Abstraction

For my concluding undertaking I have chosen to analyze M & A ; T Bank. It will be of importance to analyze the industry as whole, execute a SWOT analysis, and reexamine fiscal statements. Through analyzing each of these factors a clearer apprehension of how M & A ; T Bank operates in the commercial banking industry will be generated. Thereafter, a decision will be drawn on how M & A ; T Bank should prosecute their hereafter in the banking industry.

History

M & A ; T Bank was founded in 1856 in Buffalo, NY as the Manufacturers and Traders Bank by Pascal Pratt and Bronson Rumsey. By the terminal of this decennary the bank’s ownership increased from 13 establishing shareholders to over 145, all of which received a primary dividend of four per centum. Fast forwarding to the beginning of the 20 first century M & A ; T Bank began geting non merely land and edifices throughout Buffalo, NY but besides other Bankss. The 1970’s ushered in a new ear for M & A ; T Bank, this began with the hiring of a new president and CEO ; Robert Wilmers. Currently, Wilmers is still the CEO of M & A ; T Bank and has been able to perpetuate the tradition of long standing success. Through continued success M & A ; T has been able to get other Bankss and spread out its range into Pennsylvania, Virginia, and Washington DC. By 2011 the bank’s assets reached about $ 80 Billion doing it the 24Thursdaylargest bank in the United States.

Industry Appraisal

The industry that M & A ; T presently operates is the commercial banking industry. The commercial banking industry has seen much alteration over the past century, this alteration has predominately occurred from authorities intercession. The basic purpose of authorities ordinance is to guarantee that houses are able to be competitory while besides forestalling market failures. These include natural monopolies, inordinate competition, and economic rents. To assist with this overall end the authorities tends to modulate in two aspects ; economic and societal. An economic ordinance trades with the authorities holding a direct or indirect control over the houses in an industry. This is good because it limits markets with monopolies from raising monetary values excessively high which would ensue in unjust payments made by their clients ( Conte & A ; Karr, 2001 ) .

The societal facet of authorities ordinances is seen in antimonopoly Torahs. These are Torahs that prohibit patterns or amalgamations that would finally take to the debasement of competition. These ordinances play an of import portion in commercial banking because they are straight correlated to forestalling market failures ( Conte & A ; Karr, 2001 ) .

Commercial banking is defined as a fiscal establishment that provides services, such as accepting sedimentations, giving concern loans and car loans, mortgage loaning, and basic investing merchandises like nest eggs histories and certifications of sedimentation ( Commercial Banking, 2014 ) . As of September 2013 there are presently 539 commercial Bankss with assets over $ 1 Billion. Of the 539 commercial Bankss the top 20 Bankss presently hold 31 % market portion and the top 50 Bankss hold 41 % market portion. Furthermore, the top 20 Bankss presently hold 59 % of sums assets and the top 50 Bankss hold 70 % of all sums assets ( Census, 2007 ) .

In the commercial banking industry market portion and entire assets have become the major focal point. This most closely aligns with the mantra of the adulthood phase of the industry life rhythm, houses in this phase are concerned with market portion. Potential new entrants find these markets unattractive because of high barriers to entry and first mover advantages.

Table 1 – Top 50 Commercial Banks ( USA )

