Executive sum-up

Shadow Banking is a new fiscal glossary in recent old ages, but non-banking fiscal operations have occurred popular for a long clip and in many states. Shadow banking is mature with more than four decennaries of history in the U.S ( industry practicians of the Hong Kong Chapter of the Institute of Operational Risk and the pupils from RMBISA of the Hong Kong University of Science and Technology, 2014 ) After the planetary crisis in 2008-2009, shadow banking has caught the attending because many experts reckoned that is one of belowground factors that will impact the planetary economic system in the hereafter without timely step. This study provides information about shadow banking. Firstly is definition and overview of shadow banking in the

Definition

Shadow banking is known as a complex web of recognition intermediation that provides service similar but outside the boundary line of traditional commercial bank ( FSB, 2011 ) . The term” shadow banking“ is attributed in a 2007 by economic expert Paul McCauley, who coined it at the Kansas City Federal Reserve Bank in Jackson Hole, Wyoming.

Normally, the traditional bank is regulated by the Government to guarantee solvency by sedimentation insurance strategy. If the bank is collapsed, the Government will bail out. In contrast, Shadow banking is non- fiscal establishment that acts as a bank but it is non regulated by the Government and it takes the money from short-run and invests into the long-run plus by utilizing of the recognition derived functions to avoid the regulative government applicable to bank. Examples of shadow banking are hedge financess, insurance companies, crowd support organisations, private equity houses, particular purpose vehicles, and money market financess and others entities that hold fiscal plus.Financing activities of shadow banking are through investors, adoption, or making fiscal merchandises, different from the traditional commercial bank, it does through sedimentations.

Attraction.

Before, people borrow chiefly money from the traditional bank. However, the maps of the traditional bank is roll uping the money from depositors who has surplus money and lend to the populace who are in demand of capital so the sum of loans is limited with a batch of conditions, such as: payment adulthoods, involvement, collaterals… Therefore, people are looking for others alternate loaners, it is when shadow banking starts coming into drama.

There are 3 factors of the shadow banking’s attractive force that shadow banking attracts people more than regulated Bankss. First, shadow banking offers recognition intermediation much greater efficiency and extremely than the traditional Bankss do.

Second, shadow banking system related with systematic hazard and high return so shadow banking is an attractive force pick for investor who is seeking high return. By puting in shadow banking, the investors can acquire a high net involvement border between the controlled and the black market rates.

Last, on the borrower’s point of position, shadow banking provides beginning of finance that borrower can easy acquire into the procedure and straight lend by the absence of the regulated bank must follow with.

Shadow banking in the universe.

