This instance survey will execute ratio analysis on Xerox fiscal statements, highlight hearers ‘ duty for observing fraud and mistakes, place factors present at Xerox that were declarative of frauds being, and how could accounting houses guarantee that hearers do non subordinate their judgements to client penchants on other audit battle, and in conclusion bespeaking how fiscal statements were affected, because of accounting use.

Introduction: –

This instance survey is about Xerox corp. who misstated their fiscal statements utilizing illicit accounting methods. Harmonizing to CNN money, Xerox between the periods of 1997-2000, accelerated their rental acknowledgment gross by more than $ 3 billion and increased its pre-tax net incomes by about $ 1.5 billion. This instance besides focuses on how KPMG, Xerox ‘s outside hearer, permitted Xerox to pull strings its accounting patterns and besides failed to exert due attention, deficiency of professional agnosticism and adhere to GAAP.

( a ) How are Xerox ‘s and Hewlett Packard ‘s concern similar and dissimilar?

Xerox Corporation is one of the planetary trade name companies, which is selling and fabricating different scopes of coloring material pressmans and photocopies, every bit good as supplying related consulting services and supplies to their clients. Major rival of Xerox Corporation is Hewlett Packard Company ( HP ) , which provides similar merchandise lines and concern strategic as Xerox Corporation. The different between Xerox Corporation and HP is that HP provides merchandises such as computing machine, scanners, digital cameras, reckoners, PDAs and other. However, Xerox is merely concentrating on digital production printing

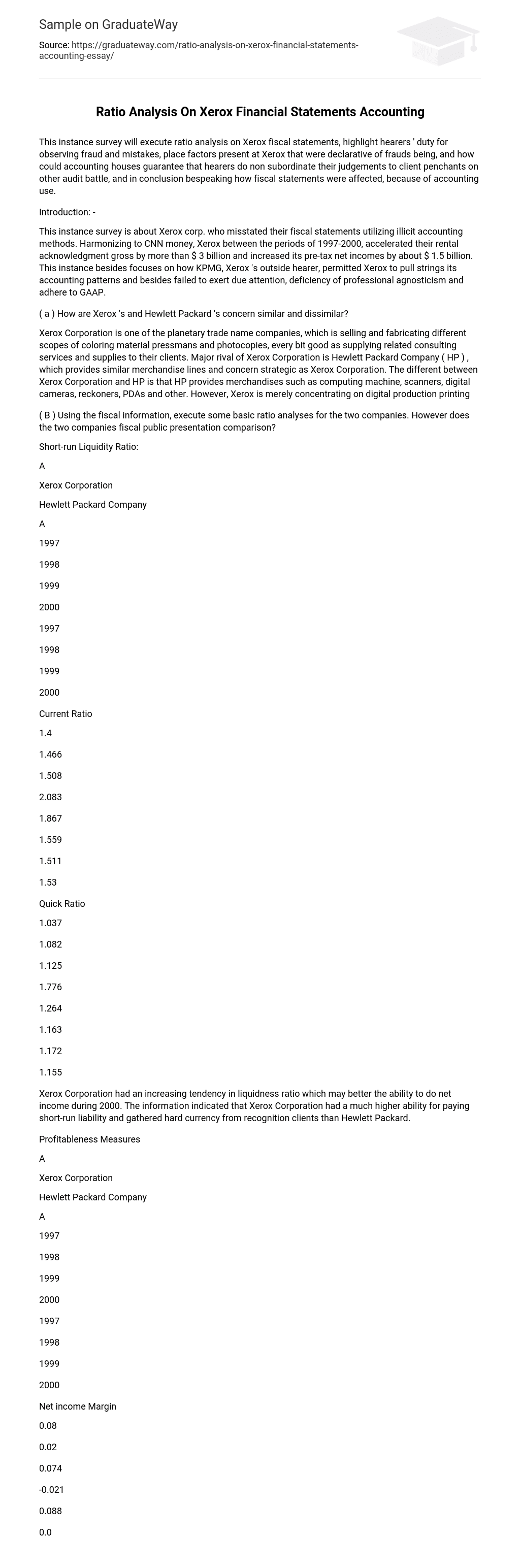

( B ) Using the fiscal information, execute some basic ratio analyses for the two companies. However does the two companies fiscal public presentation comparison?

