What is an oligopoly?

In the harsh, unsympathetic universe of concern, business communities and adult females everyplace seek to maximise his or her net incomes. Therefore, it would be really much of their involvement to hold greater control over the goods or services which they produce. Bigger and more constituted companies would frequently weigh a much broader spectrum of influence to command market monetary values, driving other new or approaching companies to go forth the industry all together and detering other interested 1s. Competition is restricted merely between those few big companies. This is an economic world bing in our universe today called oligopoly.

The online Oxford lexicon defines oligopoly as a province of limited competition, in which a market is shared by a little figure of manufacturers or Sellerss. Oligopolistic houses offer indistinguishable or homogeneous merchandises, such as gasoline ; but these companies may besides bring forth differentiated merchandises that may be similar in nature but differ in physical every bit good as qualitative facets, like gym shoes. These many merchandises can be identified in the market by an clever thought called stigmatization. For case, the market for gasoline in Malaysia is controlled by Petroliam Nasional Berhad ( National Petroleum Ltd. – PETRONAS ) , every bit good as other foreign companies like Shell and Caltex ; while Nike, Adidas and the likes control the market for gym shoes. In world, because of the limited figure of manufacturers, their actions would convey significant consequence to the balance of the market. These companies may move together as an entity in a whole to organize a monopoly – take downing their productions while raising the monetary values above fringy cost, or they make determinations independent of each other ( moving as a competitory market ) . Therefore, a cardinal characteristic of oligopoly is the tenseness between cooperation and opportunism.

Factors of success for a collusion

The many individualistic elements of an oligopolistic market may or may non do an understanding, whether unfastened or silent, about the measures to bring forth or monetary values to alter. When this agreement is made, it is called a collusion ; and the group of companies conspiring amongst each other may be called a trust. Once the understanding is made, the trust efficaciously maps as a monopoly, and would so necessitate to make up one’s mind on two of import factors – efficiency and equality, sing to the nature of their cooperation ; in order to guarantee their success. In general, there are many factors that would find the result of a collusion. There must be limited figure of houses ; houses must besides be every bit efficient ; and the colluding houses must successfully rule a defined market.

The ability to modulate monetary values among the assorted members of the trust depends on the figure of houses in engagement. Technically talking, coordination is more hard among larger figure of single constituents. Successful monetary value repairing depends on the synchronism between the houses to efficaciously set and apportion merely desirable degrees of resources to their end product, and this can be done successfully when the figure of houses is little. Besides that, it is much more hard to observe a deserter among the ranks when the figure of houses rises. For case, if of all time Northrop, Boeing and Lockheed formed a trust to monopolise the air power industry in the US, a important addition in one company ‘s production degree would in bend addition well the trust broad end product excessively. Therefore, the ‘traitor ‘ is easy identified. Compare this to state a collusion of clothe companies ( there are likely 100s, or even 1000s in the US entirely ) – even a important rise in one house ‘s production degree would barely do a bump in the trust broad end product. On the other manus, successful collusion requires a notable sum of communicating between the assorted administrative members of each house. A larger figure of houses would do this progressively hard and hazardous ( particularly for a silent collusion ) as the chance of being detected by a 3rd party rises excessively. In a theoretical facet excessively, the monetary value of goods would fall farther with an addition of manufacturers. Therefore, monetary values would discontinue to be of oligopolistic nature – that is lower than the monopolistic but above the fringy cost – and near the competitory market ‘s degree.

For a collusion to be successful, it would be better for all the members of a trust to be of equal quality, efficiency and size. Other things being equal, houses with lower efficiency – that is with a higher production cost – would surely desire to take down production and raise monetary values as to maximise net income. Therefore, even if there is a committedness in topographic point, the inequalities experienced by houses in a trust would decidedly bring on some of them to rip off. The same construct applies in relation to the companies ‘ size. By and large, if the houses conspiring with one another are of equal size, they would by and large wish to apportion resources on an indistinguishable graduated table ; and same to for a larger house. However, smaller houses prefer a pro rata construct, which is an unconditioned decrease for the larger houses ‘ portion. This would bring forth an chance for a difference to originate.