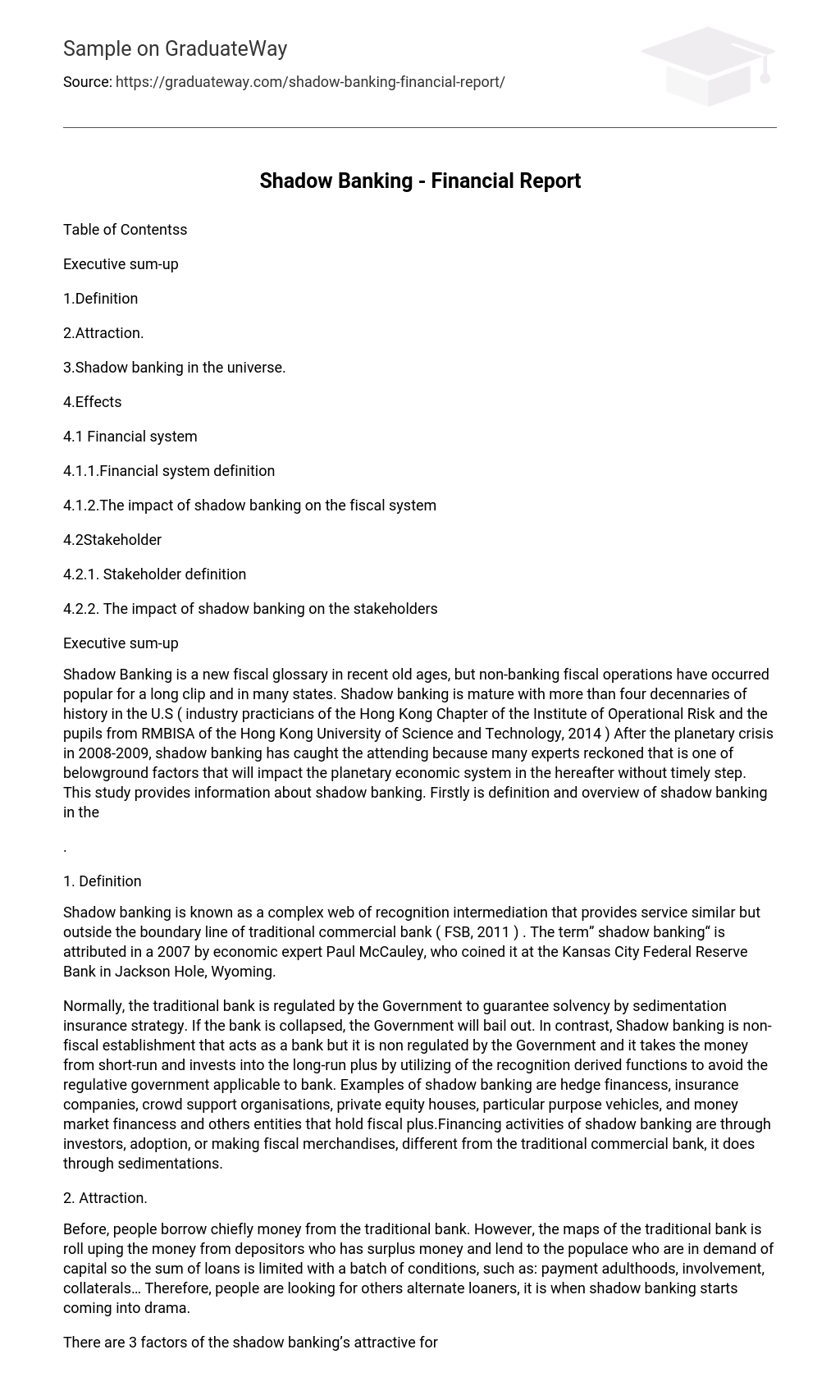

Following the Financial Stability Board exercising, the shadow banking system has grew by springs and bounds from $ 26 trillion in 2002 to $ 62 trillion in 2007, decreased to $ 59 trillion throughout the Great Depression so got back to $ 67 trillion in 2011. ( FSB, 2012a ) . Based on the Financial Stability Board’s informations, the United Kingdom with, The United States, The Euro Area have the biggest shadow banking system. ( Exhibit 1 )

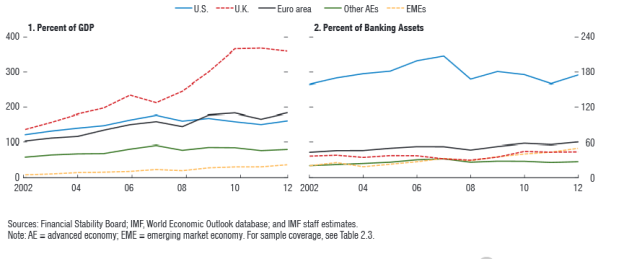

Entire shadow banking plus in The United States was valued $ 23 trillion, The United Kingdom was $ 9 trillion, The Euro Area was $ 22 trillion in 2011 and Japan was $ 4 trillion. Compare to 2005, the UK portion of entire non- bank fiscal intermediation for 20 legal power and the Euro country raised from 9 % to 13 % , whereas the US’s portion decreased from 44 % to 35 % . ( Exhibit 2 )

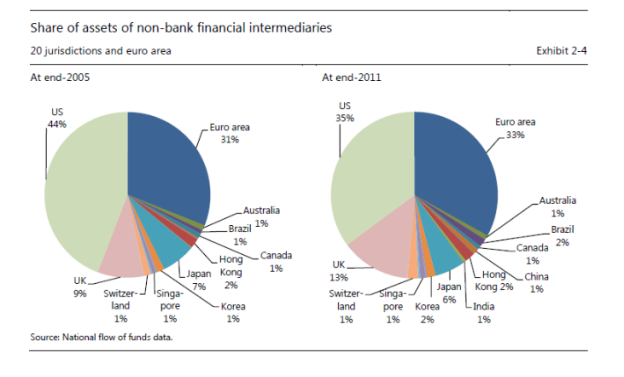

As presented in figure 3 the size of traditional banking was turning until 2008, with the exclusion of a autumn in 2005, and so it started to diminish. Besides, shadow banking’s size was turning during the Great Depression period. Although it dropped in 2008 and 2011 but continued lifting boulder clay 2013.

