Anna Sheen, upon graduating from a Boston-area university with a degree in journalism and operations research, returned to her hometown of Hamptonshire, Pennsylvania, to start a daily newspaper. The Hamptonshire Express emphasized local news which Sheen believed was not adequately covered by big-city newspapers such as the The Philadelphia Inquirer, Pittsburgh PostGazette, and The New York Times. Sheen daily wrote stories and articles around news and feature material that she gathered from around town, and typeset the newspaper using desktop software and a PC leased from a large Pittsburgh-area retailer.

She estimated her lease cost at approximately $10 per day. The newspapers were printed overnight by a local printer at a marginal cost of $0.20 per copy (i.e., the printer charged 20 cents for each additional copy of a newspaper). Anna sold the copies the following morning from 6 a.m. to 10 a.m. from a newsstand at the intersection of Main Street and Center Street in the center of Hamptonshire. Newsstand rental was $30 per day. Express was sold to consumers for $1 per copy. Copies not sold by 10 a.m. were discarded.

Demand for newspapers was unpredictable; Sheen estimated demand daily before delivering it to the printer. Based on data from similar entrepreneurial ventures and interviews with potential Hamptonshire customers, she estimated that daily demand for the Express was normally distributed with a mean of 500 and standard deviation of 100.

a.

How many newspapers should Sheen stock? Use the simulation in the spreadsheet “Hamptonshire Express: Problem #1” to identify the optimal stocking

quantity.1 What is the profit at this stocking quantity?

b.

Verify that the value derived in part (a) is consistent with the optimal stocking quantity in the Newsvendor model.2

1 You can download all spreadsheets from .

2 Optimal stocking quantity in the Newsvendor model can be shown to be

1 (.) is the inverse of the standard normal distribution function and

and

Q 1 (

Cu

) ,

Cu Co

where

are the mean and standard deviation of

the demand distribution.

________________________________________________________________________________________________________________ Professors V. G. Narayanan and Ananth Raman prepared this case. HBS cases are developed solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management. In order to utilize this case, please acquire a copy of the eight (8) related spreadsheets from Professor V. G. Narayanan or from Professor Ananth Raman. Copyright © 1998 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545-7685, write Harvard Business School Publishing, Boston, MA 02163, or go to http://www.hbsp.harvard.edu. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, or otherwise—without the permission of Harvard Business School.

