COMPANY OVERVIEW

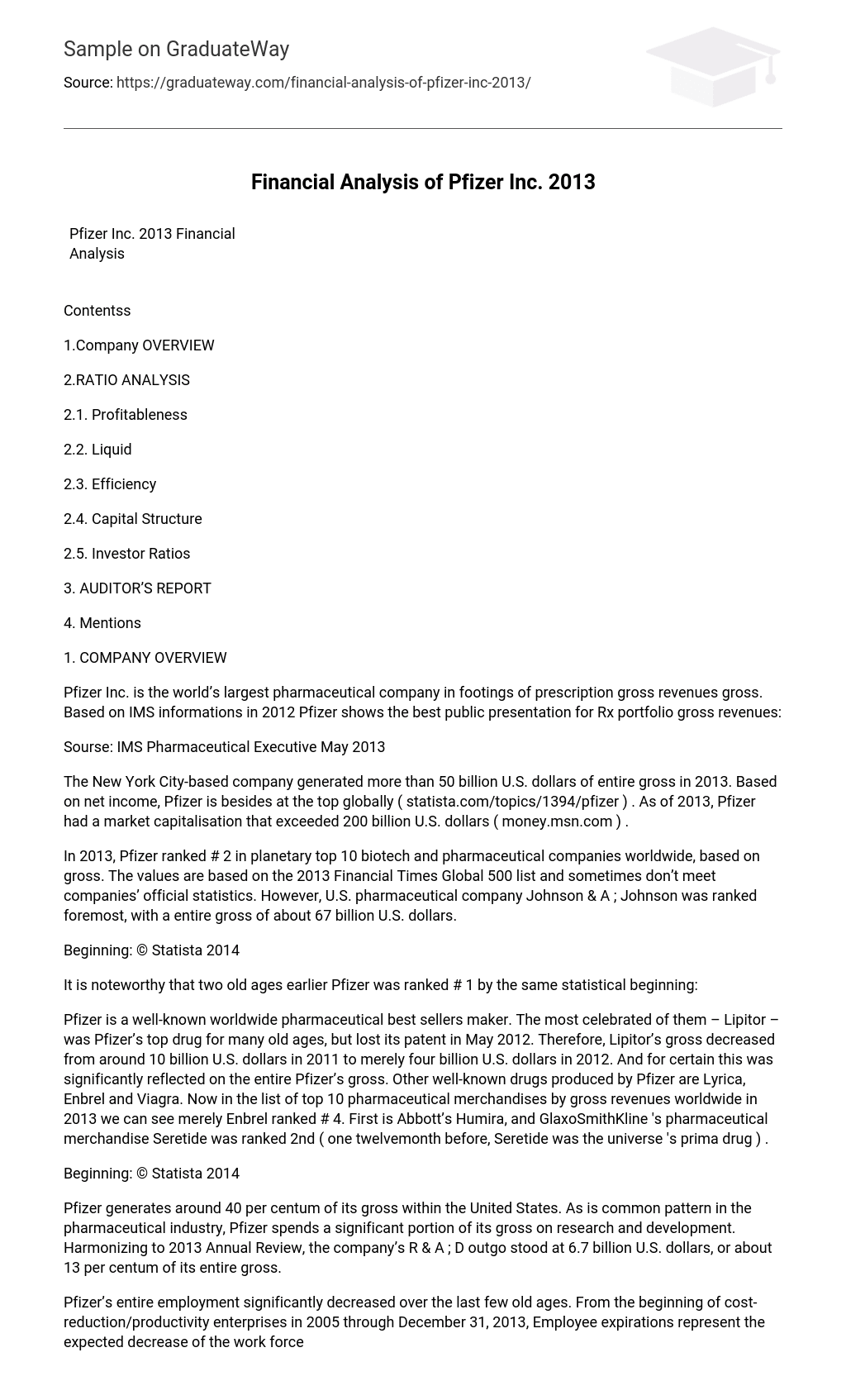

Pfizer Inc. is the world’s largest pharmaceutical company in footings of prescription gross revenues gross. Based on IMS informations in 2012 Pfizer shows the best public presentation for Rx portfolio gross revenues:

Sourse: IMS Pharmaceutical Executive May 2013

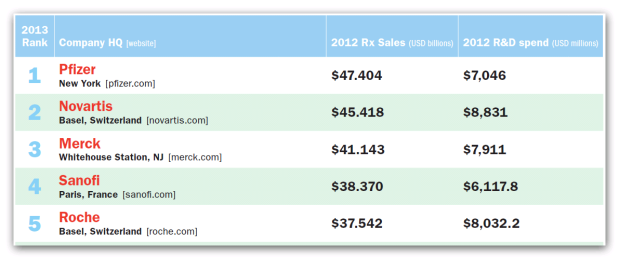

The New York City-based company generated more than 50 billion U.S. dollars of entire gross in 2013. Based on net income, Pfizer is besides at the top globally ( statista.com/topics/1394/pfizer ) . As of 2013, Pfizer had a market capitalisation that exceeded 200 billion U.S. dollars ( money.msn.com ) .

In 2013, Pfizer ranked # 2 in planetary top 10 biotech and pharmaceutical companies worldwide, based on gross. The values are based on the 2013 Financial Times Global 500 list and sometimes don’t meet companies’ official statistics. However, U.S. pharmaceutical company Johnson & A ; Johnson was ranked foremost, with a entire gross of about 67 billion U.S. dollars.

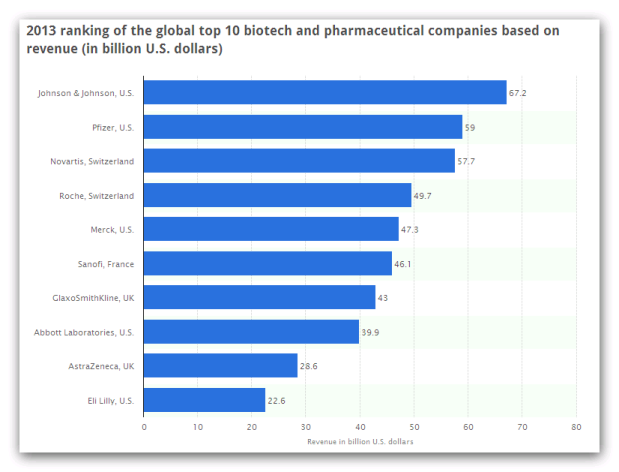

It is noteworthy that two old ages earlier Pfizer was ranked # 1 by the same statistical beginning:

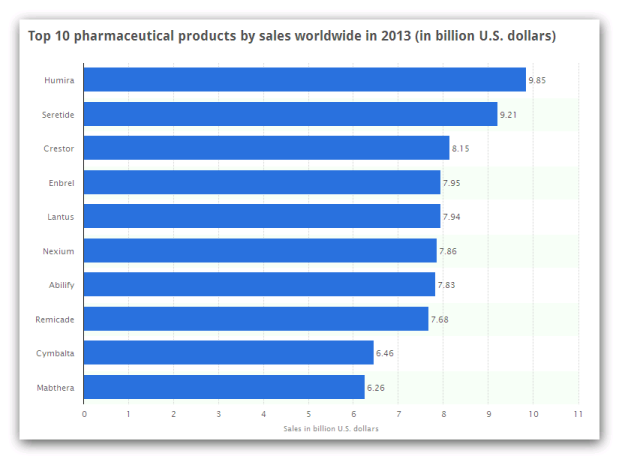

Pfizer is a well-known worldwide pharmaceutical best sellers maker. The most celebrated of them – Lipitor – was Pfizer’s top drug for many old ages, but lost its patent in May 2012. Therefore, Lipitor’s gross decreased from around 10 billion U.S. dollars in 2011 to merely four billion U.S. dollars in 2012. And for certain this was significantly reflected on the entire Pfizer’s gross. Other well-known drugs produced by Pfizer are Lyrica, Enbrel and Viagra. Now in the list of top 10 pharmaceutical merchandises by gross revenues worldwide in 2013 we can see merely Enbrel ranked # 4. First is Abbott’s Humira, and GlaxoSmithKline ‘s pharmaceutical merchandise Seretide was ranked 2nd ( one twelvemonth before, Seretide was the universe ‘s prima drug ) .