| Top 50 Commercial Banks ( USA ) | |

| 1 | JPMORGAN CHASE BK NA/JPMORGAN CHASE & A ; CO |

| 2 | BANK OF AMER NA/BANK OF AMER CORP |

| 3 | CITIBANK NA/CITIGROUP |

| 4 | WELLS FARGO BK NA/WELLS FARGO & A ; CO |

| 5 | U S BK NA/U S BC |

| 6 | PNC BK NA/PNC FNCL SVC GROUP |

| 7 | BANK OF NY MELLON/BANK OF NY MELLON CORP |

| 8 | Capital ONE NA/CAPITAL ONE FC |

| 9 | STATE STREET B & A ; TC/STATE STREET CORP |

| 10 | T D BK NA/TD US P & A ; C HOLD ULC |

| 11 | HSBC BK USA NA/HSBC NORTH AMER HOLD |

| 12 | BRANCH BKG & A ; TC/BB & A ; T CORP |

| 13 | SUNTRUST BK/SUNTRUST BK |

| 14 | FIA CARD SVC NA/BANK OF AMER CORP |

| 15 | FIFTH THIRD BK/FIFTH THIRD BC |

| 16 | CHASE BK USA NA/JPMORGAN CHASE & A ; CO |

| 17 | REGIONS BK/REGIONS FC |

| 18 | GOLDMAN SACHS BK USA/GOLDMAN SACHS GROUP THE |

| 19 | UNION BK NA/UNIONBANCAL CORP |

| 20 | RBS CITIZENS NA/RBS CITIZENS FNCL GRP |

| 21 | NORTHERN TC/NORTHERN TR CORP |

| 22 | ALLY BK/ALLY FNCL |

| 23 | BMO HARRIS BK NA/BMO FNCL CORP |

| 24 | KEYBANK NA/KEYCORP |

| 25 | MORGAN STANLEY BK NA/MORGAN STANLEY |

| 26 | MANUFACTURERS & A ; TRADERS TC/M & A ; T BK CORP |

| 27 | Capital ONE BK USA NA/CAPITAL ONE FC |

| 28 | SOVEREIGN BK NA/SANTANDER HOLDS USA |

| 29 | DISCOVER BK/DISCOVER FS |

| 30 | COMPASS BK/BBVA COMPASS BSHRS |

| 31 | BANK OF THE WEST/BANCWEST CORP |

| 32 | COMERICA BK/COMERICA |

| 33 | HUNTINGTON NB/HUNTINGTON BSHRS |

| 34 | DEUTSCHE BK TC AMERICAS/DEUTSCHE BK TR CORP |

| 35 | WELLS FARGO BK S CENT NA/WELLS FARGO & A ; CO |

| 36 | FIRST REPUBLIC BK/ |

| 37 | FIRST NIAGARA BK NA/FIRST NIAGARA FNCL GROUP |

| 38 | BOKF NA/BOK FC |

| 39 | BANK OF AMER CA NA/BANK OF AMER CORP |

| 40 | CITY NB/CITY NAT CORP |

| 41 | SYNOVUS BK/SYNOVUS FC |

| 42 | FIRST TN BK NA/FIRST HORIZON NAT CORP |

| 43 | FIRSTMERIT BK NA/FIRSTMERIT CORP |

| 44 | ASSOCIATED BK NA/ASSOCIATED BANC-CORP |

| 45 | EAST W BK/EAST W BC |

| 46 | FROST BK/CULLEN/FROST BKR |

| 47 | COMMERCE BK/COMMERCE BSHRS |

| 48 | FIRST-CITIZENS B & A ; TC/FIRST CITIZENS BSHRS |

| 49 | SILICON VALLEY BK/SVB FNCL GRP |

| 50 | BARCLAYS BK DE/BARCLAYS DE HOLDS LLC |

Mention antecedently the end of ordinance in the commercial banking industry is to supply a competitory market, this prevents entire laterality by a few houses. However, the banking industry is associated with high barriers to entry for new Banks because of the regulative limitations associated with charters and high costs of capital. High barriers to entry are besides associated with markets that are unfavourable to come in because established houses have an exponential advantage.

As shown from the old empirical grounds this industry is extremely concentrate in both market portion and entire assets. In an effort to cut down barriers to entry the Riegle-Neal Interstate Banking and Branching Efficiency Act was passed. This act changed interstate banking Torahs for both bank keeping companies and single Banks. BHCs and single Banks were given the ability to unify with other Banks located in different provinces. In theory this greatly decreased barriers to entry, nevertheless, in pattern it potentially assist top Banks become larger and more dominant.

SWOT Analysis

The SWOT analysis of M & A ; T bank will assist to measure the establishments strengths, failings, chances, and menaces. Following the decisions of the analysis will let for recommendations that leverage M & A ; T Banks strengths to take advantage of possible concern chances. Additionally, this decision will let for a better apprehension of operational failings to contend menaces to prospective growing.

Strengths

M & A ; T bank has garnered much strength since its initiation in 1856. It has grown into one of the states thirty largest Bankss with approximately $ 80 billion in assets. In add-on the bank boasts 700 subdivisions and ATMs in 1,500 different locations greatly widening is banking power ( M & A ; T Bank Corp, 2014 ) .

Its growing can be attributed to the acquisition of Bankss in upstate New York, eastern Pennsylvania, Washington D.C. , and the Baltimore part. Market laterality in these choice parts has allowed M & A ; T to non merely make a competitory advantage but besides sustain an advantage. Another cardinal strength to M & A ; T Bank is the services the bank can offer. To this point we have merely mentioned M & A ; T’s function in the commercial banking industry. However, M & A ; T offers services in retail and investing banking.

Failings

Not merely has M & A ; T Bank created a competitory advantage in the countries it serves, it has besides created a customizable attack to banking that clients love. However, the range of coverage is limited to eight provinces which finally means the bank has a comparatively little to negligible service country in comparing to other Bankss. M & A ; T Bank service country can be seen in above image. This scenario could rock possible new clients to take another bank which has a greater physical presence throughout the United States.

