Introduction

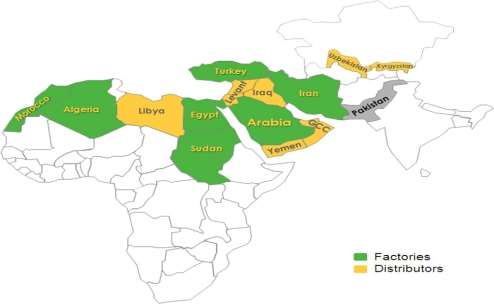

Savola Group a Saudi Arabia based company. The company was incorporated manner back 1979. The company is the maker and marketer of comestible oil and vegetable ghee. The company has become one of the most successful and fastest turning company in UAE, in the comestible oil and nutrient market. The company has presence in Gulf and the Middle East Region, North African and Turkey.

The merchandise portfolio includes Edible Oils, Vegetable Ghee, Sugar, and Pasta. Savola Group has its ain hypermarkets and ace markets in UAE and in many other parts. The gross and the net income of the company has grown well. The net income figure of 2013 was pegged at SAR 2.07 Billion, an addition 21.6 % from the 2012 figure. The gross figure for 2013 stood at SAR 26.6 Billion in comparing to SAR 25.3 Billion of 2012 ( Group, 2015 ) .

The scrutinizing portion is non merely to show position and sentiments about the fiscal statement of any entity it besides involves the professional moralss, agnosticism during the class of the audit. The audit is more related to behavior of audit and showing the sentiment about the mode in which histories are maintained. The audit study shall besides incorporate the reserves about fiscal statements. The hearer shall follow with the ethical demand to the audit of fiscal ; statement. The scrutinizing portion will be completed within following 30 yearss and the complete over position of the company can be prepared and understood from this exercising.

The concern scheme of the company is to turn in the part and to increase its pes clasp in that part. The economic sciences concepts dramas of import function taking the ultimate determination on concern policies. The managerial economic sciences is all about making the right mix of resources to achieve the best possible consequence for the company. The above definitions set up the correlativity between theory of economic and concern determination devising. The managerial economic sciences is most modern construct in footings of an administration efficaciously utilizing the firm’s scare resources. The managerial economic sciences is all about doing determination sing the client base, rival and future determination devising. The determination doing process draws information from arrested development analysis, correlativity and concretion ( Stengel, 2011 ) . The pertinence of strategic planning and managerial determination devising can be found in following countries ;

- Appraisal of Fund demand for investing.

- Beginning of fund

- Choice of concern country

- Choice of merchandise

- The end product has to be determined

- The monetary value of the merchandise

- The engineering to be used for production

- Gross saless publicity

The strategic planning of the company includes investing in the growing sector and to increase its merchandise portfolio further. The company has planned investing proposal for the nest few old ages and the company is besides increasing its interest in assorted subordinates around the universe. Savola Group is be aftering to do support industries and keeping an active investing portfolio. The company has planned to develop complementary trade names and production abilities in approaching period of 2016 to 2019.

Mission and Vision

The mission and the vision statement is the pattern of capturing someone’s whish and desire in a paragraph. The company has its mission statement that and that negotiations about the openness and the transparence in the concern and commercialism.

“ In footings of our civilization of “The Balanced Way” , we at The Savola group are committed to our Social Responsibility, and we will work unrelentingly in accomplishing universe category criterions of openness, transparence and answerability towards all our stakeholders, and construct Bridgess to make out and function the communities we operate in ( Group, Mission, 2015 ) . “

The vision of the company is to go the top notch nutrient merchandises fabricating company in Middle East and to keep the largest market portion in that part.

In UAE Savola is confronting competition from local companies like Abudhabi Vegetable Oil Co. LLC. The company is runing in the vegetable oil market. The company is giving stiff competition to Savola. The vision of the company is to go the clear leader in the premium cookery oil sector in the part ( Middle East and Africa ) . The mission of the company is constructing legacy our premium trade names and modern installations and to continually fabricate packaged comestible oils with the highest of criterions and quality. The mark of Abudhabi Vegetable Oil Co. LLC. Is to go the premium manufacturer of the comestible oil in the market and besides to fulfill the demand of the client to the great extent ( LLC. , 2015 ) .