Pfizer generates around 40 per centum of its gross within the United States. As is common pattern in the pharmaceutical industry, Pfizer spends a significant portion of its gross on research and development. Harmonizing to 2013 Annual Review, the company’s R & A ; D outgo stood at 6.7 billion U.S. dollars, or about 13 per centum of its entire gross.

Pfizer’s entire employment significantly decreased over the last few old ages. From the beginning of cost-reduction/productivity enterprises in 2005 through December 31, 2013, Employee expirations represent the expected decrease of the work force by about 65,100 employees, chiefly in fabrication, gross revenues and research, of which about 56,500 employees have been terminated as of December 31, 2013. In 2013, well all employee expiration costs represent extra costs with regard to about 2,900 employees ( Pfizer 2013 Financial Report, p.73 ) .

Pfizer’s consolidated fiscal statements include parent company and all subordinates, and are prepared in conformity with accounting rules by and large accepted in the United States of America ( U.S. GAAP ) ( Pfizer 2013 Financial Report, p.61 ) . Company’s financial twelvemonth ends December 31st.

In 2013, Pfizer started transmutation to the wholly new commercial operating construction. This worldwide concern theoretical account is based on three planetary commercial concerns.

The Global Innovative Pharmaceutical concern ( GIP ) is focused on branded medical specialties and includes many of the new advanced merchandises coming from the grapevine. The Global Established Pharmaceutical concern ( GEP ) is a big profitable concern with chances in both developed and emerging markets. It has a diverse portfolio of medical specialties that are no longer patent protected or are close to losing their patent protection. The Vaccines, Oncology and Consumer Healthcare concern ( VOC ) comprises three offprint, distinguishable concerns, each of which has the potency for steady growing worldwide ( Pfizer 2013 Annual Report, p.4 ) .

RATIO ANALYSIS

The chief portion of this survey contains Ratio Analysis of the Pfizer based on historical informations derived from company’s Annual Reports and other beginnings. This sort of analysis is really helpful for investors, because fiscal ratios provide a quick and comparatively simple agencies of measuring the fiscal wellness of a concern ( Atrill & A ; McLaney, p. 179 ) .

In this analysis above mentioned ratios calculated by investor’s attack. In each tabular array all Ratios for Pfizer calculated for the last 3 old ages plus included Industry Average ( if applicable ) and Ratios for Merck & A ; Co based on Company’s 2013 Annual Report on signifier 10K. Merck has been chosen as a most relevant Pfizer’s neighbour in the top list traveling in the wholly the same environment and conditions ( U.S. GAAP, currency, etc. ) .

Profitableness

Profitability ratios provide an penetration to the grade of success in accomplishing this intent ( Atrill & A ; McLaney, p. 180 ) .

| Profitableness | 2013 | 2012 | 2011 | 2013 | 2013 |

| PFIZER | PFIZER | PFIZER | MERCK | Industry Average | |

| Gross border % | 81,42 % | 82,03 % | 79,52 % | 61,50 % | 53,78 % |

| Tax return on gross revenues | 42,65 % | 26,66 % | 16,40 % | 10,00 % | |

| ROCE | 10,29 % | 7,11 % | 7,04 % | 6,32 % | |

| ROA | 8,78 % | 6,01 % | 6,00 % | 5,24 % | 13,53 % |

Pfizer’s Gross border is about on the same degree during considered period – about 80 % . At the same clip it is significantly higher than Merck’s and Industry Average. It means that Pfizer has more capablenesss to cover all operational disbursals including Research and Development.

