Infinity Bank – Retail Branchs and Customer Profitability

Introduction

Customer profitableness analysis is the analysis of grosss and costs related to specific clients, which provides utile information to better strategic determination devising in concern ( CIMA, 2009 ) . Specifically for banking industry, assorted challenges have been raised in recent old ages such as increased regulative restraints, shriveling border and less client trueness ( Stratecast,2013 ) . To prolong long-run profitableness, Bankss conduct client profitableness analysis to understand client behavior, and invent schemes to better profitableness by maximising value of profitable clients and cut downing or halting losingss from unprofitable clients. New information engineering has been utilised by Bankss to develop package, databases and client profitableness theoretical account ( ICAEW,2002 ) .

The study will foremost analyze application of client profitableness analysis in banking industry, and so present context of the instance, which will be followed by elaborate analysis and decision.

Literature reappraisal

In banking industry, client profitableness analytics system is established to analyse client informations. The system by and large involves three facets: profitableness computation, prognostic analytics which derives client behavior theoretical account and concern intelligence which delivers studies for determination devising in specific concern line ( Stratecast,2013 ) .

As for Bankss ‘ practical attack in client analysis, the first phase is to consolidate client information in database. Customer information consists of demographical information, merchandise information including history balance and merchandise retentions, and interaction information such as channel activity and service petitions ( IBM,2011 ) .

The following measure is to apportion grosss and costs to clients. Gross for each client is available in bank ‘s database. Activity-based costing is implemented, assorted activities and cost drivers are identified, and so costs are assigned to specific clients. For case, client enquires cost is measured by figure of telephone proceedingss ( ICAEW,2002 ) .

After profitableness computation, Bankss classify clients into different sections to separate which clients are most profitable and which clients bring loss to bank ( Hughes,2010 ) . Typically top sections of clients generate bulk of entire net incomes.

Harmonizing to cleavage, Bankss will develop schemes to maximise net incomes of profitable clients such as establishing client keeping plans to advance cross merchandising, and exchange unprofitable clients to profitable 1s, for illustration, charge extra fees and promote less dearly-won cyberspace banking.

Case Context

As one of the largest Bankss in the UK, the eternity bank had more than 1,800 subdivisions which were regarded as the bosom of the bank. 70 % clients were recruited and most costs were driven in subdivisions.

