The analysis of remittal received and sent is done to cognize the sum of remittal send or received, state from which remittal is send or received, which bureau is involved, what instrument is used, who sends the remittal, frequence of directing and having remittal, intent of remittal, clip that clients have to wait to have or direct remittal and so on.

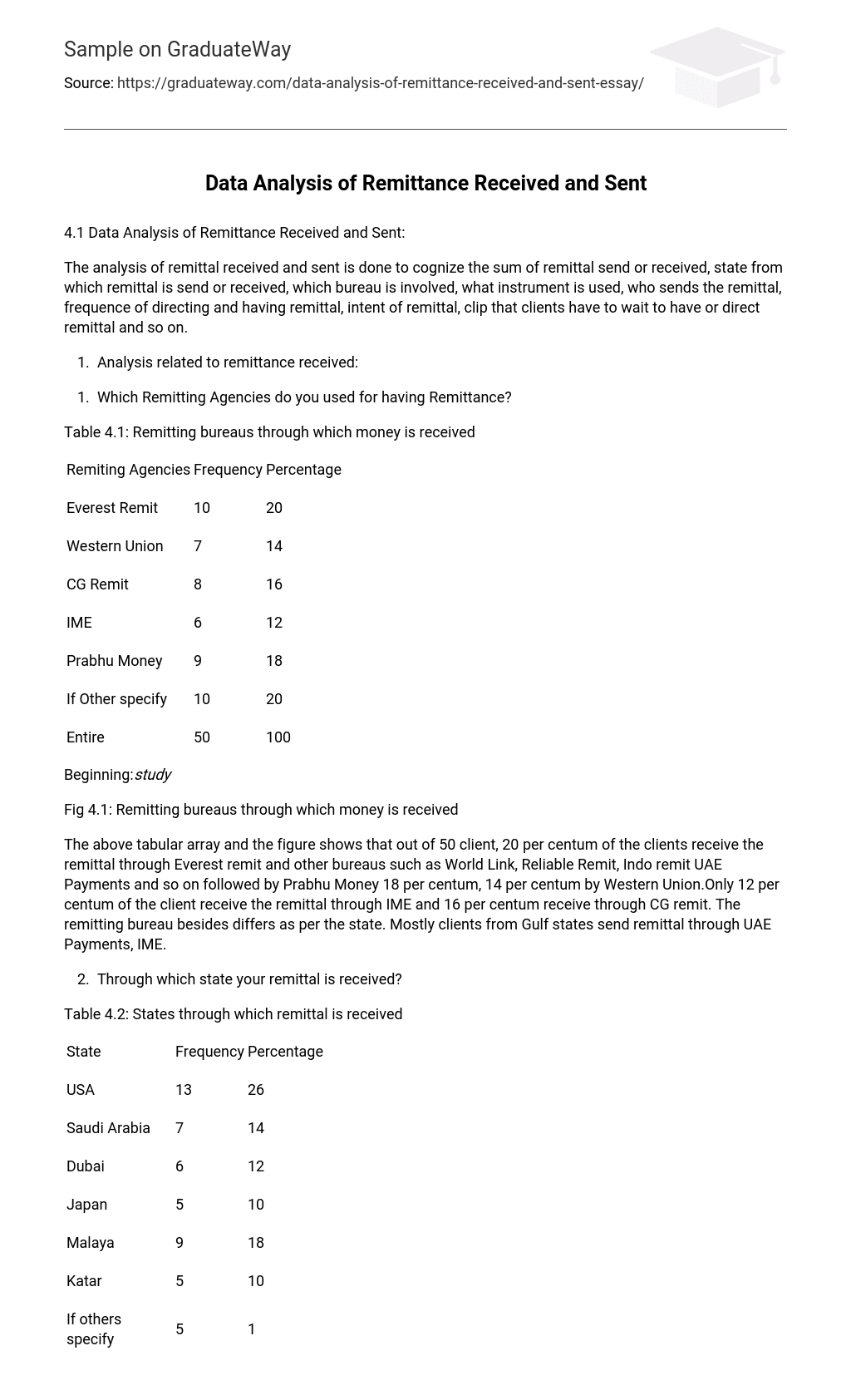

Which Remitting Agencies do you used for having Remittance?