Tax return on gross revenues degree of Pfizer is really high in 2013 – more than 4 times higher in comparing with Merck. That is because on June 24, 2013, Pfizer completed the full temperament of Animal Health concern ( Zoetis ) , and recognized a addition of about $ 10.3 billion, cyberspace of revenue enhancement, in Gain on disposal of discontinued operations – cyberspace of revenue enhancement in Pfizer’s consolidated statement of income for the twelvemonth ended December 31, 2013.

The operating consequences of this concern are reported as Income from discontinued operations – cyberspace of revenue enhancement in Pfizer’s consolidated statements of income through June 24, 2013, the day of the month of disposal. In add-on, in the amalgamate balance sheet as of December 31, 2012, the assets and liabilities associated with this concern are classified as Assetss of discontinued operations and other assets held for sale and Liabilities of discontinued operations, as appropriate( Pfizer 2013 Financial Report, p.3 ; Besides see Note 2B in Consolidated Financial Statements ; Pfizer’s Zoetis IPO set to raise $ 2.2bn – Financial Times) .

For old periods Pfizer’s Return on gross revenues is besides higher, because of following discontinued operations:

- On November 30, 2012, Pfizer completed the sale of Nutrition concern to Nestle and recognized a addition of about $ 4.8 billion, cyberspace of revenue enhancement.

- On August 1, 2011, Pfizer completed the sale of Capsugel concern and recognized a addition of about $ 1.3 billion, cyberspace of revenue enhancement.

Pfizer demonstrates a high and fast growth ROCE which is really of import for investors as it is a cardinal ratio by many concerns ( Atrill & A ; McLaney, p. 198 ) . Pfizer’s ROA is besides higher than Merck’s one, but significantly less than Industry Average. It means that competition in pharmaceutical industry traveling to be more and more aggressive particularly by Gx and Company should fix equal action programs foremost of all for LOE ( lost of exclusivity ) and post-LOE merchandises.

Liquid

It is critical to the endurance of a concern for there to be sufficient liquid resources available to run into maturing duties ( Atrill & A ; McLaney, p. 180 ) . Liquidity ratios presented in the tabular array below:

| Liquid | 2013 | 2012 | 2011 | 2013 | 2013 |

| PFIZER | PFIZER | PFIZER | MERCK | Industry Average | |

| Current ratio | 2,30 | 2,12 | 2,09 | 1,95 | 2,50 |

| Acid trial | 2,07 | 1,89 | 1,81 | 1,60 | 1,83 |

The kineticss of Current Ratio and Acid trial shows positive growing of Pfizer’s liquidness twelvemonth to twelvemonth. Acid trial is significantly higher than 1 which is really satisfactory. For the investors this is a good mark that Pfizer’s current assets can cover Company’s current liabilities and in 2013 its ability has grown by 8 % in Current Ratio and by 10 % in Acid trial. Pfizer’s liquidness ratios are much higher than for Merck, but at the same clip Pfizer’s current ratio is still non so positive in comparing with Industry Average.

2.3. Efficiency

Efficiency Ratios may be used to mensurate the efficiency with which peculiar resources have been used within the concern ( Atrill & A ; McLaney, p. 180 ) .

| Efficiency | 2013 | 2012 | 2011 | 2013 | 2013 |

| PFIZER | PFIZER | PFIZER | MERCK | Industry Average | |

| DSO ( yearss ) | 70,87 | 84,93 | 80,70 | 61,57 | |

| DPO ( yearss ) | 117,18 | 147,58 | 114,32 | 43,34 | |

| Inventory bends | 1,57 | 1,44 | 1,56 | 2,66 | 2,79 |

| DIO ( yearss ) | 233,07 | 254,08 | 234,24 | 137,35 |

Pfizer’s DSO is traveling to be less in 2013 which is really good but it is higher than Merck’s ratio. At the same clip DPO is significantly higher than for Merck but it is less than in 2012 which could be a consequence of an inefficient recognition direction.