Short-run Liquidity Ratio:

A

Xerox Corporation

Hewlett Packard Company

A

1997

1998

1999

2000

1997

1998

1999

2000

Current Ratio

1.4

1.466

1.508

2.083

1.867

1.559

1.511

1.53

Quick Ratio

1.037

1.082

1.125

1.776

1.264

1.163

1.172

1.155

Xerox Corporation had an increasing tendency in liquidness ratio which may better the ability to do net income during 2000. The information indicated that Xerox Corporation had a much higher ability for paying short-run liability and gathered hard currency from recognition clients than Hewlett Packard.

Profitableness Measures

A

Xerox Corporation

Hewlett Packard Company

A

1997

1998

1999

2000

1997

1998

1999

2000

Net income Margin

0.08

0.02

0.074

-0.021

0.088

0.075

0.082

0.076

Roe

0.291

0.081

0.29

-0.106

0.193

0.17

0.19

0.26

ROA

0.052

0.013

0.049

-0.013

0.107

0.093

0.099

0.108

Net income border

Both Xerox Corporation and Hewlett Packard Company experienced an obvious lessening in footings of cyberspace gross revenues which brings major net income to concern. However, Hewlett Packard had more power to maintain higher gaining per dollars of gross revenues than Xerox Corporation.

Return of Equity ( ROE )

The tendency of Xerox Corporation while negative has non ensured the figure has dropped to an unsatisfactory degree. It does demo, nevertheless, that the return to stockholder is less in 2000 than that in 1997. Xerox Corporation ‘s ROE was lower than Hewlett Packard Company ‘s ROE which indicated that the former has collected much more money than the later from stockholder.

Tax return of Assetss ( ROA )

There had been dramatic addition and lessenings in the ability of both Xerox Corporation and Hewlett Packard Company. The ratio of Hewlett Packard Company indicated that its assets could be used more expeditiously to gain net income, and its stockholders could gain more from their investing.

Fiscal Leverage Ratio:

A

Xerox Corporation

Hewlett Packard Company

A

1997

1998

1999

2000

1997

1998

1999

2000

D/E Ratio

3.74

4.278

4.027

5.752

0.088

0.075

0.082

0.076

Debt Ratio

0.767

0.79

0.78

0.829

0.193

0.17

0.19

0.26

Debt/Equity Ratio

Xerox Corporation has been aggressive in financing its growing with debt during 1997-2000. This could ensue in fluctuating net incomes as a consequence of the extra involvement disbursal. However, Hewlett Packard Company had got a stable tendency in fiscal purchase ratio, which may bespeak that the company has a stronger fiscal involvement in the concern than Xerox Corporation.

Debt Ratio

There is a lifting debt ratio of both of the companies during 1997-2000. However, Xerox Corporation still had a higher debt ratio of 0.829 in 2000, which illustrates that Xerox Corporation is more likely confront tenseness on paying involvement and their long-run debt. In add-on, because debt ratio increased more rapidly in Hewlett Packard Company so it decreased in Xerox Corporation, it is possible that Hewlett Packard Company have a higher concern ‘s duties in the hereafter.

Capital Turnover Ratios:

A

Xerox Corporation

Hewlett Packard Company

A

1997

1998

1999

2000

1997

1998

1999

2000

Assetss Liquidity

0.388

0.416

0.416

0.441

0.66

0.584

0.613

0.683

Gross saless to Assetss

0.654

0.648

0.667

0.628

1.117

1.243

1.2

1.437

Net Worth Gross saless

0.356

0.324

0.33

0.273

0.456

0.429

0.432

0.291

There is a growing in assets liquidness and gross revenues to assets ratios in both companies. And this means both companies use its shareholders ‘ equity to bring forth gross better from 1997 to 2000. Merely, less in assets liquidness ratio, Xerox Corporation does non needfully bespeak it had worse public presentation than Hewlett Packard Company.

Question 2

( a ) What duty does an hearer have to observe material misstatements due to mistakes and fraud?

Hearers spend a great part of their clip planning and executing scrutinizing to observe the unwilled errors made by direction and employees in fiscal studies. ( Arens, Best, Shailer, Fiedler, Elder and Beasley. 2010 ) . Hearers detect mistakes because of such things as errors in computation, skips, misconstruing and misapplication of accounting criterions, and wrong summarizations and descriptions.

