Percentage OF Use:

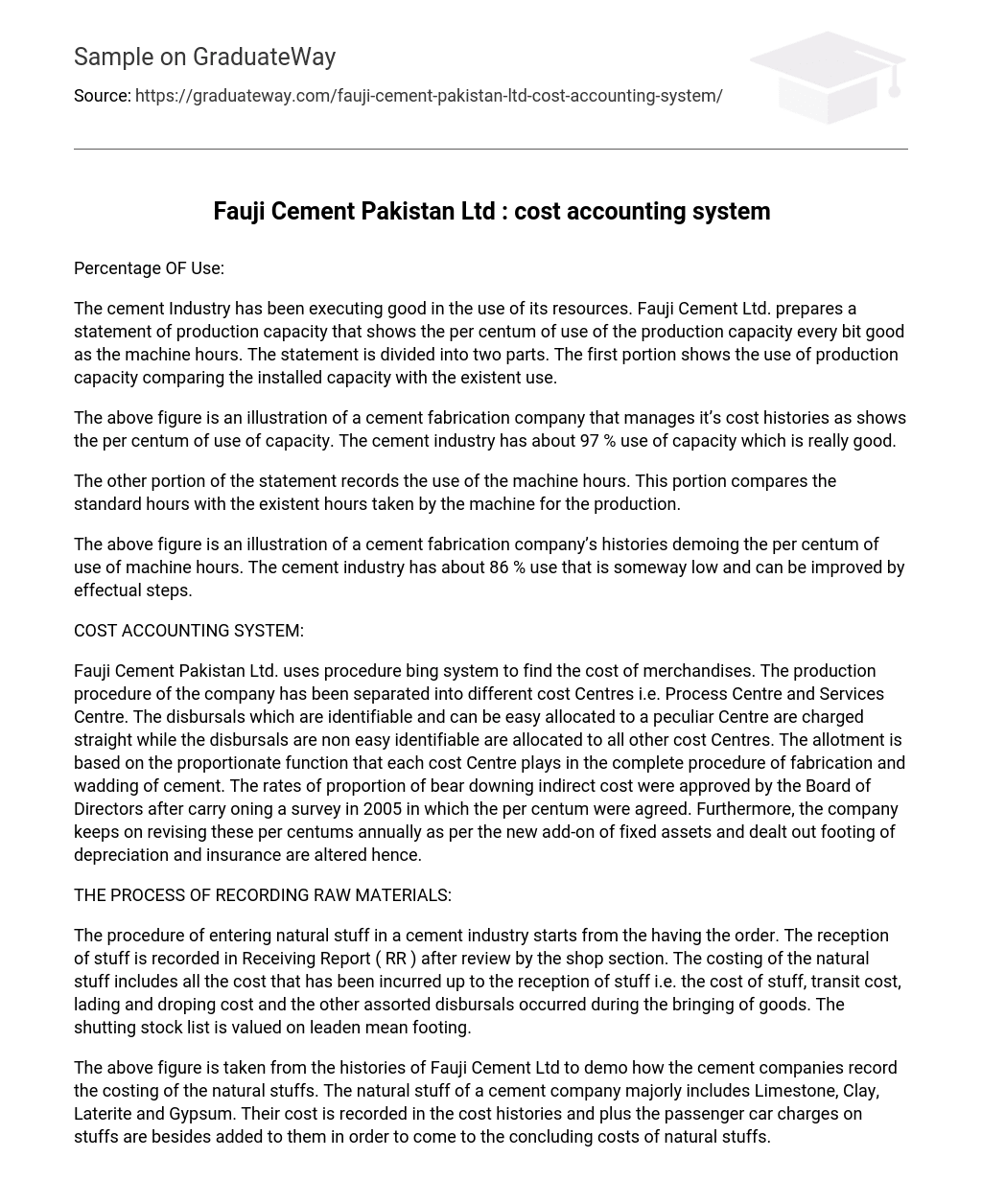

The cement Industry has been executing good in the use of its resources. Fauji Cement Ltd. prepares a statement of production capacity that shows the per centum of use of the production capacity every bit good as the machine hours. The statement is divided into two parts. The first portion shows the use of production capacity comparing the installed capacity with the existent use.

The above figure is an illustration of a cement fabrication company that manages it’s cost histories as shows the per centum of use of capacity. The cement industry has about 97 % use of capacity which is really good.