Table 4.1: Remitting bureaus through which money is received

| Remiting Agencies | Frequency | Percentage |

| Everest Remit | 10 | 20 |

| Western Union | 7 | 14 |

| CG Remit | 8 | 16 |

| IME | 6 | 12 |

| Prabhu Money | 9 | 18 |

| If Other specify | 10 | 20 |

| Entire | 50 | 100 |

Beginning:study

Fig 4.1: Remitting bureaus through which money is received

The above tabular array and the figure shows that out of 50 client, 20 per centum of the clients receive the remittal through Everest remit and other bureaus such as World Link, Reliable Remit, Indo remit UAE Payments and so on followed by Prabhu Money 18 per centum, 14 per centum by Western Union.Only 12 per centum of the client receive the remittal through IME and 16 per centum receive through CG remit. The remitting bureau besides differs as per the state. Mostly clients from Gulf states send remittal through UAE Payments, IME.

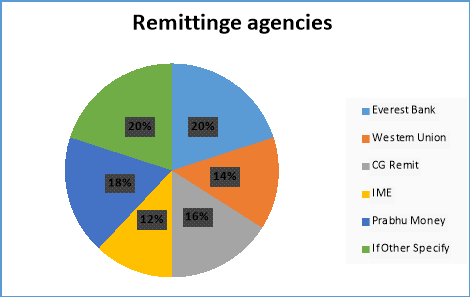

Through which state your remittal is received?

Table 4.2: States through which remittal is received

| State | Frequency | Percentage |

| USA | 13 | 26 |

| Saudi Arabia | 7 | 14 |

| Dubai | 6 | 12 |

| Japan | 5 | 10 |

| Malaya | 9 | 18 |

| Katar | 5 | 10 |

| If others specify | 5 | 10 |

| Entire | 50 | 100 |

Beginning:Survey

Fig. 4.2: States through which remittal is received

The above tabular array and figure shows the 26 per centum of the clients receive their remittal from USA followed by 18 per centum from Malaysia, 14 per centum from Saudi Arabia, 12 per centum from Dubai and 10 per centum each from Japan, Qatar and other states such as Italy, Denmark, Netherlands, Bahrain and so on. It is clear from the above analysis that most of the remittal received is from the Gulf states because most of the Nepali childs are at that place in hunt of the employment chances.

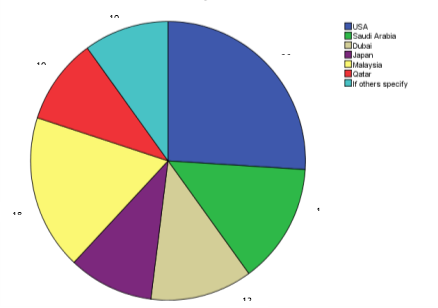

What is the Frequency of having remittal?

Table 4.3: Frequency of having remittal

| Time Period | Frequency | Percentage |

| Once biweekly | 7 | 14 |

| Once a month | 10 | 20 |

| Once a one-fourth | 6 | 12 |

| Half annual | 14 | 28 |

| Annually | 11 | 22 |

| If others specify | 2 | 4 |

| Entire | 50 | 100 |

Beginning:Survey

Fig. 4.3: Frequency of having remittal

The above tabular array and figure shows that 28 per centum of the clients receive the remittal one time half annually, followed by 22 per centum one time in a twelvemonth, 20 per centum one time a month, 14 per centum one time biweekly, 12 per centum one time a one-fourth and staying 4 per centum one time in 2 old ages or 3 old ages and so on. The inward remittal is more largely on the gay season either the festival in Nepal or the foreign states. As the chief festival of Nepalese is Dashain and Tihar, migrators send more remittal during this clip so that their household could observe decently. Migrants earn during Christmas every bit good because it is the chief festival in most of the states like USA, UK, Australia and other. So during this clip besides they save batch of money and direct money to the place state. So frequence is high on these periods.

