Introduction

Australian existent estate investing trusts ( A-REITs ) allow investors to entree belongings assets that may be out of fiscal range for single investors, due to the big cost of buying belongings. Trading costs of A-REITs are about 0.5 % of the dealing cost when compared to the physical purchase of belongings. ( Lecture notes, 2014 ) A-REITs entreaty to investors because of the liquidness factor and enhanced continual income generated from lease understandings. Investors can besides diversify their portfolio into a scope of belongings types.

The Folkestone Education Trust ( FET ) was officially listed on the Australian Securities Exchange ( ASX ) on 22neodymiumof May, 2003. In June 2014, the Australian Education Trust ( ASX codification: AEU ) changed its name to Folkestone Education Trust ( ASX codification: FET ) . ( FET, 2014a ) The Folkestone Education Trust is the largest Australian listed existent estate trust that invests in early acquisition belongingss within Australia and New Zealand.

The construction of Folkestone Education Trust allows it to keep and pull off a portfolio of assets on behalf of their investors and portions are bought and sold on the ASX. The Folkestone Education Trust is a trust, where investors ain units. Distributions are paid quarterly through to investors, they include rental income and capital payment for illustration if a belongings was sold. ( FET, 2014a ) The financess director is separate from the trust. The Trust has 205,069,661 units on issue as at 30Thursdayof June, 2014. The bulk stockholder is J P MORGAN NOMINEES AUSTRALIA LIMITED who holds 31,206,018 units which is about 15 % of the entire units available. ( FET, 2014b )

