This study aims to explain the extent of the quality service that are provided to customer and the extent of satisfaction that is obtaining from service that are provided by banking , additionally explain the factor that constituent of service quality that are used to measure the customer satisfactions and its important of banking , and the method that are used in this study is questioners to collect data and the analysis of the study reveals that improve and development of service quality increase in customer satisfactions .

Introductions: The issue of quality management within banking services has drawn considerable attention over the past few years. The move to managed service has increased demands for outcome-based accountability, cost containment, and attention to customer-focused quality in order to remain competitive in a rapidly changing environment. This dual focus on driving down costs while increasing quality has intensified pressures to understand, measure, and manage quality from a customer perspective.

The intent of this study is to examine quality service in banking industry Jordan. In banking industry, banking systems provide the same types of services, but they do not provide the same quality of services. Recently, customers are more aware of alternatives and their expectations of service have increased. Service quality can, therefore, be used as a strategic tool to build a distinctive advantage over competitors.

Today the research observe there more attentions in realize customer satisfactions and this consider a major factor successful that should take into account from all the company trading and service and manufacturing when these company make its strategic , result of track positive and negative in case realize and non realize of customer satisfactions. and thus in this study the research take the Islamic banking specifically in Jordan to xplain and to identify the range of attentions by them in customer satisfactions through service quality that is provided by the banks to customers and thus this study is coming to explain “the impact of service quality on customer satisfactions in Islamic banking ” and the dimension that consist of service quality that is contribute in customer satisfactions and benefits that the banks will gain from improve the service that are provided to customers , also identify on the obstacles that face the banks when they improve the existing service or develop new service that will provided to the customer in order to realize he satisfactions.

The research problem: Appeared recently that some of banking in Jordan give a little interest in improving its service quality that is provided to customer which led to a reflection on the performance of the bank in the loss of the customer who is dealing with the bank and this leads to guide the customer to deal with other banks whereas customer satisfactions consider is the most factors that must be taken by banks from the point of view and the dimensions of service quality is reliability, responsiveness, competitions, convenience, time, assurance, courtesy, tangible, that contribute to increase customer satisfactions.

In contrast, there are banks give a little attention to its service that is provided To customers and this case some of negative aspect on these banks is lack of realize customer satisfactions, until attracted me this subject to explain this aspect of the Problem of study is “the impact of service quality on customer satisfactions in Islamic Jordanian banking” And the problem can be representing in the following: – What is the impact of service quality on customer satisfactions in bank? 2- What are the factors contributed to increase customer satisfactions in banks? 3- What is the relationship between the service quality and customer satisfactions? 4- What are the factors played in realize customer satisfactions in banks? The importance of study:

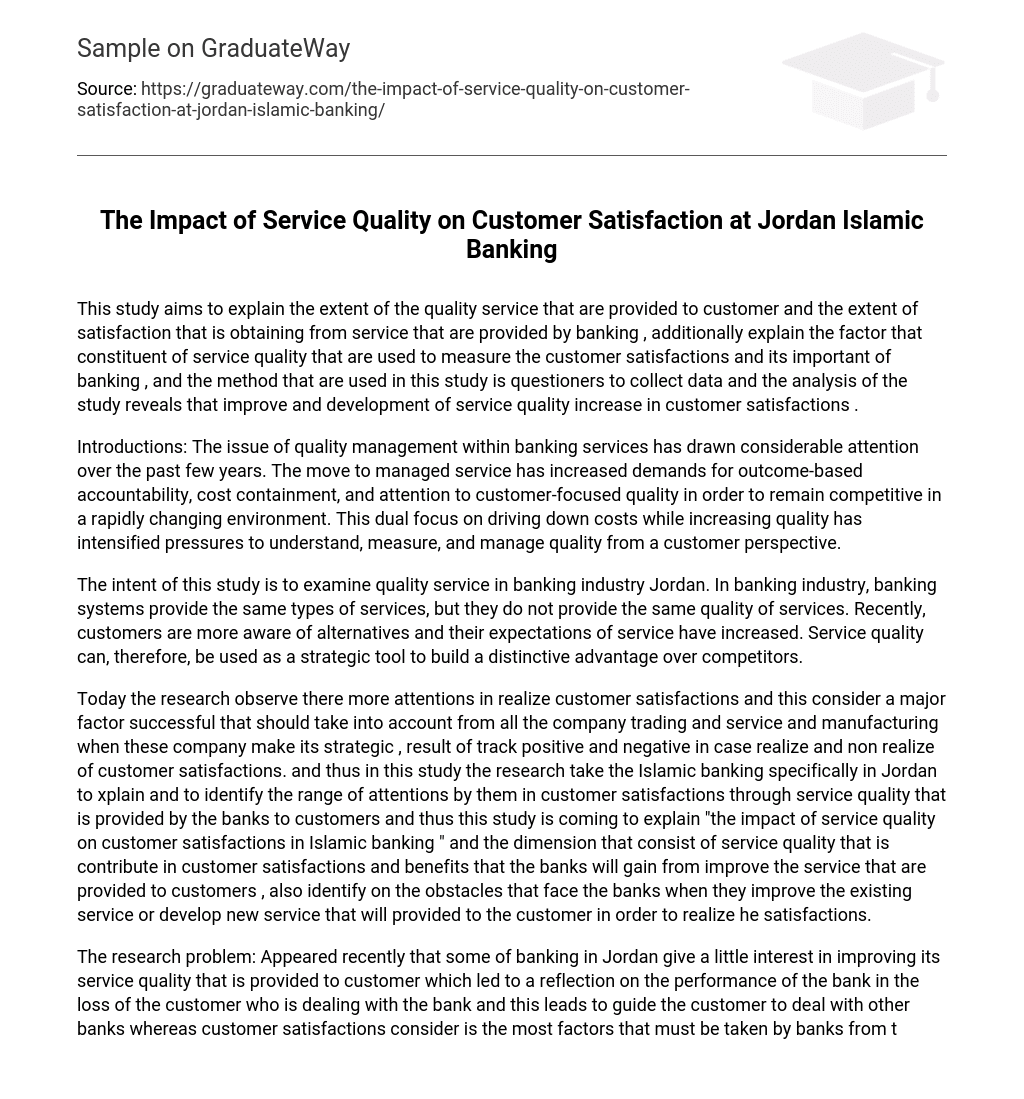

This study explains the role of Islamic banking in Jordan that is played in improving its service quality that are provided to realize customer satisfactions and the benefits that will gain from this intentions of banking to do that, the positions that will obtain between other company financial service and this is lead to realize competitive advantage and attain and retain of customer and thus realize customer satisfactions and this study comes to explain influence of the dimensions of service quality and that consist of reliability , time , responsiveness , assurance , convenience , competitions on customer satisfactions and detrimental of customers satisfactions and feature of service of quality. The objective of study: Study objectives are: 1- Identify the importance of dimensions of service quality that lead to increase customer satisfactions. 2- Explain the degree of reliability of the service that is provided by sector bank to its customers. 3- Identify the rezones that are paid the sector banking to improve its service quality that are offering by them to its customers. – Explain the importance of customer satisfactions related to the banks and list the benefits that will gain from this work. 5- Explain the detrimental that are faced by the banking during improve its service quality that are perform to customers and when the customer come to request any service from the banks. The study model: The study model [pic] Hypotheses of the study: H01: there is No statistically significant relationship between the reliability and the customer satisfactions. H02: there is No statistically significant relationship between the assurance and the customer satisfactions. H03: there is No statistically significant relationship between the accessibility and the customer satisfactions.