Collusion among houses is besides easier when there is merchandise homogeneousness. When the goods or services produced by those companies are similar, competition is merely limited to these houses and therefore, would profit them straight. As an illustration, compare a trust between Nike and Adidas with a trust between the former with Calvin Klein. While the first group is a collusion between athleticss footwear manufacturers, the latter is between a athleticss footwear with a formal footwear manufacturer. In these instances, grounds would indicate that the first collusion would be more successful than the 2nd 1. There is more coordination between manufacturers of homogeneous merchandises because the demand for these goods are alone to that specific industry. On the other manus, collusions between manufacturers of heterogenous would non work out that good because there are different demands for the goods sold. Hence, the mark market is dissimilar and coordination is instead hard to happen in two separate and alone audiences.

The snap of the goods or services produced can besides find the result of a collusion. In general, the goods or services provided by the houses in a trust must be inelastic. When there are no close replacements for a peculiar merchandise, and consumers can non easy alter their purchasing penchants, the consequence would be that the oligopolistic houses can profit well when a collusion is made and the goods ‘ monetary values rise above the competitory degree. This can be reflected in the $ 150 million investing of Microsoft in non-voting portions of Apple in 1997. Although this is seen as a legitimate concern trade between the two elephantine computing machine runing system bring forthing companies, this factual history can explicate why inelastic goods would take to a successful collusion. Operating systems for computing machines are comparatively really inelastic, contributed by the fact that there is a roar in the figure of computing machine users in the US ( and so, the universe ) but merely a smattering of runing systems to take from. Therefore, when Microsoft ‘helped ‘ Apple, computing machine users can non easy change their pick even when the monetary values rose. In describing its financial 1998 first-quarter fiscal consequences, Apple clocked in a net income of $ 45 million and its stocks rose 20 % , while Microsoft, already the most popular and preferable pick of operating system, got a immense encouragement in public dealingss.

Effectss of oligopolies on public involvements

By and large talking, a trust of oligopolistic houses has many negative impacts towards the consumers. This happens because as a trust, the houses efficaciously behave much like a monopolistic entity and hence, retain much of the unwanted elements of a monopoly.