Pfizer’s Inventory bend is lower than for Merck and Industry Average. So it demonstrates higher inventories’ degree for Pfizer but with positive kineticss. DIO besides has a positive alteration in 2013 but still non satisfactory in comparing with Merck.

Capital Structure

Leverage Ratio and Interest Cover Ratio foregrounding alterations in the capital construction.

| Capital STRUCTURE | 2013 | 2012 | 2011 | 2013 | 2013 |

| PFIZER | PFIZER | PFIZER | MERCK | Industry Average | |

| Leverage | 46,72 % | 46,50 % | 38,81 % | 42,33 % | 94,80 % |

| Interest screen | 19,32 | 11,78 | 8,84 | 39,97 | 26,46 |

Actually we can see that Pfizer has no jobs with Capital Structure and ratios demonstrate positive kineticss. Interest screen is in line with Industry Average but significantly lower than for Merck with about the same Leverage.

Investor Ratios

Certain ratios are concerned with measuring the returns and public presentation of portions held in a peculiar concern from the position of stockholders who are non involved with the direction of the concern ( Atrill & A ; McLaney, p. 180 ) .

| Investing | 2013 | 2012 | 2011 | 2013 | 2013 |

| PFIZER | PFIZER | PFIZER | MERCK | Industry Average | |

| Roe | 27,80 % | 17,74 % | 11,71 % | 8,17 % | 20,13 % |

| Dividend output | 1,90 % | 3,32 % | 4,07 % | 2,93 % | 1,73 % |

| EPS ( basic ) | 3,45 | 2,03 | 1,33 | 1,23 | 1,65 |

| Pe | 9,31 | 13,50 | 15,98 | 39,91 | 19,80 |

Roe shows how much the stockholders earned from their investing to the company. The tabular array shows Pfizer’s ROE significantly increased in 2013 and really much higher than Merck’s ratio and Industry Average. That happens due to Pfizer’s Net Income addition for the same period of clip based on above mentioned factors.

Dividend output for Pfizer is in line with Industry Average but less than for Merck and shows negative kineticss during last 3 old ages. Pfizer’s EPS is increasing and much higher than for Merck and Industry Average, foremost of all based on important public presentation in footings of profitableness.

PE for Pfizer diminishing during last 3 old ages and it is lower than both Merck and Industry Average so Pfizer has to make a batch of activities to return Investors’ assurance. Based on Macroaxis.com popularity evaluation, Pfizer Inc has a mark of 23 on a graduated table of 0 to 100. This implies that the stock is non every bit attractive to investors as 77 % of all other stocks in USA.

AUDITOR’S REPORT

Pfizer has its ain Audit Committee which is a commission of the Board of Directors. As it is mentioned in the Audit Committee Charter, the Audit Committee consists of three Independent Directors in conformity with New York Stock Exchange listing criterions. Each member shall, in the judgement of the Board of Directors, have the ability to read and understand the Company’s basic fiscal statements.

Harmonizing to 2013 Financial Report Committee has recommended to the Board of Directors, and the Board has approved, that the audited fiscal statements be included in the Company’s Annual Report on Form 10-K for the twelvemonth ended December 31, 2013, for registering with the SEC. The Committee has selected, and the Board of Directors has ratified, the choice of the Company’s independent registered public accounting house for 2014.

Actually Pfizer’s amalgamate fiscal statements and Internal Control Over Financial Reporting have been audited by KPMG. Below are some abstracts from the KPMG’s studies signed on February 28, 2014 and included in Pfizer 2013 Financial Report.

KPMG audited the attach toing amalgamate balance sheets of Pfizer Inc. and Subsidiary Companies as of December 31, 2013 and 2012, and the related amalgamate statements of income, comprehensive income, equity, and hard currency flows for each of the old ages in the threeyear period ended December 31, 2013.

