Microeconomics on Hilton HotelsIntroductionHilton Hotel Corporation- one of the most successful companies in the international market and currently operating around 3000 hotels in less than 100 countries (Schein 1). Just recently, Hilton Hotel made an announcement of merging with Blackstone Group, one of the chief private equity firms in the world, and the said merging costs $26 billion. Furthermore, Hilton Hotel Corporation does not only operate hotels but also casino and tourism.

With this wide range service line of Hilton Hotel, it is not surprisingly the said company was able to dominate the hospitality industry.CostAs expected, the volume of expenditure by Hilton Hotel justifies the size of its operation and service coverage. One component of Hilton Hotel Corporation total costs would be their plant, property and equipment expenses. This includes all the tangible assets that they purchase in order to improve the services of Hilton Hotel to its customers, see Appendix 1.

With their high quality standards, Hilton Hotel spends around 7 million USD just to buy new equipments and improve their facilities. Since 2002, they budget allotted to this said costs component will not be less than $5 million. Some of the equipments that Hilton Hotel is being purchased every year are kitchen and utility equipment as well as other maintenance equipment of the company. The management of Hilton Hotel also purchases state of the art furniture and appliance to suit the style of living of their customers.

They see to it that their furniture and appliance are with accordance to the “mainstream” of their target customers.Moreover, another factor of cost component of Hilton Hotel’s operation would be the selling, general and administrative expenses. This includes all the costs acquired by the company in providing services such as salaries of the employees, office supplies, telephone expenses, electrical and water expenses. In other words, this cost component encompasses all the intangible current expenses of Hilton Hotel.

In the electricity alone, Hilton Hotel spends around 5 million USD every year since they consume more than 4 billion kWh of electricity. They also consume five million “therms” of natural gas and around 7 billion gallons of water every year not to mention the 100,000 employees that need to be paid twice a month and the office supplies like paper; pen etc. to be purchased for administrative purposes. In 2006 the selling, general and administrative expenses of Hilton Hotel accounts to around 900 million USD from 400 USD in 2003.

The said figures are justifiable given the fact that Hilton Hotel is continuously expanding every year.Another cost component of Hilton Hotel would be interest expense or the interest paid by the company from the loans and mortgages that they have from various financial institutions. Those long term loans incurred by Hilton Hotel are being used for the expansion of the company’s operation. One example of loans that were acquired by Hilton Hotel for its expansion would be the 5 million USD loan allotted for Park Place Entertainment last 2001.

From 2003 to 2006, the spending of Hilton Hotel to interest rate continuously increased from 300 million USD to 500 million USD respectively. Most of the reason why Hilton Hotel acquires millions of dollars of loans to financial institutions is their acquisition of other businesses in the industry to increase their operation. With limited cash on hand, borrowing money is the easiest way of Hilton Hotel to generate money to buy those companies in the market.Aside from the already given cost component of Hilton Hotel, taxes is also one of the primary source of capital outflow of Hilton Hotel.

From 2003 to 2006 the total amount of taxes that is being paid by Hilton Hotel would be from 81 million USD to 260 million USD respectively. The gross profit of Hilton Hotel from 2003 to 2006 was doubled from 1,300 USD to 2,600 USD respectively. As what have already said a while ago, Hilton Hotel has been aggressively expanding its operation which enormously increases the taxable income of the said company. Therefore, the increase in the tax expenses of Hilton Hotel is already justified.

The said above tax payment made by Hilton Hotel is the net of the tax rate of various countries where Hilton Hotel operates. Meaning, tax expenditure of Hilton Hotel varies depending on which country, where Hilton Hotel operates, is being considered.The last but not the least costs component of Hilton Hotel would be the dividend costs of it stocks. Just last July of this year, Hilton Hotel announced the dividend rate per share of stocks in the company.

The company declared a $0.4 dividend per share and paid last September of this year. Since 2005 up to the present, the dividend rate of Hilton Hotel increased from $0.2 to $0.

4 although the divided per share of the company seems to became stagnant from 1999 to 2005. This said dividends paid by Hilton Hotel deplete the net income of the company since it is also considered as financial obligation on the side of the company.RevenueBased from the 2006 financial issue of Hilton Hotel Corporation, the net income of the said company reached around 600 million USD as compared to the 500 million net incomes in 2005. As for its operating income, around 1.

