Department of Currency Management and Payment Systems Bangladesh Bank Head Office Dhaka DCMPS Circular No. 09/2010 Date : 10 Bhadro 1417 25 August 2010 Managing Director/Chief Executive Officers All scheduled banks in Bangladesh Dear Sir, Bangladesh Electronic Fund Transfer Network (BEFTN) Operating Rules. All Scheduled banks of the country that will participate in the Bangladesh Automated Clearing House (BACH) are hereby advised to download the Bangladesh Electronic Fund Transfer Network (BEFTN) Operating Rules for their use.

The approved BEFTN Operating Rules is published in the website of Bangladesh Bank. The addresses of the website are: www. bb. org. bd www. bangladesh-bank. org They are also requested to execute and sign the Bangladesh Electronic Fund Transfer Network Participant Agreement and Indemnity (Appendix Seven) and send it to the Department of Currency Management and Payment systems, Bangladesh Bank within 30 September, 2010. Please acknowledge receipt. Sincerely Yours, Signed (Jinnatul Bakeya) General Manager Tel: 880-2-7120372 Fax: 880-2-7120373 Email: jinnatul. akeya@bb. org. bd Enclosure: BEFTN Participant Agreement and Indemnity (Appendix Seven). Bangladesh Electronic Funds Transfer Network (BEFTN) OPERATING RULES Payment Systems Division Department of Currency Management and Payment Systems Bangladesh Bank 10 August 2010 FOREWORD A modern national payment system is the backbone for a country’s monetary and financial infrastructure and an advanced payment system plays a critical role in the country’s current and future economic development. Several years ago, Bangladesh Bank in partnership with the U.

K. Department for International Development (DFID) embarked on a project to modernize Bangladesh’s national payments system. The project is multifaceted and its primary objective was to increase and improve the delivery of workers’ remittances. The effort is known as the Remittance and Payments Partnership (RPP). Over the past two years significant progress has been made in achieving the goals of the initiative. The RPP project has two major payment system components consisting of the creation of an inter? ank electronic funds transfer system which has been named the Bangladesh Electronic Funds Transfer Network (BEFTN) and the automation of the existing paper cheque clearing system which is known as the Bangladesh Automated Cheque Processing System (BACPS). The creation of the Bangladesh Electronic Funds Transfer Network is the most critical component in the development of a modern payments system infrastructure. BEFTN will be the most powerful payments system in Bangladesh.

The network will have extensive reach by connecting, for the first time, all of the banks in Bangladesh. This new electronic funds transfer network will provide the foundation for providing access to every banked and non? banked consumer as well as every business customer to facilitate electronic commerce. No other single electronic network will have the reach of BEFTN. This is a significant advantage over other payments systems being developed in the country. It is lso the only payment system that handles a wide variety of credit transfer applications such as payroll, foreign and domestic remittances, social security, dividends, retirement, expense reimbursement, bill payments, corporate payments, government tax payments, veterans payments, government licences and person to person payments as well as debit transfer applications such as mortgage payments, membership dues, loan payments, insurance premiums, utility bill payments, company cash concentration, government tax payments, government licenses and fees.

In the future BEFTN will be linked to the mobile payment initiatives currently being developed within Bangladesh, the mobile networks will provide the gateway for the non? banked to reach banked consumers and businesses and for banked consumers and businesses to reach the non? banked. The BEFTN Operating Rules that are contained in this document in conjunction with the recently enacted Bangladesh Payments and Settlement Systems Regulations – 2009 establish the legal foundation needed to support BEFTN. The BEFTN rules define the roles and responsibilities of all of the parties.

Each bank will execute a contractual agreement that will bind the bank to comply and adhere to the BEFTN Rules completing the legal underpinning of the system. I would like to take this opportunity to thank DFID, the RPP Advisory Team, and especially George Thomas, the RPP Regulatory Advisor for their contributions in the development of the BEFTN Rules. I would also like to thank the National Automated Clearing House Association (NACHA) of the United States for allowing their ACH rules to be used as the foundation for the BEFTN Rules.

Dasgupta Asim Kumar Executive Director & Project Director, Bangladesh Bank, RPP Project 10 August 2010 TABLE OF CONTENTS INTRODUCTION ………………………………………………………………………………………………………………. 1 BEFTN OVERVIEW ………………………………………………………………………………………………………………………………… 1 1. ABOUT BEFTN ……………………………………………………………………………………………………………………………. 1 2.

PARTICIPANTS IN BEFTN ……………………………………………………………………………………………………………. 1 3. EFT TRANSACTION FLOW…………………………………………………………………………………………………………….. 2 4. CONSUMER VS. CORPORATE PAYMENTS ………………………………………………………………………………………. 5 5. PAYMENT APPLICATIONS…………………………………………………………………………………………………………….. 5 6.

