Target Markets

Our brand ‘G.Love’ is dedicated to offering high-quality male condoms to the target group of urban youth (typically aged 18-35). We aim to meet the specific needs of this segment through our product offerings, packaging, and delivery channels. Unlike existing competitors, who continue to cater to this market in traditional ways without adapting to their changing sensibilities, we strive to fill this gap as a brand.

The typical condom user targeted by G.Love Condoms can be identified through various geographic, demographic, and behavioral factors. According to data from the National Health Survey (Gov. of India), there is a high level of awareness about condoms across different regions in India, except in remote forested areas [1]. Although no specific region is the focus, urban areas are emphasized due to the higher percentage of condom users compared to rural areas (14% vs. 6%), as indicated by NHS data. Additionally, urban users are more likely to purchase condoms at full price (39% of sales) compared to rural areas (13%), highlighting the significance of the urban market for G.Love Condoms.

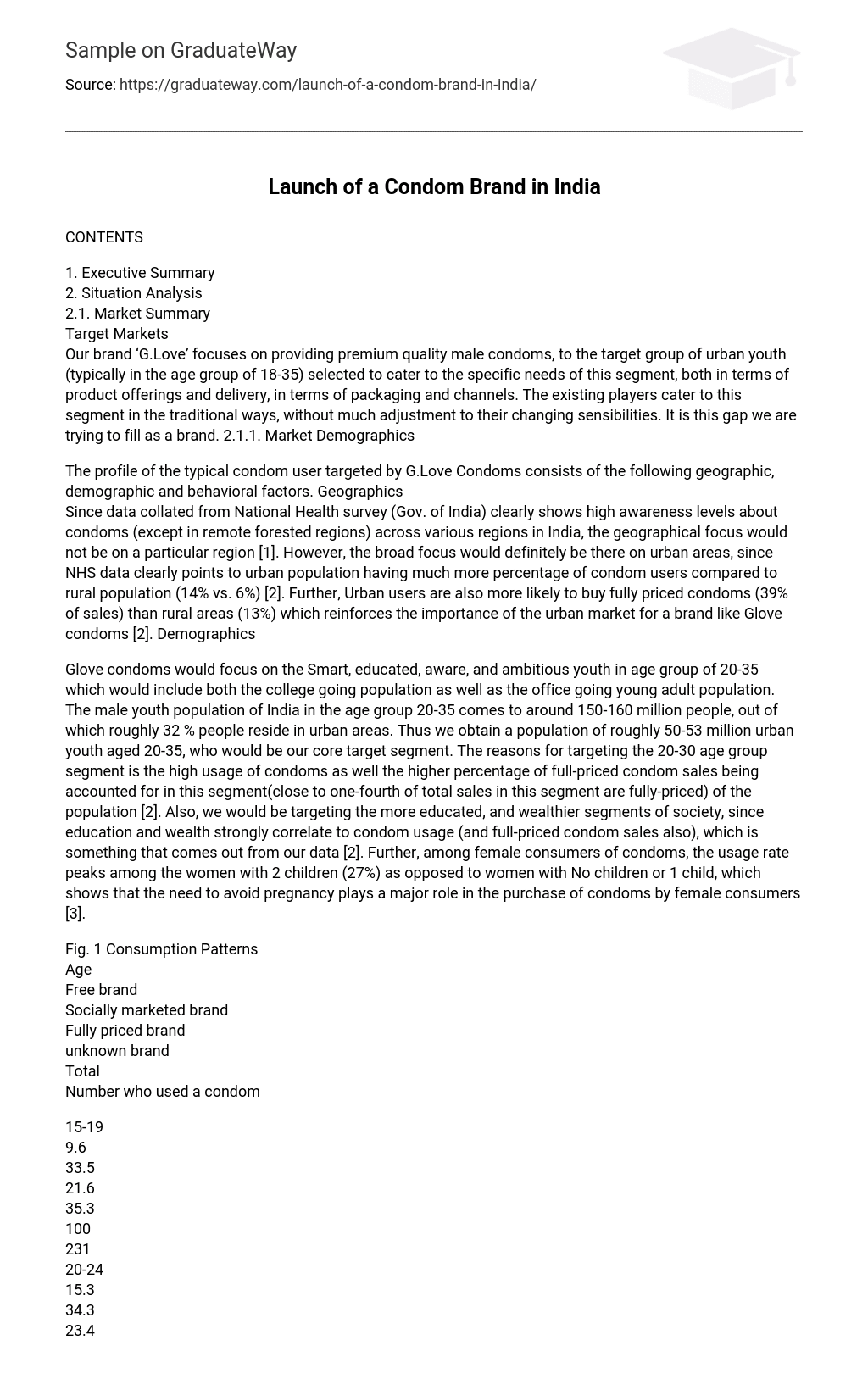

Glove condoms is specifically targeting the smart, educated, aware, and ambitious youth between the ages of 20 and 35. This demographic includes both college students and young professionals. In India, there are approximately 150-160 million males in this age group, with about 32% residing in urban areas. As a result, we have an estimated market size of around 50-53 million urban youth aged 20-35 who align with our target segment. The decision to focus on this age group is driven by their significant condom usage and the fact that nearly one-fourth of condom sales in this segment are sold at full price.

Our data indicates a strong correlation between education, wealth, and condom usage (including full-priced condom sales). Furthermore, we will specifically target the educated and wealthier demographics. It is worth noting that among women who use condoms, those with two children have the highest usage rate at 27%. This highlights the importance of preventing pregnancy in the purchasing choices of female consumers.

Condom use in the Indian market faces reservations and taboos. Despite government campaigns to address STDs and AIDS, the issue remains twofold: lack of awareness and low usage. Awareness about condom benefits and comparisons with alternatives is lacking. Reasons for low usage include feeling immune or not needing them in regular encounters, discomfort, and perception of limited pleasure. Additionally, purchasing condoms poses a challenge.

Consumers are not open about discussing their needs. Additionally, over 45% of consumers choose a brand based on advertisements they have seen. Moreover, consumers also prefer brands that offer discounts.

Our brand is aiming to address the major needs of the market:

- Safe sex and protection from STDs

- Birth Control

- Premium quality reliable condoms

Hassle-free purchase