H04: there is No statistically significant relationship between the responsiveness and the customer satisfactions. H05: there is No statistically significant relationship between the empathy and the customer satisfactions. Literature review: Customer satisfactions and service quality: In the service literature, strong emphasis is pleased on the importance of service quality perceptions and the relationship between customer satisfactions and service quality (see for example Bitner and Hubbert, 1994; Cronin and Taylor, 1992; Taylor and baker 1994) service quality has been described as a form of attitude that result from the comparisons of expectations with performance (Cronin and taylor, 1992; parasuraman et al. 1985). Gronroos, 1982) argued that customer, while evaluating the quality of a service, compare the service they expect with perceptions of service is not a unidimensional contrast . rather, service quality incorporate various dimensions that relate to both core and augmented service offering (Bitran and lojo, 1993; gronroos, 1984; lewis, 1993). Parasuraman et al. (1985; 1988) initially described five dimensions of service quality: reliability, tangible, responsiveness, assurance, empathy. Parasuraman et al. (1991a) argued that reliability was mainly concerned with outcome of service whereas tangible ,responsiveness , assurance , and empathy were concerned with service delivery process.

The customer not only judge the accuracy and dependability of the delivered service but they also judge the other dimensions satisfactions can thus be based not only on the judgment of customer experiences towards the reliability of the delivered service but also on customer experiences with service delivery process . on the basis of their review of service quality literature , McDougall and Levesque(1994) ,however ,argued that there were tow overriding dimensions to service quality . the first one being the core or out come aspect (contractual)of the service , and the second being the relational or process aspect (customer- employee relationship) of the service .

It is generally accepted that customer satisfactions often depends on the quality of product or service offering (Andersons and Sullivan, 1993; Levesque and McDougall, 1996). For this reason, research on customer satisfactions is often closely associated with the measurement of quality (East, 1997). Thus , both service quality and customer satisfactions share a close relationship , though they are normally conceptualize as unique constructs (Bitner and hubbert,1994;Cronin and Taylor ,1992; Patterson and Johnson ,1993 ; Taylor and Baker,1994). there is some empirical evidence suggesting that service quality is a causal antecedent of customer satisfactions . owever , there is vary little empirical research demonstrating the importance of service quality dimensions in determining customer satisfactions (Fisk et el ,1993 ; McDougall and Levesque(1996) found that the performance of the service provider on core and relational dimensions of service was an Important driver for customer satisfactions in retail banking in the UK. However, in a nonwestern context, the link between core and relational dimensions of service quality and customer satisfactions is yet to be established empirically. The literature dealing with service outlines some major characteristics of service that make them unique and different from physical product (Bitran and lojo, 1993; parasuraman et al, 1985) service are often characterized by their intangibility, inseparability, heterogeneity, and perish ability. he implications of these characteristics are that it is often difficult for customer to evaluate service at per consumption, consumptions and post consumptions stage of the customer decisions making ( legg and baker , 1996) because of the tangible nature of service , it becomes difficult for an organizations to understand how its customer perceive and evaluate the quality of its service (the buildings , the physical layout ) that surround the service environment . Support for this argument comes from empirical evidence suggesting that the tangible, physical surrounding of the service environment can have a significant impact on customer affective responses and their behavioral intentions (Wakefield and Blodgett, 1990). In today s world of instance competitions, a fairm ability to deliver high quality service that result in satisfied customers is the key to a sustainable competitive advantage ( shemwell et al . 1998) .

Muffato and Panizzolo (1995) also suggested that customer satisfactions is considered to be one of the most important competitive factors for the future , and will be the best indicator of a firm profit ability the further suggest that customer satisfactions will drive firms to improve their reputations and image , to reduce customer turnover and to increase attentions to customer needs . such actions will help firm create barriers to switching and improve business relationship with their customer Customer satisfactions and service features: Factor related to service offerings are also related to customer satisfactions (Levesque and McDougall, 1996).

