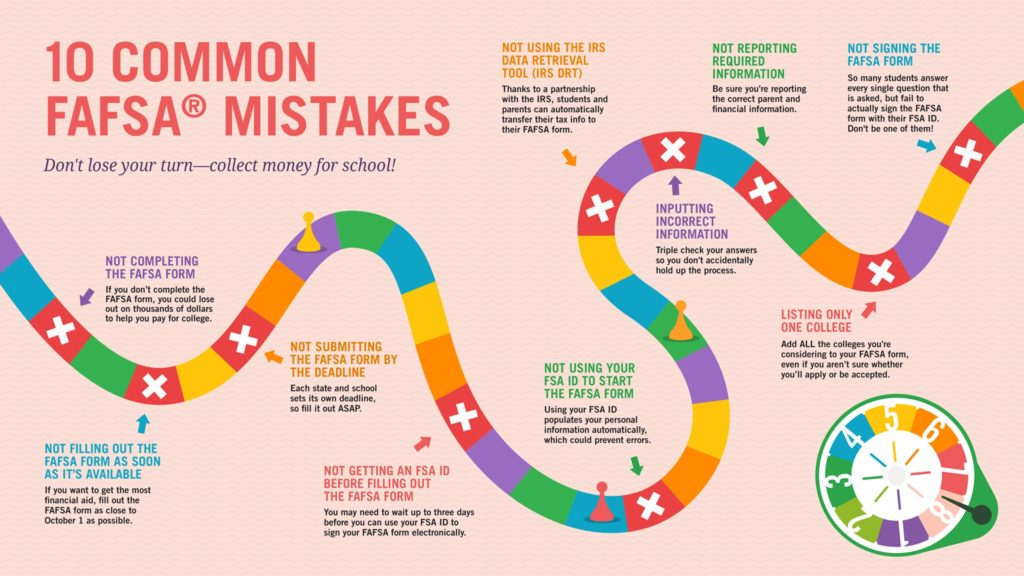

There are plenty of potential missteps you can make with your FAFSA. But which one is the worst? Keep reading for our countdown of the worst FAFSA mistakes you can make.

If you’re going to be in college next year, you can file the FAFSA starting October 1. And you’ll want to get on that ASAP, since a lot of financial aid is first come, first served.

In case you hadn’t heard, the FAFSA application timeline was bumped up to more closely coincide with the college application process. High school seniors (and current college students who plan to be enrolled next school year) can file their FAFSA after October 1 for the following college year using tax info from the previous year. Confused? We were too. Here’s a handy chart with FAFSA dates. Also, the US Department of Education blog has tons of great FAFSA advice, including this list of common questions about changes to the FAFSA. Five stars, highly recommend.

Waiting to file is one of the biggest mistakes you can make with the FAFSA—but it’s hardly the only one. Keep reading for our countdown of the worst FAFSA mistakes you can make.

15. Using the wrong website

Use fafsa.gov and only fafsa.gov! That’s the real, legit FAFSA site. (Luckily, they must’ve bought “fafsa.com” too, because it now redirects to the .gov site.) There are some scammy sites out there that will try to get you to pay to file your FAFSA. Not cool.

14. Not knowing your independent/dependent status

If you’re a high school senior, in all likelihood, you will be a dependent student, as far as the FAFSA is concerned. But if you’re unsure, check the dependency guidelines here. (Unfortunately, just because you feel like an independent student doesn’t mean you technically are one.)

13. About the IRS Data Retrieval Tool…

Typically, we’d say not using the IRS Data Retrieval Tool is a big FAFSA mistake, because it saves time and helps reduce errors by importing your family’s tax info automatically. The IRS suspended this handy feature in the spring of 2017 because hackers had breached the system. But the good news is the security problems have been corrected and the tool is up and running again.

12. Fudging the numbers

Don’t. Just don’t. Supply complete and accurate info on your FAFSA to the best of your knowledge. Rounding numbers and guessing won’t fly.

And if you were wondering what happens to people who try to cheat the system: lying on the FAFSA counts as fraud, and if you get caught, you could be fined up to $20,000 and sentenced to up to five years in jail, says Edvisors. Oh, and you’d also have to repay all the federal aid you got and could get kicked out of school. It’s definitely not worth it—and they’re really good at catching people.

Of course, this is different from honest FAFSA mistakes. But those can hurt you too. Which brings us to…

11. Not reading the directions/checking your work

Accidentally putting in the wrong info on your FAFSA is bad. It can lead to your FAFSA being returned, which further delays your results. And, as we keep saying, time is of the essence, because a lot of financial aid is first come, first served.

Just like with Ikea furniture, you need to read and follow the FAFSA directions carefully—or everything could fall apart. There are several common FAFSA errors that come from not following the directions, such as:

- Confusing parent and child info. Remember, the FAFSA is supposed to be the student’s form. So when the FAFSA says “you,” it means you the student, not your parents. (Yes, the FAFSA has sections specifically for parents, but they are clearly labeled.)

- Using the wrong name. Yup, this happens. You should only use your full official name on the FAFSA, aka whatever appears on government documents, like your birth certificate. No nicknames.