The contraceptive market in India has seen significant growth for various reasons. One contributing factor is the increased awareness of contraceptives in the country. Moreover, the negative perception surrounding condoms has shifted, leading to changes in advertising strategies. Previously, government initiatives focused on creating awareness about family planning, whereas now, advertising has become more commercialized. According to M Ayyappan, CMD of HLL Lifecare, the private sector will drive most of the demand for pills and condoms. Additionally, the distribution channels for condoms are also changing, with a rising trend of online purchases.

According to Global Industry Analytics, the condoms market worldwide is expected to achieve sales volume of 27 billion units and generate revenue amounting to US$6 billion by 2015. The growth in this market can mainly be credited to emerging economies situated in Asia, the Middle East, and Africa. Countries like India and China are particularly experiencing a consistent rise in condom usage due to factors including their robust economies, heightened public awareness regarding the significance of condoms in preventing sexually transmitted diseases, as well as population growth.According to [7], there was an 8% increase in the commercial sector in 2012. The condom market in the Asia-Pacific region is anticipated to show significant growth in terms of value and volume. It is estimated that from 2007 to 2015, this market will experience a compound annual growth rate of over 6.0%. To tap into this expanding market and appeal to young individuals, MTV, a youth-focused channel, has partnered with JK Ansell to introduce MTV Hardwear as part of their brand expansion strategy.

SWOT Analysis

Positive attributes

- Negligible raw material cost due to already available rubber plantation Latest high precision machinery and testing facilities

- Emphasis on Image differentiation

- Differentiation through complementary customer services

Weaknesses

The market already has numerous manufacturers, making it difficult for a new entrant. Expensive machinery and testing facilities result in high capital investment. The industry faces challenges in achieving economies of scale, as mass production is necessary for profitability. Additionally, there is a threat of substitutes in this industry.

Opportunities

Huge potential in India due to increasing awareness about safe sex and demographic dividend. Additionally, expanding operations in other emerging markets.

Threats

The market share could be lost due to intense competition. The industry may experience a revolution and a threat from the entrance of new and innovative products such as unrolled condoms or spray-on condoms, which could affect the existing Latex condoms.

Competition is the competition.

Our competition includes all companies that offer contraceptive measures such as male and female condoms, birth control pills, and intrauterine devices. For our specific target segment, Durex, Kamasutra, Skore, and Moods are our direct competition. We conduct a competitor analysis to assess their value propositions.

