Cost Volume Net Income Analysis

Table of Contents

- Introduction

- CVP analysis and determination devising

- Relationship between grosss, costs, net incomes and volume

- Fixed vs. variable costs

- Break even analysis:

- Margin of safety

- 1.Non- Linear CVP analysis:

- 2.Linear CVP analysis:

- Operating Leverage

- Income Tax benefits:

- Future prediction

- Preparation of Budgets:

- Cost Control:

Monetary value Determination:

- Net income Planning:

- Hazard Appraisal:

- Decision Devising:

- Decision

- Mentions

Describe the benefits of utilizing cost volume net income analysis for direction determination devising

Introduction

Every organisation needs to cipher future grosss in order to assist the directors carry out their operations efficaciously. Cost volume is the attack used for this intent. Cost Volume Net income analysis or CVP analysis helps in placing the operating activity degrees with a intent to avoid any sort of losingss and accomplish net incomes. Furthermore, it besides helps the companies to be after their future operations and see whether their organisational public presentation is traveling on the right path or non ( Lewis ) . While carry oning a concern, the companies besides have to confront assorted hazards and in order to counter those hazards, CVP analysis is an effectual tool.

The undermentioned undertaking tends to analyse the cardinal constructs sing cost volume net income analysis along with an illustration of how these constructs can be utile in transporting out organisational operations.

Cvp Analysis and Determination Devising

Cost Volume Net income analysis helps organisations to analyze their net incomes, costs and monetary values with regard to any changed that occur in gross revenues volume. CVP is an effectual tool that helps comptrollers to prosecute in determination devising sing future operations ( Breakeven analysis ( CVP analysis ) ) . Furthermore, it besides helps in doing the undermentioned determinations for the company:

- It helps to analyse which merchandises and services are good and how can company utilize these merchandises and services to bring forth the maximal sum of gross.

- It besides explains what gross revenues volume will be needed by the company in order to accomplish a fixed degree of net incomes

- Furthermore, it tells how much gross should the company mark so as to do certain that no losingss occur

- It besides highlights what would be expected budget of the company

- It besides helps to cipher company’s fixed costs and mensurate the sum of hazard associated with any investing