SETTLEMENT AND POSTING…………………………………………………………………………………………………………. 6 7. LEGAL FRAMEWORK …………………………………………………………………………………………………………………… 7 ARTICLE ONE……………………………………………………………………………………………………………………. 9 GENERAL…………………………………………………………………………………………………………………………………………….. 9 SECTION 1. Application of Rules …………………………………………………………………………………………………………… 9 SECTION 1. 2 Compliance with Rules……………………………………………………………………………………………………….. 9 1. 2. 1 Compensation……………………………………………………………………………………………………………………….. ……. 9 1. 2. 2 Dispute Resolution………………………………………………………………………………………………………………………. SECTION 1. 3 Excused Delay …………………………………………………………………………………………………………………… 9 SECTION 1. 4 Days on Which Institution or Facility is Closed ………………………………………………………………………. 9 SECTION 1. 5 Records ……………………………………………………………………………………………………………………………. 9 1. 5. 1 Records of Entries………………………………………………………………………………………………………………………… 1. 5. 2 Record Retention…………………………………………………………………………………………………………………………. 9 1. 5. 3 Electronic Records Permitted ………………………………………………………………………………………………………. 10 SECTION 1. 6 Choice of Law………………………………………………………………………………………………………………….. 10 ARTICLE TWO ………………………………………………………………………………………………………………… 1 ORIGINATION OF ENTRIES …………………………………………………………………………………………………………………… 11 SECTION 2. 1 Prerequisites to Origination………………………………………………………………………………………………. 11 2. 1. 1 Originator Authorization and Agreement………………………………………………………………………………………. 11 2. 1. 2 Receiver Authorization and Agreement ………………………………………………………………………………………… 11 2. 1. Exception to Authorization Requirement………………………………………………………………………………………. 11 2. 1. 4 Notice by OB ……………………………………………………………………………………………………………………………… 11 2. 1. 5 Notice by RB ……………………………………………………………………………………………………………………………… 12 2. 1. 6 OB Exposure Limits …………………………………………………………………………………………………………………….. 2 SECTION 2. 2 Warranties and Liabilities of Originating Banks……………………………………………………………………. 12 2. 2. 1 Warranties ………………………………………………………………………………………………………………………………… 12 2. 2. 1. 1 Authorization by Originator and Receiver …………………………………………………………………………………… 12 2. 2. 1. 2 Timeliness of Entries………………………………………………………………………………………………………………… 2 2. 2. 1. 3 Compliance With Other Requirements ………………………………………………………………………………………. 12 2. 2. 1. 4 Revocation of Authorization……………………………………………………………………………………………………… 13 2. 2. 1. 5 Termination of Authorization by Operation of Law ……………………………………………………………………… 13 2. 2. 1. 6 Transmittal of Required Information………………………………………………………………………………………….. 13 2. 2. 1. Reclamation Entries…………………………………………………………………………………………………………………. 13 2. 2. 1. 8 Correspondent Bank…………………………………………… …………………………………………………………………… 13 2. 2. 2 Limitation………………………………………………………………………………………………………………………………….. 13 2. 2. 3 Liability for Breach of Warranty……………………………………………………………………………………………………. 4 SECTION 2. 3 Reversing Files ………………………………………………………………………………………………………………… 14 2. 3. 1 General Rule ……………………………………………………………………………………………………………………………… 14 2. 3. 2 Limitations on Initiation of Reversing Files…………………………………………………………………………………….. 14 2. 3. 3 Notification by BEFTN Authority…………………………………………………………………………………………………… 14 2. 3. Correcting Files ………………………………………………………………………………………………………………………….. 14 2. 3. 5 Indemnification………………………………………………………………………………………………………………………….. 14 2. 3. 6 Inapplicable Provisions ……………………………………………………………………………………………………………….. 15 SECTION 2. 4 Reversing Entries …………………………………………………………………………………………………………….. 5 2. 4. 1 General Rule ……………………………………………………………………………………………………………………………… 15 2. 4. 2 Indemnification………………………………………………………………………………………………………………………….. 15 2. 4. 3 Inapplicable Provisions ……………………………………………………………………………………………………………….. 15 SECTION 2. Reclamation Entries …………………………………………………………………………………………………………. 15 2. 5. 1 General Rule ……………………………………………………………………………………………………………………………… 15 2. 5. 2 Definition ………………………………………………………………………………………………………………………………….. 16 2. 5. 3 Inapplicable Provisions ……………………………………………………………………………………………………………….. 6 SECTION 2. 6 Reinitiating Returned Entries by Originators ……………………………………………………………………….. 16 SECTION 2. 7 Media and Format Specification Requirements …………………………………………………………………… 16 SECTION 2. 8 Release of Information …………………………………………………………………………………………………….. 16 ARTICLE THREE …………………………………………………………………………………………………………….. 7 OBLIGATIONS OF ORIGINATORS…………………………………………………………………………………………………………… 17 SECTION 3. 1 General ………………………………………………………………………………………………………………………….. 17 SECTION 3. 2 Consumer Accounts—Notice by Originator to Receiver of Variable Debits ……………………………… 17 3. 2. 1 Notice of Change in Amount ……………………………………………………………………………………………………….. 17 3. 2. Receiver’s Election……………………………………………………………………………………………………………………… 17 3. 2. 3 Notice of Change in Scheduled Debiting Date………………………. ……………………………………………………….. 17 SECTION 3. 3 Record of Authorization……………………………………………………………………………………………………. 17 ARTICLE FOUR……………………………………………………………………………………………………………….. 8 RECEIPT OF ENTRIES …………………………………………………………………………………………………………………………… 18 SECTION 4. 1 General Rights and Obligations of RB …………………………………………………………………………………. 18 4. 1. 1 Right to Information Regarding Entries …………………………………………………………………………………………. 18 4. 1. 2 Obligation to Accept Entries ………………………………………………………………………………………………………… 8 4. 1. 3 Reliance on Account Numbers for Posting of Entries………………………………………………………………………. 18 SECTION 4. 2 Warranties of Receiving Banks ………………………………………………………………………………………….. 18 SECTION 4. 3 Availability of Entries, Crediting and Debiting of Entries ……………………………………………………….. 18 4. 3. 1 Availability of Credit Entries to Receivers………………………………………………………………………………………. 18 4. . 2 Time of Debiting of Entries ………………………………………………………………………………………………………….. 19 4. 3. 3 Provision of Payment? Related Information to Receiver …………………………………………………………………… 19 4. 3. 4 Crediting of Originators’ Accounts by Receiver ………………………………………………………………………………. 19 4. 3. 5 Rights of Receiver Upon Unauthorized Debit to Its Account…………………………………………………………….. 19 4. 