Opportunities

In recent old ages M & A ; T bank has created many chances that have positively affected the company’s place. Since 2006 M & A ; T has acquired over 130 brick and howitzer banking locations, many of which are outside the province of New York. Along with the purchase of physical brick and howitzer locations M & A ; T Banks has purchased other commercial Bankss such as Wilmington Trust. and Hudson City Bancorp ( Rochester, 2014 ) .

This was a strategic move that has allowed M & A ; T’s entire assets to increase greatly over the past five old ages. Since the twelvemonth 2005, which is a important twelvemonth, M & A ; T has increased their entire assets by about 50 % ( M & A ; T Bank Corporation, 2014 ) Last, M & A ; T Bank is non merely located in the United States but has a location across the boundary line in Toronto, ON. Harmonizing to bank President Mark Czarnecki, “…our apprehension of cross-border commercialism, along with decennaries of experience functioning Canadian concerns runing in the U.S. , makes Ontario an ideal location for M & A ; T ‘s first international commercial bank office ( M & A ; T Bank, 2010 ) .” This subdivision will non merely let M & A ; T to function a big figure of US-based companies runing Canada but will let M & A ; T to distinguish itself from the competition.

Menaces

Since the fiscal crisis of 2008 – 2009 banking Torahs and ordinances have become more rigorous. Regulative conformity poses an undoubtable load on M & A ; T Bank. Regulatory conformity is besides positively correlated to higher cost. One such ordinance is Dodd-Frank Act, this act has mandated that Bankss need to maintain higher ratios of capital on manus. Therefore, this limits M & A ; T’s ability to spread out into other parts.

Second, M & A ; T Bank faces other external menaces such as the loss of their sustained competitory advantage. This loss can happen because of their little geographical coverage country. Other Bankss, through acquisitions and amalgamations, could open subdivisions in similar locations. Therefore, this would diminish their market portion and potentially do them less valuable.

Stakeholder Analysis

The stakeholder analysis aims to measure the stakeholders of M & A ; T Bank. The stakeholders can be broken down into three major groups ; Customer both possible and current, investors, and direction. Following figure, the interest/power grid allows us to plot current and possible clients in the quadrant “keep satisfied.” The clients of M & A ; T Bank are responsible for driving net incomes without them the bank would be forced to shut its doors. The group of investors and direction can be grouped into the quarter-circle labeled support informed. Keeping investors and particularly direction informed allows the company to do the best possible determinations.

Fiscal Analysis

Table 2 – FDIC Ratios

| Ratio Measures of Bank Performance | |

| Designation of Variable | What the Variable Measures |

| Loans-to-assets ratio | Liquid and hazard. The higher the ratio, the greater the sum of the bank’s entire portfolio that is capable to default hazard |

| Tax return on Assetss ( ROA ) | The bank’s profitableness. Low ROA may promote hazard pickings by the bank. High ROA may bespeak bad loaning to increase net incomes |

| Asset growing from old twelvemonth | Hazard of growing |

| Loan growing from old twelvemonth | Hazard of growing |

| Salary disbursals per employee | Management’s control of disbursals |

| Interest on loans and rentals to entire loans and rentals ( involvement output ) | The mean income of loans. High outputs might bespeak that the bank is arising bad loans. |

| Interest and fee income to entire loans and rentals ( involvement & A ; fees to loans ) | Income. The add-on of fees to the variables may catch houses that are lading up on fee income. |

| Operating disbursals to entire disbursals | Management’s control of disbursals. Higher disbursals are assumed to be indexs of loose control. |

The success of any bank depends on several factors which involve many different facets of the balance sheet. The FDIC has created ( Table 2 – FDIC Ratios ) to assist explicate the public presentation of a bank in respect to the balance sheet. Although the full list is used by the FDIC to guarantee a thorough apprehension of a bank’s public presentation, non all of these ratios and old ages are able to be used due to a deficiency of information. The countries that we will analyze in our fiscal analysis are the entire loans to assets ratio, the plus growing from the old twelvemonth, the loan growing from the old twelvemonth, and the return on assets. To assistance in this analysis we will compare M & A ; T to the mean US bank, and the mean New York bank.

