Introduction

Neo-classical theories see amalgamations and acquisitions ( M & A ; As ) as efficiency betterment step taken by the organisations in response to industry challenges such as deteriorating profitableness, cut downing market portion, duplicate of resources, rigorous industry ordinance etc. ( Jovanovic and Rousseau, 2002 ) . However, neo-classical theory entirely can non depict a broad scope of grounds that force the companies to unify together or follow an acquisition scheme ( horizontal or perpendicular acquisition ) to obtain or prolong a competitory advantage by accomplishing synergism, diversify concern portfolio to administer hazard, attain growing, increase dickering power with purchasers and providers or to merely extinguish competition ( Marks & A ; Mirvis, 2013 ) .

This paper will discourse the instance of biggest acquisition in the pharmaceutical industry with the acquisition of Wyeth by Pfizer in January 2009 for $ 68 billion, the 2nd biggest acquisition in the history of corporate America since AT & A ; T and BellSouth ‘s US $ 70 billion trade in March 2006 ( Pfizer, 2009 ) . The acquisition of Wyeth was a cash-and-stock dealing valued, based on the shutting market monetary value of Pfizer’s common stock on the acquisition day of the month, at $ 50.19 per portion of Wyeth common stock ( Pfizer, 2009 ).

At the clip of this acquisition Wyeth was bring forthing $ 22.4 billion in gross revenues with a bottom line of $ 4.6 billion and Pfizer generated net grosss of $ 48.3 billion and the net income of $ 8.1 billion ( Pfizer, 2008 ) . The completion of acquisition in October 2009 made Pfizer the largest pharmaceutical company in the universe with possible nest eggs of $ 4 billion from the use of common resources and riddance of inefficiencies in the supply concatenation.

However, under this trade Pfizer had to repatriate one million millions of gross dollars from foreign subordinates to the US, ensuing in higher revenue enhancement costs and waste of value ( Pfizer, 2009 ) . This amalgamation was besides criticized by Harvard University Professor Gary Pisano, who commented on this intelligence “the record of large amalgamations and acquisitions in Big Pharma has merely non been good. There’s merely been an tremendous sum of stockholder wealth destroyed” ( Karnitschnig & A ; Rockoff, 2009 ) .