2 billion USD was generated by Hilton Hotel in 2006 as compared to 800 million operating income in 2005. Moreover, the revenue generated by the said company reached up to 8 billion USD in 2006 in contrast to 4.4 billion USD in 2005 (“Hilton Hotels Corporation 2006 Annual Report: Growing Brands Globally” 1).The total revenue that is being received by Hilton Hotel from its owned chain of hotels around the world is around 2.

5 billion in 2006. If the revenue generated from the chain of hotels of Hilton Hotel Corporation is to be monitored, one could clearly see that it increases every year due to the establishment of new hotels in Asia and Europe in the previous years. In 2005 around 2 billion USD was the revenue generated by Hilton Hotel Corporation from the hotels that they originally owned. As for those acquired hotels of Hilton Hotel, it was stated in the financial report of the company that their comparable owned hotels worldwide was up by 8% in 2005 and reached 9% growth in 2006.

The “time share business” of Hilton Hotel, “Hilton Grand Vacations Company”, contributed revenue of around 650 million USD in 2006 as compared to 550 million USD in 2005. In other words, the revenue of HGCV has increased by 19% from 2005 to 2006 to the increase in the unit sales and the marginal increase in the average unit sales in 2006.Another income generating activity of the Hilton Hotel is the selling of properties. In 2006, around 1.

5 billion USD worth of properties were able to sell by Hilton Hotels Corporation. This said activity of Hilton Hotel started in 2004 to cater their “company strategy” of further increasing their profits from managing and franchising their assets in the market.Aside from hotel chains of Hilton Hotel Corporation, their spa services also generate considerable amount of income for the company. The Hilton Glasgow Hotel is one of the hotels of Hilton Hotel Corporation that offers spa services and other fitness related activities like sauna, 15 meter pool and fitness center.

Another company under Hilton Hotel Corporation that also offers spa and health related services is the Hilton Sandestin Beach Golf Resort and Spa.Moreover, Hilton Hotel Corporation also handles gaming companies in Las Vegas. The Las Vegas Hilton is one of the subsidiaries of Hilton Hotel Corporation concentrating on gaming and casino business.CompetitionFor the past years, Hilton Hotels seems to concentrate more on developing businesses that is les related to hotel line of business.

Like for instance the “casino hotel” and “spa-hotel” of the Hilton Hotel Corporation is really unique and attracts more customers. On the other hand, their competitors like Marriott and Hyatt Hotels gives more attention in the “luxury-hotels” line of business.Marriott International Inc., just like Hilton Hotel, is also one of the successful hospitality companies in the world.

Marriott International Inc. also operates chains of hotels and casinos to various countries around the world. Currently, Marriott handles around 3,000 lodging properties on 70 countries (“Corporate Information” 1). Most of the services being offered by Marriott belong under full-service lodging.

Its initial capital is only equal to 200 million USD after it split to its mother company. The revenue of Marriott International reached around 15.1 billion USD in 2004 and employs around 150,000 workers in 2006. Marriott, despite of limited available capital, still manages to acquire hotels and other related business firms to revitalize their product lines and gain market influence to compete with par to larger hotel chains like Hilton Hotel.

Given the size and coverage of operation, Marriott imposes a small threat to Hilton Hotel, but it would be better to keep on eye in this company since for the past years, it was able to experience impressive growth and acquisitions in the market. Hilton Hotel must monitor every actions of Marriott in order not to give chance this company to further gain market influence.On the other hand, the Global Hyatt Corporation is being comprised by hotel brands and other related business line. It currently specializes in luxury hotel line of brand and one of the top companies which offers full service of luxury hotels, resorts and spa.

The target customers of Hyatt are travelers and vacationers from around the world. Moreover, like Hilton Hotel, Hyatt also offers resorts and spa services to their customers, thus, adding up to the brand of the company, like the Grand Hyatt Kauai Resorts and Spa located in Hawaii and the Hyatt Regency Huntington Beach Resort and Spa located in California. In 2006, Global Hyatt Corporation made 3,500 million USD worth of revenue and they received a negative growth rate of around 45%. Given the limited target customers of Hyatt, it is not surprisingly that their revenue is not that high enough to justify the wide operation of the said company.