3. Reliance on Standard Entry Class Codes………………………………………………………………………………………… 19 4. 3. 7 Reimbursement of RB…………………………………………………………………………………………………………………. 19 SECTION 4. 4 Periodic Statements…………………………………………………………………………………………………………. 19 SECTION 4. 5 Notice to Receiver……………………………………………………………………………………………………………. 20 SECTION 4. Release of Information …………………………………………………………………………………………………….. 20 SECTION 4. 7 Liability of RB for Benefit Payments …………………………………………………………………………………… 20 4. 7. 1 Liability of RB …………………………………………………………………………………………………………………………….. 20 4. 7. 2 Amount of RB Liability ………………………………………………………………………………………………………………… 20 4. . 3 Demand for Payment………………………………………………………………………………………………………………….. 20 4. 7. 4 Timing ………………………………………………………………………………………………………………………………………. 20 4. 7. 5 Alteration by Agreement …………………………………………………………………………………………………………….. 20 ARTICLE FIVE…………………………………………………………………………………………………………………. 2 RETURN, ADJUSTMENT, CORRECTION, AND ACKNOWLEDGMENT……………………………………………………………. 22 OF ENTRIES AND ENTRY INFORMATION……………………………………… ………………………………………………………… 22 SECTION 5. 1 Return of Entries……………………………………………………………………………………………………………… 22 5. 1. 1 Right to Return Entries ……………………………………………………………………………………………………………….. 22 5. 1. Requirements of Returns…………………………………………………………………………………………………………….. 22 5. 1. 3 Restrictions on Right to Return…………………………………………………………………………………………………….. 22 5. 1. 4 Credit Entries Returned by Receiver……………………………………………………………………………………………… 22 5. 1. 5 Return of Un? posted Credit Entries ………………………………………………………………………………………………. 2 5. 1. 6 Acceptance of Return Entries by OB……………………………………………………………………………………………… 22 5. 1. 7 Re? initiation of Return Entries by OB…………………………………………………………………………………………….. 23 SECTION 5. 2 Dishonour of Return Entries ……………………………………………………………………………………………… 23 5. 2. 1 Dishonour of Return by OB………………………………………………………………………………………………………….. 3 5. 2. 2 Contesting of Dishonoured Returns by RB …………………………………………………………………………………….. 23 5. 2. 3 Contesting a Contested Dishonoured Return…………………………………………………………………………………. 23 5. 2. 4 Corrected Returns………………………………………………………………………………………………………………………. 23 SECTION 5. 3 Notification of Change ……………………………………………………………………………………………………… 3 5. 3. 1 Notifications of Change; RB Warranties and Indemnity…………………………………………………………………… 23 5. 3. 2 OB and Originator Action on Notification of Change ………………………………………………………………………. 24 SECTION 5. 4 Refused Notification of Change …………………………………………………………………………………………. 24 5. 4. 1 OB Right to Refuse Notification of Change Entries………………………………………………………………………….. 24 5. 4. RB Action on Refused Notification of Change ………………………………………………………………………………… 24 ARTICLE SIX……………………………………………………………………………………………………………………. 25 SETTLEMENT AND ACCOUNTABILITY…………………………………………………………………………………………………….. 25 SECTION 6. 1 Maintenance of Central Bank Account ……………………………………………………………………………….. 25 SECTION 6. Settlement ……………………………………………………………………………………………………………………… 25 SECTION 6. 3 Effect of Settlement…………………………………………………………………………………………………………. 25 SECTION 6. 4 Accountability for Entries …………………………………………………………………………………………………. 25 SECTION 6. 5 Effect of RB Closing on Time of Settlement …………………………………………………………………………. 5 SECTION 6. 6 Effect of OB Closing on Time of Settlement ………………………………………………………………………… 25 ARTICLE SEVEN ……………………………………………………………………………………………………………… 26 RECALL, STOP PAYMENT, RECREDIT, AND ADJUSTMENT …………………………………………………………………………. 26 SECTION 7. 1 Recall by OB or Originator ………………………………………………………………………………………………… 6 SECTION 7. 2 OB Request for Return……………………………………………………………………………………………………… 26 SECTION 7. 3 OB Agrees to Accept a Corporate Debit Return……………………………………………………………………. 26 SECTION 7. 4 Stop Payment Affecting Consumer Accounts ………………………………………………………………………. 26 SECTION 7. 5 Stop Payment Affecting Non? Consumer Accounts ……………………………………………………………….. 26 SECTION 7. Receiver’s Right to Recredit………………………………………………………………………………………………. 27 7. 6. 1 Receiver’s Right to Recredit…………………………………………………………………………………………………………. 27 7. 6. 2 Receiver’s Written Statement ……………………………………………………………………………………………………… 27 7. 6. 3 Unauthorized Debit Entry……………………………………………………………………………………………………………. 7 7. 6. 4 Waiver of Right to Re? credit ………………………………………………………………………………………………………… 27 7. 6. 5 Effect of Execution of Waiver ………………………………………………………………………………………………………. 27 7. 6. 6 Re? credit Right Not Exclusive……………………………………………………………………………………………………….. 28 SECTION 7. 7 Adjustment Entries …………………………………………………………………………………………………………. 28 7. 7. 1 RB’s Right to Adjustment…………………………………………………………………………………………………………….. 28 7. 7. 2 Warranty of RB ………………………………………………………………………………………………………………………….. 28 7. 7. 3 Copy of Written Statement …………………………………………………………………………………………………………. 8 7. 7. 4 Acceptance of Adjustment Entries by OB………………………………………………………………………………………. 28 ARTICLE EIGHT ……………………………………………………………………………………………………………… 29 OBLIGATIONS OF THE BEFTN AUTHORITY ……………………………………………………………………………………………… 29 SECTION 8. 1 Processing Obligation ………………………………………………………………………………………………………. 29 SECTION 8. Return and Rejection by BEFTN …………………………………………………………………………………………. 29 SECTION 8. 3 Originator Status Code Review ………………………………………………………………………………………….. 29 SECTION 8. 4 Optional Services …………………………………………………………………………………………………………….. 29 SECTION 8. 5 Non? Settled Entries………………………………………………………………………………………………………….. 9 SECTION 8. 6 Entries Originated to a RB that Cannot Settle ……………………………………………………………………… 29 SECTION 8. 7 Entries Received from an OB that Cannot Settle ………………………………………………………………….. 30 SECTION 8. 8 Record of Entries …………………………………………………………………………………………………………….. 30 ARTICLE NINE ………………………………………………………………………………………………………………… 1 RESPONSIBILITIES OF BANGLADESH BANK AND BEFTN PARTICIPANTS ……………………………………………………… 31 SECTION 9. 1 General ………………………………………………………………………………………………………………………….. 31 SECTION 9. 2 Sending Credit and Debit Items …………………………………………………………………………………………. 31 SECTION 9. 3 Security Procedures …………………………………………………………………………………………………………. 31