Relationship Between Grosss, Costs, Net Incomes and Volume

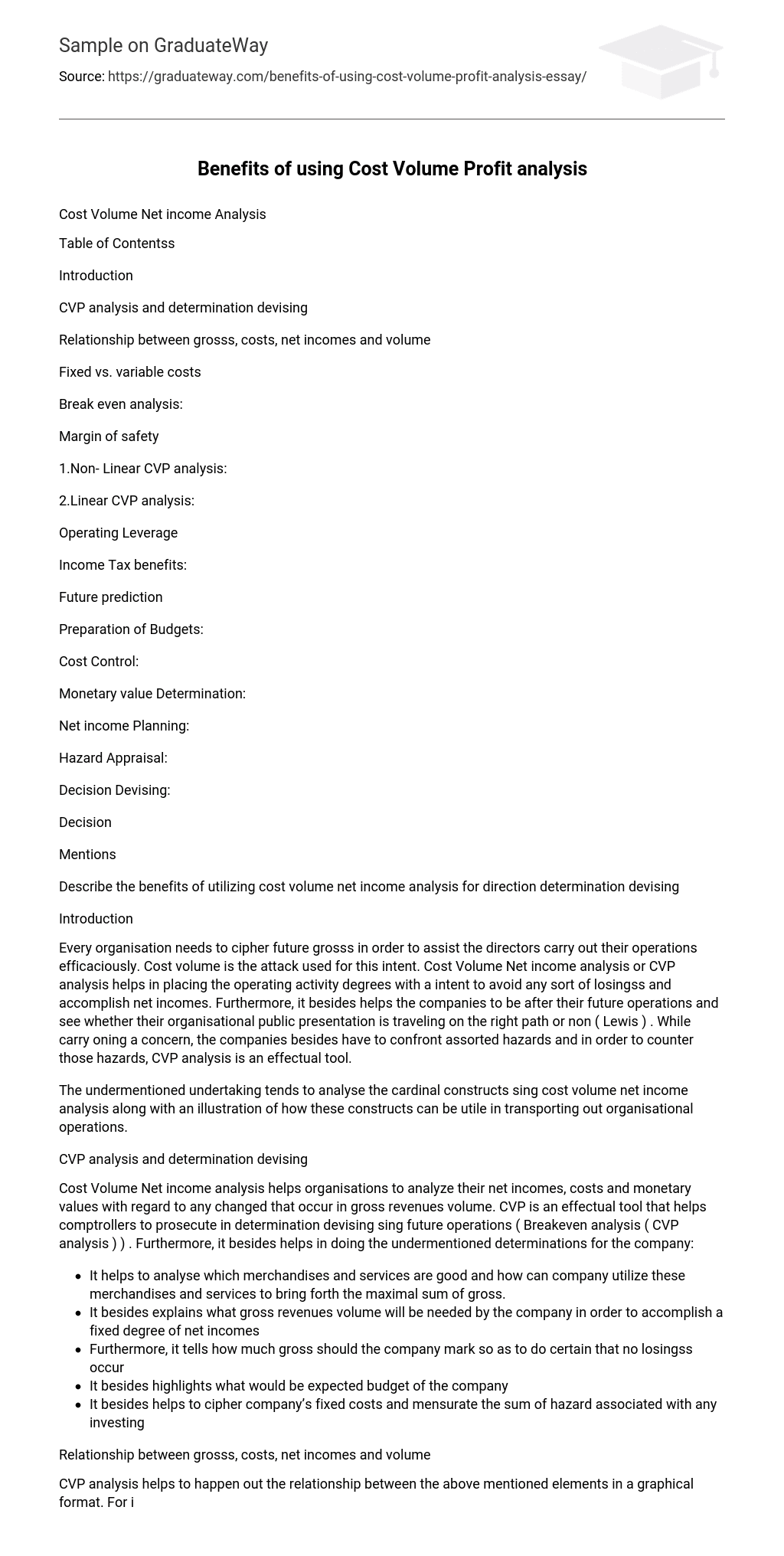

CVP analysis helps to happen out the relationship between the above mentioned elements in a graphical format. For illustration: if a company has part border of 300, 400 and 500 units severally on its income statements, so the CVP graph can be represented as follows:

The part border ratio used for this intent can be calculated as follows:

- CM ratio =Entire CM

- Entire Gross sales

This ratio can be used to cipher unit part border and the entire part border ( MAAW, 2011 ) . The unit part border helps us to cipher the difference between entire grosss and unit costs of the company whereas the entire part border is related to the difference between entire grosss and the entire costs of a company. In other words, the sum can be calculated by multiplying the unit cost with the entire figure of units. So, this shows can CVP is an effectual tool for ciphering the part border.

Fixed vs. Variable Costs

Another benefit that organisations get by utilizing the cost volume net income analysis is the determination doing about different types of costs. This is of import because while transporting out a concern, the company is non concerned with the entire sum instead it is concerned with the existent cost behaviour. This is so because cost behaviour helps us to sort the costs into assorted classs such as fixed, variable, administrative and so on. For illustration:

Let’s take a company with fixed costs F, variable costs V and the entire figure of units equal to X, its part border will be equal to ( P-V ) X and net income can be calculated as follows:

Net income = ( P-V ) X – F

Break Even Analysis

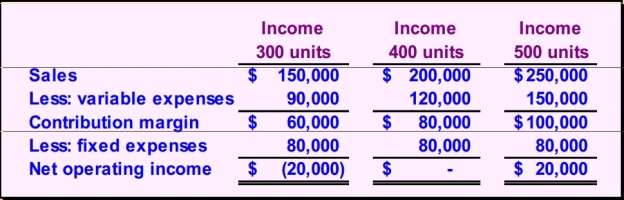

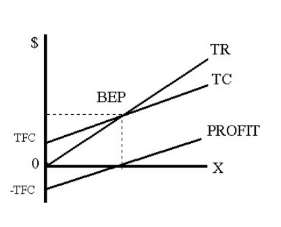

Cost volume net income analysis can besides assist the organisations in ciphering the breakeven point which is the point at which the net incomes become equal to nothing. This can be done by happening the interruption even volume and so utilizing it to do graphical representations. The break even volume can either be expressed in dollars or in units depending upon the nature and type of the organisation ( Cafferky, 2010 ). For case: if the organisation makes a big sums of merchandises, so the company must prefer to cipher the breakeven volume in the signifier of gross revenues dollars while in instance of one merchandise company, the unit method might be a more effectual computation of gross revenues volume.

Presented below are the computation method and the graphical representation in both instances:

Break even volume in unit method =Fixed costs

Unit part border

Break even volume in gross revenues dollar method =Fixed costs

Contribution border ratio

This chart illustrated that at the breakeven point, the net incomes of the company go zero and below this point, the company begins to incur losingss. So, it is a good tool for the organisations which help them to analyse what should be the mark ad how this mark can be achieved by pull offing the fixed every bit good as variable costs and besides by fixing a program for the future operations.