698-053

Hamptonshire Express

Problem # 2

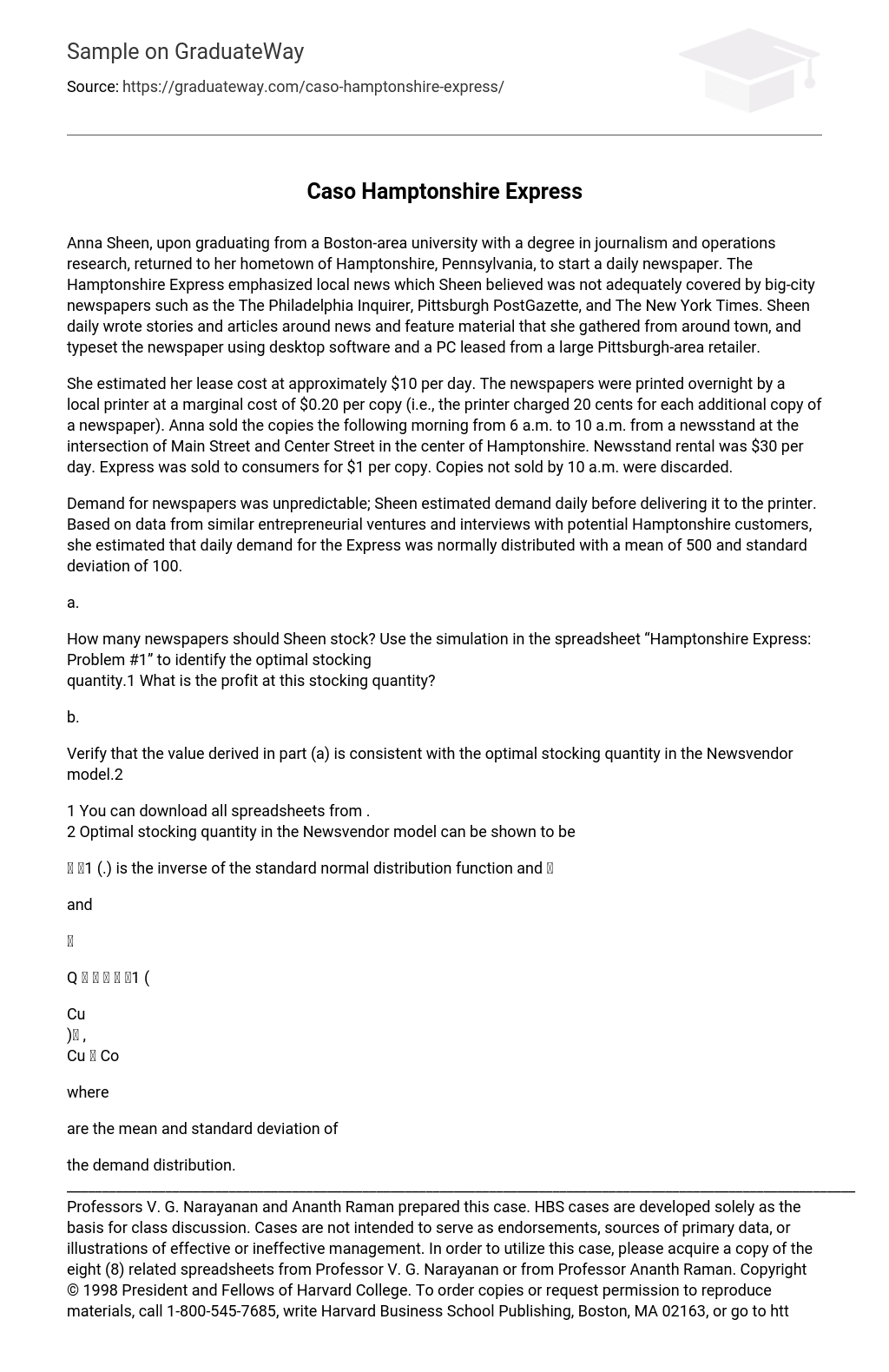

Sheen came to believe after about six weeks of operation that demand for the Express could be increased by adding a section that profiled people in the town and its suburbs, as well as state, national, and international personalities. Experiments suggested to her that demand was a function of the stylistic quality and pictorial and information content of such a section; hence, of the amount of time she invested in it. Sheen had kept records of the time she had spent each day developing the profile section. Using empirical data from the last few weeks, Sheen had developed Figure 1, to study the relationship between the number of hours invested in creating the profile section, and demand for the Express on any given day.

700

650

600

550

14

13

12

11

10

9

8

7

6

5

4

3

2

1

500

0

Expected demand

Figure 1: Average Daily Demand vs. # hours

invested daily in creating the profile section

for a particular day

# hours invested in creating the profile section

on a given day

The function in Figure 1 can be expressed as a simple equation: D 500 h 500 50 h , where D is daily demand for The Hamptonshire Express, and h the number of hours Sheen has invested in creating the profile section.

As before, Sheen forecast demand for the following day’s newspapers every evening based on the quality of the profile section, and used her demand forecast to determine her stocking quantity. a.

How many hours should Sheen invest daily in the creation of the profile section? Assume the opportunity cost of her time (based on other employment opportunities in Hamptonshire) to be $10 per hour. Try different values for h in the spreadsheet “Hamptonshire Express: Problem #2.” (To make your life easier, optimal stocking quantity, Q, is computed by the spreadsheet based on the newsvendor formula for your choice of h .)

b.

