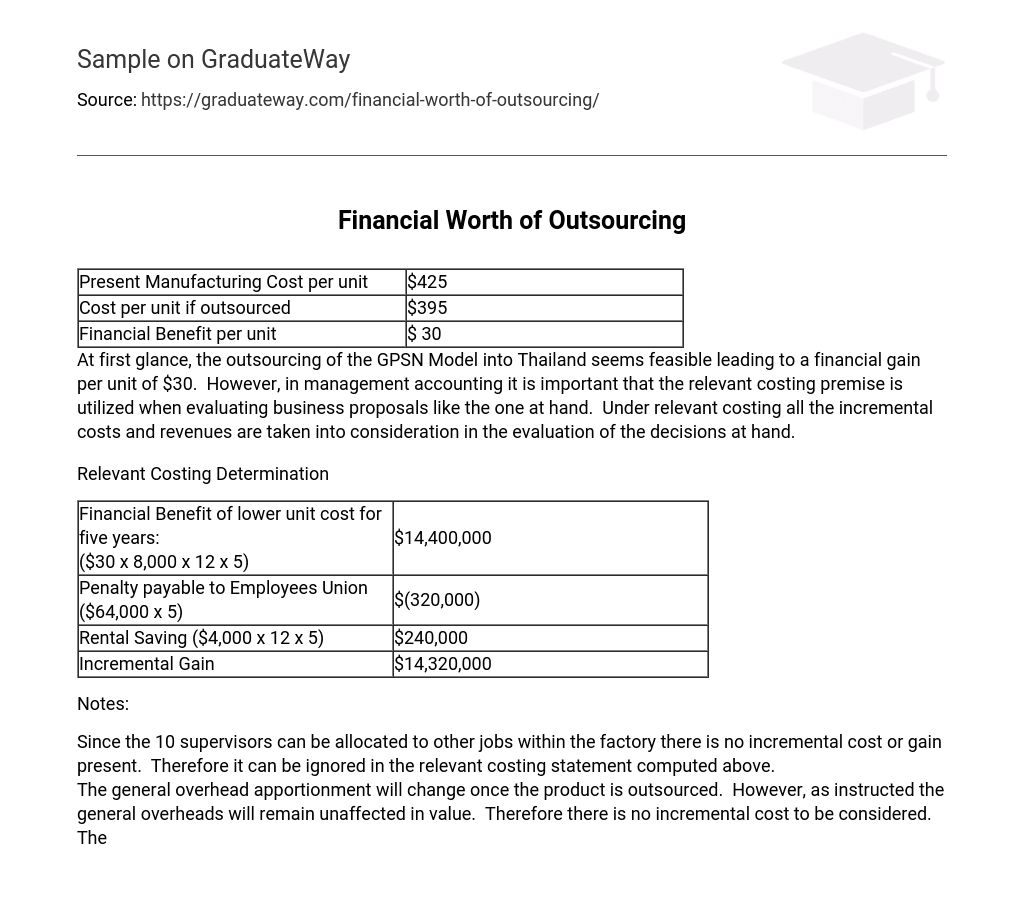

| Present Manufacturing Cost per unit | $425 |

| Cost per unit if outsourced | $395 |

| Financial Benefit per unit | $ 30 |

At first glance, the outsourcing of the GPSN Model into Thailand seems feasible leading to a financial gain per unit of $30. However, in management accounting it is important that the relevant costing premise is utilized when evaluating business proposals like the one at hand. Under relevant costing all the incremental costs and revenues are taken into consideration in the evaluation of the decisions at hand.

Relevant Costing Determination

| Financial Benefit of lower unit cost for five years: ($30 x 8,000 x 12 x 5) |

$14,400,000 |

| Penalty payable to Employees Union ($64,000 x 5) | $(320,000) |

| Rental Saving ($4,000 x 12 x 5) | $240,000 |

| Incremental Gain | $14,320,000 |

Notes:

Since the 10 supervisors can be allocated to other jobs within the factory there is no incremental cost or gain present. Therefore it can be ignored in the relevant costing statement computed above.

The general overhead apportionment will change once the product is outsourced. However, as instructed the general overheads will remain unaffected in value. Therefore there is no incremental cost to be considered.

The units manufactured by the FEE will hold the same quality as those presently manufactured leading to a 2% of the units inspected failing to meet quality standards. In this respect there is no incremental cost or gain arising from the shift. Thus such element can be neglected in the relevant costing computation.

Suggestion on the Outsourcing Decision

Based on the financial figures computed above, the outsourcing decision is financially viable, because it leads to an increase in the financial wealth of the organization. However, at this stage, an important point out to be outlined in the computation conducted above. Under such calculations it is presumed that the outsourcing will last for five years. However, presently the organization holds the possibility to enter in a 2 year contract with Far East Enterprises Limited. Therefore before reaching any drastic conclusions it is reasonable to compute the incremental profit again under relevant costing based on a 2 year contract. The relevant costing statement under such a contingency approach would be as follows:

| Financial Benefit of lower unit cost for two years: ($30 x 8,000 x 12 x 2) |

$5,760,000 |

| Penalty payable to Employees Union ($64,000 x 5) | $ (320,000) |

| Rental Saving ($4,000 x 12 x 2) | $ 96,000 |

| Incremental Gain | $ 5,536,000 |

Under such a stance the organization will still incur a substantial gain despite it will have to pay the penalty to the Employees Union for five years. Therefore such outsourcing exercise should be accepted by the company.

References:

- Drury C. (1996). Management and Cost Accounting. Fourth Edition. New York: International Thomson Business Press.

- Lucey T. (2003). Management Accounting. Fifth Edition. Great Britain: Biddles Limited.