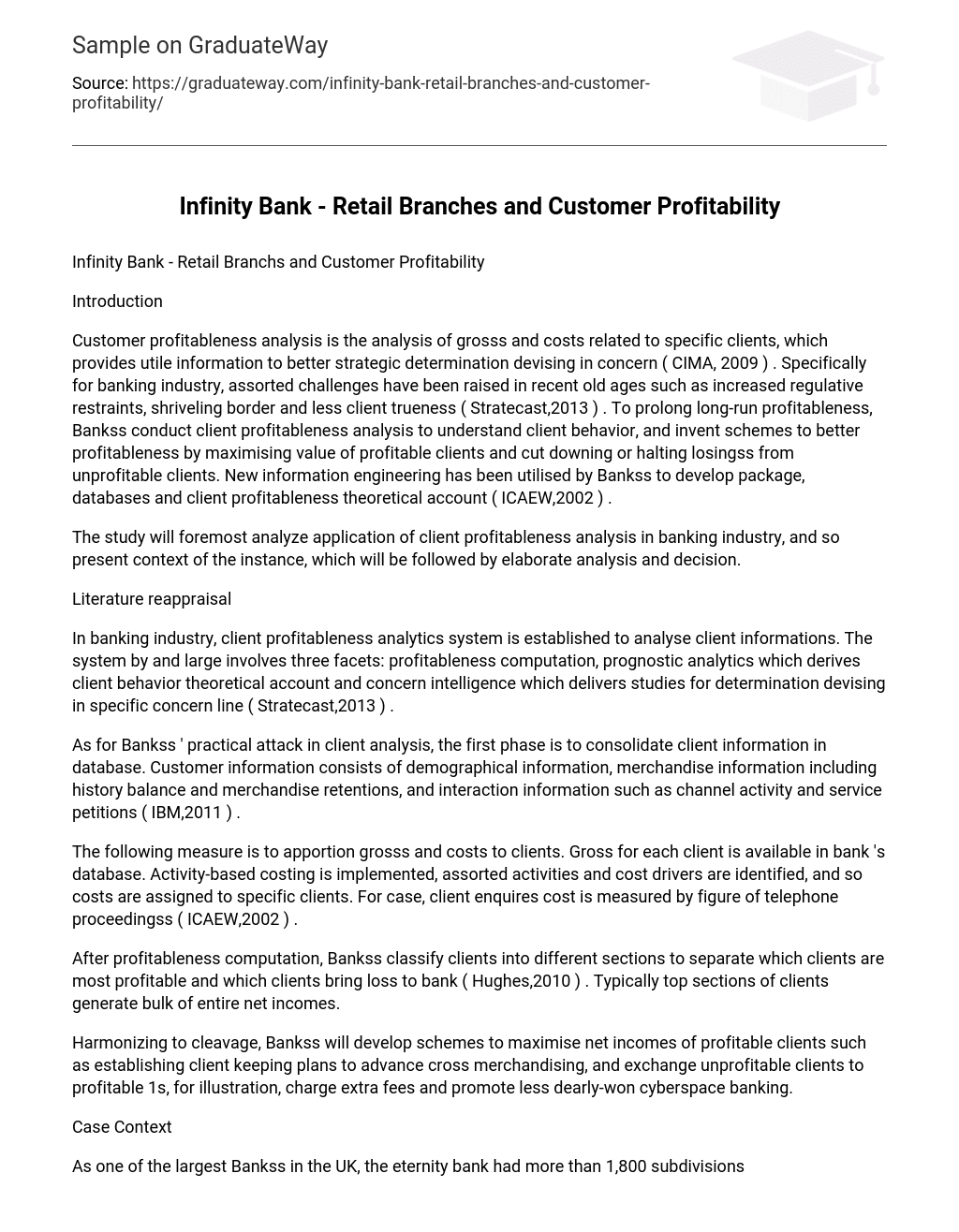

From 1980 to 2003, there were three major alterations in retail banking industry: deregulating, subdivision options and new engineering. Regulatory alterations made market entry easier, telephone and internet-based channels were created to replace subdivisions. Furthermore, new engineerings allowed decrease in head count. However, the eternity bank did non cover with these alterations successfully, it had lower profitableness compared with rivals, and net income declined from 1998 to 2003 ( Appendix I ) , intending the subdivision web underperformed and failed in accomplishing high profitableness.

A “ supermarket ” scheme was proposed to better its public presentation. Branchs were viewed as one-stop stores selling fiscal services. Each subdivision was responsible for ain profitableness, and directors took charge of ain net income and loss. Wagess would be given based on merchandise profitableness.

The analysis will be conducted to happen out whether the product-based supermarket scheme makes sense, and how client profitableness analysis helps the bank develop schemes.

Analysis

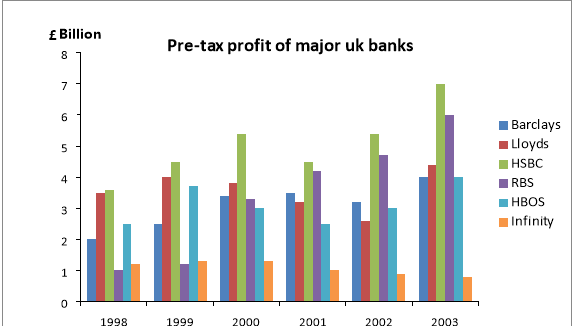

For the eternity bank, there are three chief merchandises: current histories, recognition cards, and mortgages. Product profitableness from 1999 to 2003 has been analyzed ( Appendix II ) , the consequence indicates that current history is unprofitable due to big service costs such as service calls and check processing fees. Credit card is more profitable and mortgages generate the largest net income per history. However, this merchandise study merely focuses on merchandise gross revenues, disregarding client cross-holding state of affairss. Besides, it can non explicate fluctuations among clients, and big proportion of fixed costs are hard to be allocated to single merchandise.