SECTION 9. 4 Sending Bank’s Agreements ……………………………………………………………………………………………… 32 SECTION 9. 5 Processing of Items………………………………………………………………………………………………………….. 32 SECTION 9. 6 Delivery of Items……………………………………………………………………………………………………………… 33 SECTION 9. 7 Time Schedules, Settlement Dates and Extension of Time Limits …………………………………………… 34 SECTION 9. Designation of Settlement Account……………………………………………………………………………………. 34 SECTION 9. 9 Settlement ……………………………………………………………………………………………………………………… 35 SECTION 9. 10 Availability of Credit……………………………………………………………………………………………………….. 36 SECTION 9. 11 Receiving Bank’s Agreements………………………………………………………………………………………….. 36 SECTION 9. 2 Revocation of Items ……………………………………………………………………………………………………….. 36 SECTION 9. 13 Return of Items and Funds ……………………………………………………………………………………………… 37 SECTION 9. 14 Disputed Returns …………………………………………………………………………………………………………… 37 SECTION 9. 15 Advices of Credit and Debit; Reporting of Errors………………………………………………………………… 37 SECTION 9. 6 Records ………………………………………………………………………………………………………………………… 37 SECTION 9. 17 Fees……………………………………………………………………………………………………………………………… 37 SECTION 9. 18 Non? Value Messages ……………………………………………………………………………………………………… 37 SECTION 9. 19 Bangladesh Bank Liability ……………………………………………………………………………………………….. 8 SECTION 9. 20 As of Adjustments………………………………………………………………………………………………………….. 38 SECTION 9. 21 Right to Amend ……………………………………………………………………………………………………………… 38 ARTICLE TEN………………………………………………………………………………………………………………….. 39 DEFINITION OF TERMS………………………………………………………………………………………………………………………… 9 SECTION 10. 1 Definitions As Used In These Rules………………………… ………………………………………………………… 39 SECTION 10. 2 Construction Rules…………………………………………………………………………………………………………. 41 SECTION 10. 3 Other definitions……………………………………………………………………………………………………………. 42 THE APPENDICES…………………………………………………………………………………………………………… 7 TECHNICAL SPECIFICATIONS………………………………………………………………………………………………………………… 47 BEFTN PARTICIPATION AGREEMENT …………………………………………………………………………………………………….. 47 APPENDIX ONE ………………………………………………………………………………………………………………. 48 BEFTN FILE EXCHANGE SPECIFICATIONS ……………………………………………………………………………………………….. 8 SECTION 1. 1 Electronic Transmission Requirements……………………………………………………………………………….. 48 SECTION 1. 2 BEFTN CD/DVD Specifications……………………………………………………………………………………………. 48 SECTION 1. 3 Data Specifications…………………………………………………………………………………………………………… 48 SECTION 1. 4 Sequence of Records in BEFTN Files …………………………………………………………………………………… 8 SECTION 1. 5 File Structure…………………………………………………………………………………………………………………… 49 SECTION 1. 6 Trace Number Sequence in BEFTN Files ………………………………………………………………….. …………. 50 APPENDIX TWO……………………………………………………………………………………………………………… 51 BEFTN RECORD FORMAT SPECIFICATIONS …………………………………………………………………………………………….. 51 SECTION 2. BEFTN Record Formats …………………………………………………………………………………………………….. 51 2. 1. 1 BEFTN File Record Format for All Entries……………………………………………………………………………………….. 51 2. 1. 2 BEFTN Batch Record Format for All Entries ……………………………………………………………………………………. 52 2. 1. 3 Sequence of Records for ADV Entries……………………………………………………………………………………………. 52 2. 1. Sequence of Records for ADV Entries (continued) ………………………………………………………………………….. 53 2. 1. 4 Sequence of Records for CCD Entries ……………………………………………………………………………………………. 53 2. 1. 5 Sequence of Records for CIE Entries……………………………………………………………………………………………… 54 2. 1. 6 Sequence of Records for CTX Entries…………………………………………………………………………………………….. 54 2. 1. Sequence of Records for PPD Entries ……………………………………………………………………………………………. 55 2. 1. 8 Sequence of Records for TRX Entries…………………………………………………………………………………………….. 55 SECTION 2. 2 Code Values ……………………………………………………………………………………………………………………. 55 SECTION 2. 3 Glossary of File Format Data Elements……………………………………………………………………………….. 8 APPENDIX THREE………………………………………………………………………………………………………….. 59 SPECIFICATIONS FOR DATA ACCEPTANCE ……………………………………………………………………………………………… 59 SECTION 3. 1 File Acknowledgment ………………………………………………………………………………………………………. 59 SECTION 3. 2 File Level Reject Option ……………………………………………………………………………………………………. 9 SECTION 3. 3 Batch Level Reject Option…………………………………………………………………………………………………. 60 SECTION 3. 4 Automatic File Rejections …………………………………………………………………………………………………. 60 SECTION 3. 5 Automatic Batch Rejection ……………………………………………………………………………………………….. 60 SECTION 3. 6 Automatic Entry Detail Return Entry ………………………………………………………………………………….. 1 APPENDIX FOUR ……………………………………………………………………………………………………………. 62 MINIMUM DESCRIPTION STANDARDS ………………………………………………………………………………………………….. 62 APPENDIX FIVE ……………………………………………………………………………………………………………… 63 RETURN ENTRIES ……………………………………………………………………………………………………………………………….. 63