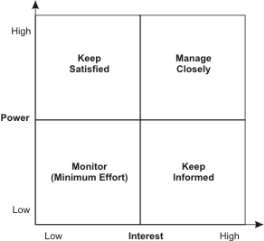

Figure 1- Loans to Assets Ratio

The entire loans to assets ratio helps to explicate the bank’s liquidness and hazard. The higher the ratio the more likely a Banks is to default. Figure ( Figure 1- Loans to Assets Ratio ) upon comparing shows that M & A ; T is more likely to default. Although this is an unlikely scenario, M & A ; T Bank’s loan to assets ratio is the riskiest

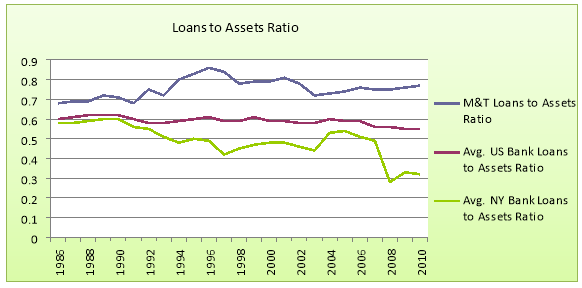

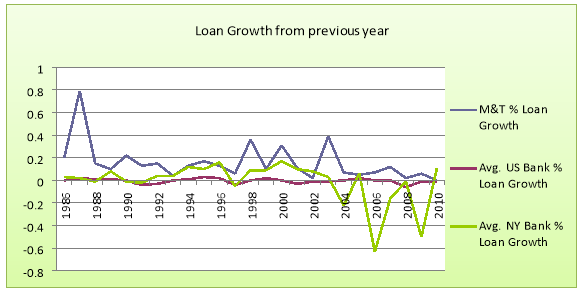

The plus growing and loan growing from the old twelvemonth are two ratios that deal with the overall hazard of growing. The figures of ( Figure 2 – Asset Growth & A ; Figure 3 – Loan Growth ) show this comparing. During times of economic prosperity, such as the recovery and peak phase of the economic concern rhythm, M & A ; T’s loans and assets increase greatly. However, during downswings in the economic system, such as a recession or trough, M & A ; T’s loans and assets decrease. Furthermore, over the long tally M & A ; T Bank has see the best overall growing in loans and assets from the old old ages.

Figure 2 – Asset Growth

Figure 3 – Loan Growth

Last, we examine M & A ; T’s return on assets. This ratio helps to explicate the bank’s profitableness. Low ROA may promote hazard pickings by the bank and high ROA may bespeak bad loaning to increase net incomes ( FDIC ) . M & A ; T has experience an mean ROA of 1.20 % , for the banking industry a ROA of somewhat higher than 1.5 % is optimum ( Loth, 2009 ) .

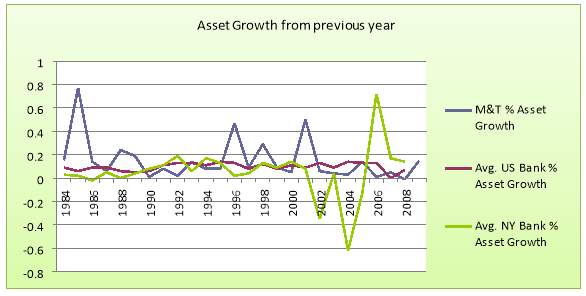

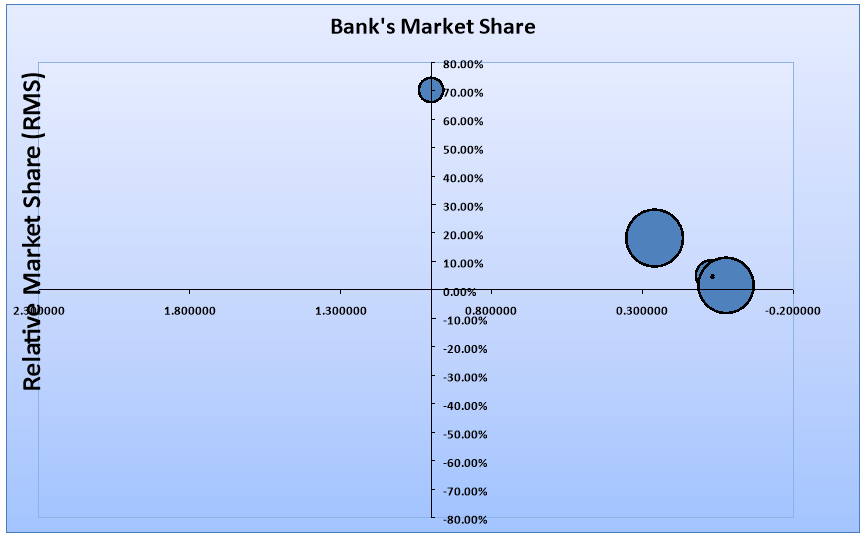

BCG Matrix

The above BCG Matrix analyses M & A ; T Bank and its four closest regional rivals. From the information we can see that that M & A ; T is ranked in the “question mark” quarter-circle. It has both a little overall market portion and relation markets portion. Businesss that are located in this quadrant require huge resources to turn, but whether they will win and travel into the star quarter-circle is unknown.