Durex

- Target Segment: Youth; Age: 16-25 Positioning: Category experts and thought leaders; Branding as products for ‘Sexual wellbeing’; Appeal to the emotional aspects rather than the functional aspects of their offerings.

- Target Segment: Youth; Age: 18-35; Positioning: Bold and edgy advertising that redefined condom marketing in India. Very Sensual. Focus on pleasure, with taglines like ‘for the pleasure of making love’, ‘what do you want to be tonight?’

- Target Segment: Youth; Age: 18-25; Positioning: Focus on youth and naughtiness, with tagline like ‘good news for bad boys’ and ‘a lot to be won’. Aggressive marketing strategy that ensured rapid growth.

- Target segment: Youth; 18-35; Positioning: Market leader with various sister brands including successful ones like Moods and Kohinoor; Focusses on presenting the picture of a happy young couple. Also focuses on emotional and fun aspects rather than sensual ones.

The Birth Pill, an emergency female contraceptive available over the counter, is experiencing a growth rate of 25-30%. This small device, typically ‘T’-shaped, is a long-acting reversible contraception that is highly effective in preventing pregnancy. Despite its efficacy, it only occupies a small portion of the contraceptive market.

Product Offering

Our portfolio is continuously adapting to meet our customers’ evolving needs. We recognize their constant search for new choices, which is why our portfolio includes a wide variety of both traditional and cutting-edge products. Each product in our portfolio is known for its outstanding quality.

- We are offering traditional Flavored, colored and dotted condom to serve our customers. Our offerings include three flavors-Chocolate, Strawberry and banana flavors based on customer requirements.

- Marathon condoms-They have a layer of a topical anesthetic on the inside which will increase duration and pleasure.

- Ultrathin condoms- These are very thin and reliable condoms which will increase the sensitivity and will offer natural sensation.

- Double lubrication condom-This is our unique offering which is not easily available in the market. We are maintaining parity by offering traditional products and differentiating ourselves with Double lubrication condom.

- We will be offering specialized packages for special occasions like Valentine’s Day. Customer will have choice of customizing product and will themselves choose the bucket of products they want. Attractive packaging will add to the value of the occasion.

India’s contraceptives industry has significant market potential. After evaluating both the past successes and failures in this field and considering future needs, we have identified the main factors for success in this industry, which includes offering a wide range of products.

It is important to continually search for fresh approaches to engage with consumers, including utilizing modern tools like social media. It is also crucial to employ the latest technologies that can enhance the customer experience and distinguish the product. In addition, appealing to women and encouraging their partners to use Glove condoms is necessary. Keeping raw material costs low, specifically latex, is vital for protecting profitability. Constant innovation in product offerings and marketing strategy is essential. Providing satisfactory returns to retailers ensures their promotion of Glove condoms over competing brands. 2.6. The key problems are:

Condom marketing in conservative societies like India is greatly restricted by social norms, requiring messages to stay within certain boundaries. The industry also faces increasing competition with the entry of new players. There is a prevailing pessimism regarding the effectiveness of condoms, with people often questioning the need for protection. However, efforts are being made to reduce the embarrassment felt by both buyers and sellers when purchasing condoms.

Marketing Strategy

The goal is to establish a brand that is known for its high quality and dependability, while also embodying a smart attitude.

- To design a marketing strategy and a brand image of ‘Being Smart & Being Responsible’, which is the mantra of this generation, and be perceived as a Cool brand. To deliver value to customer by proper packaging

- To gain a market share of 8% in 5 years.

There are several age groups that can be categorized as condom users:

Among individuals aged 15-19, there are high school and college students. Within this group, 22% of sexually active males utilize condoms. This statistic can be explained by the education on sexual health and awareness provided to teenagers through schools and various media outlets.

The segment of individuals aged 20-24 includes senior college students and recently employed. Among sexually active men in this group, 12% use condoms. While the percentage of condom users is lower in this segment, it still presents a lucrative opportunity due to its large size. The market scenario in India is rapidly changing, influenced by shifting attitudes towards sex and western culture. However, existing brands have not made sufficient adjustments in terms of approach and offerings to cater to this segment. This is the gap our brand aims to fill by providing quality products and promoting the concept of “Quality of experience” as a factor in product selection. For the younger generation, our brand also appeals through clean design and packaging, with a touch of wit and fun, aligning with the image we aim to establish.