What is the Purpose of remittal?

Table 4.4: Purpose of remittal

| Aim | Frequency | Percentage |

| Family | 19 | 38 |

| Education | 14 | 28 |

| Business | 6 | 12 |

| Salvaging | 3 | 6 |

| Refund of loan | 8 | 16 |

| Entire | 50 | 100 |

Beginning:Survey

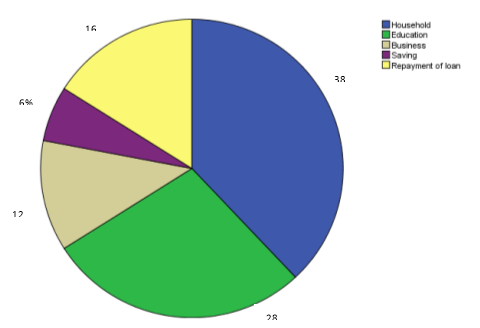

Fig. 4.4: Purpose of remittal

The above tabular array and figure shows that most of the remittal is used for the family intent which takes 38 per centum of the sum. The 2nd largest intent for which the remittal is used is for instruction representing 28 per centum followed by 16 per centum for the intent of refund of the loan, 12 per centum for concern and staying 6 per centum for the intent of salvaging. As migrators move to foreign states in hunt of employment chances it is obvious that the chief intent of inward remittal is for family. And besides the migrators who move for instruction intent largely move by taking loan so after gaining in the foreign states they send the money back to refund the loan.

What is your Relation to the remitter?

Table 4.5: Relation to the remitter

| Relation | Frequency | Percentage |

| Parent | 10 | 20 |

| Sibling | 14 | 28 |

| Husband / Wife | 6 | 12 |

| Son / Daughter | 17 | 34 |

| Friend | 3 | 6 |

| Entire | 50 | 100 |

Beginning:Survey

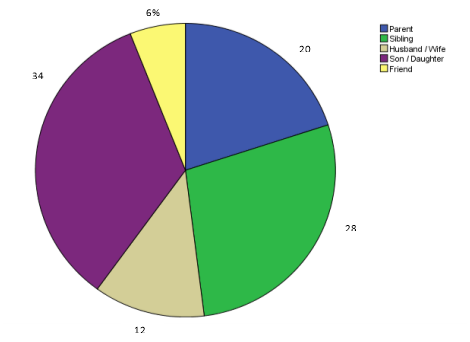

Fig. 4.5: Relation to the remitter

The tabular array and figure above shows that the largest portion of remittal is sent by boy / girl with 34 per centum of the sum followed by 28 per centum by siblings, 20 per centum parents, 12 per centum hubby / married woman and the staying 6 per centum by friends. As most of the childs migrate it is obvious that the 1 who sends the money to place state are the childs such as the kids of the parents, brothers or sisters or it may be parents directing money to their kids as parents live in foreign state but kids are in the place state with their other relations. It is besides found that some of the friends besides send the remittal. Besides the partner life in foreign state sends the remittal.

What is the clip spent in remittal section to have money?