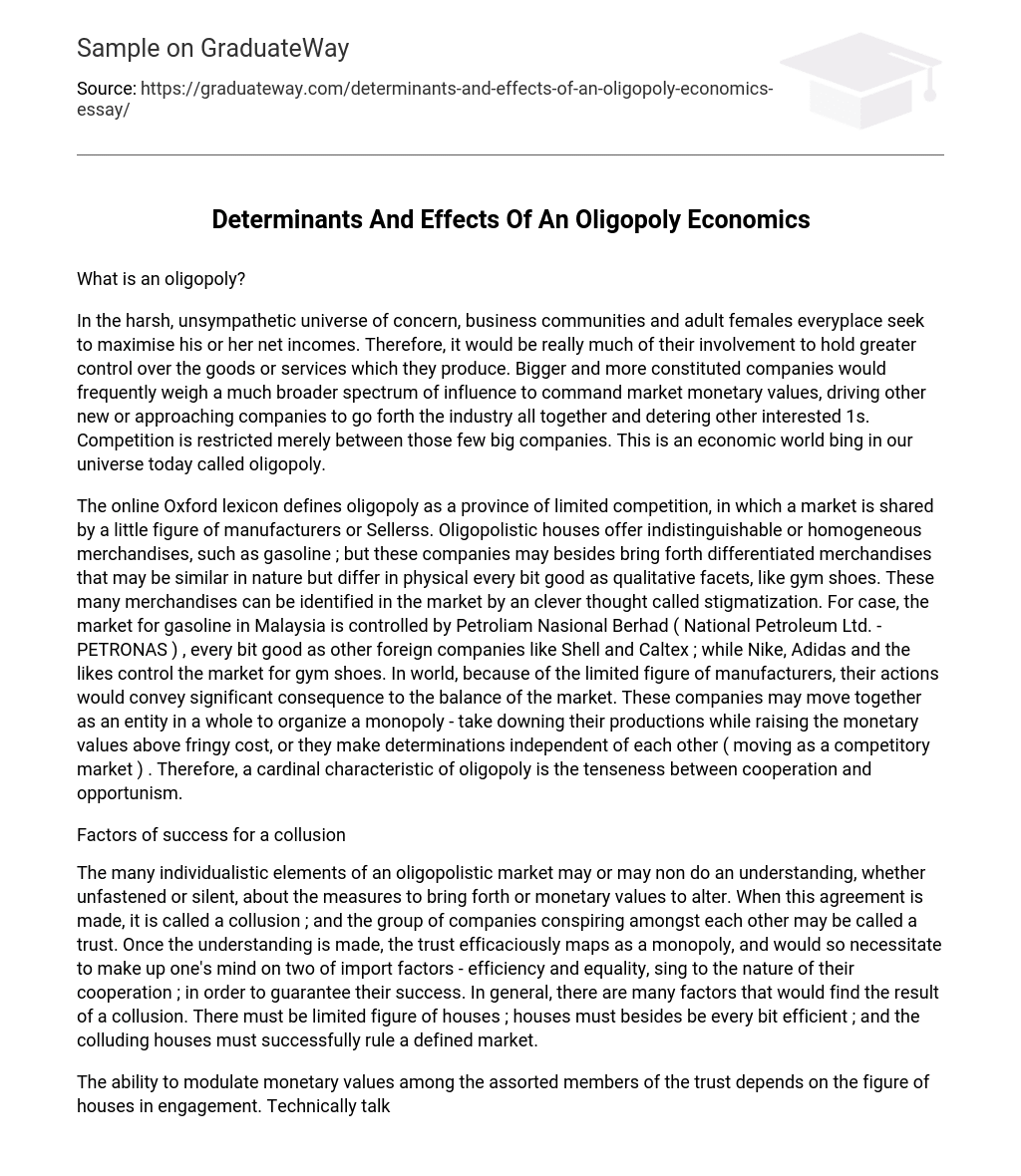

First, monetary values are overcharged beyond the market degree whenever a collusion is formed. The monetary value would usually be above the fringy cost, but below the monopolistic degree. Therefore, houses normally would have supranormal net incomes compared with the zero economic net incomes they would hold earned if they remained absolutely competitory. Look at the graph below:

oligopoly.jpg

The oligopolistic houses would take an end product degree where their combined fringy gross peers their combined fringy cost. The monetary value is so determined by the market demand of the same end product degree. The net income received by the companies is the country of the rectangular box ‘abcd ‘ . Therefore, like a monopolistic house, the monetary values concurred would really be a load to the general populace. Wagess of the populace, where most would be in the middle-income group, are normally dead in the short-run. Thereby, the populace would sometimes necessitate to do uncomfortable accommodations to their lives to do make with the rise in monetary value of a normally inelastic demand ; as what we can and often see whenever OPEC ( Organization of the Petroleum Exporting Countries ) raises the monetary value of oil.

In add-on, whilst the monetary value rises, the measure produced would dwindle alternatively. This would decidedly bring forth a deficit in the market, making a contributing environment for market favoritism to go on. When this happens, the goods may non be bought by clients who value them the most. Therefore, the market excess as a whole becomes a lopsided matter. While manufacturer excess is outrageously maximized ; the same can non be said about consumer excess. Questions of efficiency and equality are without uncertainty being subjugated. This is decidedly non in the best public assistance of the populace. This is one ground why antimonopoly steps, such as the 1890 US Sherman Antitrust Act and the place of the Competition Commissioner of the European Union are created.

Besides that, there are many other inauspicious effects of oligopolies on the populace. High monetary values in the market do non vouch quality. Once once more, the populace is cheated of their right for monetary values matching to the quality of the goods or services. High entry barriers prevent smaller endeavors to vie on the scene – forestalling the monetary values to fall farther towards the more ethically just degree of the absolutely competitory 1. Freedom of pick is besides being restrained, as consumers are forced between picks of goods merely provided by the colluding houses. There, is no oppugning the reason of policymakers ( who had, in the US and Europe, recognized this job since before the nineteenth century ) that restricting collusion would be for the best involvement of non merely the populace, but the public assistance of the state involved.