Shadow banking has been turning quickly among developing market economic systems, for case: China. Shadow banking sector of China has quickly growing after the Great Depression and ranks as the 3rd largest in the universe. ( Reuters,2014 ) . the portion of China’s shadow banking raised four clip between the terminal of 2007 and 2013, pension financess and insurance companies – grew more than 37 percent year-on-year in 2013 to merely under $ 3 trillion, informations released with the study showed, harmonizing to the Financial Stability Board. ( FSB,2014 )

Effectss

Financial system

Financial system definition

Fiscal system is the set of merchandises and services, i.e. insurance, Bankss and pecuniary policies which provide by fiscal establishments and interaction market ( pension financess, Bankss, pension financess, organized exchanges, and others companies… ) There are multiple definitions of fiscal system based on different domains ( organisation, regional and international ) that mobilize financess for investing and installations commercial activity. Fiscal system plays an of import function in the economic system, if fiscal system does non work good, that negatively affected the economic growing.

The fiscal system in the house is the constituents of processs, which consist of confirmation, recording, and seasonably coverage of minutess. Firm’s fiscal system affects the fiscal activities of the organisation.

Regional fiscal system is the system that allows interchanging financess between loaners and borrowers. It comprises of fiscal markets, fiscal establishments, and Bankss.

The planetary fiscal system includes borrowers, investors, fiscal establishments such as World Bank, International Monetary Fundss, Central Bankss which is runing in the international economic system.

The impact of shadow banking on the fiscal system

Positive effects

Shadow banking system is a non-bank fiscal entity which plays two chief maps as securitization – to make and administer safe assets, and indirect intermediation – to concentrate on cut downing counterparty hazards and helping secured minutess. So Shadow banking can be seen as a type of regulative arbitrage that is really good portion of fiscal system in all economic sciences across the universe.

In developed economic systems such as: the United States, South Korea, the United Kingdom, Canada, Japan, Australia, Germany, France, etc. , shadow banking system plays a hazard transmutation in the economic. In lower developed economic systems, shadow banking system performs a auxiliary function to regulated- banking activities it helps to finance the demand of borrowers with the funding conditions where the traditional banking are controlled with regulative restraints. Shadow banking provides an alternate beginning of support and liquidness for corporations and market participants by interceding recognition and hike economic activities. Typically shadow banking does non take sedimentations from clients, it collects financess from pension financess, insurance companies and ordinary rescuers to put into securitization, therefore the beginning financess of shadow banking is flexibleness that satisfy the demand of borrowers. Furthermore, shadow banking provides mobilise financess that means there are many loaners. It helps fiscal system to avoid chance insolvents which is the ground of helter-skelter fiscal system.

Securitization – based on interceding recognition, shadow banking has liability to cut down the dealing cost of operation and better the stableness of fiscal system. Take China as an illustration, all most of investors borrow the sum of money from shadows banking to put into building industry. By constructing houses, sections, shopping promenades, shopping centres that created occupations and bolster the economic system. Besides, the development of building industry is a motive of the growing of steel production. Therefore, steel export of Australia besides goes up.

Negative

However the Financial Depression has highlighted the hazard of shadow banking is systematic hazard that affects greatly to fiscal system.

Shadow banking does be on its ain ; it is a web of interconnectedness and integrating that includes: Bankss, fiscal establishments, market participants and subordinates. Additionally, shadow banking is deficiency of transparence that acts like traditional Bankss but outside the Government’s insurance, so if shadow banking prostration, it will non have any aid signifier the Government that can do a Domino consequence across other fiscal establishments and borders, harming fiscal system.