The auditing criterions recognise that it is more hard to observe fraud and mistakes because direction, or the employees commiting the fraud, effort to hide the fraud. ( Arens, Best, Shailer, Fiedler, Elder and Beasley. 2010 ) one of import thing to measure fraud is to maintain in head fraud has two features: the force per unit area and inducement to acquire a coveted fiscal addition, and the sensed chance to perpetrate the fraud.

( B ) What two chief classs of fraud affect fiscal coverage?

Deceitful fiscal coverage

This is an knowing misstatement or skip of sums with the purpose to deceive users. The fraud involves direction ‘s deliberate actions to run into gaining aims and switching gross and disbursals to cut down fluctuations. Companies frequently overstate net income and assets or omit liabilities and disbursals or they intentionally understate net income in an effort to cut down net income revenue enhancements.

Embezzlement of assets

This is larceny of an entity ‘s assets affecting employees and others internal to the administration. The embezzlement of assets is by and large perpetrated at lower degree of the administration hierarchy. Sometimes, top direction in involved in the larceny because of its greater authorization and control over organisation assets.

( degree Celsius ) What types of factors should hearers see when measuring the likeliness of stuff misstatements due to fraud?

Incentives/pressure, chances and attitudes are three conditions of fraud ( Arens, Best, Shailer, Fiedler, Elder and Beasley. 2010 ) . In measuring the fraud hazards, hearers should skeptically see the followers:

Information the hearers obtained through communicating about their cognition of the company and its industry.

Inquires of direction about their position of the hazard of fraud and about bing plans and controls to turn to specific fraud hazards.

Specific hazard factors, such as inducements or force per unit areas to commit fraud, chance to transport out fraud or attitudes used to warrant a deceitful action.

Analytic processs consequences obtained during planning

Information gained from other processs every bit good as corporate administration and other control factors.

Which factors existed during the 1997 though 2000 audits of Xerox that created an environment conducive for fraud?

Xerox ‘s action to speed up the rental gross acknowledgment. For illustration, it allocates a bigger part of the lease payment to the equipment alternatively of service or funding activity or sporadically change the premises used to cipher the return on equity.

Xerox elects to acknowledge the gross from lease monetary value instantly alternatively of acknowledging the gross over the life of the rentals.

Xerox write-up the residuary value of some leased equipments.

Xerox switched from sales-type rental understandings to rental contracts, and there is no revelation of the alteration.

Xerox established an acquisition modesty for unknown concern hazards and recorded unrelated disbursals to the modesty accounting.

The involvement income acknowledgment had been implemented since 1997, but had non been done for the old old ages.

Question 3

Identify factors present at Xerox that are declarative of each of the three fraud conditions: Incentives, Opportunities, and attitudes.

Incentives/ Pressure: –

A common motive for companies to pull strings fiscal studies is a diminution in the company ‘s fiscal chances. As Xerox corp. was confronting a market which was turning strongly and transitioning quickly to digital engineerings that created force per unit area on the company to rapidly react to these new alterations. In 1990 ‘s, companies were confronting force per unit areas from investors that whichever failed to run into the estimated net incomes by even a little sum will confront important diminution in stock pricing.

Xerox corp. succumbed to the force per unit areas of Wall Street and competitory market by following several accounting uses like acceleration of rental gross acknowledgment, cooky jar contraries and Non Generally accepted accounting patterns ( GAAP ) , to blow up net incomes from 1997 to 1999. From 1997, Xerox corp. was undergoing few alterations which were taking longer to demo profitable growing gross, better stockholder value and cut down costs than what Xerox has expected, motivated to execute accounting abnormalities. Besides, inducements available for public presentation and net incomes tempted senior direction to execute accounting patterns that will blow up net incomes and in return, they will have large inducements.

Opportunities: –

Fortunes provide chances for direction or employees to perpetrate fraud. Through its activities, direction provides clear signals to employees about the importance of internal control. Xerox reflected weak internal control due to accounting use activities and direction had the ability to overrule the control, because of these grounds perpetrating fraud was executable in Xerox.

Xerox direction used to apportion a greater part of the lease payment of bundled rental to equipment in foreign states because foreign direction were obliged to describe same gross border as in United States. This state of affairs created fortunes and because direction had the ability to overrule the control, that provided chances for direction to perpetrate fraud.