What explains Sheen’s choice of effort level h ? Do not spend more than 10 minutes thinking about this question. (Hint: Sheen would choose h to equate marginal cost of effort with marginal benefit. The marginal cost of her effort is $10 per hour; that is, the opportunity cost of her time, the marginal benefit of her effort is

2

0.8 * 50

.)

2 h

Hamptonshire Express

c.

698-053

Compare the optimal profit under this scenario with the optimal profit derived in Problem #1.

Problem #3

Becoming extremely busy over the next few months, Sheen decided to hand over the retailing portion of her business to another Hamptonshire resident. Ralph Armentrout offered to run the newsstand from 6 a.m. to 10 a.m. and pay the daily rent of $30 to the landlord. He was to estimate expected demand for the Express on the basis of a copy viewed at 10 p.m. the previous night. Newspapers purchased from Sheen at $0.80 per copy were to be delivered to the newsstand by 6 a.m. the following morning. Armentrout was responsible for any newspapers left unsold at the end of the day.

a.

Assuming h =4, (i.e., Sheen has spent four hours creating the profiles section), what would Armentrout’s stocking quantity be? To identify the stocking quantity that maximizes Armentrout’s profits, try varying Q while holding h =4 in the spreadsheet “Hamptonshire Express Problem #3.”

b.

Why does the optimal stocking quantity differ from the optimal stocking quantity identified in Problem #2? Is the result here consistent with the newsvendor formula?

c.

Now try varying h in spreadsheet “Hamptonshire Express: Problem #3c” (this spreadsheet has optimal newsboy calculation for differentiated channel, i.e. to maximize Ralph’s profit) to see what happens to Sheen’s profit. How does her optimal effort in this question differ from the answer to question 2. Why?

d. How would changing the transfer price from the current value of $0.80 per newspaper impact Sheen’s effort level and Armentrout’s stocking decision? Try changing the transfer price in the spreadsheet “Hamptonshire Express: Problem #3d.” (This spreadsheet has formulas for h and Q embedded.)

e.

What conclusions can you draw about stocking and effort levels in a differentiated channel vis-à-vis an integrated firm that manufactures and retails its product?

Problem #4

The Express was firmly established as the town newspaper after around a year of operation. Expected daily demand remained at 500, the standard deviation of daily demand at 100. As in Problem #3, Armentrout retailed at $1 newspapers purchased from Sheen at $0.80 per copy. Armentrout was responsible for unsold newspapers. Having virtually no competition from other newsstands and being firmly established in his store at the intersection of Center and Main Streets, Armentrout broadened his product line, diversifying into coffee, soft drinks, and breakfast items such as muffins and bagels. He had become friendly with a number of customers who often stopped to discuss the latest news in the Express.

Inspired by the success of the Express and his newsstand, Armentrout decided to launch his own private-label newspaper. A short, two-page newspaper, Ralph’s Private Eye, carried news from around town with little analysis and no special section. Consistent with its low-cost image, the Private was photocopied at the Kinko’s store adjacent to Armentrout’s newsstand. Hence, he carried no inventory, instead making copies as customers demanded them. 3

698-053

Hamptonshire Express

The marginal cost to produce the Private which retailed for $0.50 (well below the $1 that was charged for the Express) was $0.10 (i.e., the cost of photocopying two pages at Kinko’s). Sheen believed that the Private posed no threat to the Express. “It’s a rag!” she exclaimed; “I cannot imagine any consumer choosing the Private instead of the Express.” Armentrout agreed

that his newspaper was a “rag” and that no customer would choose the Private over the more expensive Express, but he observed that he frequently stocked out of the latter. He estimated that approximately 40% of the customers who experienced a stockout of the Express, would switch to the Private. The other 60% would not buy a newspaper at his stand on that particular day. a.

If you were Armentrout, how many copies of the Express would you stock? Use spreadsheet “Hamptonshire Express: Problem #4” to determine the optimal stocking quantity (the spreadsheet calculates h to maximize Sheen’s profits for the given wholesale price). Compare your stocking decision with the optimal decision in Problem #3a.

b.