Even though many brands target the same demographic, most of them focus on sensuality as their main theme. Before the 1990s, condoms were primarily marketed as a safe sex and birth control tool through mundane advertisements. However, in the 90s, KamaSutra took a more sensual approach to positioning and establishing their brand image, which then became the norm. As culture and globalization have evolved, customer preferences have also changed.

Despite minimal changes in customer approach, sensuality remains the central theme in most condom advertisements. However, there are alternative ways to approach this market. Customers seek a brand that comprehends their sensibilities and creates products to fulfill their needs, rather than promoting them as tools for seduction in inappropriate settings.

Moving away from the norm, our brand aims to appeal to consumers who value intelligence and appreciate high-quality products. We understand our target consumer’s sensibilities and strive to connect with them on an intellectual level. Rather than focusing on educating users about AIDS and birth control, we assume they are already aware of those aspects. Instead, we attract the attention of female partners by encouraging them to “be smart” and use condoms for birth control instead of pills, due to the obvious complications associated with the latter. Our guarantee is a premium product packaged in a clean and clutter-free manner.

Differentiation

For College Youth

When it comes to the age group in India that typically starts using condoms, pricing and perceived quality play a crucial role. These individuals prioritize product quality over price. Therefore, our strategy is focused on positioning our brand as a provider of top-notch products. We also align our prices with this perception of high quality, taking advantage of the strong link between perceived quality and pricing.

We are proud to present ourselves as a leading ‘Smart’ brand, which is evident in our exceptional design and packaging. Initially, we analyzed the shortcomings of existing packaging designs. For packs containing 10 items, the conventional approach involves a box that can be torn open or opened from the top. These packs are typically intended for use over a week or more. Therefore, we created our packaging with this in consideration and opted for a user-friendly design reminiscent of a matchbox. Our brand and packaging exhibit an elegant and striking design philosophy based on simplicity.

For the first time in India, our website is offering customization. We have included a range of designs for customers to choose from and personalize their own covers. Moreover, we have introduced a feature that enables customers to design their own condom covers. Initially, the usage of this feature may be low due to the current market conditions. Nevertheless, considering the long-term outlook, this feature becomes a noteworthy differentiating factor. With the rise in online presence and people’s inclination towards exploring new options, providing a platform for them to customize their purchases allows for a more personalized experience.

The advertising emphasizes the brand as being both cool and smart, which helps customers connect with the brand and build its image. This feature also increases on-site time and boosts online sales at a low cost compared to customized products. An e-commerce site, sayitwithacondom.com, has implemented a similar approach for condoms by offering customized packaging. This strategy led to massive success, with shipments to 62 countries and over 1,000 retail stores selling their product.

For young working individual (In a relationship)

The “Be Smart” Campaign acknowledges the significant role partners play in the decision-making process when purchasing condoms. This campaign directly addresses issues related to women and contraceptive usage, promoting condoms as a more effective contraceptive measure compared to alternatives like the morning pill. Throughout the campaign, we prioritize brand identification to establish a strong brand attachment with women.

Strategies

Our company is known for creating high-quality products that cater to customer needs and are presented in a clever and minimalist design. To achieve this, we carefully select our product range based on the demands of the consumer market. Additionally, our branding strategy focuses on every aspect of our brand, from selecting the right brand name to packaging and messaging in advertisements, all aimed at delivering our message in an intelligent manner.

Before the product launch, we will initiate a nationwide campaign to establish a strong foundation for the brand. We will begin creating a brand image among young people through the ‘My Glove’ Campaign, specifically targeting college students. The campaign will revolve around the message ‘Celebrate your first love’ and feature custom designs. Additionally, we will organize college workshops in six cities: Delhi, Mumbai, Bangalore, Hyderabad, Chandigarh, and Kolkata. During these workshops, we will select campus ambassadors referred to as Mr. Smart or Ms. Smart. These ambassadors will be encouraged to promote safe sex within their colleges. Throughout the year, we will coordinate with these ambassadors for various activities.

‘Be Smart’ campaign is targeted towards addressing the issues faced by female partners due to the consequences of not using condoms. It urges individuals to make smart choices and emphasizes the significance of doing so in crucial scenarios. The advertising series creatively and humorously conveys this message. The objective of these campaigns is to establish a strong brand image among the specific target segments and create a perceived value among the target audience.