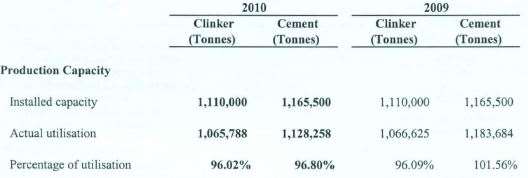

The other portion of the statement records the use of the machine hours. This portion compares the standard hours with the existent hours taken by the machine for the production.

The above figure is an illustration of a cement fabrication company’s histories demoing the per centum of use of machine hours. The cement industry has about 86 % use that is someway low and can be improved by effectual steps.

COST ACCOUNTING SYSTEM:

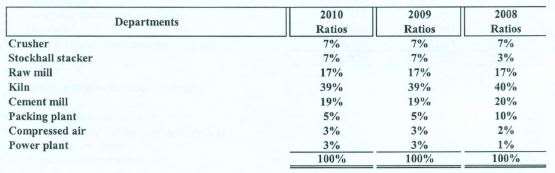

Fauji Cement Pakistan Ltd. uses procedure bing system to find the cost of merchandises. The production procedure of the company has been separated into different cost Centres i.e. Process Centre and Services Centre. The disbursals which are identifiable and can be easy allocated to a peculiar Centre are charged straight while the disbursals are non easy identifiable are allocated to all other cost Centres. The allotment is based on the proportionate function that each cost Centre plays in the complete procedure of fabrication and wadding of cement. The rates of proportion of bear downing indirect cost were approved by the Board of Directors after carry oning a survey in 2005 in which the per centum were agreed. Furthermore, the company keeps on revising these per centums annually as per the new add-on of fixed assets and dealt out footing of depreciation and insurance are altered hence.

THE PROCESS OF RECORDING RAW MATERIALS:

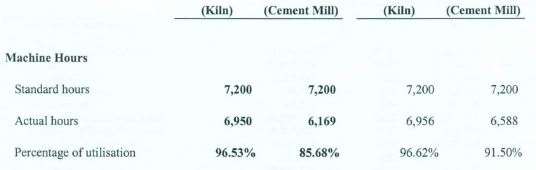

The procedure of entering natural stuff in a cement industry starts from the having the order. The reception of stuff is recorded in Receiving Report ( RR ) after review by the shop section. The costing of the natural stuff includes all the cost that has been incurred up to the reception of stuff i.e. the cost of stuff, transit cost, lading and droping cost and the other assorted disbursals occurred during the bringing of goods. The shutting stock list is valued on leaden mean footing.

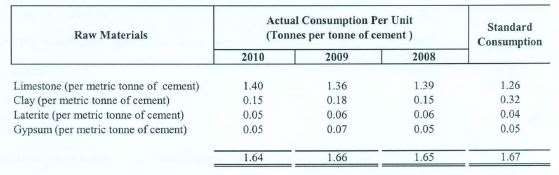

The above figure is taken from the histories of Fauji Cement Ltd to demo how the cement companies record the costing of the natural stuffs. The natural stuff of a cement company majorly includes Limestone, Clay, Laterite and Gypsum. Their cost is recorded in the cost histories and plus the passenger car charges on stuffs are besides added to them in order to come to the concluding costs of natural stuffs.

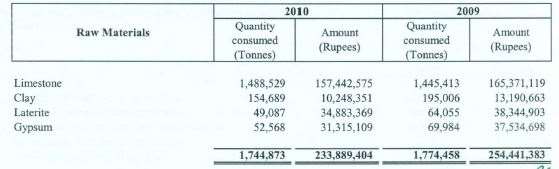

The cost of natural stuffs are recorded, moreover, their ingestion per unit of production is so compared with the standard ingestions in order to cipher the discrepancies. These discrepancies helps the directors to acquire information about the alteration in ingestions and can do determinations consequently.

The above figure shows the method of comparing the ingestion of natural stuff with the standard ingestions.