Shadow banking in China is the best illustration of Domino consequence. As the world’s most popular state with 1.357 billion in 2013, it’s one of the largest consumer purchase power in the universe. Furthermore, China is the largest trading spouse in the universe. It became the largest exporter over the universe in 2013 with primary merchandises such as: electrical, computing machines and informations processing equipment, optical and medical equipment every bit good as dress, cloth and fabrics. ( FSB,2013 ) China is a chief member in universe trade good market and deep trade connexions with Western markets and one of the chief holders of U.S. debt.That means the economic growing of China plays a important function in universe economic system development. When the economic sciences of China is unstable, it sends shockwaves through the fiscal markets of developing economic systems and has an consequence on the growing of planetary. These investors’ particularly foreign investors which have invested in China suffered huge losingss in ( Thomson Reuters, 2014 ) because they can non take the money back.

Stakeholder

Stakeholder definition

Stakeholders are those who have an consequence or may be affected by the concern of shadow banking. They include primary stakeholders, secondary stakeholder and cardinal stakeholders. Primary stakeholders are those who may be straight affected, either positively or negatively, by an attempt or the actions of shadow banking establishment. In some instances, there might be involvement struggle inside primary stakeholders because a ordinance that has positive consequence on one group may hold a negative consequence on another. For illustrations: Peoples or groups that are indirectly affected, either positively or negatively, by an attempt or the actions of shadow banking are secondary stakeholders. Cardinal stakeholders are those who are of import to the operation or can hold a positive or negative consequence on an attempt of shadow banking establishment. The cardinal stakeholders might be the manager, the funder or line staff of the establishment. Basically, stakeholders are every people in fiscal systems, for illustration: managers, creditors, Government, employees, stockholders, providers.

The impact of shadow banking on the stakeholders

Positive effects

Shadow banking provides the assorted types of loan with low cost for clients because it is unregulated. As we know, traditional bank merely do a loan to borrower who are able to pay back the loan on clip, so they are utilizing 5Cs: capital, capacity, collateral, character and conditions to analyse the borrower’s recognition worthiness. It is really hard for the single clients who was bankruptcy before or deficiency of cognition about finance to acquire finance from the bank. In add-on, corporates besides have trouble in acquiring loan from traditional bank if they invest in a high hazard undertaking or necessitate for a big sum of money that bank can non function. As a consequence, shadow banking is their pick. They may travel directly to the shadow banking to borrow the money through Repos market.

Although the activities and maps of shadow banking and bank are separate, shadow banking still impacts on traditional banking. It provides good competition for regulated Bankss. Presents, more and more people choose shadow banking as the beginning to raise fund alternatively of regulated bank so traditional bank is losing their client. Therefore, it motivates Bankss to restitute their schemes to pull more clients. Furthermore, shadow banking besides support traditional bank. Sometimes traditional banking is restricted the bound of ability to function the clients by the ordinance of Government, when shadow banking will come into market and assist the fiscal system to run efficient by reassigning hazards outside of the traditional bank system. While shadow banking need support from traditional bank through liquidness to publish related structured merchandises and asset-backed commercial paper to the market, traditional bank depends on the shadow banking for plighting a greater fraction of their portfolios than reasonable ordinance for illustration … .

Shadow banking provide trust and entrusted loans, wealth direction merchandises and bankers ‘acceptance measures as an alternate beginning of support to existent estate developers and the authorities financing vehicles in order to construct up belongingss and substructure, efficaciously bring forthing GDP. Furthermore, with the aid of fund from shadow banking, more undertakings are satisfied so that it creates more occupations for the community and cut down the unemployment rate.

Negative effects

Although shadow banking have a batch of benefit, they besides bring negative to the stakeholder. The extension of shadow banking creates bubble markets, such as: the trade goods market, the stock market, the existent estate market. It is the chief ground cause the Financial Crisis 2007-2008 that affect strongly to stakeholders in many ways. Many companies collapsed so a batch of employees lost occupations and clients cut off disbursement. Besides, Government have to supply out assistance loan to salvage and boot economic and it is limit in commanding the hard currency flow in the state. Rather, deficiency of transparence and lucidity in activities act as an hindrance to the effectual conductivity of pecuniary policy.