Maybe, they are just spending much from developing their hotels into a luxury one and later on, in the long run, be able to experience the benefits from their investments today. Another possible reason why this company has low revenue is due to the fact that this company just started in the market in 2004 from separating into its mother company. Due to this, like the Marriott International Inc., Hilton Hotel Corporation must monitor the company status of Global Hyatt Corporation to prevent any possible great threat from Hyatt Corporation.

Aside from Hyatt and Marriott there are still other companies in the hospitality industry that serves to be the competitors of Hilton Hotel like the InterContinental Hotels and Choice Hotel. The former concentrates on hotel chains and has a revenue equivalent to 960 million pounds in 2006 and was founded in 2003. Slowly but surely, InterContinental Hotels Group is penetrating to the luxury-hotel market just like Marriott and Hyatt Hotel. In terms of size and operation coverage, still, Hilton Hotel is larger as compared to InterContinental Hotels Group.

With this, there is only little threat on the welfare of Hilton Hotel the existence of InterContinental Hotels Group in the industry.On the other hand, Choice Hotels International franchises around 5,000 hotels in over 40 countries around the globe (“About Choice Hotels” 1. For the past years, Choice Hotel was able to manage to maintain a continuous growth level for the entire company. In terms of market coverage, Hilton Hotel still larger as compared to Choice Hotel.

Therefore, just like the first three companies, Choice Hotel only imposes a small amount of threats to the operation of Hilton Hotel.ConclusionWith the aggressive market expansion of Hilton Hotels Corporations, they were able to establish great margin with its competitors in terms of market coverage, capitalization, profitability and target customers. Although its competitors has the advantage over Hilton Corporation in terms of luxury-hotel brand line, but the point is that with the sufficient amount of assets on Hilton Hotels, it is not possible for them to cope up with their competitors and be able to penetrate the luxury-hotel brand line.With regards to the profitability of Hilton Hotel, one of the reasons why they were able to attain the said status is due to the fact that they were able to cater to a larger group of people and finds way on how to minimize their operational costs and give value to their investors and customers.

One of their ways on minimizing their operational costs is the purchase of cheaper yet quality products. They also start to use electricity wisely and purchased “ENERGY STAR” labeled products in the market as well as swapping older and inefficient boilers of the company. With this, Hilton Corporation was able to save around 2.5 million USD within a year (“ENERGY STAR Success Story: Hilton Hotels Corporation”1).

Good working relationship is also being established in the floors of Hilton Hotels Corporation and it helped the company to get along with the changes in the market behavior as well as on their employees. Moreover, since Hilton Hotel Corporation has been in the hospitality industry for many decades, they already establish brand loyalty with their target customers. With this, there is nothing to worry about the competitors for the mean time. But Hilton Hotel must monitor its competitors to prepare their management from any strategies of the latter that aims to run over Hilton Hotel Corporation.

