1. EXECUTIVE SUMMARY

Nordstrom, Inc. is working on heightened regulatory and market scrutiny of corporate governance practices in order to communicate and represent the organization in a manner that pleases the shareholders, utilizing resources in a new and evolving compliance environment. Management should be eyeing the macro factors like Government’s policies, competition and tax rates where they operate business because local, national or international jurisdictions and new or changing regulations might create hurdle in their way. Company’s strong point is that they have sharpened their focus on sales, service and customer orientation and are eagerly looking forward to improve its software quality in order to capture the market and the segment in every possible manner and the management is passionate to maintain the performance momentum and competitive advantage in the marketplace. In the end, Nordstrom, Inc.’s highest priority is their stockholders and a firm belief that has given the best possible reward of the stockholders’ investment properly which really makes an impression on the stock value and more importantly, the goodwill of the company.

2. NORDSTROM’S BACKGROUND

Nordstrom, Inc. is a very prestige and renowned name in the industry and it was established in the year 1946, as a fashion specialty retailer and the company are related with Retail (Apparel) industry. At the start of the year 2010, company operates in 28 different states of United States along with 187 stores. Nordstrom, Inc. operates its business in four different segments the name of these segments is

· Direct

· Retail Stores

· Credit

· other

In the fiscal year 2010, Nordstrom, Inc. opened three rack stores in Florida, Texas, Houston, etc. In addition, Nordstrom, Inc. also owns six different merchandise distribution centers in different states. The other competitors of Nordstrom, Inc. are Macy’s Inc., Stage Stores. Inc. etc.

3. FINANCIAL REVIEW& ANALYSIS

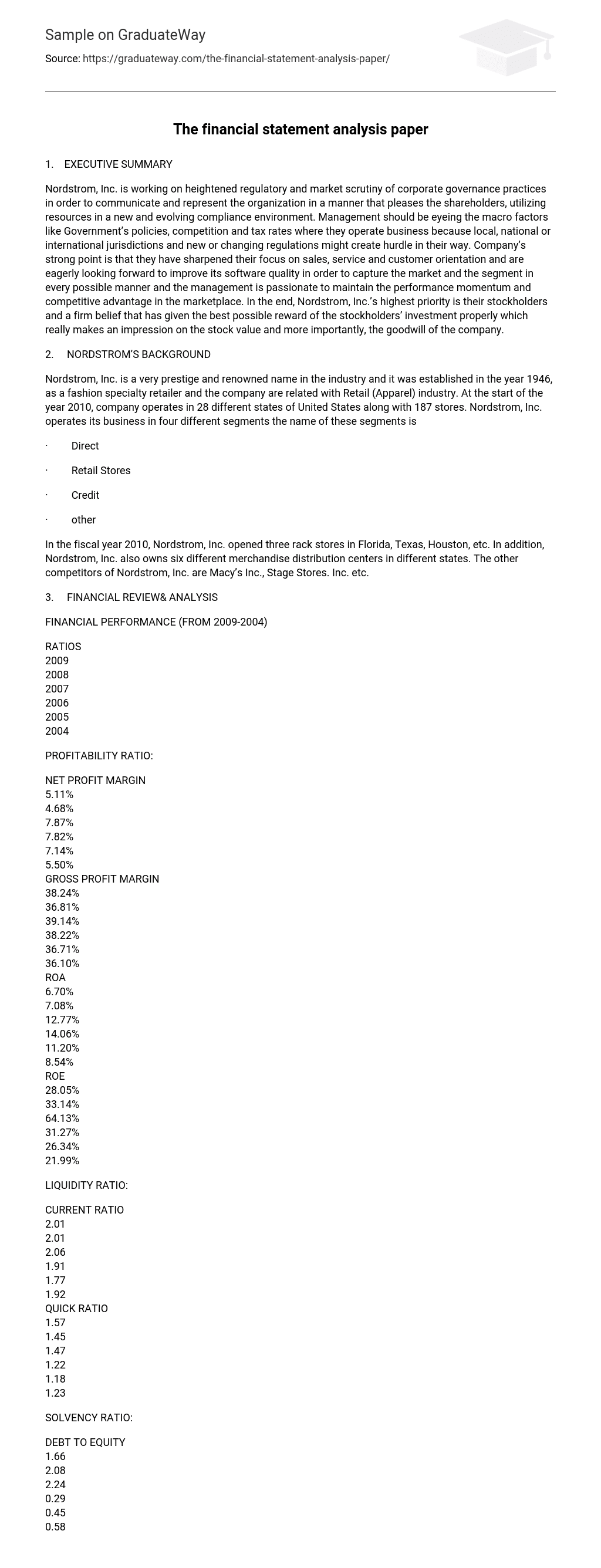

FINANCIAL PERFORMANCE (FROM 2009-2004)