Savola is concerned about the transparence and openness in the company and the addition in the stockholders wealth but on the other manus Abudhabi Vegetable Oil Co. LLC. wants to go the market leader in the premium comestible oil in the Middle East and Africa market. The marks of both the company is non different. Savola is large trade name in Middle East and Abudhabi Vegetable Oil Co. LLC wants to set up itself as the biggest trade name in the comestible oil market.

The vision statement of Savola shall be more towards the client satisfaction and edifice new merchandise line to run into the demand of the clients.

Internal appraisal

The fiscal analysis is related to the appraisal of the concern, undertakings, public presentation and profitableness of a company or house. The basic demand of fiscal analysis is to happen the fiscal stableness of an administration. The fiscal analysis is imperative for apprehension of the company and its dorsum land. It is imperative for the investor to happen whether puting in this company is safe or non. The chief focal point during analysis of a company, it would be towards the Income Statement, Balance Sheet and hard currency flow statement of the company. The most of import manner of analyzing the fiscal statement is to cipher assorted ratios from the figures provided in the one-year study of the company ( Tracy, 2012 ) .

Current Ratio

Liquidity ratio measures the ability of a house to run into short term and long term duty. The ratios are really of import for the house to mensurate the ability to pay the duties otherwise lower ratios can take to bankruptcy of the house. The higher ratios are favorable for any house to run into the short term duties. The ratio analysis is of import for the bankers and the fiscal establishments mensurating the ability to pay short term duty of the house to the Bankss and the fiscal establishments. The measuring of the liquidness ratio depends on the user of the information. There are by and large two chief liquidness ratios one is current ratio and another is speedy ratio or acerb trial ratio ( Jain, 2006 ) .

The current ratio is declarative of the fact that the company has better place I footings of current assets. The current ratio is the measuring of the company’s ability to pay short term liabilities with short term assets. The higher the ratio, the company is more quipped to pay its duties. The expression for current ratio is Current assets/ Current Liabilities. The current ratio gives the sense of the operations and runing rhythm of the company.

Debt to deserving ratio

The grade of purchase is calculated by the geartrain ratios. The debt equity ratio shows the proper mix of debt and equity in formation of capital. The gearing ratios are hard to compare as the geartrain ratio for different industry varies. Therefore the comparing of the pitching ratio can be done among the same companies in the same industry. It is widely known that higher pitching ratio airss risk to any industry or company, as even in worst turnover figures the company have to still serve the debt.

The fiscal statements play their portion in computation and projection of the fiscal ability and strength of any entity or administration. The fiscal statement and balance sheet is prepared on accrual footing. The statement is used to fit the income and disbursals received and paid in hard currency of any entity for any given period. The fiscal statements include any hard currency dealing. The state of affairs for Samsung is appealable. The balance sheet figures are declarative of the fact that the company is poised to execute better in the hereafter.

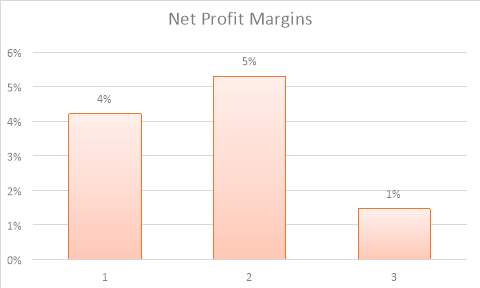

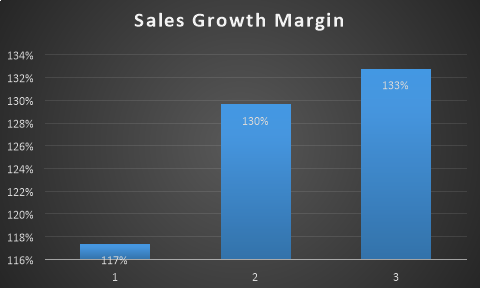

| SL NO | Ratio Analysis | 2010 | 2009 | 2008 |

| 1 | Gross saless Growth Margin | |||

| 117 % | 130 % | 133 % | ||

| 2 | OPERATING Net income Margin | 16 % | 17 % | 13 % |

| OPERATING Net incomeGross | ||||

| 3 | Net Net income Margin | 4 % | 5 % | 1 % |

| Net Net incomeGross | ||||

| 4 | Administration and selling disbursals divided by entire gross revenues | 12 % | 17 % | 11 % |