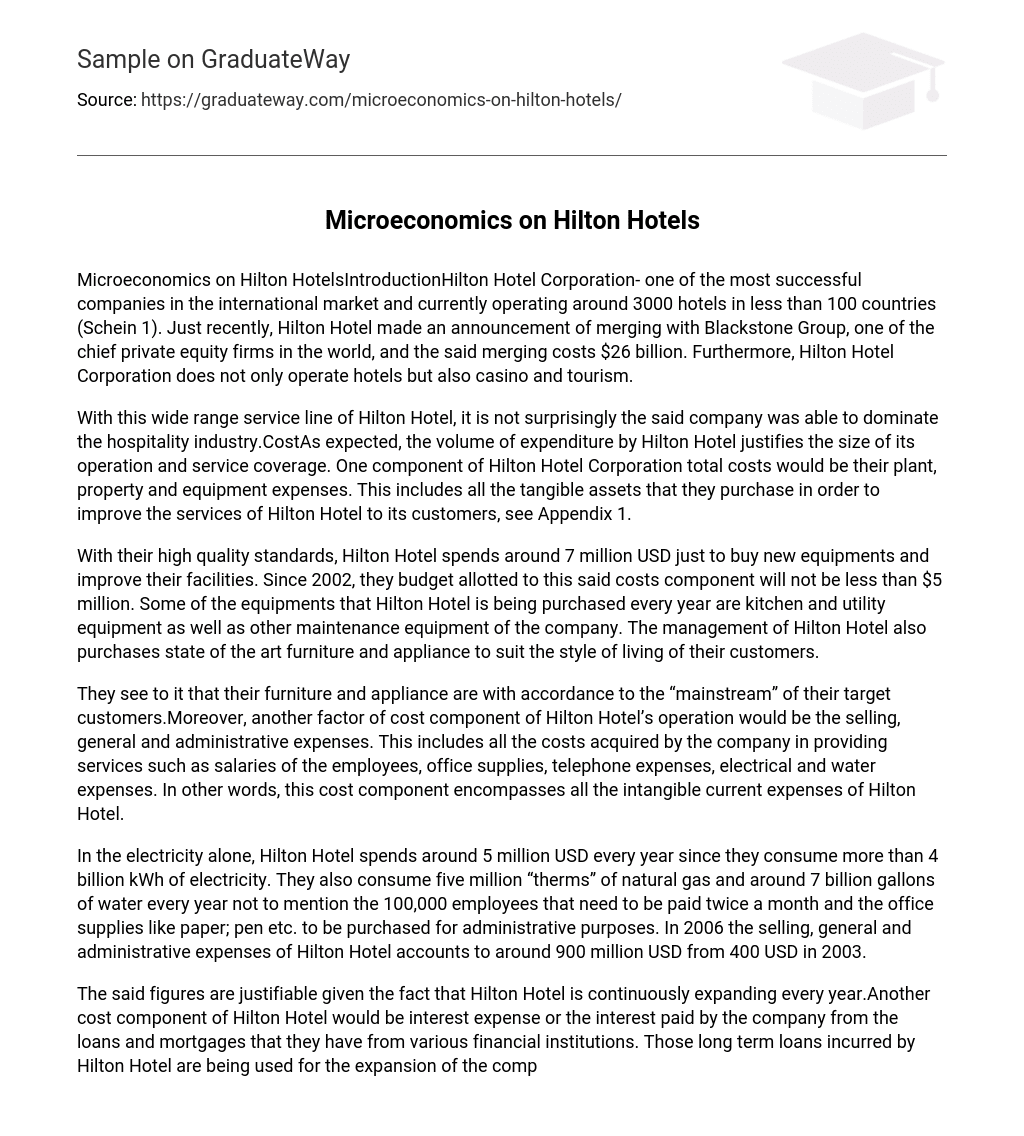

Appendix 1Hilton Hotels CorporationAnnual Income StatementPeriod Ended12/31/200612/31/200512/31/200412/31/200312/31/2002Net Sales8,162.004,437.004,146.003,819.

002,895.00Cost of Goods Sold5,597.002,770.002,722.

002,566.001,563.00Gross Profit2,565.001,667.

001,424.001,253.001,332.00R & D Expendituren/an/an/an/an/aSelling, General & Admin Expenses907607485404381Depreciation & Amort.

441299330334348Non-Operating Income11913638310Interest Expense498259274295328Income Before Taxes838638373223285Prov. For Inc. Taxes2591661275381Minority Interest712866Realized Investment (Gain/Loss)n/an/an/an/an/aOther Incomen/an/an/an/an/aNet Income Before Extra Items572460238164198Extra Items & Disc. Ops.

n/an/an/an/an/aNet Income572460238164198in millions of USD Works citedSchein, Amy. “Hilton Hotels Corporation,” 2007. Hoovers.com.

23 November 2007 <http://www.hoovers.com/hilton/–ID__10733–/free-co-factsheet.xhtml>.

“About Choice Hotels,” 2007. Choicehotels.com. 23 November 2007 <http://www.

choicehotels.com/ires/en-US/html/AboutChoiceHotels?sid=2TIIi.6XG7dg3HZ.8>.

“Corporate Information,” 2007. Marriott.com. 23 November 2007 <http://www.

marriott.com/corporateinfo/default.mi>.“ENERGY STAR Success Story: Hilton Hotels Corporation,” 2001.

Energystar.gov. 23, November 2007 <http://www.energystar.

gov/index.cfm?c=hospitality.bus_hospitality_hilton>.“Hilton Hotels Corporation 2006 Annual Report: Growing Brands Globally,” 2006.

Corporate.net. 23 November 2007 <http://library.corporate-ir.net/library/88/885/88577/items/239651/Hilton_AR_2006.pdf>.