Audit procedure conducted in conformity with the criterions of the Public Company Accounting Oversight Board ( United States ) . Those criterions require that hearer program and execute the audit to obtain sensible confidence about whether the fiscal statements are free of material misstatement. An audit includes analyzing, on a trial footing, grounds back uping the sums and revelations in the fiscal statements. An audit besides includes measuring the accounting rules used and important estimations made by direction, every bit good as measuring the overall fiscal statement presentation.

In auditor’s sentiment, the amalgamate fiscal statements present reasonably, in all stuff respects, the fiscal place of Pfizer Inc. and Subsidiary Companies as of December 31, 2013 and 2012, and the consequences of their operations and their hard currency flows for each of the old ages in the three-year period ended December 31, 2013, in conformance with U.S. by and large accepted accounting rules ( Pfizer 2013 Financial Report, p. 53 ) .

KPMG’s study expressed an unqualified sentiment on the effectual operation of the Company’s internal control over fiscal coverage. KPMG mentioned that because of its built-in restrictions, internal control over fiscal coverage may non forestall or observe misstatements. Besides, projections of any rating of effectivity to future periods are capable to the hazard that controls may go unequal because of alterations in conditions, or that the grade of conformity with the policies or processs may deteriorate.

In auditor’s sentiment, Pfizer Inc. and Subsidiary Companies maintained, in all stuff respects, effectual internal control over fiscal coverage as of December 31, 2013, based on standards established in Internal Control—Integrated Framework ( 1992 ) issued by COSO.

KPMG besides have audited, in conformity with the criterions of the Public Company Accounting Oversight Board ( United States ) , the amalgamate balance sheets of Pfizer Inc. and Subsidiary Companies as of December 31, 2013 and 2012, and the related amalgamate statements of income, comprehensive income, equity, and hard currency flows for each of the old ages in the three-year period ended December 31, 2013, and KPMG’s study expressed an unqualified sentiment on those amalgamate fiscal statements ( Pfizer 2013 Financial Report, p. 54 ) .

Mentions

- Atrill, & A ; McLaney, Accounting and Finance for Non-Specialists with MyAccountingLab entree card, 8th edition, published 2013, Pearson

- Pfizer Annual Review 2013 [ hypertext transfer protocol: //www.pfizer.com/files/investors/financial_reports/annual_reports/2013/index.htm ] ( Apr 2014 )

- Pfizer 2013 10K signifier [ hypertext transfer protocol: //services.corporate-ir.net/SEC/Document.Service? id=P3VybD1hSFIwY0RvdkwyRndhUzUwWlc1cmQybDZZWEprTG1OdmJTOWtiM2R1Ykc5aFpDNXdhSEEvWVdOMGFXOXVQVkJFUmlacGNHRm5aVDA1TkRNek16RTBKbk4xWW5OcFpEMDFOdz09JnR5cGU9MiZmbj05NDMzMzE0LnBkZg== ] ( Apr 2014 )

- Pfizer 2013 Financial Report [ hypertext transfer protocols: //www.pfizer.com/files/investors/presentations/FinancialReport2013.pdf ] ( Apr 2014 )

- 2013 Merck Annual Report on signifier 10K [ hypertext transfer protocol: //www.merck.com/investors/financials/annual-reports/home.html ] ( Apr 2014 )

- IMS Pharmaceutical Executive May 2013 [ hypertext transfer protocol: //www.imshealth.com/deployedfiles/consulting/Global/Content/How We Help/Strategy & A ; Portfolio/PharmExec-pharma50.pdf ] ( Apr 2014 )

- Pfizer Audit Committee Charter [ hypertext transfer protocol: //www.pfizer.com/files/investors/corporate_governance/cg_charter_audit.pdf ] ( Apr 2014 )

- Pfizer’s Zoetis IPO set to raise $ 2.2bn [ hypertext transfer protocol: //www.ft.com/intl/cms/s/0/3ed81952-6192-11e2-9545-00144feab49a.html # axzz2zKKiH8FM ] ( Apr 2014 )