WAGES AND SALARIES:

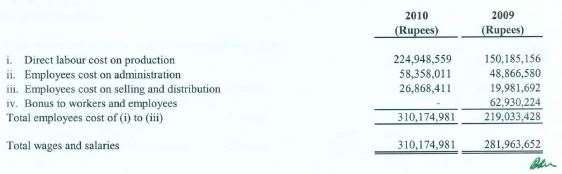

The cement fabrication companies records the cost of labour in two classs. The cost histories are prepared into two different parts. The first parts shows the rewards and wages paid to the different classs of employees during the twelvemonth. These cost classs are employees include Direct labor cost, employees on disposal, employees cost on merchandising and distribution and the fillips to workers and employees. The illustration of the first portion of the labour cost history is shown below.

The other portion of the labour cost histories consist of the salary and fringe benefits of managers and main executives. This portion deals with the costs like managerial wage, company’s part to provident fund, remunerated absences, public-service corporations and upkeep. The illustration is shown below.

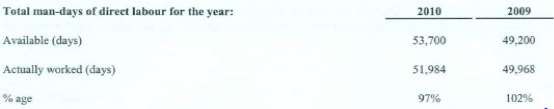

Fauji Cement Ltd besides prepares the sheet of use of the labour hours. The sheet provides the information about how much proportion of the available yearss of direct labours is utilised. The sheet compares the available yearss with the really worked yearss.

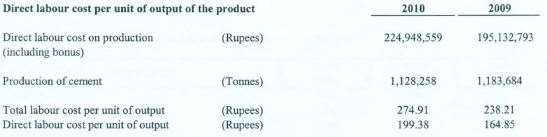

The company besides prepares the sheet for entering direct labour cost per unit in order to compare them with the standard figures and cipher the discrepancies. These discrepancies helps the directors to make up one’s mind upon the addition and lessening in the direct labour cost per unit and can take steps consequently. The sheet is shown below as an illustration.

Property, PLANT AND EQUIPMENT & A ; DEPRECIATION TREATMENT:

Except for free clasp land and capital work in advancement, the company reports belongings, works and equipment at cost less accrued depreciation and impairment loss. Cost of belongings, works and equipment includes purchase cost, borrowing cost during building stage and other straight attributable costs including test tally production disbursals. However Freehold land and capital work in advancement are stated at cost less allowance for damage, if any. On management’s intend, when the assets are available for usage, transportations from capital work in advancement are made to the relevant class of belongings, works and equipment.

At the specified rates, deprecation is recorded straight against income, on footing of consecutive line method for belongings works and equipment taking into consideration their utile lives ( from the day of the month plus is in usage boulder clay when it is disposed of ) . As the company is merely bring forthing cement, any depreciation charged to cost of gross revenues signifiers portion of the cost of cement. Last, the cost of the twenty-four hours to twenty-four hours service of belongings, works and equipment are recognized in net income or loss as incurred.

To demo an illustration of the allotment of depreciation, below is the chart that shows how the depreciation is charged to different sections.

STORES, SPARES AND LOOSE TOOLS:

Cost for shops and spare is determined utilizing leaden mean method. In specific, shops, spares and loose tools are valued at lower of leaden mean cost and cyberspace realizable value less impairment, if any. However, for points in theodolite, their cost is determined on the footing of cost incurred up to the balance sheet day of the month. Adequate damage is recognized for points which are slow traveling and/ or identified as excess to the Company ‘s demand. On a regular footing, the transporting sum of shops, spare parts and loose tools is reviewed and proviso is made for obsolescence consequently. All points of shops and spares are recorded in shops legers and are being accounted for on ageless stock list system.

STOCK IN Trade

Stock of natural stuff, except for those in theodolite, work in procedure and finished goods are valued at the lower of mean cost and cyberspace realizable value. Cost of work in procedure and finished goods comprises cost of direct stuffs, labor and appropriate fabrication operating expenses. However, stuffs in theodolite are stated at cost consisting bill value plus other charges paid at that place on less damage, if any. Stock of packing stuff is valued at traveling mean cost less impairment, if any.

Internet realizable value signifies the estimated merchandising monetary value in the ordinary class of concern less estimated cost of completion and estimated costs necessary to be incurred in order to do a sale.

Borrowing Cost

Borrowing cost includes exchange differences originating from foreign currency adoptions to the extent these are regarded as an accommodation to adoption costs. Borrowing costs are recognized as an disbursal in the period in which they are incurred except where such costs relate to the acquisition, building or production of a qualifying plus in which instance such costs are capitalized as portion of the cost of that plus.