According to Levesque and McDougall, convenience and competitiveness of the banks are tow important factors which are likely to influence the overall satisfactions levels of a customer. A number of researchers have looked into the bank selections criteria adopted by customer… Empirical findings from this stream of research suggest that convenient locations is a critical factor influencing the choice of a bank by customer. A convenient banks locations means customer can easily do business with their banks on regular basis (Levesque and McDougall, 1996). Accessibility is also a related factor which, while acting together with convenience, enables customers to deal with their banks more easily (Levesque and McDougall, 1996).

Furthermore, customer satisfactions in retail banking are also likely to be influenced by the perceived competitiveness of the banks interest rate (Lariche and Taylor, 1988; Levesque and McDougall, 1996). However, customer might not instantly switch their banks after experiencing a problem during the service productions. This is mainly because of the fact that the perceived costs of switching are relatively high in banking. Customer might display a passive response to a problem, which can be in the front of making a formal complaint. Customer satisfactions in such cases can depend upon the efficient and effective response of the service provider (Levesque and McDougall, 1996). A customer satisfaction is also related to the service offering.

With retail banking, the convenience and competitiveness of the providers offerings can be expected to affect a customer overall satisfactions and ongoing patronage and thus the research has shown that locations is a major determinant of bank choice (Anderson et al ,1976; Laroche and Taylor ,1988; Thwaites and vere , 1985 ). Underlying locations are the customer benefits of convenience and accessibility which are enabling factors that make it easy for customer to do business with the bank. The bank ability to deliver these benefits on an ongoing basis to its existing clientele will probably impact on customer satisfactions. Another determinant of banks choice is competitive interest rate (Laroche and Taylor, 1988) while differences in rates, either savings or borrowings, are likely to be minimal between competing banks.

Customer is concerned that they are getting competitive rates on savings or loans because of the impact on their financial situation. And thus, a customer satisfaction is likely to be influenced by the perceived competitiveness of the banks interest rate. Dimensions of service quality: A review of the literature , however , suggests that service quality is not a uni-dimensional construct , rather , service quality incorporates a number of dimensions such as a reliability , tangible , responsiveness , assurance , empathy ( Carman ,1990 ; Gronroos , 1984 ; lewis , 1993 ; bitran and lojo,1993 ; Levesque and McDougall ,1994 ; parasuraman et al , 1985 ,1988) .

Although the number and compositions of service quality dimensions are likely to be dependent on service setting, one can argue that there are two overriding dimensions of service quality. The first one refers to the core aspect of the service (e. g. reliability) and the second one refers to the relational or process aspect of the service (e. g. tangible, responsiveness, assurance and empathy are concerned with the service delivery process (parasuraman et al, 1991). In this context, we propose that both the core and relational dimensions of service quality are likely to be antecedent of customer satisfactions. Researcher have paid much attentions to the close relationship between service quality and customer satisfactions ( parasuraman et al 1988) .

Oliver suggests that service quality is a more specific judgement which can lead to broad evaluations of customer satisfactions (Oliver, 1993). Regarding the particular service quality dimensions that influence the formations of customer satisfactions, Johnston (1995, 1997) has found that the causes of dissatisfactions and satisfactions are not necessarily the same. Some service quality attribute may not be critical for consumer satisfactions but can significantly lead to dissatisfactions when they are performed poorly. the same author has further classified all dimensions into enhancing (satisfiers ) hygiene( dissatisfies) and dual factors.

Enhancing factors are those which will lead to customer satisfactions if they are delivered properly, but will not necessarily cause dissatisfactions if absent. in contrast, hygiene factors will lead to customer dissatisfactions if they fail to deliver, but will not result in satisfactions if they are present . dual factors are these that will have an impact on both satisfactions and dissatisfactions . Johnston (1995) identified attentiveness, responsiveness, care and friendliness as the main source of satisfactions (satisfiers) in banking service and integrity, reliability and functionality as the main sources of dissatisfactions (dissatisfies). Yang et al (2004) identified five online service quality dimensions (responsiveness, reliability, competence, access and security) and their relationship with customer satisfactions. (Wolfinbarger and Gilly, 2002) observed that reliability and fulfillment are the strongest predictors for customer satisfactions. (Liu and Arnett (2000)identified five critical dimensions of online service quality in relations to customer satisfactions in the website . Among these , the quality of information that is relevant ,accurate , timely , customized and dimensions of online service quality in relations to customer satisfactions in online service. * Sreekumar , khan , mahapatra ,2009 (service quality evaluations in banking ) : this study aims at evaluating service quality of bank service in India from customer perspective .