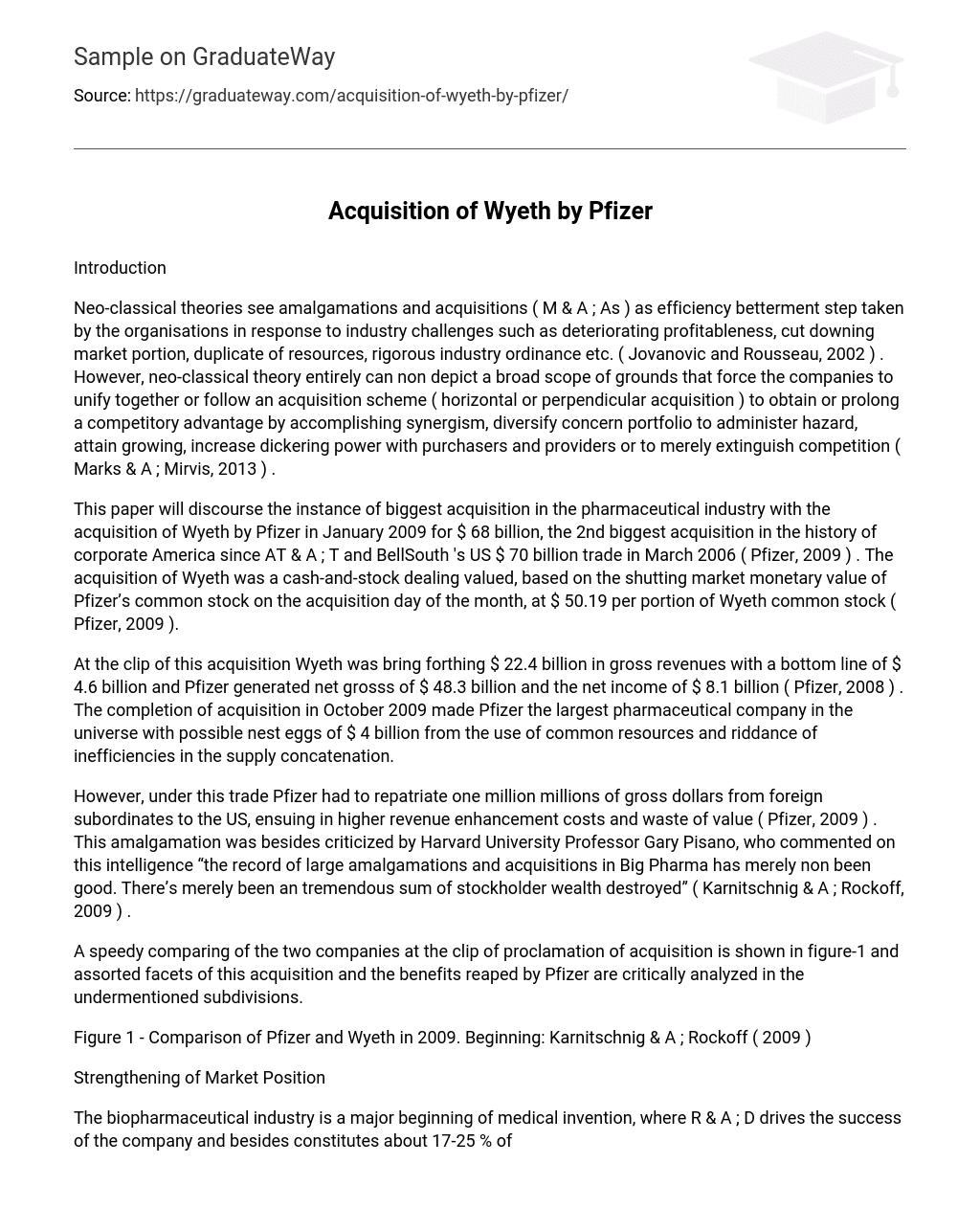

A speedy comparing of the two companies at the clip of proclamation of acquisition is shown in figure-1 and assorted facets of this acquisition and the benefits reaped by Pfizer are critically analyzed in the undermentioned subdivisions.

Figure 1 – Comparison of Pfizer and Wyeth in 2009. Beginning: Karnitschnig & A ; Rockoff ( 2009 )

Strengthening of Market Position

The biopharmaceutical industry is a major beginning of medical invention, where R & A ; D drives the success of the company and besides constitutes about 17-25 % of its disbursals ( Danzon, 2014 ) . The drug company industry is extremely competitory due to rigorous ordinances and longer times to market their drugs as they seek blessing from relevant governmental bureaus ( for illustration Food and Drug Administration – FDA in the USA ) that set the safety, efficaciousness and quality of fabrication as a requirement to market the drug to consumers ( Danzon, 2014 ) .

Other industry challenges include the loss or termination of rational belongings rights that allow low cost generic trade names to come in the market and drive down the monetary values, the grapevine productiveness, pricing and entree force per unit areas and increasing competition among branded merchandises ( Pfizer, 2009 ) .

So, in response to these challenges in the operating environment Pfizer made an effort to beef up its market place by geting Wyeth that enabled the company to diversify its merchandise portfolio with the inclusion of vaccinums, biologics, little molecules and nutrition across developed and emerging markets. This interactive consequence is shown in figure-2.

Figure 2 – Synergies from the acquisition of Wyeth by Pfizer. Beginning: NYTimes ( 2009 )

Despite the unfavorable judgment environing the amalgamation of two pharma giants and the unfavourable economic conditions amid planetary economic downswing, the Wall Street and the major Bankss supported this is acquisition because of good market place and lent $ 26 billion to back up the acquisition trade ( NYTimes, 2009 ) .

With this acquisition, Pfizer has consolidated its place as the market leader by come ining antecedently untasted market sections refering to oncology, hurting, redness, Alzheimer’s disease, psychoses and diabetes, every bit good as the critical engineerings of vaccinums and biologics. This acquisition will besides assist Pfizer to accomplish its purpose to go the top-tier biotherapeutics company by 2015 and it will besides derive growing in emerging markets of Brazil, India, Russia and China ( Pfizer, 2009 ) .

Operational and Economic Benefits

The literature points to the fact that horizontal M & A ; As, such as Pfizer-Wyeth, achieve more operating efficiencies and economic systems of graduated table than perpendicular 1s ( Maksimovic and Phillips, 2001 ) . The operational and economic benefits have besides been recognized by the main executive of Pfizer, Jeffery B. Kindler who commented “Our combined company will be one of the most diversified in the industry and will profit from complementary patient-centric units that match velocity with the benefits of a planetary company’s graduated table and resources” ( NYTimes, 2009 ) .

First, Pfizer expects to salvage $ 4 billion yearly by uniting and streamlining its operations with Wyeth due to lower and more flexible cost base for the combined operations that helped in cutting down the production operating expense, R & A ; D, and the figure of employees ( NY Times, 2009, Pfizer, 2009 ) .