Why does the optimal stocking quantity differ from the answers given in Problems #1, #2, and #3? How is this answer consistent with the logic of the newsvendor model?

c.

Armentrout’s newsstand was constrained for space as he continued to add new products. To get a better idea of true profitability for each product, he decided to allocate the cost of real estate according to the space occupied by each product. If he figured daily real estate costs for each additional newspaper at approximately 3 cents, how would this affect his stocking decision? (Answer this question qualitatively.)

Problem #5

Responding to competition from the Private, Sheen invested in an advertising campaign, aimed at making customers more loyal to the Express. As a result of the ad campaign, few customers were willing to switch to the Private when Armentrout stocked out of the Express, choosing instead to not purchase either the Express or the Private. Owing to higher customer loyalty to the Express, demand for the Private was low, and Armentrout eventually decided to stop publishing the Private. Thus, the situation in Hamptonshire reverted

to the scenario described in problem # 3 above (i.e., Sheen sold the Express to Armentrout at a wholesale price of $0.80 per copy who did not carry a competing private-label newspaper).

Sheen, however, noted that Armentrout’s fill rate was low even though he was no longer carrying the Private; she noted (from spreadsheet Express #3c) that he stocked approximately 491 newspapers, even though expected daily demand for the Express was around 575 units. Fill rate on the Express was close to 85%.

When Sheen spoke to Armentrout about stocking more copies of the Express, he pointed out that he was stocking what was optimal for his newsstand. “I even used the newsvendor formula,” he pointed out defensively, adding: “I will offer you a solution. Why don’t you buy back unsold copies of the Express at a salvage price close to the price at which you sell me the newspapers. You could even sell me all the newspapers on consignment [i.e., buy back unsold units at the wholesale price]— that’s what the major publishers do with their retailers. I will surely buy more if you buy back unsold newspapers.”

Sheen returned to her office to construct the spreadsheet (“Hamptonshire Express: Problem #5”). The spreadsheet calculates Ralph’s stocking quantity to maximize his profits (as a function of buyback price and wholesale price), and also calculates h (i.e., Sheen’s effort) to maximize her profits (as a function of wholesale price). To understand the impact of subsidizing unsold inventory on her effort 4

Hamptonshire Express

698-053

and Armentrout’s inventory stocking levels, Sheen varied the buy-back price at which she bought back unsold newspapers.

a.

Assume Sheen charges a wholesale price of $0.80 per copy of the Express. How

does her buyback price impact Armentrout’s stocking quantity? What buy-back price would maximize channel profit? How much does Armentrout stock under this buy-back plan?

b.

Identify the combination of transfer price and buy-back price that maximizes expected daily profit for the channel. How does this number compare with expected daily profit for the channel in Problem #2 (i.e., the vertically integrated channel)? Use the simulation in “Hamptonshire Express: Problem #5b”; the spreadsheet determines the optimal buy-back price given the value of the wholesale transfer price from Anna to Ralph.

c.

How would Armentrout’s stocking decision, and Sheen’s effort decision be altered if Sheen insisted on a daily franchise fee in addition to the margins she earned (a franchise fee would require Armentrout to pay Sheen a fixed fee every day to be able to carry the Express in his newsstand).

Problem #6

Sheen wondered why she could not proceed to a form of “vendor managed inventory” in her relationship with Armentrout. Specifically, she wondered if she, rather than Armentrout, could decide how much to stock at the newsstand. Under her “VMI plan,” Sheen reasoned, Armentrout did not require a commission for additional sales. “Previously, I had to ensure that his margins were structured appropriately, because he decided how much to stock. Why should I pay him a commission if he does not have stocking decision rights?” she thought aloud. Anna figured she could pay Ralph a “slotting allowance” (i.e., a fixed daily payment independent of Express demand) under the VMI plan.

a.

How would the performance of this channel compare with the integrated channel