Table 4.6: Time spent in remittal section to have remittal

| Time taken | Frequency | Percentage |

| Less than 5 proceedingss | 7 | 14 |

| 5 proceedingss – 10 proceedingss | 16 | 32 |

| 11 proceedingss to 15 proceedingss | 16 | 32 |

| 16 proceedingss – 20 proceedingss | 10 | 20 |

| More than 20 proceedingss | 1 | 2 |

| Entire | 50 | 100 |

Beginning:Survey

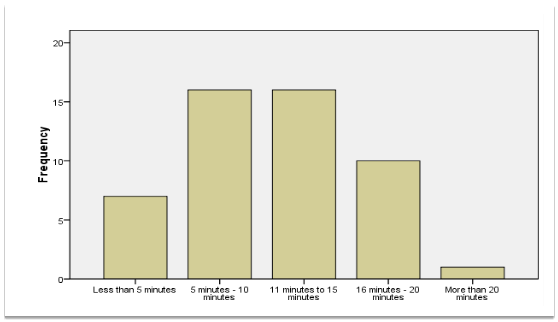

Fig. 4.6: Time spent in remittal section to have remittal

The tabular array and saloon chart above shows that most of the clients have to wait from 5 minutes-10 proceedingss to 11 minutes-15 proceedingss in the remittal section for having the remittal. 10 clients say that they had to wait for 16 minutes-20 proceedingss followed by 7 clients who had to wait for less than 5 proceedingss and 1 client had to wait for more than 20 proceedingss for having the remittal. As the staff in the remittal section is less in figure so merely a staff can non make the full undertaking in an effectual mode. Therefore, it is obvious that the clip taken to have remittal is someway long.

What is the Range of remittal Received?

Table 4.7: Sum of remittal

| Sum | Frequency | Percentage |

| Below 50000 | 19 | 38 |

| 50000 – 99999 | 11 | 22 |

| 100000 – 149999 | 2 | 4 |

| 150000 – 199999 | 8 | 16 |

| 200000 and above | 10 | 20 |

| Entire | 50 | 100 |

Beginning: Survey

Beginning: Survey

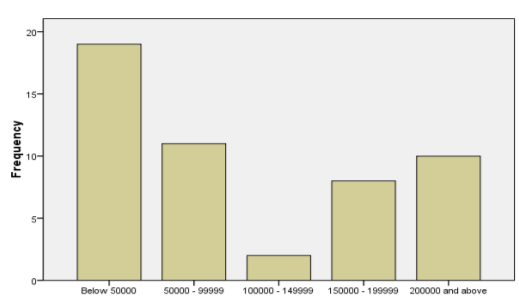

Fig. 4.7: Sum of remittal

The tabular array and figure above shows that 19 out of 50 clients receive below Rs. 50000 at a clip. Most of the clients who receive remittal one time biweekly or monthly have this sum of remittal. 11 clients receive the sum between Rs. 50000-99999 followed by 10 clients who receive Rs. 200000 and supra, followed by 8 clients who receive sum in between Rs.150000-199999 and merely 2 clients received sum in between Rs. 100000-149999. During the festival clip the sum or the scope of remittal is more and since the survey is conducted during non-festival month the sum of remittal is tentatively less or can be said it is really low.

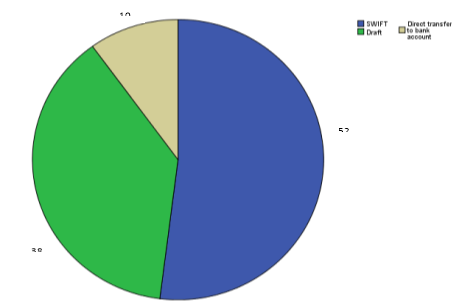

What is The Instruments used for directing remittal?

Table 4.8: Instruments used for directing remittal

| Sending Tools | Frequency | Percentage |

| Swift | 26 | 52 |

| Draft | 19 | 38 |

| Direct transportation to bank history | 5 | 10 |

| Entire | 50 | 100 |

Beginning: Survey

Fig. 4.8: Instruments used for directing remittal

The tabular array and figure above shows that the instrument largely used for directing remittal is SWIFT. 52 per centum of the clients used SWIFT as an instrument for directing remittal followed by 38 per centum who used bill of exchange and 5 per centum made direct transportation to the bank history in the foreign state. As SWIFT is the safest and most dependable method of directing remittal it is seen that most of the clients send the remittal by utilizing SWIFT followed by bill of exchange and merely few clients make direct transportation to the bank history. The job with directing remittal through bill of exchange is that it may or may non make the finish as per the clip scheduled.

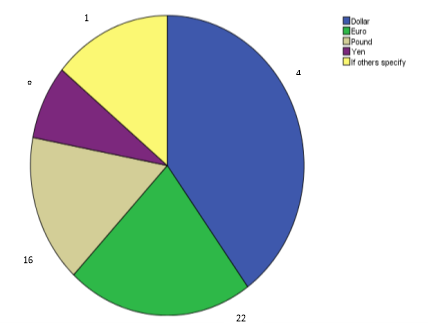

What is the Currency denomination for directing money?