To better the survey, client profitableness analysis is conducted based on different sample sizes with grosss and activity-based costs given.

First, 1000 clients are sampled for each class of merchandise cross-holdings ( Appendix III ) . Customers with multiple merchandises are more profitable. Customers keeping all three merchandises have the highest degree of profitableness ( Appendix IV ) , therefore the bank should advance cross-selling of merchandises. Furthermore, mortgages generate high profitableness, and current history is unprofitable, the bank can cut down service costs by go throughing some costs to clients. The analysis of mean net income per client for each merchandise besides proves that multiple merchandises keeping makes each merchandise generate higher mean net income ( Appendix V ) .

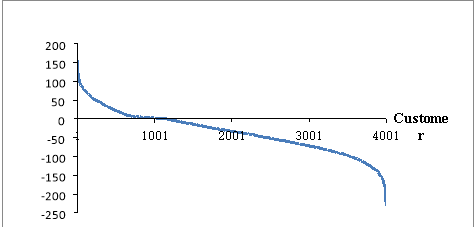

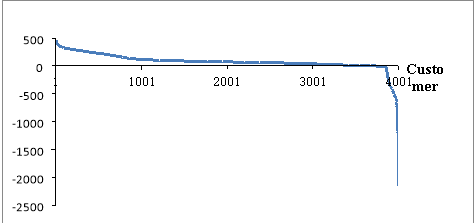

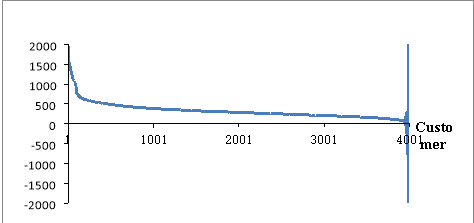

Furthermore, 4000 clients are sampled for each merchandise and ranked from most to least profitable clients, therefore fluctuation among clients can be identified in each merchandise. Overall 72 % clients with current history are unprofitable. Majority of mortgage and recognition card clients are profitable ( Appendix VI ) .

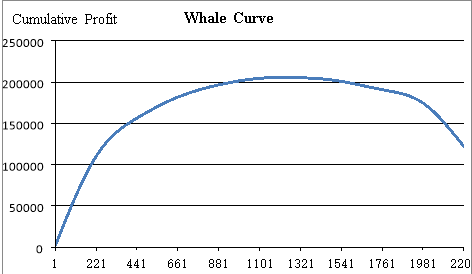

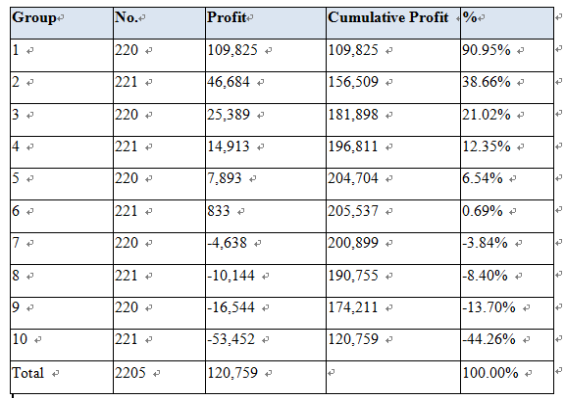

Finally a leaden sample with 2205 clients from all merchandise combination classs is examined ( Appendix VII ) , these clients are ranked by profitableness and divided into 10 groups ( Appendix VIII ) , top 10 % clients generate 90.95 % of entire net income, and about 130 % of entire net income is created by top 20 % clients, hence, the bank should concentrate on these most profitable clients. In add-on, a whale curve demoing cumulative net income is drawn, bespeaking that 1229 clients generate positive net incomes ( Appendix IX ) .