SECTION 5. 1 Automated Return Entries………………………………………………………………………………………………… 63 SECTION 5. 2 Non? Automated Return Entries …………………………………………………………………………………………. 63 SECTION 5. 3 Adjustment Entries ………………………………………………………………………………………………………….. 63 SECTION 5. 4 Table of Return Reason Codes…………………………………………………………………………………………… 4 SECTION 5. 5 Record Formats for Automated and Converted Return Entries ……………………………………………… 68 5. 5. 1 Corporate Entry Detail Record Format for Returns …………………………………………………………………………. 68 5. 5. 2 Entry Detail Record Format for Returns ………………………………………………………………………………………… 69 5. 5. 4 Addenda Record Format for Returns…………………………………………………………………………………………….. 9 SECTION 5. 6 Dishonoured Return Entries by BEFTN ……………………………………………………………………………….. 70 5. 6. 1 Company/Batch Header Record Format for Automated Dishonoured Returns…………………………………… 70 5. 6. 2 Corporate Entry Detail Record for Automated Dishonoured Returns………………………………………………… 71 5. 6. 3 Entry Detail Record Format for Automated Dishonoured Returns ……………………………………………………. 71 5. 6. Addenda Record Format for Automated Dishonoured Returns………………………………………………………… 72 SECTION 5. 7 Contested Dishonoured BEFTN Return Entries…………………………………………………………………….. 72 5. 7. 1 Automated Contested Dishonoured Return Entries………………………………………………………………………… 72 5. 7. 2 Non? Automated Contested Dishonoured Return Entries…………………………………………………………………. 73 5. 7. Corrected Return Entries …………………………………………………………………………………………………………….. 73 5. 7. 4 Company/Batch Header Record Format for Automated Contested Dishonoured Returns …………………… 73 5. 7. 5 Corporate Entry Detail Record Format for Automated Contested Dishonoured Returns……………………… 74 5. 7. 6 Entry Detail Record Format for Automated Contested Dishonoured Returns …………………………………….. 74 5. 7. 7 Addenda Record Format for Automated Contested Dishonoured Returns ………………………………………… 5 APPENDIX SIX ………………………………………………………………………………………………………………… 76 NOTIFICATION OF CHANGE …………………………………………………………………………………………………………………. 76 SECTION 6. 1 Automated Notification of Change…………………………………………………………………………………….. 76 SECTION 6. 2 Non? Automated Notification of Change……………………………………………………………………………… 6 SECTION 6. 3 Refused BEFTN Notification of Change……………………………………………………………………………….. 76 SECTION 6. 4 Minimum Description Standards for Notifications of Change and Corrected Notifications of Change……………………………………………………………………………………………………………………………………………… 76 SECTION 6. 5 Table of Change Codes …………………………………………………………………………………………………….. 7 SECTION 6. 6 Record Formats for Automated and Converted Notifications of Change…………………………………. 79 6. 6. 1 Company/Batch Header Record Format for Notifications of Change ………………………………………………… 79 6. 6. 2 Corporate Entry Detail Record Format for Notifications of Change……. …………………………………………….. 79 6. 6. 3 Entry Detail Record Format for Notifications of Change ………………………………………………………………….. 80 6. 6. Addenda Record Format for Notifications of Change ……………………………………………………………………… 80 6. 6. 5 Company/Batch Header Record Format for Automated Refused Notifications of Change …………………… 81 6. 6. 6 Corporate Entry Detail Record Format for Automated Refused Notifications of Change……………………… 81 6. 6. 7 Entry Detail Record Format for Automated Refused Notifications of Change …………………………………….. 82 6. 6. 8 Addenda Record Format for Automated Refused Notifications of Change ………………………………………… 2 APPENDIX SEVEN…………………………………………………………………………………………………………… 83 BEFTN PARTICIPANT AGREEMENT………………………………………………………………………………………………………… 83 APPENDIX EIGHT…………………………………………………………………………………………………………… 84 SAMPLE BEFTN ORIGINATION AGREEMENT…………………………………………………………………………………………… 84 INTRODUCTION BEFTN OVERVIEW 1.