Table 4.9: Currency denomination for directing remittal

| Currency | Frequency | Percentage |

| Dollar | 20 | 40 |

| Euro | 11 | 22 |

| Pound | 8 | 16 |

| Hankering | 4 | 8 |

| If others specify | 7 | 14 |

| Entire | 50 | 100 |

Beginning:study

Fig. 4.9: Currency denomination for directing remittal

The tabular array and figure above shows that the currency used for directing remittal largely is dollar. 40 per centum of the client used dollar for directing remittal followed by 22 per centum who used euro, 16 per centum lb, 14 per centum other currencies such as INR, Swiss Franc ( CHF ) and so on and merely 8 per centum of the entire clients used hankerings for directing remittal. As dollar being the universally recognized currency it is obvious that largely dollar is used for directing remittal followed by Euro. The largely used currencies in the universe are Dollar, Euro, Pound and Yen and the usage of this currency is besides more as per figure.

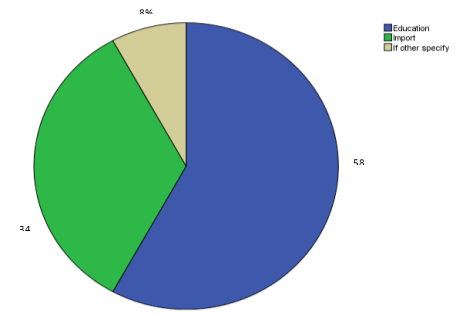

What is the chief Purpose of directing remittal?

Table 4.10: Purpose of directing remittal

| Aim | Frequency | Percentage |

| Education | 29 | 58 |

| Import | 17 | 34 |

| If other specify | 4 | 8 |

| Entire | 50 | 100 |

Beginning: Survey

Fig. 4.10: Purpose of directing remittal

The tabular array and figure above shows that the major intent for directing remittal is for the intent of instruction. 58 per centum of the client had sent the remittal for bearing educational disbursals which include the life disbursals of the person. 34 per centum of the client had sent remittal for the intent of import. And only8 per centum of the client had sent remittal for other intents such as for preparation, workshop, visa processing, and salary and so on.

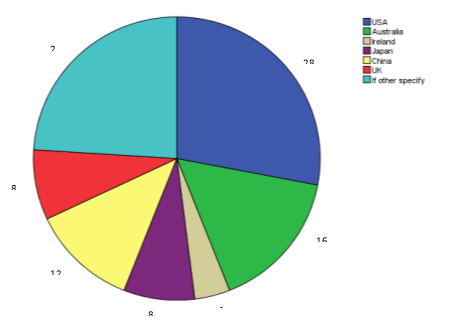

In which state do you often direct your remittal?

Table 4.11: States in which remittal is sent

| State | Frequency | Percentage |

| USA | 14 | 28 |

| Australia | 8 | 16 |

| Irish republic | 2 | 4 |

| Japan | 4 | 8 |

| China | 6 | 12 |

| United kingdom | 4 | 8 |

| If other specify | 12 | 24 |

| Entire | 50 | 100 |

Beginning:Survey

Fig. 4.11: States in which remittal is sent

The tabular array and figure above shows the remittal sent to foreign states. The largest portion of remittal is sent to USA representing 28 per centum of the sum, followed by other states which are non specified as India, Germany, Italy, Switzerland, and Norway. Similarly, 16 per centum of remittal is sent to Australia, 12 per centum to China, 8 per centum each to Japan and UK and merely 4 per centum of remittal is sent to Ireland. As people move to states like USA, UK, Australia, Japan etc for instruction, the remittal is sent more to these states.