RATIOS

2009

2008

2007

2006

2005

2004

PROFITABILITY RATIO:

NET PROFIT MARGIN

5.11%

4.68%

7.87%

7.82%

7.14%

5.50%

GROSS PROFIT MARGIN

38.24%

36.81%

39.14%

38.22%

36.71%

36.10%

ROA

6.70%

7.08%

12.77%

14.06%

11.20%

8.54%

ROE

28.05%

33.14%

64.13%

31.27%

26.34%

21.99%

LIQUIDITY RATIO:

CURRENT RATIO

2.01

2.01

2.06

1.91

1.77

1.92

QUICK RATIO

1.57

1.45

1.47

1.22

1.18

1.23

SOLVENCY RATIO:

DEBT TO EQUITY

1.66

2.08

2.24

0.29

0.45

0.58

DEBT TO ASSET

0.40

0.44

0.45

0.13

0.19

0.22

(Nordstrom, Inc., Annual Report, 2009-2004)

PROFITABILITY RATIO

NET PROFIT MARGIN

The profit margin on sales ratio tells us the ability of the firm to convert its sales into profits. A low profit margin on sales indicates high expenses which consume most of the revenue earned by the firm. In such a case, the firm needs to analyze and point out areas which are producing more expenses than usual. The higher the ratio, the better it is for the company. From the perspective of Nordstrom, Inc. there is not significant moment is reviewed in all the six years. Nordstrom, Inc.’s net profit margin is almost constant in the year 2007-02 because of margins in selling, administration expenses, R&D expenditure, etc. In that case Nordstrom, Inc. still has a room for improvement in the net profit margin. Moreover in the year 2009-08, because of rough economic and business condition, Nordstrom, Inc.’s efficient business running strategy hit badly in terms of net profit margin. It is viewed that Net Profit margin rate will increase in years to come. The management strategy has helped generate more revenue but there has been significant impact made on the net profit (Myers, Brealey and Marcus, 2001).

GROSS PROFIT MARGIN

Efficient management strategy reflects in the gross profit sales which increased in the year 2009 and 2007 with 38% and 39% respectively (Annual Report, 2009-2007) as compared with the rest of the years. In the year 2009, Nordstrom, Inc.’s has focuses on reduces the cost of goods sold which gives a slightly positive reflection on the gross profit. Slight increment in the year 2009 gross profit because of company’s policies in order to deal with the economic recession. Moreover, Nordstrom, Inc.’s lower ratio of COGS in the shape of FOH, Purchases etc and also due to internal restructuring made a strong reflection on the gross profit ratio in the year 2009 and 2007. On the whole the gross profit margin is fair enough and one should hope that the percentage of gross profit margin will increase in years to come.

RETURN ON ASSETS (ROA)

Nordstrom, Inc.’s ROA suggests that the firm utilizes its asset and resources in an appropriate manner in order to generate more profits in comparison with their asset acquisition. This ratio also gives the positive signal that proper asset management strategy is adopted in order to generate the maximum output. It is the prime responsibility of the management is to explore newer market segments but it is making sufficient profits out of their assets.

RETURN ON EQUITY (ROE)

An ROE of 64% (Annual Report, 2007) in the year 2007 indicates that Nordstrom, Inc. is less dependent on debt financing and company is heavily relying on equity financing. The Nordstrom, Inc.’s return on equity (ROE) other than the year 2007 reported volatile growth rates in because of Nordstrom, Inc.’s internal policies or due to macro factors. Company’s inconsistent performance in the shape of net profit year by year not make a significant impact on the ROE of the company in contrast with the industry as we know that the stockholder equity, which includes retained earnings, also makes a reflection on the company’s stock prices.

LIQUIDITY RATIO

CURRENT RATIO

The current ratio tells us about the liquidity of the company. It is the ratio which tells us the company’s ability to pay off its liabilities using the current assets in case the company is liquidated. Higher the current ratio, the better it is. Nordstrom, Inc.’s current ratio is on the higher side year by year from the year 2009-2004 in comparison with rivals such as Macy’s Inc. and this ratio indicates a higher margin of safety with respect to meeting current obligations. Nordstrom, Inc.’s current ratio will allow them to take more debt as compared to previous years practices. Although, Nordstrom, Inc. has made short-term investments due to which the current ratio is reported on the higher side and looks stable and healthy as compared to the previous years (Besley, Brigham, Scott, Eugene F., 2001). Nordstrom, Inc.’s current ratio has strong current ratio and its gives a strong and positive signal to the creditors that company’s business operation is running on a right path. The current ratio of Nordstrom, Inc. suggests that company have not sufficient and ample reserve cash or liquid asset and Nordstrom, Inc. can utilize the excess or reserve cash on their ongoing business.