Xerox has been writing-up the residuary value of antecedently recorded leased equipment which reflected a lessening in the cost of gross revenues in the period the residuary value was increased. This accounting process violated criterions under GAAP. This use took topographic point because of weak internal control in Xerox.

Rationalism: –

The direction is in the environment that imposes sufficient force per unit area that causes them to rationalize perpetrating a dishonest act. Rational behavior was seen in Xerox Mexico operation who was confronting troubles in accomplishing fiscal marks set by corporate central office. This pressurised environment stimulated rational behavior on determinations like non decently unwraping policies and besides some unusual leasing patterns which inflated net incomes of Xerox Mexico for short footings.

Management ‘s unity and ethical values are of import considerations in internal controls. Xerox has shown accounting abnormalities by speed uping lease gross from lease monetary value additions and extensions which did non follow with GAAP. Xerox besides failed to unwrap the alteration in concern attack in Brazil where they switched to rental contracts from sale-type understandings. This approaches in concern shows that Xerox direction was itself engaged in unethical activities which affected direction ‘s unity and promoted unethical sets of values and rationalism in doing determinations.

Question 4

Which of the questionable accounting uses used by Xerox involved estimations?

Harmonizing to AU 342, Estimates are based on the subjective every bit good as nonsubjective and as a consequence, opinion is required to gauge an sum at the day of the month of the fiscal statement.

Xerox accelerated lease gross acknowledgment from bundled rental is one of the two estimations used by direction. The questionable patterns involve appraisal of higher part of lease payment to equipment despite of bundled rental. By apportioning in this mode, Xerox was able to recognize greater gross instantly for the instead so, postponing gross over the term of the rental which complies with GAAP. Harmonizing to GAAP, in a bundled rental which includes equipment, services, supplies and funding, Xerox should hold allocated appropriate part of gross for non equipment gross that means, postponing gross over the term of the rental. Xerox justified their appraisal about apportioning less gross for finance, stating that finance operation should accomplish about 15 % return on equity ( ROE ) and besides changed the premises to cipher lease involvement rate that would bring forth a 15 per centum ROE, as a consequence increasing gross for current fiscal period. The rational behavior was experienced in doing appraisal because direction ‘s opinion and premises were taken in a colored manner for a ground that hereafter gross could be adjusted over the period and besides, the force per unit areas and inducements motivated direction in Xerox to move in a colored manner.

Another accounting appraisal used by Xerox was increasing the residuary values of chartered equipment. Xerox used appraisal in increasing the residuary value of the antecedently recorded rental equipment. Because of this type of appraisal which decreases cost of gross revenues for the current period, and increases the residuary value, therefore increases net income for the current period. GAAP under FAS 13 amended by FAS 23 prohibits upward accommodation of estimated residuary values after lease beginning.

( B ) Based on AU342, Auditing Accounting Estimates, describe the hearer ‘s duties for analyzing management-generated estimations?

AU 342 Auditing accounting estimations states that, the hearer should place the rationality of accounting estimations made by direction in the relation of the fiscal statements. As estimations are based on subjective every bit good as nonsubjective factors, the hearers should find direction ‘s internal control. Auditor should besides see direction ‘s making, competence and accomplishments in doing appraisal. Auditor is required to reexamine anterior twelvemonth ‘s fiscal statement to observe any alterations in the direction ‘s opinion and premises that might reflect a bias position. The hearer should see, during planning and acting processs which will measure accounting estimations, with an attitude of professional agnosticism, both the subjective and nonsubjective factors.

Question 5

How could accounting houses guarantee that hearers do non subordinate their opinions to client penchants on other audit battles?

First of all we should detect that all the actions from KPMG are abnormalities. Because it against several hearer aims and duties. From ASA 200 requires “ that an audit should to supply sensible confidence of observing stuff misstatements in the fiscal study originating from fraud or mistake. ” ( Arens, Best, Shailer, Fiedler, Elder and Beasley. 2010 ) And the primary aim of the audit is to show an sentiment on the fiscal statements. Auditor should unwrap or declaring any damage to independence or objectivity that may be. Which KPMG forces questioned the appropriateness uses but they did non carry direction to alter accounting patterns. Hearers must avoid doing deceptive or false statements that tend to wound or discredit the audited company ‘s repute. To avoidance all those impropriety error, the hearer should work independency and take duties. Auditor independency is hearer ‘s ain judgement to scrutinize the finance study without other influences, no affair exterior or interior. Auditor ‘s independency is most radical and of import to the finance study. If hearer did n’t make their work independency, their study information may non be believable, and besides the finance information will rip off to the stockholder and clients, eventually it will acquire loss. To avoid this happen, hearers should make their work independent in both fact and visual aspect. However, there is many facts influence hearer ‘s independency judgement.