Margin of safety

A new component introduced in this chart is the border of safety which refers to the sum by which the gross revenues grosss of a company might diminish because it begins to incur any losingss. It is besides called as the shock absorber of loss which provides a deeper penetration into the company’s net incomes, losingss and grosss. It can be calculated as follows:

A new component introduced in this chart is the border of safety which refers to the sum by which the gross revenues grosss of a company might diminish because it begins to incur any losingss. It is besides called as the shock absorber of loss which provides a deeper penetration into the company’s net incomes, losingss and grosss. It can be calculated as follows:

Margin of Safety = Gross saless – Breakeven gross revenues

Marin of safety ratio =Margin of safety

Gross saless

Larger ratios are preferred because they indicate that there is a lower hazard that the company would make breakeven point of even below it.

This is the simplest method of ciphering the breakeven point. However, it is non the lone 1. There are two types of methods used by different companies in order to profit from the CVP attack ( Yunkera & A ; Yunker, 2003 ) .

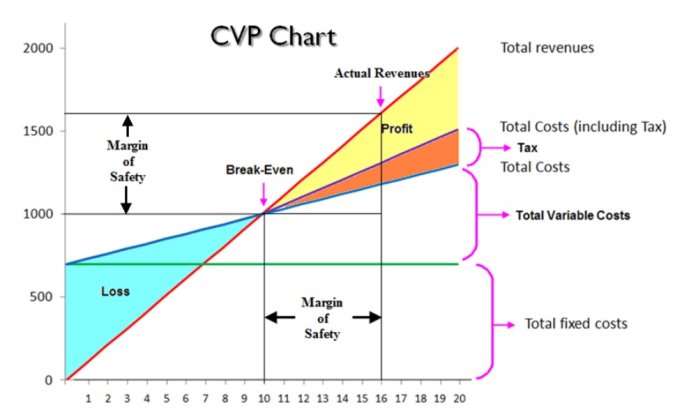

Non- Linear CVP analysis:

This attack is used largely for the intent of economic sciences in order to cipher assorted elements such as productiveness and returns in the long tally. However, this has non proved to be a truly good attack because it has undependable input parametric quantities. Since it is designed specifically for the long term minutess, hence ; it is non truly believable and dependable attack for doing short term concern computations. Furthermore, it has been found to be more complex as compared to the simple breakeven computation.

Linear CVP analysis:

This is more realistic, practical and dependable attack to happen the relationship between costs and grosss. It is the breakeven method that presents the things in a instead simple and “easy to understand” manner. However, in order to do this attack a more effectual one, the following 5 things need to be followed:

This is more realistic, practical and dependable attack to happen the relationship between costs and grosss. It is the breakeven method that presents the things in a instead simple and “easy to understand” manner. However, in order to do this attack a more effectual one, the following 5 things need to be followed:

- Keeping the sale monetary value invariable

- Keeping the variable cost per unit besides changeless

- The entire fixed costs must besides stay the same

- In instance of more than one merchandise lines, the company should seek to maintain the gross revenues volume changeless

- The figure of units sold must be equal to the figure of units produced.

Operating Leverage

Another benefit that companies gain by utilizing the CVP attack is the operating purchase benefit which explains how the cost construction of an organisation is made up of fixed cost procedures. This is a immense benefit because the cost construction is straight related to the degree of growing and net income a company has ( Phillips, 1994 ) .

Operating purchase can change greatly from one company to another. In the houses that have a high ratio of fixed costs as compared to the variable costs, the operating purchase is good because it produces a high part border. Similarly, higher fixed gross revenues besides mean that the company has a higher breakeven point. A higher breakeven point is straight related to the fiscal success of the company because at this point, the company can claim high net incomes at a much higher rate ( Raichura, 2007 ) .

Income Tax benefits

Similarly, the simple CVP theoretical account can be extended to other issues such as the computation of integrated revenue enhancements of multiple merchandises within a company. This is done by modifying the net income equation of the chart to include revenue enhancements every bit good. This analysis can besides be extended to those houses that offer more than one merchandise or service instead than a simple merchandise. This can be calculated as follows:

After revenue enhancement net income = [ ( P-V ) X – F ] x ( 1 – T )

Future prediction

By utilizing the above mentioned theoretical accounts, attacks and graphs, directors can analyse the way in which their company is traveling and this analysis might assist them to better understand the different operations and activities within the organisations. By acquiring beforehand cognition of net incomes and costs, the company can pull off them in a more efficient manner to increase productiveness.