QUICK RATIO

Nordstrom, Inc.’s quick ratio is better in all the six years period. Although Nordstrom, Inc.’s has a higher inventory but improper maintenance of working capital management strategy has also a hurdle in order to produce a healthy quick ratio. In addition, Nordstrom, Inc.’s quick ratio gives a positive signal to the market, indicating that there is no liquidity problem for Nordstrom, Inc. Marks and Spencer (Besley, Brigham, Scott, Eugene F., 2001).

SOLVENCY RATIO

DEBT TO EQUITY RATIO

Dependency on debt financing is not a bad habit but it has consequences if you rely on more. Nordstrom, Inc. debt to equity ratio is on the higher side in the year 2008-2007 in comparison with the year 2009 due to the factors of business volume, increment in sales, fulfillment to pay the suppliers and acquisitions of fixed asset. Due to the expansion in business, Nordstrom, Inc. has plenty of financial obligations, most of which has been acquired through equity. In the year 2009, Nordstrom, Inc. reliance less on debt financing as compare to the rest of the years.

DEBT TO ASSET

Nordstrom, Inc. D/A ratio, is around 40% from the year 2009 to 2007 (Annual Report, 2009-07) .In the year 2006 to 2004, the debt to total assets is around 20 % which is good as far as the performance is concerned (Annual Report, 2006-04). The year 2009 is worst for Nordstrom, Inc., the main reason behind is the improper utilization of debt in order to capitalize assets. Moreover, it also reveals the fact that the management of the company can’t generate more assets in response with the debt. A higher D/A ratio would place the company under increased amount of risk, especially if the interest rates are rising. Hence, a lower D/A ratio would be more desirable (Besley, Brigham, Scott, Eugene F., 2001).

4. NORDSTROM, INC. POSITION

According to my analysis and evaluation, I analyze some evaluate some valuable points which are stated below:

· Articulate risk management techniques regarding the inventory level, economic recession, product lifecycle etc.

· Design the Internal control system that really helps in the company’s financial policies.

· Formulating and implementing the corporate strategy which determines the company’s mission and objectives and also oversight the risk associated with.

· High cost of sales make a negative impact on the gross profit and also the raising variable and fixed cost cut down the profit so the company take all necessary step to continue the same practice.

· Balance sheet composition mainly consisted on debt financing and the company is not relying on equity financing. Company also acquiring fixed assets with the help of debt that the company utilizes which increase through out the business. Currently the company’s balance sheet is over leveraged.

· Company also making the strategy to utilize all the assets at its optimum level and not should eyeing on the fact that no asset remains idle. Moreover, company focuses more on capital expenditure.

The analysis of company’s stock is concluded below:

The closing stock price of Nordstrom, Inc.’s stock on May 20, 2010 is $ 38.41.If I am the broker I would prefer to hold rather than sold because on some grounds which is stated below:

· Not out of the woods but small improvements in sales and margins and return to basics could translate into more upside.

· In the year 2009 company’s earning is at the higher side as compare with the year 2008. So, it is very evident fact that Nordstrom, Inc.’s performance and its earnings have increased, and subsequently had a significant impact on its stock price. In addition, this little increment in net earnings will make a strong reflection in the years to come and also this has had a positive influence on the investor, as the company has managed to keep its returns higher than that of the entire sector.

· If I am the investor, I would invest the company, because I belief the company will actually deliver on recent proposals and meet current consensus forecasts. Also because the company’s recent market analysis shows that the company’s stock has been trading at a higher price than the entire sector.

5. CONCLUSION

Although Nordstrom, Inc. portrays a very strong and positive position in the markets place and without doubt this company has an ability to challenge its rivals to have a girds to become the market leader in the near future. There are certain areas where Nordstrom, Inc. should pay attention to like in the area of stock prices (plus dividend policies), net profit margin, reduction in revenue expenditures on consistent basis and assist in increase its investor’s confidence towards the organization. Moreover, extra efforts need to be concentrated towards improving the product quality which really helps in uplifting the sales. Also company formulates the strategy to overcome the macro factors like economic recession etc that really troubles the company’s future.

REFERENCES

Besley, Brigham, Scott, Eugene F. (2001). Principles of Finance. Florida: Harcourt College Publishers.

Brealey, Richard A., Stewart C. Myers, Alan J. Marcus (2001). Fundamentals of Corporate Finance. 4th ed. New York: McGraw-Hill.

Nordstrom, Inc. (2009). Annual Report.

Nordstrom, Inc. (2008). Annual Report.

Nordstrom, Inc. (2007). Annual Report.

Nordstrom, Inc. (2006). Annual Report.

Nordstrom, Inc. (2005). Annual Report.

Nordstrom, Inc. (2004). Annual Report.

Reuters. (2009). Nordstrom, Inc. (JWN). Available: http://www.reuters.com/finance/stocks/incomeStatement?stmtType=INC&perType=ANN&symbol=JWN Last accessed 09 January 2010.