First of all is imperativeness. For illustration, KPMG found Xerox have some accounting job, and alter several of Xerox ‘s accounting patterns. But Xerox ‘s senior direction told the house that they wanted a new battle spouse assigned to their history. Under this imperativeness, KPMG allowed Xerox to go on utilizing those questionable patterns and did n’t observe those actions. To avoid this imperativeness job, KPMG should describe those questionable patterns to the higher up director or stockholders. Because they consider the long net income, and they will give audit an independency environment.

Second is fraud, Xerox have many inappropriate finance uses like Xerox acquisition modesty for unknown concern hazard and recoded unrelated concern disbursals to the modesty history to blow up net incomes. Therefore do a great chance to take the money from Xerox, even the hearer. To avoid fraud, hearer ‘s must be believable and his independency must be based on an nonsubjective and disinterested appraisal of the fiscal statements. . On the other manus, Frank claimed that “ Auditor independency helps to guarantee quality audits and contributes to fiscal statement users ‘ trust on the fiscal coverage procedure. An hearer who is independent in fact has the ability to do independent audit determinations even if there is a sensed deficiency of independency or if the hearer is placed in a potentially conciliatory place. “ ( 2007 )

Question 6

( a ) For each accounting use identified, indicate fiscal statement histories affected.

( B ) For each accounting use identified, indicate one audit process the hearer could hold used to measure the rightness of the pattern.

The first questionable accounting use is acceleration of rental gross acknowledgment from bundled rentals. This use will impact grosss account, because Xerox accelerated the rental gross acknowledgment by apportioning a higher part of the lease payment to the equipment alternatively of the service or funding activity. By reapportioning grosss from the finance and service activity to the equipment, Xerox was able to recognize greater grosss in the current coverage period alternatively of postponing gross to the hereafter periods. There are two audit processs that can accommodate for this environment. First utilizing internal process, recalculation: look intoing the mathematical truth of paperss or records. Second utilizing external process, verification: the procedure of obtaining a representation from a 3rd party.

Another questionable accounting uses performed by Xerox were acceleration of rental gross from lease monetary value addition & A ; extensions, addition in the residuary values of leased equipment and acceleration of grosss from portfolio plus scheme minutess. All these three use will increase gross history and income statement. The consequence of these determinations taken by Xerox will gain gross in short term, but it will give the long term net income. To protect company long term net income, hearer should detect all the procedures and processs that are performed. On the other manus hearer should re-performance ; it means the hearer ‘s should look into the processs antecedently performed by entity staff.

For questionable use of militias. This use will impact equity history. Because Xerox established an acquisition modesty for unknown concern hazard and unrelated concern to the modesty history to blow up earning. It means Xerox put money in equity history to forestall possible hazard, but it unrelated to disbursals. It easy causes fraud. Hearer can utilize observation process, to looking at procedures and processs being performed or utilize inquiry process, to seeking information from knowing individuals.

For questionable use of other income. This use will impact cost and disbursals account. Because Xerox elect to acknowledge most of the involvement income during period old ages. The cost and disbursals account will cut down in period old ages, and meanwhile do that twelvemonth ‘s study expression better. To appropriateness of this pattern, audit should utilize analytical process. Compare the day of the month with similar prior-period day of the month, to maintain the study justness.

For questionable failure to unwrap factoring minutess. This use will impact grosss account and plus history. From stuff, we can cognize Xerox sold future hard currency from receivable history to local Bankss for immediate hard currency. It made Xerox have a strong hard currency place in the present twelvemonth, like the grosss account will increase, on the other manus sold receivables to bank must take some lost. The plus history must diminish. It besides easy cost fraud. Audited accounts can utilize review of touchable assets and analytical processs. Inspection of touchable assets can happen out the entire plus addition or lessening. Xerox company failure to unwrap factoring dealing should enter in one-year study, so use analytical process will unwrap this job.