Second, the extract of new thoughts, positions and procedures can bring forth enduring benefits that are broader and deeper than ab initio expected by the companies ( Vermeulen, 2005 ) . In this instance, the bing patents and the on-going research at Wyeth added complementary capablenesss to Pfizer, which benefitted from diversified merchandise portfolio of consumer and nutritionary drugs ( Stempel & A ; Schiffer, 2009 ) .

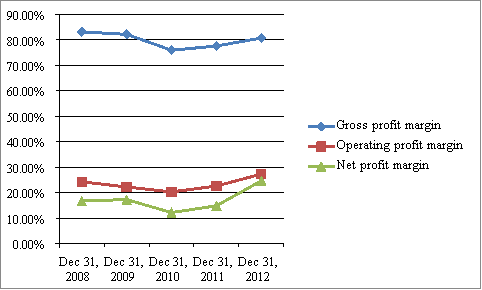

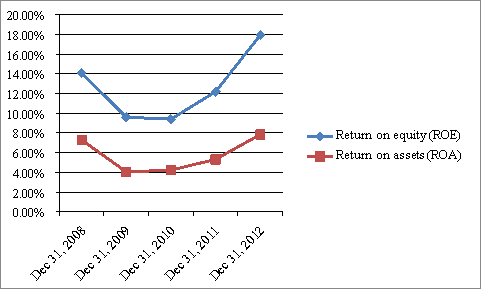

This acquisition will besides assist the company in picturing higher public presentation in invention and technological cognition coevals, ensuing in higher quality drugs in hereafter ( Makri et al. , 2010 ) . The operational and economic benefits of this acquisition can besides be shown through the ratio analysis of Pfizer before and after acquisition as shown in figure-3 and figure-4.

Figure 3 – Net income Margins of Pfizer before and after acquisition of Wyeth in 2009. Beginning: Fiscal statements of Pfizer from 2008 – 2012

Figure 4 – ROA and ROE of Pfizer before and after acquisition of Wyeth in 2009. Beginning: Fiscal statements of Pfizer from 2008 – 2012

It can be seen in both the aforesaid figures that all the public presentation prosodies fell instantly after acquisition, but over following three old ages the public presentation measures met or exceeded their initial values before acquisition, thereby indicating to be nest eggs, decrease in inefficiencies, addition in productiveness, enhanced operational public presentation, better plus use and increased profitableness.

Fiscal Benefits

Stock markets frequently behave irrationally or unsuitably to the intelligence of acquisition, particularly, when it involves big companies, but the grounds shows that if an acquirer makes a hard currency offer to buy the company ; it ends up gaining long–run unnatural returns due to non-dilution of net incomes per portion ( EPS ) , as comparison to stock offerings that earn negative long-run unnatural returns ( Loughran & A ; Vijh, 1997 ) .

Under the trade of this acquisition the Pfizer paid $ 50.19 per portion of Wyeth utilizing a assorted construction of hard currency and equity — $ 33 a portion in hard currency and 0.985 Pfizer portions deserving $ 17.19 a portion based on Pfizer’s shutting monetary value, and paid about 29 % premium over the existent company rating per portion ( Karnitschnig, 2009 ) . This trade was instantly appreciated by the stock market ensuing in the portions of Wyeth to increase by 12.96 % ( by $ 4.91 ) and the portions of Pfizer to mount by 1.4 % or 24 cents ( Karnitschnig, 2009 ) .

The acquisition of Wyeth has extremely good to Pfizer financially, because Pfizer was confronting a pressure challenge of its patent ( or exclusivity ) termination of Lipitor, a cholesterin take downing drug that accounted for about 25 % of its gross watercourse as being the best cholesterin control in the universe. Although, the loss of exclusivity on this drug in 2011 costed Pfizer a jutting loss of $ 12 billion, non much has been solved with the acquisition of Wyeth as 14 other drug patents are scheduled to run out in 2014 with a jutting loss of $ 35 billion ( Pfizer, 2010 ) .

However, some of these lost grosss have been compensated by the bequest drug trade names of Wyeth as the grosss of Pfizer in 2010 increased by 36 % to $ 67.8 billion, compared to $ 50.0 billion in 2009. This fiscal growing was achieved due to the inclusion of grosss from bequest Wyeth merchandises for a full twelvemonth in 2010 compared to portion of the twelvemonth in 2009, which favourably impacted grosss by $ 18.1 billion or 37 % ( Pfizer, 2010 ) . The Ag liner in this treatment is that such challenges are non alone to Pfizer and its rival drug shapers – Merck, Bristol Myers Squibb and Eli Lilly are all confronting their ain patent losingss in the following twosome of old ages.