Decision

The merchandise based supermarket scheme is non appropriate, as it is non client oriented. Alternatively, the eternity bank should implement client profitableness analysis which provides more comprehensive information for strategic determination devising because it can associate merchandises and clients together, place client sections, explain transverse keeping state of affairss and research fluctuations among clients.

The bank should concentrate on clients who generate major net income such as top 20 % profitable clients, and get new clients who are similar to current most profitable clients. In add-on, clients can be encouraged to hold cross-holding merchandises. For unprofitable clients, some service costs can be passed to clients, and the bank can cut down recognition bound and increase involvement rate for recognition card defaulted clients. Furthermore, new channels including telephone, mails and cyberspace banking demand to be utilised to cut down costs.

Mentions

CIMA. ( 2009 )Customer Profitability Analysis.[ Online ] January 2009. Available from: hypertext transfer protocol: //www.cimaglobal.com/Documents/ImportedDocuments/cid_tg_customer_profitability_analysis_jan09.pdf.pdf [ Accessed: 2nd April 2014 ]

Cognos. ( 2008 )Customer Profitability in Real-world Banking.[ Online ] February 2008. Available from: file transfer protocol: //ftp.software.ibm.com/la/documents/gb/mx/banking1.pdf [ Accessed: 25th April 2014 ]

Girish, P B. ( 2010 )How to Increase Banking Customer Profitability: Cleavage and Timing of Products and Services.[ Online ] Available from: hypertext transfer protocol: //customerthink.com/segmentation_timing_products_services_customer_profitability/ [ Accessed: 25th April 2014 ]

Hughes, A, M. ( 2010 )How Banks Use Profitability Analysis.[ Online ] Available from:

hypertext transfer protocol: //www.dbmarketing.com/2010/03/how-banks-use-profitability-analysis/ [ Accessed: 20th April 2014 ]

IBM. ( 2011 )Customer Analytics in Banking.[ Online ] April 2011. Available from:

hypertext transfer protocol: //www.bankingreview.nl/download/25887 [ Accessed: 10th April 2014 ]

ICAEW. ( 2002 )Customer Profitability Analysis.[ Online ] March 2002. Available from:

hypertext transfer protocol: //www.icaew.com/~/media/Files/Technical/Business-and-financial-management/busines-support-functions/Marketing/customer-profitability-analysis-gpg-37-march-02.pdf [ Accessed: 15th April 2014 ]

IMA. ( 2010 )CustomerProfitablenessManagement.[ Online ] Available from: hypertext transfer protocol: //www.imanet.org/PDFs/Public/Research/SMA/Customer Profitability Management ( 1 ) .pdf [ Accessed: 24th March 2014 ]

Storbacka, K. ( 1997 ) Segmentation Based on Customer Profitability-Retrospective Analysis of Retail Bank Customer Bases.Journal of Marketing Management.[ Online ] 13 ( 5 ) . p.479-492. Available from:hypertext transfer protocol: //home.btconnect.com/icd-partnership/storbacka.pdf [ Accessed: 25th April 2014 ] [ Accessed: 27th April 2014 ]

Stratecast. ( 2013 )How Banks Can Use Customer ProfitabilityAnalytics to Boom in Uncertain Times.[ Online ] March 2013.Available from: hypertext transfer protocol: //public.dhe.ibm.com/common/ssi/ecm/en/ytl03207usen/YTL03207USEN.PDF [ Accessed: 16th April 2014 ]

Appendixs

Appendix I

Beginning: Vaysman, I and Smyth, S. 2006

Appendix II

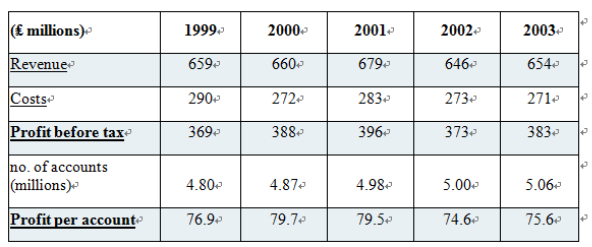

Current History:

Appendix II ( continued )