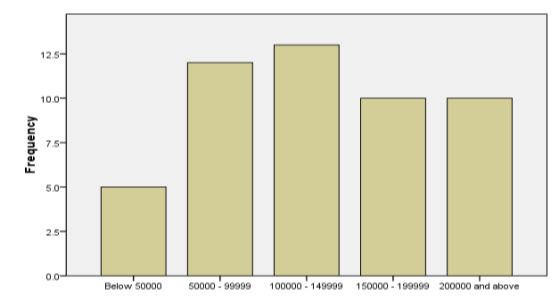

What is the scope of remittal sent?

Table 4.12: Sum of remittal sent

| Sum | Frequency | Percentage |

| Below 50000 | 5 | 10 |

| 50000 – 99999 | 12 | 24 |

| 100000 – 149999 | 13 | 26 |

| 150000 – 199999 | 10 | 20 |

| 200000 and above | 10 | 20 |

| Entire | 50 | 100 |

Beginning:Survey

Fig. 4.12: Sum of remittal sent

The tabular array and figure above shows the sum of remittal sent. It is clear that the sum of remittal from Rs. 100000-199999 is sent more Internet Explorers. by 13 clients. Similarly, the sum from Rs.50000-99999 is sent by 12 clients followed by Rs.150000-199999 and 200000 and above by 10 clients each and merely 5 clients have sent less than Rs 50000.

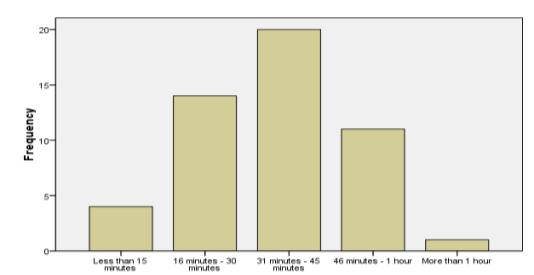

What is the clip spent in remittal section for directing remittal?

Table 4.13: Time spent in remittal section for directing remittal

| Time taken | Frequency | Percentage |

| Less than 15 proceedingss | 4 | 8 |

| 16 proceedingss – 30 proceedingss | 14 | 28 |

| 31 proceedingss – 45 proceedingss | 20 | 40 |

| 46 proceedingss – 1 hr | 11 | 22 |

| More than 1 hr | 1 | 2 |

| Entire | 50 | 100 |

Beginning: Survey

Fig. 4.13: Time spent in remittal section for directing remittal

The tabular array and figure above shows the clip spent by the clients in the remittal section for directing the remittal. 20 clients said that they spent 31 proceedingss – 45 proceedingss for directing remittal, followed by 14 clients who had spent 16 proceedingss – 30 proceedingss, 11 clients from 46 proceedingss – 1 hr, 4 clients had to wait less than 15 proceedingss and merely 1 client had to wait for more than an hr.

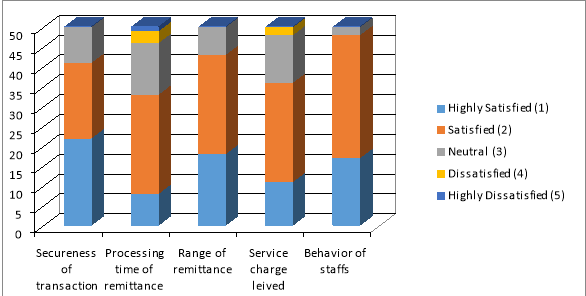

Customers satisfaction with services of remittal section:

In relation to having remittal:

Table 4.14: Customers satisfaction that comes to have remittal

| Are you satisfied with | Secureness of dealing | Processing clip of remittal | Scope of remittal | Service charge levied | Behavior of staff |

| Highly Satisfied | 22 | 8 | 18 | 11 | 17 |

| Satisfied | 19 | 25 | 25 | 25 | 31 |

| Impersonal | 9 | 13 | 7 | 12 | 2 |

| Dissatisfied | – | 3 | – | 2 | – |

| Highly Dissatisfied | – | 1 | – | – | – |

| Entire | 50 | 50 | 50 | 50 | 50 |

Beginning:Survey

Fig. 4.13: Customers satisfaction that comes to have remittal

The tabular array and figure above shows the figure of clients who comes to have remittal are satisfied or non with the services of remittal section of EBL. It is seen that out of 50 clients who had came to remittance section to have remittal 22 clients are extremely satisfied, 19 satisfied and 9 neither satisfied nor disgruntled with the secureness of dealing. It is seen that 8 clients are extremely satisfied, 25 satisfied, 13 neither satisfied nor disgruntled with the processing clip of remittal.