Preparation of Budgets

Since the cost net income volume analysis helps in finding the degree of gross revenues and therefore helps organisations to accomplish their coveted marks. This attack would assist the directors to fix their budgets which consist of the costs every bit good as the grosss at any degree of production within the organisation.

Cost Control

The biggest benefit of CVP analysis is to measure the cost volume alterations within an organisation and the impact of these alterations on gross coevals. For case: there is a dental infirmary that wants to buy a new dental machine so that the patient’s degree of satisfaction can be increased by cut downing the clip required for dental intervention. The purchase of this new machine will be given to increase fixed costs of an organisation.

So, at such complex state of affairss, the cost volume analysis can be the most effectual tool to assist in simplifying the company’s determination. If this dental infirmary uses CVP analysis, it can pull off to diminish its variable costs by maintain the net income at the same coveted degree.

Monetary value Determination

It is another benefit of utilizing this attack. For illustration: taking the above illustration once more, if any rival within the dental industry has set the monetary value at AED 50,000 for a individual alveolar consonant operation and the concern can non supply this operation at any cost lower than AED 20,000, so the company can utilize cost net income volume analysis to compare the competitor’s monetary value with the fixed and variable costs of its ain operations and therefore it can pull off to come up with a monetary value that is in the best involvement of the company.

Net income Planning

The purpose of any concern is to make value for the clients and to acquire net incomes for the company. However, pull offing all operations and costs in such a manner that can maximise net incomes is non an easy undertaking. Therefore, organisations have to see a batch of things in order to prosecute in proper net income planning techniques. The CVP analysis can assist the companies to make the best and most profitable combination of cost, monetary value and gross revenues volume. Therefore, it can assist directors to cipher and gauge their net income at different degrees and for different scope of merchandises.

Hazard Appraisal

The concern universe is altering and due to several internal s good as external menaces associated with any industry, concerns have to confront excessively many hazards. Although the computation of hazard and return through mensurating a changeless ( beta ) is a method in finance but managerial accounting is besides concerned with this. Pull offing hazard is excessively important for any concern because it tends to specify all the processs and patterns involved within an organisation.

Therefore, CVP is a tool which helps to cipher hazard peculiarly in footings of costs and volumes. After analysing this hazard, the companies can come up with efficient solutions to cut down this hazard.

Decision Devising

All the above mentioned benefits re straight or indirectly related to the determination devising procedures of a company. Any concern organisation has to do a batch of determinations sing their monetary value, their costs, and merchandises, fixed and variable unit costs and so on. The CVP attack simplifies this procedure by supplying the companies with a breakeven point and by assisting them to prosecute in better determination devising and planning for the hereafter.

Decision

So, the undertaking has presented a elaborate analysis of how is CVP calculated and how can it be used to profit an organisation. Out of the two types of CVP attacks, additive attack is the simple one and it provides companies with easy ways to do estimations sing costs, monetary values and gross revenues volumes. The computation of breakeven pint helps in determination devising for a company by supplying it a better hereafter prediction, hazard appraisal, , monetary value appraisal and so on. In other word, the cost volume net income attack has a direct impact on bettering the organisational public presentation and productiveness.

Mentions

- Breakeven analysis ( CVP analysis ). ( n.d. ) . Retrieved 4 9, 2014, from hypertext transfer protocol: //www.acornlive.com/demos/pdf/P2_PM_Chapter_5.pdf

- Cafferky, M. ( 2010 ) .Breakeven Analysis: The Definitive Guide to Cost-Volume-Profit Analysis.Business Expert Press.

- Lewis, J. ( n.d. ) .Advantages & A ; Disadvantages of Cost-Volume-Profit Analysis. Retrieved 4 9, 2014, from hypertext transfer protocol: //smallbusiness.chron.com/advantages-disadvantages-costvolumeprofit-analysis-35135.html

- MAAW. ( 2011 ) .The contention over part border attack.

- Phillips, P. A. ( 1994 ) . Cambrian Hotel: Cost-Volume-Profit Analysis and Uncertainty.International Journal of Contemporary Hospitality Management, 31-36.

- Raichura, K. ( 2007 ) .C-V-P Analysis & A ; Operating Leverage. Retrieved 4 9, 2014, from hypertext transfer protocol: //www.managementparadise.com/forums/financial-management/20603-c-v-p-analysis-operating-leverage.html

- Yunkera, J. A. , & A ; Yunker, P. J. ( 2003 ) . Stochastic CVP analysis as a gateway to decision-making under uncertainness.Journal of accounting Education, 339-365.