ABOUT BEFTN The Bangladesh Electronic Funds Transfer Network (BEFTN) will operate as a processing and delivery centre providing for the distribution and settlement of electronic credit and debit instruments among all participating banks. This Network will operate in a real? time batch processing mode. Transaction files received from the banks during the day will be processed as they are received to ensure that if there are conditions that would result in a file or batch reject the banking company will have sufficient time to fix the errors and resubmit the file.

All payment transactions will be calculated into a single multilateral netting figure for each individual bank. Final settlement will take place using accounts that are maintained with Bangladesh Bank. Participating banks in the EFT Network and the EFT Operator (BEFTN) will be inter? connected via communication links. The use of a communication network facilitates the transmission of payments information that provides faster, safer and a more efficient means of inter? ank clearing than would be possible using the existing paper? based system. BEFTN will provide the capability to offer a wide range of electronic products that will improve payment services for the participating banks’ customers. BEFTN will dramatically lower the operational cost, reduce risk and will also increase the efficiency of the overall payment process. 2. PARTICIPANTS IN BEFTN The EFT Network is a multilateral electronic clearing system in which electronic payment instructions will be exchanged among Scheduled Banks.

The system involves transmitting, reconciling and calculating the net position of each individual participant at the end of each processing cycle. The participants involved are: (a) Originator. (b) Originating Bank (OB) (c) Bangladesh Electronic Funds Transfer Network (EFT Operator) (d) Receiving Bank (RB) (e) Receiver (f) Correspondent Bank a) Originator The Originator is the entity that agrees to initiate EFT entries into the network according to an arrangement with a receiver.

The originator is usually a company, government agency or an individual directing a transfer of funds to or from a consumer’s or a company’s account. The originator executes an EFT fund transfer entry through an Originating Bank (OB). b) Originating Bank (OB) The originating bank is the bank which receives payment instructions from its client (the originator) and forwards the entry to the BEFTN. A bank may participate in the EFT system as a receiving bank without acting as an originating bank; however, if a Bank chooses to originate EFT entries, it must also agree to act as a receiving bank. ) Bangladesh Electronic Funds Transfer Network (BEFTN) BEFTN is the central clearing facility, operated by Bangladesh Bank that receives entries from OBs, distributes the entries to appropriate RBs, and facilitates the settlement functions for the participating banking institutions d) Receiving Bank (RB) The receiving bank is the bank that will receive EFT entries from BEFTN and post the entries to the account of its depositors (Receivers). e) Receiver A receiver is a person/organization who has authorized an Originator to transmit an EFT entry to the account of the receiver maintained with the Receiving Bank (RB). ) Correspondent Bank In some cases an Originator, Originating Bank or Receiving Bank may choose to use the services of a Correspondent Bank for all or part of the process of handling EFT entries. A Correspondent Bank’s function can include, but is not limited to, the creation of EFT files on behalf of the Originator or acting on behalf of an OB or RB, respectively. All Correspondent Banks must be approved by Bangladesh Bank before a bank enters into an agreement with the Correspondent Bank.