A structured questionnaire containing 44 quality items is Administered to various target groups. seven dimensions: reliability , accessibility , user-friendliness ,privacy/security , efficiency , responsiveness , and fulfillment , are identified based on principal component factor for use analysis , the result of this study show the customer are satisfied with quality of service on four dimensions such as reliability , accessibility , privacy / security , responsiveness and fulfillment , but least satisfied with the user-friendliness dimensions . * Boyd, Leonard, and White (1994) investigated the importance of bank selection criteria in terms of the age of the head of the household.

They found that for the age group under 21 years, a bank’s reputation plays a major role in determining their bank selection, followed by location, hours of operation, interest on savings accounts and the provision of convenient and quick services. The least important factors for this age group were found to be the friendliness of bank employees and the modern nature of their facilities. * Al-Fawzan, 2005(Assessing Service Quality in a Saudi Bank): In this study, the research have shown that it is important in the analysis of service quality to use the SERVQUAL as a technique necessary to explore the most important strength and weaknesses in a service provider. The application in this study was on a Saudi Bank (SB). Many gaps in SB services have been discovered.

Despite the fact that none of these gaps is serious, SB has to devote their efforts to cover these gaps especially the Accessibility gap. SB customers considered the level of services below their expectations. This means that SB has to do the maximum efforts that it can afford to raise the level of services in these dimensions to the level of customers’ expectations. In the accessibility dimension, car parking seems to be the most serious problem. Therefore, SB management has to Solve this problem as soon as possible. In reliability dimension, the most serious service gap is in performing customers’ transactions at the right time. SB should search for the reasons of delays.

Moreover, performing services as customers want is another service gap in this dimension and it should also be tackled. As assurance dimension seems to be the most important dimension to SB customers, the widest gap was found in the Sufficiency of employees’ knowledge to answer customers’ questions. In this respect, SB management has to increase the knowledge of the employees by providing training courses in their deficiency areas. And this study explain importance of customer satisfactions through the service that are provided by the bank and explain, the range impact that these dimensions contribute in banking whereas the quickly of delivery of service and easily of input deposits of money in the bank. So on. Tahir and Bakar, 2007(Service Quality Gap and Customers’ Satisfactions of Commercial Banks in Malaysia): This study aim to builds on earlier research by one of the authors and examines the level of service quality of Malaysia’s commercial banking industry from the customers’ perspective. Customers’ perceptions are very important especially in the service industry such as the commercial banking industry since there is high customer involvement in the delivery of the service itself. and thus through A total of 300 questionnaires were distributed and only 255 were useable for analysis . As an overall, customers of commercial banks in Malaysia were slightly satisfied with the services provided by the banks.

However, banks should not be happy with these findings because all the attributes had negative scores and these need to be improved otherwise the gaps will widen and therefore cause serious shortfalls. *Jamal and Naser, 2002 (Customer satisfaction and retail banking: an assessment of some of the key antecedents of customer satisfaction in retail banking: this study aims to Understanding the antecedents to and outcomes of customer satisfaction is a critical issue for both academics and bank marketers. Previous research has identified service quality, expectations, disconfirmation, performance, desires, affect and equity as important antecedents of customer satisfaction.

This study reports findings from a survey which looked into the impact of service quality dimensions and customer expertise on satisfaction. A sample of 167 respondents took part in this study. Findings indicate that both core and relational dimensions of service quality appear to be linked to customer satisfaction. Findings also indicate that expertise is negatively related to satisfaction. This study discusses implications for bank managers. Methodology of the study: In this study, the research will use survey approach to describe the importance of the impact of the customer satisfactions on service quality in commercial Jordan banking. And explain range improving by the banking to its service that is provided to customers.