Location of Properties

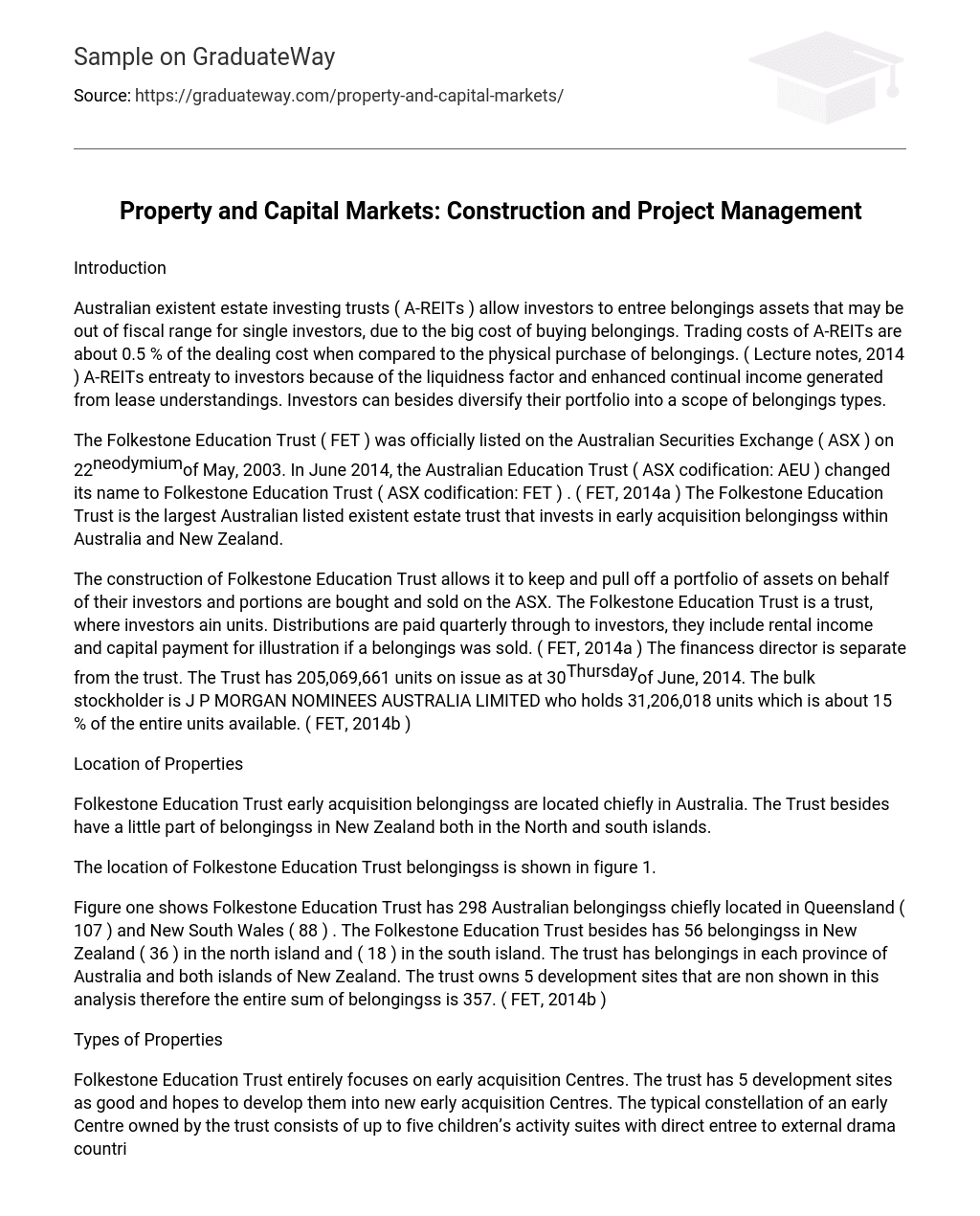

Folkestone Education Trust early acquisition belongingss are located chiefly in Australia. The Trust besides have a little part of belongingss in New Zealand both in the North and south islands.

The location of Folkestone Education Trust belongingss is shown in figure 1.

Figure one shows Folkestone Education Trust has 298 Australian belongingss chiefly located in Queensland ( 107 ) and New South Wales ( 88 ) . The Folkestone Education Trust besides has 56 belongingss in New Zealand ( 36 ) in the north island and ( 18 ) in the south island. The trust has belongings in each province of Australia and both islands of New Zealand. The trust owns 5 development sites that are non shown in this analysis therefore the entire sum of belongingss is 357. ( FET, 2014b )

Types of Properties

Folkestone Education Trust entirely focuses on early acquisition Centres. The trust has 5 development sites as good and hopes to develop them into new early acquisition Centres. The typical constellation of an early Centre owned by the trust consists of up to five children’s activity suites with direct entree to external drama countries. The internal layout consists of a characteristic entry & A ; anteroom, cardinal hallway, lavatories for changing ages, shower, readying countries, baby’s room, kitchen, extra staff country, response, disposal country, storage, and handicapped lavatory.

The external drama countries consist of shade fabrics, sandpits, awning covered galleries bordering external drama countries, grass and rubber entangling to external drama countries, kid cogent evidence fencing throughout, paving, landscape gardening, illuming and signage. Besides early acquisition Centres consist of on-site auto parking infinites in pronounced bays ( incl. 1 handicapped ) norm 16, maximal 48. All renters must follow with ordinances to run into the needed legislative demands sing edifice services, occupational wellness & A ; safety and early acquisition licensing demands. Location is typically within established residential and commercial locations having medium to high traffic countries, good handiness and entree to public conveyance. ( FET, 2014c )

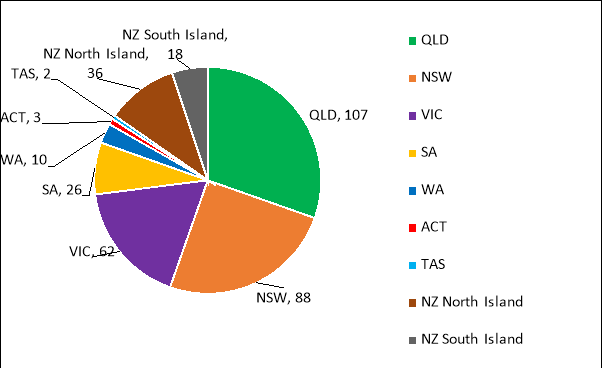

In figure two the renter variegation is shown by rental income as at 31stof December, 2013.

Beginning:FET, 2014c

Figure two shows the trust has 28 renters, 27 in Australia and 1 in New Zealand. 203 lease understandings with Goodstart Early Learning Limited for early larning belongingss in Australia, equates to 60 % of the rental income for the trust. Kidicorp Limited has 56 rentals with all the early acquisition Centre belongingss in New Zealand, equates to 11 % of the rental income for the trust.

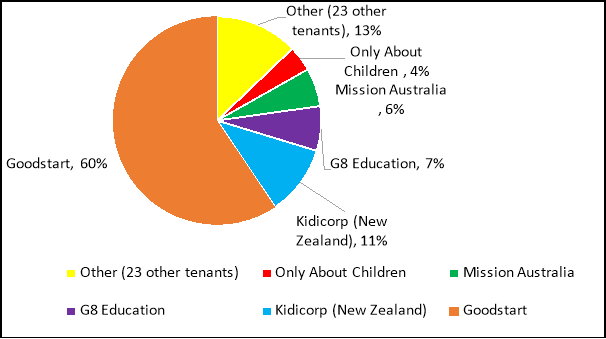

Figure 3 displays the sum of income earned during the lease understanding until the rental expires. From 2019 onwards until 2023 tonss of rentals will run out. Folkestone Education Trust will hold to renegociate new rentals with renters in order to procure future income.