Despite these fiscal benefits, Pfizer has faced a major cost of acquisition in the signifier of added revenue enhancements ensuing from the repatriating the one million millions of dollars in the US as a portion of acquisition trade and this resulted in the effectual revenue enhancement rate addition from 17 % in 2008 to 20.3 % in 2009 amounting to $ 2.1 billion in revenue enhancements in 2009 up from $ 1.6 billion in 2008 ( Pfizer, 2009 ) .

Decision

In decision, the fiscal public presentation prosodies are an obvious index of success of this acquisition as the company has successfully created value for its stockholders and has gained sustained market advantage in predominating extremely competitory operating environment. Although, in making so the company has destroyed some value due to increased revenue enhancement load and the menace of loss of gross due to run outing patents still looms at big, the company’s increased capableness to put in R & A ; D and develop following discovery drug ( like Lipitor ) will be the exclusive decider of its future public presentation.

Mentions

- Danzon, P. ( 2014 ) .Economicss of the Pharmaceutical Industry. [ ONLINE ] Available at: hypertext transfer protocol: //www.nber.org/reporter/fall06/danzon.html. [ Accessed 13 February 2014 ] .

- Jovanovic, B. , Rousseau, P. ( 2002 ) . The q-theory of amalgamations.American Economic Review, 92, 198–204.

- Karnitschnig, M, & A ; Rockoff, J. D. ( 2009 ) .Pfizer in Talks to Buy Wyeth – WSJ.com. [ ONLINE ] Available at: hypertext transfer protocol: //online.wsj.com/news/articles/SB123268511212809429. [ Accessed 13 February 2014 ] .

- Karnitschnig, M. ( 2009 ) .Pfizer to Pay $ 68 Billion for Wyeth – WSJ.com. [ ONLINE ] Available at: hypertext transfer protocol: //online.wsj.com/news/articles/SB123293456420414421. [ Accessed 13 February 2014 ] .

- Loughran, T. , Vijh, A. , 1997. Make long-run stockholders benefit from corporate acquisitions?Journal of Finance, 52, 1765–1790.

- Maksimovic, V. , Phillips, G. , 2001. The Market for Corporate Assets: Who Engages in Amalgamations and Asset Gross saless and Are There Efficiency Gains?Journal of Finance,56 ( 6 ) , 2019–2065.

- Makri, M. , Hitt, A. M. , Lane, P. J. ( 2010 ) . Complementary Technologies, Knowledge Relatedness, and Invention Outcomes in High Technology Mergers and Acquisitions.Strategic Management Journal, 31 ( 6 ) , 602-628.

- Marks, M. L. , & A ; Mirvis, P. H. ( 2013 ) . The amalgamation syndrome.Mergers & A ; Acquisitions: A Critical Reader, 149.

- NYTimes ( 2009 ) .Pfizer Agrees to Pay $ 68 Billion for Rival Drug Maker Wyeth. [ ONLINE ] Available at: hypertext transfer protocol: //www.nytimes.com/2009/01/26/business/26drug.html? pagewanted=all & A ; _r=2 & A ; . [ Accessed 13 February 2014 ] .

- Pfizer ( 2008 ) .Pfizer 2008 Financial Performance Overview. [ ONLINE ] Available at: hypertext transfer protocol: //www.pfizer.com/files/annualreport/2008/financial/financial2008.pdf.[ Accessed 13 February 2014 ] .

- Pfizer ( 2009 ) .Pfizer Wyeth 2009 Financial Performance Overview. [ ONLINE ] Available at: hypertext transfer protocol: //www.pfizer.com/files/annualreport/2009/financial/financial2009.pdf. [ Accessed 13 February 2014 ] .

- Pfizer ( 2010 ) .Pfizer Wyeth 2009 Financial Performance Overview. [ ONLINE ] Available at: hypertext transfer protocol: //www.pfizer.com/files/annualreport/2010/financial/financial2010.pdf. [ Accessed 13 February 2014 ] .

- Stempel, A. S. , Schiffer D. , 2009. Pfizer-Wyeth: Lessons from the First Major Merger Review of the Obama Administration.The Threshold?Vol. XI ( 1 ) , 6-96.

- Vermulen, F. ( 2005 ) .How Acquisitions Can Regenerate Companies | MIT Sloan Management Review. [ ONLINE ] Available at: hypertext transfer protocol: //sloanreview.mit.edu/article/how-acquisitions-can-revitalize-companies/ . [ Accessed 13 February 2014 ].