- Putting your full income when the FAFSA calls for income tax.

- Forgetting to include yourself! If you are a dependent student, you count as part of your family’s size, even if you didn’t live at home the previous year.

- Confusing divorced parents’ assets. This page can help you, your parents, and any stepparents sort things out.

Of course, mistakes do happen, which makes it super important to read the directions carefully and go over your FAFSA a couple of times after you’ve filled it out to make sure all of your information is correct. Then have your parents check. And maybe check one more time just to be sure.

10. Overstating your income and assets (accidentally)

Make sure you and your parents count only relevant sources of income. This includes things like interest payments, child support, and workers compensation but not things like “qualified retirement accounts (401ks, 403b, and IRAs) and the value of your home… Reporting that information may reduce the amount of aid you receive,” says Consumer Reports. This is where the FAFSA can get a little confusing, since your parents might have lots of different assets and sources of income. When in doubt, ask for help.

9. Leaving FAFSA fields empty

There’s really no reason to leave any FAFSA questions blank. So even if your answer is “zero,” actually put a zero in there! Otherwise it might register as an error, and errors hold up processing your FAFSA, and holdups might cost you aid. If you’re not sure how you should answer a question, ask your intended college(s) or turn to the FAFSA for help.

8. Not including all of the colleges you’re considering

You can have up to 10 potential schools get your FAFSA results, so don’t limit yourself to just your top-choice college. Include any schools you’re applying to. This will save you the hassle of sending your results later. And if you’re feeling shy, don’t worry: the schools can’t see who else gets your results.

7. Waiting to get your FSA ID

Like a lot of important documents, you need to sign your FAFSA to make it official. The FSA ID serves as your legal digital signature, and you need to sign up for it ahead of time here, if you haven’t already. (If you’ve filed the FAFSA before, the FSA ID might also come as a surprise; it replaced the Federal Student Aid PIN you and your parents used in the past.) If you’re a dependent student and your parents are helping you file, they will need FSA IDs too. Heads up: it takes about three days to get the ID after you sign up, so if you don’t have one yet and you need to file the FAFSA this year, get your FSA ID ASAP!!!

6. Forgetting to sign the darn thing all together

As noted above, you and your parents need to digitally “sign” your FAFSA with your FSA ID before you submit it. But lots of students and their families simply overlook this step. Don’t let this happen to you! Neglecting to sign means the FAFSA can’t be processed, and processing delays means losing your space in line for those financial aid dollars.

5. Paying to file the FAFSA

“Free” is baked right into the name: it’s the “Free Application for Federal Student Aid.” However, you and your family may be tempted to pay someone to file for you anyway, perhaps your family’s financial advisor or—worse—a scam site promising better results if you go through them. (Spoiler alert: there’s no such thing.)

Even though the FAFSA may seem intimidating, it’s much more streamlined and easy to use than it was in the past. You can totally do this on your own, so don’t pay anyone to do it for you.

4. Taking your time to file the FAFSA

When we say some financial aid is first come, first served—we mean it. It will run out. Get your fair share by filing as soon as you possibly can. Really, you should be shooting for October 1 or as close to as possible each for year you’re going to be enrolled in college. There’s no reason to wait.

3. Missing the FAFSA filing deadline entirely

The 2017–2018 FAFSA federal deadline is June 30, 2018; check out the handy schedule here. However, your state and/or college might have their own deadlines too. You definitely want to file ASAP, but you need to file before the deadline—or you’ll be up a certain creek without a paddle. Go here to find out your state deadline (your home state, not the state your college is in). If you can’t find your school’s deadline on their website, just give the financial aid office a quick call or shoot them an e-mail.

2. Not checking your status

You can log into the FAFSA system to check the status of your application, including confirming that it was submitted correctly. It’s easy enough to do, and you can check your status immediately after submitting. So log on and make sure everything went smoothly!

And that brings us to the #1, top, worst-of-the-worst mistake you can make with the FAFSA…

*insert drumroll*

1. Not filing the FAFSA at all

Yup. Not filing the FAFSA is basically the #1 mistake you can make. Seriously.

Sure, it can be intimidating. But the FAFSA has gotten a lot easier in recent years. And there are plenty of people who can help you, from college financial aid counselors to your high school guidance counselor. You can even contact the FAFSA directly. Of course, even if the FAFSA was a ginormous pain in the butt, it would still be worth it. It’s one of the best—and sometimes only—ways of getting money for college.

And if you think your family makes too much money to get any federal aid, you might be surprised. There’s no cap on income and lots of things can change your eligibility, like the number of people in your family, if anyone else is in college, etc. Worst-case scenario? You file the FAFSA and don’t get any financial aid. Best-case scenario? You get thousands of dollars for 30–60 minutes’ worth of work. #worthit

The FAFSA is a huge piece of your college financial aid puzzle, and you never know what kind of aid you’ll be eligible for (grants, loans, work-study) until you file. Don’t let this opportunity go to waste.

One more FAFSA tip for the road…

Don’t get discouraged! Mistakes will happen sometimes, and that’s okay. If something sneaks through, you can correct your FAFSA and move on with your life—hopefully with a bunch of money for college.