Trust size and Debt degrees

As at 30 June 2014, the Folkestone Education Trust entire assets are valued at $ 464.6 million. Gross debt was $ 147.3million and net assets were $ 306.7million. The net touchable plus per unit is $ 1.50 ( Last fiscal twelvemonth 30 June, 2013: $ 1.33 ) . The Trust has geartrain ( adoptions and hard currency overdraft / entire assets ) of 31.7 % . ( FET, 2014b ) The major moneymans for the Folkestone Education Trust are the National Australia Bank ( NAB ) who provide the major capital and Australia & A ; New Zealand Bank ( ANZ ) who provide the hard currency overdraft. Both these Bankss provide the debt installations for Folkestone Education Trust. The trust got an extension of the debt ‘s adulthood to June, 2017 with the National Australia Bank and a $ 50 million addition to the installation bound to $ 173 million. The Trust besides has an overdraft installation with ANZ in order to more expeditiously pull off its working capital place $ 0.3 million as at 30 June, 2014 with a bound of $ 10 million. ( FET, 2014b )

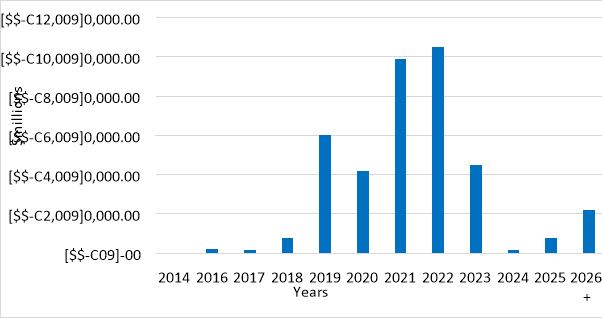

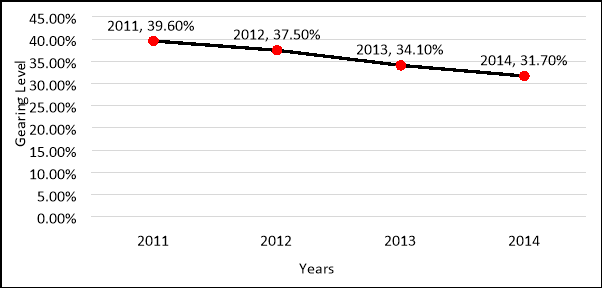

Figure four demonstrates the pitching degree from 2011 to 2014. The pitching degree in 2011 was 39.60 % and has fallen to 31.70 % as at 30Thursdayof June, 2014. There are two grounds that could explicate how Folkestone Education Trust’s pitching degree has fallen. The first ground could be borrowing less hard currency from fiscal establishments reduces the pitching degree. The 2nd ground could be an addition in entire assets will take down geartrain.

Reference list

- Lecture notes 2014, Property and Capital Markets BUIL1228, Module 3 Understanding Property Investment Markets Session 9: Real Estate Investment Trusts, RMIT University, Melbourne, viewed 20Thursdayof August, hypertext transfer protocol: //lms.rmit.edu.au/bbcswebdav/pid-5507329-dt-content-rid-11236982_1/courses/BUIL1228_1450/Lecture Notes S9.pdf

- Folkestone Education Trust 2014a,Folkestone Education Trust web site,FET hypertext transfer protocol: //educationtrust.folkestone.com.au/ , viewed 20Thursdayof August 2014

- Folkestone Education Trust 2014b, 6Thursdayof August 2014,Annual study 2014,FET, Melbourne, viewed 20Thursdayof August 2014, hypertext transfer protocol: //educationtrust.folkestone.com.au/wp-content/uploads/sites/2/2014/04/FET-Annual-Report-30-June-2014.pdf

- Folkestone Education Trust 2014c, 31stof December 2013,Folkestone Education Trust Profile,FET, Melbourne, viewed 20Thursdayof August 2014, hypertext transfer protocol: //educationtrust.folkestone.com.au/wp-content/uploads/sites/2/2014/04/FET-Profile-Final.pdf

- Australian Securities Exchange ( ASX ) , 6th of August 2014,ASX ANNOUNCEMENT, Australian Securities Exchange ( ASX ) , Sydney, viewed 20th of August 2014, hypertext transfer protocol: //www.asx.com.au/asxpdf/20140806/pdf/42r9q57pc0c0fc.pdf