| 5 | CURRENT RATIO | 7/8 | 8/9 | 4/5 |

| CURRENT ASSETS | ||||

| CURRENT LIABILITIES | ||||

| 6 | Debt to worth ratio | 29 % | 23 % | 16 % |

| Entire DEBT TO OUTSIDER | ||||

| EQUITY CAPITAL+ RESERVES | ||||

| 7 | ROA | 5 % | 6 % | 1 % |

| Net Income | ||||

| Entire assets | ||||

| 8 | EPS | 3.00 | 2.76 | 1.34 |

Profitability Ratio

The profitableness ratios are the indexs of the net income per centum against gross revenues. It is the measuring of the ability to bring forth net incomes of the company. The most of the ratios are declarative of the profitableness place of the company. Some of the profitableness ratio is net income borders and return on assets and return on equity. The profitableness ratio are really of import for the house to demo to the investors that the company has n=made net income significantly.

The presence of the company is needed in many other states including emerging market economic systems. The emerging market economic systems can supply them better growing chances. The schemes the company is taking is of import for the growing but the growing will come from new merchandise and new goods in the market. To increase the demand and to keep the leading place in the market the company needs to increase its merchandise portfolio.

| IFE Matrix | |||

| Internal Factor Evaluation | Weight | Rating | Weighted Mark |

| Strength | |||

| Brand value of the company is immense | 0.09 | 4 | 0.36 |

| Assortment of merchandise | 0.05 | 3 | 0.15 |

| Selling scheme | 0.07 | 4 | 0.28 |

| Personal shopping promenades and hyper market | 0.08 | 5 | 0.4 |

| Business country and the volume of concern | 0.06 | 4 | 0.24 |

| Operation in Middle East and Africa | 0.05 | 3.5 | 0.175 |

| Strong Gross | 0.06 | 4 | 0.24 |

| Strong Net income | 0.05 | 4 | 0.2 |

| Ad and trade name value | 0.04 | 3 | 0.12 |

| Failings | |||

| No new merchandises | 0.08 | 5 | 0.4 |

| New rivals in the market | 0.06 | 4 | 0.24 |

| Price competition has increased | 0.08 | 4 | 0.32 |

| Political convulsion | 0.08 | 5 | 0.4 |

| Increased input costs | 0.07 | 4 | 0.28 |

| Debt place lifting | 0.08 | 4 | 0.32 |

| Sum | 1.00 | 4.125 |

External Appraisal

The President of UAE has signed Economic Agreement with GCC in 2002. UAE has besides signed understandings to intensify its trade ties with Arab states. Greater Arab Free Trade Area Agreement and other bilateral free trade understandings within the model of GCC understandings are besides to be signed with Syria, Lebanon, Iraq, Morocco and Jordan ( www.abudhabi.ae, 2015 ) . UAE is one of the member state of WTO. Beyond GCC the state has entered into trade understanding with many states.

The state has besides signed trade understanding with major economic systems of the universe. The UAE is the federal monarchy. By far Saudi Arabia is the largest Gulf states with strong economic system and the largest exporter of Oil. The UAE is the 2nd largest economic system in the Gulf part after Saudi Arabia ( dubaifaqs.com, 2015 ) .

The state has exposure of the state has in many Fieldss. Information collected from assorted beginning would assist understanding the external environment and its consequence on the concern houses like Savola. The UAE is the 2nd largest economic system in the Gulf part after Saudi Arabia ( dubaifaqs.com, 2015 ) .

If we go by the infrastructural and economical point of position UAE is manner in front of Saudi Arabia. Saudi Arabia is wholly dependent on exporting of oil. The UAE has managed to diversify its income. The 70 % of the part in GDP of UAE economic system is coming from service sector. The UAE economic system has made the impossible possible. The state has managed to diversify the economic system of the state to the big extent. The substructure development is the pre necessity for growing. The infrastructural growing is of import for puting up new concern and to take the growing to a new flight.