Table 3 – M & A ; T & A ; Rivals

| M & A ; T & A ; Competitors BCG Matrix | ||||

| Trade names | Grosss ( Billions ) | Bank ‘s Market Share | Relative Market Share ( RMS ) | Market Growth Rate |

| M & A ; T Bank | $ 4.35 | 5.18 % | 0.0738 | 6.52 % |

| PNC | $ 15.30 | 18.23 % | 0.2595 | 12.50 % |

| HSBC | $ 58.96 | 70.26 % | 1.0000 | 5.36 % |

| First Niagara | $ 1.35 | 1.61 % | 0.0229 | 12.18 % |

| KeyCorp | $ 3.96 | 4.72 % | 0.0672 | 0.51 % |

However, of the five Banks compared M & A ; T has one of the best market growing rates. Additionally, the hapless arrangement of M & A ; T Bank on the BCG Matrix can be explained. Two of the Banks, HSBC and PNC, presently reside in the top 20 Banks nationally. As mentioned antecedently Banks in the top 20 control 59 % of entire assets and 31 % of the market portion, therefore, these two Banks adversely skew the information. Furthermore, M & A ; T Bank is mid-market regional bank that competes on a regional ( North Eastern States ) degree non on a national degree.

Figure 4 – BCG Matrix

Recommendations

For M & A ; T Bank to stay successful they should concentrate on two countries of focal point. The first country of focal point should be on fiscal ratios. As stated antecedently, fiscal ratios are of import in understanding the overall public presentation of the bank. Even though M & A ; T was one of the best acting Banks through the Great Recession of 2008 they should endeavor to take down their loan to plus ratio.

Their higher than mean ratio can take to the ultimate failure of M & A ; T. Secondly, the bank should concentrate of amalgamations and acquisitions to assist keep their competitory advantage. M & A ; T’s current little market size puts them at a possible disadvantage in comparing to their competition. Geting other Banks would let them farther convey their thought of community banking. This gives clients the personal touch that many big commercial Banks are non able to give.

The scrutiny of M & A ; T Bank versus its rivals at both a national and province degree is of import in understanding the Banks success. M & A ; T Bank has succeeded in out executing their competition through non merely good economic times, but the same bad 1s that have led to the failures of their competition. M & A ; T’s success is garnered in their mantra of “community banking” and their ability to work their competitory advantage ( Throwback, 2014 ) .

Plants Cited

- Census Bureau Homepage. ” Census Bureau Homepage. N.p. , n.d. Web. 03 Mar. 2014.

- Commercial Bank. ” Investopedia. N.p. , n.d. Web. 05 Mar. 2014.

- Conte, C. , & A ; Karr, A. R. ( 2001 ) . An lineation of the U.S. economic system. Washington, D.C. : U.S. Dept. of State, International Information Programs.

- Federal deposit insurance corporation: Statisticss on Depository Institutions. ” Federal deposit insurance corporation: Statisticss on Depository Institutions. N.p. , n.d. Web. 05 Mar. 2014.

- FRB: Large Commercial Banks — June 30, 2013. ” FRB: Large Commercial Banks — June 30, 2013. N.p. , n.d. Web. 05 Mar. 2014.

- Loth, Richard. Financial Ratio Tutorial “ROA” Retrieved October 23, 2009, from

- hypertext transfer protocol: //www.investopedia.com/university/ratios/profitability-indicator/ratio3.asp

- M & A ; T Bank Corporation – About M & A ; T Bank Corporation. ” M & A ; T Bank Corporation – About M & A ; T Bank Corporation. N.p. , n.d. Web. 05 Mar. 2014.

- M & A ; T Bank Corporation – M & A ; T Bank Approved to Open Canadian Commercial Banking Branch. ” M & A ; T Bank Corporation – M & A ; T Bank Approved to Open Canadian Commercial Banking Branch. N.p. , 07 June 2010. Web. 05 Mar. 2014.

- Rochester Business Journal. ” M & A ; T Acquires Delaware Bank for $ 351 Million. N.p. , n.d. Web. 05 Mar. 2014.

- Throwback Approach Keeps Wilmers, M & A ; T on Top. ” American Banker RSS. N.p. , n.d. Web. 05 Mar. 2014.