 )

| Elements/Banks | Public Bank | Maybank | RHB Bank |

| Menaces of new entrants | I’m presume it is low which authorities did non put any barrier or policies for any fiscal establishment so any Bankss are easy to perforate into the industry. | ||

| Dickering power of provider | Low unless there is better service or involvement on nest eggs is higher than Public Bank. | Low | Low |

| Dickering power of purchasers | Low | Low | Low |

| Menaces of replacement merchandises or services | There are same replacement which same merchandises or services are offered by three Bankss. | ||

| Rivalry among bing rivals | High with awarded ISO enfranchisement of client satisfaction criterion and awarded most profitable bank in Malaysia at 2013. | Low | Low |

Summary of competition arise between Public Bank, Maybank and RHB Bank

As illustrated on Table 1, Public Bank has the nucleus competences with ISO enfranchisement of client service criterion and most profitable bank in Malaysia at 2013. I’m assume the scheme used by Public Bank is better than Maybank and RHB Bank as Public has a batch of awards for its accomplishment in banking industry by functioning client within their outlook and high client satisfaction besides.

Conclusion and Recommendations for Public Bank Group

Galavan, Murray and Markides argues that concern environment in which rapid alterations in globalisation of markets are making communities of clients. ( 2008, p. 131 ) In fact, it is same as The Public Bank Group where the top direction will entree all the micro and macro environments to analyse in order to set up a new and good scheme for achieve the mission.

In Section 1, the growing scheme used by The Public Bank Group is aim to run into their client demands and satisfaction and there is an accomplishment to the corporate mission which is ‘To sustain the place of being the most efficient, profitable and respected premier fiscal establishment in Malaysia’ . The award of most profitable bank in Malaysia at 2013 and ISO 9001:2008 which is client service criterion is the result after they have offered particular preparation to over 90 % front office staff in reacting questions from client within 2-minute.

In Section 2, the client construction chart brings a batch of advantages to the Public Bank Group where it is authorising their staff to work out and straight to react to the altering demand of client demands with creatively and innovatively. By making so, the construction besides able to present their scheme which to run into client demands with gracious and efficient.

In Section 3, there is low competition arise between Public Bank, Maybank and RHB Bank where Public Bank is achieved so many awards by comparing to Maybank and RHB Bank.

Last, the recommendation for The Public Bank Group is to maintain puting on their research and development on their service in order to keep and prolong the best client service in accomplishing the mission.