The GDP figure of UAE is bespeaking that after 2008 crisis the economic system has moved on ( Bank, 2015 ) . The GDP growing figure for last five old ages were 1.6 for 2010, 4.9 for 2011, 4.7 for 2012 and 5.2 for 2013. Dubai has transformed in to universe category finish in footings of concern and tourer finish.

| External Factor Evaluation Matrix | |||

| Weight | Rating | Weighted Mark | |

| Opportunities | |||

| Higher gross | 0.08 | 4 | 0.32 |

| Increasing presence | 0.05 | 3 | 0.15 |

| Aggressive selling | 0.05 | 4 | 0.2 |

| New Markets in the GCC states and Africa | 0.06 | 5 | 0.3 |

| Largest Operating state in footings of gross revenues in many states | 0.06 | 4 | 0.24 |

| Increasing presence in little towns | 0.05 | 4.5 | 0.225 |

| Increasing merchandise quality and borders | 0.06 | 3.2 | 0.192 |

| Lower rival in different markets | 0.05 | 4 | 0.2 |

| Expecting biggest investing from Middle East | 0.04 | 3 | 0.12 |

| Africa Potential market | 0 | ||

| 0 | |||

| Menaces | 0.05 | 5 | 0.25 |

| Indian and Chinese companies | 0.04 | 4 | 0.16 |

| Competitive pricing of the merchandises | 0.05 | 4 | 0.2 |

| Consuming market portion | 0.04 | 5 | 0.2 |

| Aggressive selling schemes by rivals | 0.06 | 4 | 0.24 |

| Aggressive PR my the rival | 0.06 | 4 | 0.24 |

| Discounted monetary value by the rival | 0.04 | 2.5 | 0.1 |

| No presence in emerging markets | 0.03 | 4.5 | 0.135 |

| Lower merchandise portfolio | 0.05 | 4 | 0.2 |

| Increasing debt | 0.04 | 3 | 0.12 |

| Political convulsion | 0.04 | 6 | 0.24 |

| Entire | 1.00 | 4.032 |

Strategy Formulation

Porter’s Five Pint Forces:

The fabrication industry creates value by altering the inputs for the merchandise. This is one of the most of import fundamental for a company that establishes the fact that on which the company will stand. In instance of fabrication companies, the accent is ever will be on the natural stuffs that will make value of the merchandise. Inbound Logisticss:

This is all about the procedure of receiving, hive awaying and distribution of inputs internally. The purchaser and provider relationship is of import for cre3ating value concatenation for fabricating industries.

Operationss:

The fabrication procedure is used to transform the natural stuff to the finished goods. The procedure of transforming the merchandise is portion of operation procedure. Outbound Logisticss:

The outbound logistics is all about the bringing of the merchandises to the terminal clients. The clients get the merchandise from the market.

Selling and Gross saless:

The procedure includes carrying clients. The persuasion is the disputing occupation for the market section.

Swot:

| Strengths | Failings |

| 1. Good market portion | 1. The quality of the merchandises |

| 2. Turning Gross saless and Market portion | 2. No Vertical Integration |

| 3. Creation of New Value Chain | 3. Depending on the nutrient Merchandise |

| 4. Presence in Emerging markets | |

| Opportunities | Menaces |

| 1. New Marketing Strategy | 1. Competition |

| 2. Growth in Smartphone Market | 2. Strong Position of the Rivals |

| 3. Investing in New R & A ; D Division

4. New Market in Middle East and Africa |

|

BCG Model:

The categorization depends on market growing, market portion compared to big rivals. The categorizations indicated the addition in market portion increase the hard currency coevals. There is 2nd premise harmonizing to this matrix that the growing depends on the investing and the investing is related to ingestion of hard currency. The company is anticipating that the market for nutrient concern will turn to SR35 billion. The company is siting on normal growing rate. The state of affairs of the company can non be compared with Cash cattles.