Recommendation

Although the shadow banking has had negative impacts of human and planetary economic system during the universe economic crisis, but cipher can deny the benefits of shadow banking. Shadow banking helps the planetary fiscal system to work better by making abundant beginning of loans for all sectors of the economic system. Additionally shadow Bankss besides support traditional Bankss to supply debts to stabilise the economic system in each state in the universe. In my personal sentiment, the shadow banking will go on advance its ability to back up the economic system if the Government limits the deficiency of transparence in its operations by making a competitory environment where both shadow banking and traditional bank can vie with each other’s. However, shadow banking have to subscribe a contract with the Government. They have the right to run with the policy on their ain without the bank licence, but they have the duty to supply information and balance sheet when the Government requires because the hazard prognosis is excessively high. After the government’s probe, if the hazard of doing fiscal crisis was low and removed, shadow banking can continues to run. Otherwise, shadow banking has to halt instantly when the petition of the Government is issued. By this manner, shadow banking is still unregulated and Government can foretell the hazard in the fiscal system to

Mentions

- FRB: Address — Tarullo, Shadow Banking and Systemic Risk Regulation — November 22, 2013. 2015. FRB: Address — Tarullo, Shadow Banking and Systemic Risk Regulation — November 22, 2013. [ ONLINE ] Available at: hypertext transfer protocol: //www.federalreserve.gov/newsevents/speech/tarullo20131122a.htm. [ Accessed 01 April 2015 ] .

- Shadow banking and the economic system | VOX, CEPR’s Policy Portal. 2015. Shadow banking and the economic system | VOX, CEPR’s Policy Portal. [ ONLINE ] Available at: hypertext transfer protocol: //www.voxeu.org/article/shadow-banking-and-economy. [ Accessed 28 March 2015 ] .

- The Effects of the Global Financial Crisis on China ‘s Financial Market and Macroeconomy. 2015. The Effects of the Global Financial Crisis on China ‘s Financial Market and Macroeconomy. [ ONLINE ] Available at: hypertext transfer protocol: //www.hindawi.com/journals/ecri/2012/961694/ . [ Accessed 05 March 2015 ] .

- Reserve Bank of India. 2015. Reserve Bank of India. [ ONLINE ] Available at: hypertext transfer protocol: //www.rbi.org.in/scripts/BS_SpeechesView.aspx? Id=911. [ Accessed 02 April 2015 ] .

- Shadow Banking in India – General Knowledge Today. 2015. Shadow Banking in India – General Knowledge Today. [ ONLINE ] Available at: hypertext transfer protocol: //www.gktoday.in/shadow-banking/ . [ Accessed 08 April 2015 ] .

- . 2015. . [ ONLINE ] Available at: hypertext transfer protocol: //www.bis.org/review/r130204g.pdf. [ Accessed 04 April 2015 ]

- 2015. . [ ONLINE ] Available at: hypertext transfer protocol: //www.financialstabilityboard.org/wp-content/uploads/r_111027a.pdf? page_moved=1. [ Accessed 20 March 2015 ] .

- RiskMinds Asia Conference – Hazard Management Banking Event – RiskMinds Asia Blog. 2015. RiskMinds Asia Conference – Hazard Management Banking Event – RiskMinds Asia Blog. [ ONLINE ] Available at: hypertext transfer protocol: //www.riskmindsasia.com/blog/Risk-Minds-Asia-Conference/tag/id/Chinese-Shadow-Banking. [ Accessed 25 March 2015 ] .

- China ‘s shadow banking sector ‘growing quickly, third-largest in universe ‘ | Asiatic Legal Business. 2015. China ‘s shadow banking sector ‘growing quickly, third-largest in universe ‘ | Asiatic Legal Business. [ ONLINE ] Available at: hypertext transfer protocol: //www.legalbusinessonline.com/news-analysis/chinas-shadow-banking-sector-growing-rapidly-third-largest-world/67325. [ Accessed 01 March 2015 ] .

- 2015. . [ ONLINE ] Available at: hypertext transfer protocol: //www.financialstabilityboard.org/wp-content/uploads/r_131114.pdf? page_moved=1. [ Accessed 03 April 2015 ] .