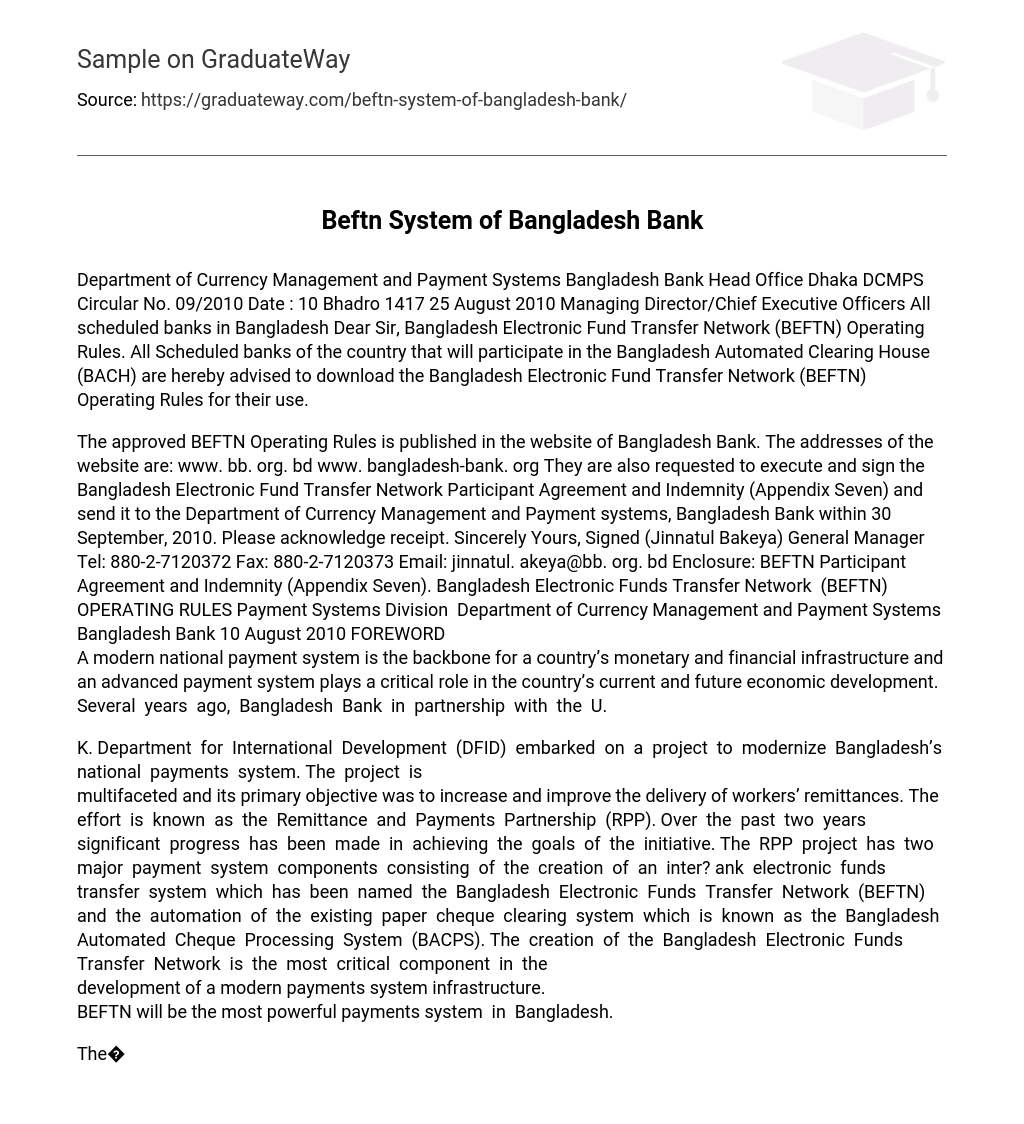

Originating Bank BEFTN Receiving Bank Bangladesh Bank (Reporting & Settlement) Authorization Receiver Originator Figure 1: Participants involved in an EFT transaction Authorization A written arrangement with the originating company signed by an employee or customer to allow payments processed through the EFT Network to be deposited in or withdrawn from his or her account at a bank. Authorization can also be a written agreement that defines the terms, conditions and legal relationship between Originator and Receiver. . EFT TRANSACTION FLOW In EFT terminology, Originator and Receiver refer to the participants that initiate and receive the EFT entries rather than the funds. Unlike a check, which is always a debit instrument, an EFT entry may either be a credit or a debit entry. By examining what happens to the receiver’s account, one can distinguish between an EFT Credit and EFT Debit transaction. If the receiver’s account is debited, then the entry is an EFT debit.

If the receiver’s account is credited, then the entry is an EFT credit. Conversely, the offset of an EFT debit is a credit to the originator’s account and the offset to an EFT credit is a debit to the Originator’s account. In the later sections the description of the transaction and/or instruments to be used in the BEFTN has been described in logical sequence regardless of their implementation schedule. 2 a) EFT Credits EFT credit entries occur when an Originator initiates a transfer to move funds into a Receivers account.

For example, when a corporate uses the payroll service at a bank to pay the salary of its employee each month, the corporate originates the payment through the OB to transfer the money into the account of the employee; the individual is the receiver in this example. EFT credit transactions involve both consumer and corporate payments with separate rules and regulations for each. The most typical consumer EFT application is Direct Deposit of Payroll. Originating Bank BEFTN Receiving Bank TK TK Debit Originator TK Credit Receiver

Figure 2: EFT Credit Transactions Flow In the illustration above an EFT credit transaction flow for payroll payment is shown, where an organization initiates an EFT entry to credit its employee’s account. Some other common credit applications are: • Inward Foreign remittances • Domestic remittances • Payroll private and government • Dividends/Interest/Refunds of IPO • Business to business payments (B2B) • Government tax payments • Government vendor payments • Customer? initiated transactions b) EFT Debits In an EFT debit transaction, funds flow in the opposite direction to the information.

Funds are collected from the Receiver’s account and transferred to an Originator’s account, even though the originator initiates the entry. 3 In the illustration below it is shown that a utility company initiates an EFT entry to collect its bill from the consumer. Some examples of EFT debit application: • • • • • • • Utility bill payments Equal Monthly Installments (EMI) Government tax payments Government license fees Insurance premium Mortgage payments Club/Association subscriptions Originating Bank BEFTN Receiving Bank TK TK Credit Originator TK Debit Receiver

Figure 3: EFT Debit Transactions Flow A typical transaction as it flows through the EFT Network might follow the path described below: The Originator and its bank (OB) determine by agreement that how the information will be delivered from the originator to the OB. Ideally, the originating bank or originator would format the data in accordance with the BEFTN prescribed format and transmit the information to the OB via a communication line. The OB generally removes “on? us” entries (if any) and transmits the remaining entries to the BEFTN within the preset timeline. An “on? s” transaction is one in which the Receiver and the Originator both have accounts at the same bank. Therefore, the transaction needs not to be sent through BEFTN but instead may be simply retained by the bank and posted to the approp riate account. The BEFTN will sort the entries by Receiving Bank (RB) routing number and transmit the payment information to the appropriate RB for posting. On settlement date/time, BEFTN will calculate the net settlement figure for each participating bank and the settlement will take place at the books of accounts of Bangladesh Bank. 4 . CONSUMER VS. CORPORATE PAYMENTS EFT transactions are typically categorized as either consumer payments, Government payments or commercial payments. These transactions are defined in accordance with the relationship of parties involved in the transaction and the type of receiver account. Consumer payments that could be made via the EFT network include credit applications such as payroll, dividend, interest and annuity payments and so on. Consumer EFT debit applications include the collection of utility bills, insurance premiums, loan installments and other recurring obligations.