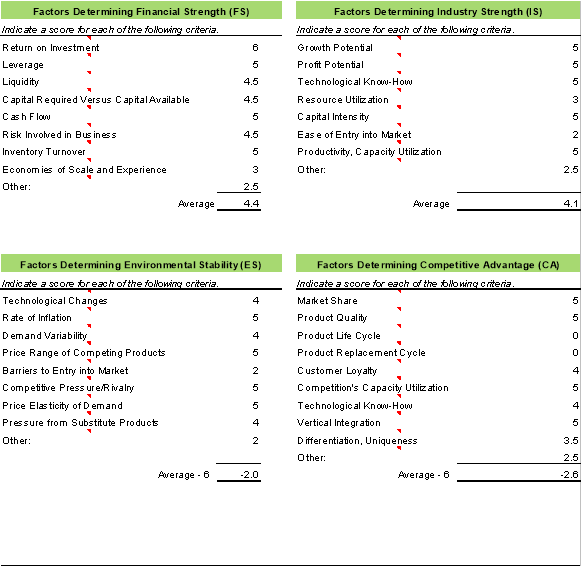

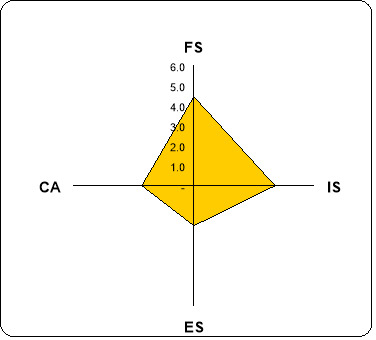

Space:

Mentions

- Bank, T. W. ( 2015, 04 28 ) .GDP growing ( one-year % ). Retrieved from hypertext transfer protocol: //data.worldbank.org/ : hypertext transfer protocol: //data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG

- dubaifaqs.com. ( 2015, 05 13 ) .List of GCC states and states. Retrieved from hypertext transfer protocol: //www.dubaifaqs.com/ : hypertext transfer protocol: //www.dubaifaqs.com/list-of-gcc-countries.php

- Formulas, F. ( 2015, 04 22 ) .Finance Formulas. Retrieved from Finance Formulas: hypertext transfer protocol: //www.financeformulas.net/Days-in-Inventory.html

- Group, S. ( 2015, 05 26 ) .About the Savola Group. Retrieved from hypertext transfer protocol: //www.savola.com/ : hypertext transfer protocol: //www.savola.com/SavolaE/About_The_Savola_Group.php

- Group, S. ( 2015, 05 26 ) .Mission. Retrieved from hypertext transfer protocol: //www.savola.com/ : hypertext transfer protocol: //www.savola.com/SavolaE/Mission.php

- Jain, K. & A ; . ( 2006 ) .Management Accounting ;hypertext transfer protocol: //books.google.co.in/books? id=Es37CPpEItwC & A ; pg=SA6-PA2 & A ; dq=ratio+analysis & A ; hl=en & A ; sa=X & A ; ei=lTDCVPHPGczj8AXtwoDwCg & A ; ved=0CDYQ6AEwAjgK # v=onepage & A ; q=ratio analysis & A ; f=false.New Delhi: Tata McGraw-Hill Education.

- LLC. , A. V. ( 2015, 05 26 ) .Vision & A ; Mission. Retrieved from hypertext transfer protocol: //www.advocuae.com: hypertext transfer protocol: //www.advocuae.com/aboutus/vision-mission/

- Stengel, D. N. ( 2011 ) .Managerial Economicss: Concepts and Principles ;hypertext transfer protocol: //books.google.co.in/books? id=ot7FFc2JUBYC & A ; dq=managerial+economics & A ; source=gbs_navlinks_s.New York: Business Expert Press.

- Tracy, A. ( 2012 ) .Ratio Analysis Fundamentalss: How 17 Financial Ratios Can Allow You to Analyse Any Business on the Planet ;hypertext transfer protocol: //books.google.co.in/books? id=GadRYnALi-oC & A ; printsec=frontcover & A ; dq=ratio+analysis & A ; hl=en & A ; sa=X & A ; ei=3y_CVORkjOjwBYLjgMgD & A ; ved=0CDUQ6AEwAg # v=onepage & A ;.London: RatioAnalysis.net.

- www.abudhabi.ae. ( 2015, 05 26 ) .Free Trade Agreements of the UAE. Retrieved from www.abudhabi.ae: hypertext transfer protocol: //www.abudhabi.ae/portal/public/en/business/international_trade/import_and_export/gen_info92? docName=ADEGP_DF_162968_EN & A ; _adf.ctrl-state=90sx1yk4x_4 & A ; _afrLoop=1471836418238393