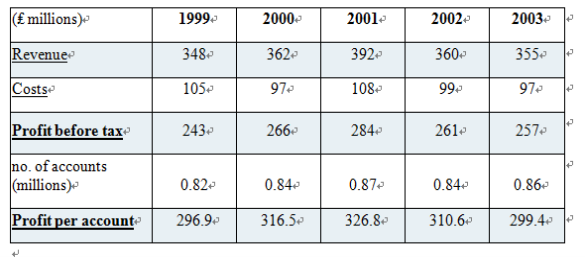

Recognition Card games:

Mortgages:

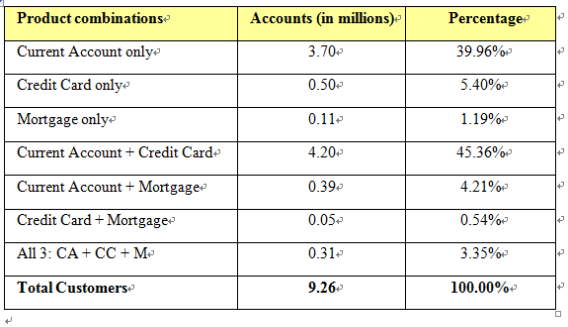

Appendix III

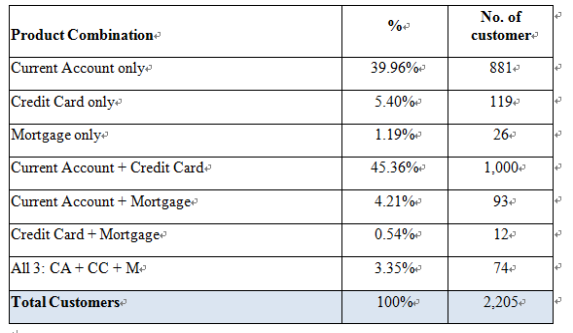

Statisticss on client cross retentions ( 2003 )

Beginning: Vaysman, I and Smyth, S. 2006

Beginning: Vaysman, I and Smyth, S. 2006

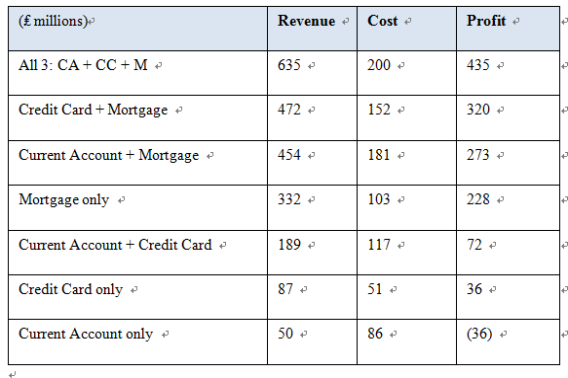

Appendix IV

1000 client sample for each class of merchandise cross-holdings

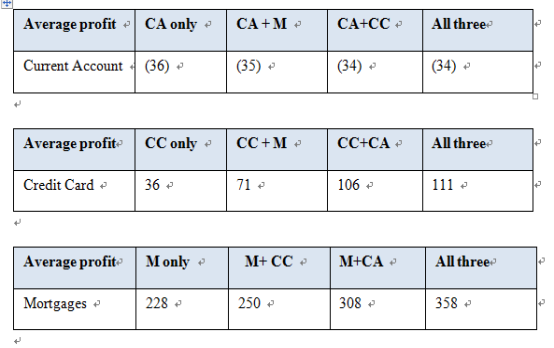

Appendix V

Average net income ( per client ) for each merchandise

Appendix VI

4000 clients ranked from most profitable to least profitable clients:

Current History

Appendix VI ( continued )

Recognition Card games

Mortgages

Appendix VII

Weighted sample ( 2,205 clients )

Beginning: Vaysman, I and Smyth, S. 2006

Beginning: Vaysman, I and Smyth, S. 2006

Appendix VIII

Leaden sample: client cleavage ( ranked by profitableness )

Appendix IX

Whale Curve