The research will use the raw data and other and back to periodicals in order to the conceptual framework As well as to refer to previous studies on the subject in order to identify questioners comprehensive the variables of a study, including: – 1-Demographic variables: gender, age, qualifications, experience. 2-Questions related to the impact of service quality on customer satisfactions in commercial Jordan banking, and will be distributed to the respondents. Population: Society of study is all Islamic Jordanian banking that is making on improves its (quality) of service . that are, in contrast, offering to customers. Study sample: Will brief on the Islamic banking in Tafila References: 1- Amitava MiTra , fundamentals of quality control and improvement , Second editions. 2- Carman, J. 1990), “Consumer perceptions of service quality: an assessment of the SERVQUAL dimensions”, Journal of Retailing, Vol. 66 No. 1, Spring, pp. 33-55. 3- Ennew, C. T. , Reed, G. V. and Binks, M. R. (1993), “Importance performance analysis and the measurement of service quality”, European Journal of Marketing, Vol. 27 No. 2, pp. 59-70. 4- Parasuraman, A. , Zeithaml, V. and Berry, L. (1985), “A conceptual model of service quality and its implications for future research”, Journal of Marketing, Fall, Vol. 49, pp. 41-50. 5- Levesque, T. & McDougall, G. H. G. (1996). Determinants of customer satisfaction in retail banking. International Journal of Bank Marketing, 14(7): pp. 12-20 6- Shemwell, D. J. , Yavas, U. & Bilgin, Z. 1998.

Customer-service provider relationships: an empirical test of a model of service quality, satisfaction and relationship-oriented outcomes. International Journal of Service Industry Management, 9(2): pp. 155-168. 7- Sureshchandar, G. S. , Rajendarn, C. & Anantharaman, R. N. 2002. The relationship between service quality and customer satisfaction–a factor specific approach. Journal of Services Marketing, 16(4): pp. 363-379. 8- Taylor, S. A. and Baker, T. L. (1994), “An assessment of the relationship between service quality and customer satisfaction in the formation of consumers’ purchase intentions’’, Journal of Retailing, Vol. 70 No. 2, pp. 163-78. 9- Oliver, R. 1993) ‘Cognitive, affective and of attribute bases of satisfaction response’, Journal of Consumer Research, Vol. 20, pp. 418–430. 10- Smith, A. M. (1995), “Measuring service quality: is SERVQUAL now redundant? ”, Journal of Marketing Management, Vol. 11 Nos. 1-3, pp. 257-76. 11- McDougall, G. and Levesque, T. (1994), “A revised view of service quality dimensions: an empirical investigation”, Journal of Professional Services Marketing, Vol. 11 No. 1, pp. 189-210. 12- Lewis, B. R. (1991), “Service quality: an international comparison of bank customers’ expectations and perceptions”, Journal of Marketing Management, Vol. 7 No. 1, pp. 47-62. 13- LeBlanc, G. and Nguygen, N. 1988), “Customers’ perceptions of service quality in financial institutions”, International Journal of Bank Marketing, Vol. 6 No. 4, pp. 7-18. 14- Brown, T. J. , Churchill, G. A. Jr and Peter, J. P. (1993), “Improving the measurement of service quality”, Journal of Retailing, Vol. 69, Spring, pp. 127-38. 15 – Johnston, R. 1995. The determinants of service quality: satisfiers and dissatisfies. International Journal of Service Industry Management, 6(5): pp. 53-71. 16- Jannadi, O. A. and Al-Saqqaf, H. “Measurement of Quality in Saudi Arabian Service Industry. ” International Journal of Quality and Reliability Management, 17, No. 9 (2000), 949-965. ———————– Empathy Responsiveness Accessibility Assurance Reliability Customer Satisfactions