Unlike secureness of dealing 3 clients are dissatisfied and 1 extremely dissatisfied with the processing clip of remittal. Sing the scope of remittal it is seen that most of the clients are satisfied. 18 clients are extremely satisfied, 25 satisfied and 7 neither satisfied nor disgruntled with the scope of remittal. It is seen that 11 clients are extremely satisfied, 25 satisfied, 12 neither satisfied nor disgruntled and few clients ie. 2 clients are dissatisfied with the service charge levied.

More than 90 per centum clients are satisfied with the behaviour of staff in the remittal department.17 clients are extremely satisfied, 31 satisfied and 2 neither satisfied nor disgruntled with the behaviour of staffs. Overall from the above tabular array and figure it can be concluded that most of the clients who come to have remittal are satisfied with the services provided by remittal section in footings of secureness of dealing, scope of remittal and behaviour of staffs.

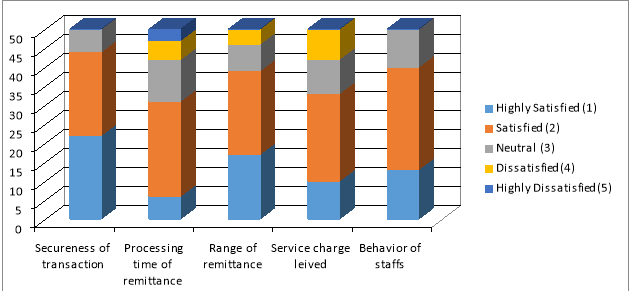

In relation to directing remittal:

Table 4.14: Customers satisfaction that comes to direct remittal

| Are you satisfied with | Secureness of dealing | Processing clip of remittal | Scope of remittal | Service charge levied | Behavior of staff |

| Highly Satisfied | 22 | 6 | 17 | 10 | 13 |

| Satisfied | 22 | 25 | 22 | 23 | 27 |

| Impersonal | 6 | 11 | 7 | 9 | 10 |

| Dissatisfied | – | 5 | 4 | 8 | – |

| Highly Dissatisfied | – | 3 | – | – | – |

| Entire | 50 | 50 | 50 | 50 | 50 |

Beginning:Survey

Fig. 4.14: Customers satisfaction that comes to direct remittal

The tabular array and figure above shows the figure of clients who come to direct remittals are satisfied or non with the services of remittal section of EBL. It is seen that out of 50 clients who had came to remittance section to direct remittal 22 clients are extremely satisfied, 22 satisfied and 6 neither satisfied nor disgruntled with the secureness of dealing. It is seen that 6 clients are extremely satisfied, 25 satisfied, 11 neither satisfied nor disgruntled with the processing clip of remittal.

Unlike secureness of dealing 5 clients are dissatisfied and 3 extremely dissatisfied with the processing clip of remittal. Sing the scope of remittal it is seen that most of the clients are satisfied. 17 clients are extremely satisfied, 22 satisfied and 7 neither satisfied nor disgruntled and 4 dissatisfied with the scope of remittal. It is seen that 10 clients are extremely satisfied, 23 satisfied, 9 neither satisfied nor disgruntled and few clients ie. 8 clients are dissatisfied with the service charge levied.

About 80 per centum clients are satisfied with the behaviour of staff in the remittal department.13 clients are extremely satisfied, 27 satisfied and 10 neither satisfied nor disgruntled with the behaviour of staffs. Overall from the above tabular array and figure it can be concluded that most of the clients who comes to direct remittal are satisfied with the services provided by remittal section in footings of secureness of dealing, and behaviour of staffs. But at the same clip it is besides seen that some clients are dissatisfied with the services provided by remittal section in footings of processing clip of remittal, scope of remittal and service charge levied by the bank.