Corporate EFT applications include cash collection and disbursement, corporate trade payments, government. tax payments etc. Cash collection and disbursement allows companies to achieve efficiency in cash management through intra? company transfer of funds. Corporate trade payments enable corporations to exchange both data and funds with trading partners, facilitating an automated process of updating their accounts receivable and accounts payable systems. 5. PAYMENT APPLICATIONS The BEFTN will support a variety of payment applications.

An Originator initiating entries into the system will code the entries in such a manner as to indicate the type of payment, such as a debit or a credit, and whether an entry is a consumer or corporate in nature. Each EFT application is identified and recognized by a specific three? digit code, which will be termed as Standard Entry Class (SEC) Codes, which appear in the EFT batch record format and are used to carry the payment and payment? related information relevant to the application. Following is a list of SEC codes and the different products each code supports.

I. Consumer Applications • CIE – Customer Initiated Entry: Customer initiated entries are limited to credit applications where the consumer initiates the transfer of funds to a company or person for payment of funds owed to that company or person, typical example of these entries are utility bill and other Internet banking product payments. PPD – Prearranged Payment and Deposit Entry • Direct Deposit: Direct deposit is a credit application that transfers funds into a consumer’s account at the receiving bank.

The funds being deposited can represent a variety of products such as payroll, remittances, interest, pension, dividends and/or refunds, etc. Preauthorized Bill Payment: A preauthorized payment is a debit application. Companies with existing relationship with the customers may participate in the EFT through the electronic transfer (direct debit) of bill payment entries. Through standing authorizations, the consumer grants the company authority to initiate periodic charges to his or her account as bills become due.

This concept is especially applicable in situations where the recurring bills are regular and do not vary in amount such as insurance premiums, loan installments, etc. Standing authorization may also used for bills where the amount does vary, such as utility payments. II. Corporate Applications • CCD – Corporate Credit or Debit: This application can be either a credit or a debit application where funds are either distributed or consolidated between corporate entities or government entities.

This application can serve as a stand? alone fund transfer between corporate or government entities, or it can support a limited disclosure of information when the funds are being transferred between organizations (i. e. sister concerns) under the same group. CTX ? Corporate Trade Exchange: This application supports the transfer of funds (debit or credit) within a trading partner relationship in which business payment remittance information is sent with the funds transfer. The payment? related information is placed in multiple addenda records 5 in a format agreed to by the parties and BEFTN. III. Other Applications • ADV – Automated Accounting Advice: This SEC Code represents an optional service to be provided by BEFTN that identifies automated accounting advices of EFT accounting information in machine? readable format to facilitate the automation of accounting information for Participating Banks. 6. SETTLEMENT AND POSTING Settlement is the actual transfer of the funds between participating banks to complete the payment instruction of an EFT entry.

The transactions processed by the BEFTN will affect the accounts of the concerned banks maintaining accounts with BB at the end of each processing cycle. Settlement will be completed using the following processing schedule: Processing Window Normal Processing Settlement and processing sessions may be reviewed and communicated to member banks by the Clearing House (BACH) authority from time to time. The following are the three main participants and their responsibilities concerning settlement and posting. Originating Bank: Settlement with the OB for entries originated will follow the same procedures used for settlement of entries received. If the scheduled settlement date of a credit entry is not a banking day for the OB, but the BB office is open, then the settlement will occur on the scheduled date. Specific procedures and timing of settlement between the OB and the originator are solely at the discretion of the OB and the originator and therefore, governed by agreement between them. It is the OB‘s responsibility to monitor the credit? orthiness of its corporate customers to ensure that the OB‘s risk in originating EFT payments is managed efficiently. • EFT Operator (BEFTN): BEFTN will calculate net settlement figures for each participating bank. BEFTN will also provide information to participating banks on the amounts that will be settled for each bank on each settlement date. BEFTN will also send a summary statement which contains the net amount to be settled for each participating bank to the Deposit Accounts Bibagh (DAB) of Bangladesh Bank.

Receiving Bank (RB) a) Posting: The RB is responsible for posting entries and for providing funds availability, both of which are determined by the settlement date in the batch header record. EFT Debits will be delivered to a RB not earlier than one banking day prior to the settlement date. The rule clearly mentions that debit entries cannot be posted prior to the settlement date. If the RB is closed for business on the scheduled settlement date of a debit entry, but the Cut Offs Item Submission 00:00 ? 24:00 hrs Returns As provided in BEFTN Rules Settlement 10:00 hrs Next Day 6 BEFTN is open, the RB will be debited on the scheduled settlement date unless it has advised the BEFTN to delay settlement to the next business day of the RB. If BEFTN agrees to delay settlement, the RB must pay for any costs for float resulting from the deferral of settlement. EFT Credits will be delivered to a RB not earlier than one working day prior to the settlement date. b) Settlement Settlement between the originator and the OB is governed by agreement. Settlement between the RB and the receiver is determined by these Rules.

If BEFTN determines that the entry cannot be settled on the effective entry date due to a stale date, weekend, or holiday, the BEFTN authority will insert the Julian date of the next business day into the settlement date filed, reflecting that settlement will occur on that day. • Settlement information is produced by BEFTN as the entries are processed. This information is accumulated based on the type of entry (debit or credit) by settlement date. These settlement totals are reported to the participating banks daily. BEFTN may provide EFT settlement information in a machine? eadable format to f