Introduction

China Eastern Air Keeping Company ( CEA ) is one of the three major air hose companies in China, which headquartered in Shanghai. At the terminal of September 2012, China Eastern owned entire assets of about 108.5 billion RMB, which included more than 400 big and moderate-sized and had over 60,000 employees. ( CEA, 2014 )

As an official member of SkyTeam, CEA builds its flight web from Shanghai, which convergences with the Union, included 187 states around the universe and more than 1000 metropoliss. CEA services the universe ‘s 70 million rider trips each twelvemonth, which ranked among the world’s top 5 rider traffic.

Since 2009, CEA with a new attitude Ussher in a new development, named “China ‘s civil air power safety Five Star Award ” ; topped the Fortune magazine Most Advanced Chinese Companies Top 25 ” , was named the international trade name bureau WPP “Top 50 most valuable trade names in China ” . ( Anon. , n, vitamin D. )

The major intent of this study is to discourse the China Eastern Air Holding Company scheme, which included external analysis ( PESTLE analysis ) , internal analysis ( SWOT analysis ) , and so on. As a company, concern scheme is playing an of import function in house development and success. In the study, it besides will include in strategic options and recommended schemes.

External Analysis

PESTLE Analysis

External analysis included in PESTLE and five forces. “The PESTLE model classs environmental influences into six chief types: political, economic, societal, technological, environmental and legal.” ( Johnson, et al. , 2012, p. 21 ) .

Politicss highlights the function of authoritiess. The china political background is contributing to state-owned air power company, which included in China Eastern. Aspects of domestic paths, no one air power company except for three state-owned air power companies can use to a private air hose to wing the chief paths in 2005 to 2007, these paths are the all the high-quality air hoses. Internationally path, national policies biased in favour of Air China, most of the international paths are concentrated in the custodies of Air China. China Eastern Airlines and China Southern Airlines in this respect are at a disadvantage.

The background to the rapid development of private air power industry, but the China internal policy was biased in favour of oligopoly. And the development of private air hoses has been about impossible.

Economicss refers to macro-economic factors, which included universe economic system and domestic economic system. The planetary economic growing sustained, planetary economic growing in 2014 of 3.7 % , compared with 2013 growing of 0.7 % . Advanced countries’ economic systems from 1.3 % to 2.2 % , which indicates that there will be new chances in advanced states. ( World Economic Outlook, 2014 )

China ‘s economic system will keep steady and rapid development in recent old ages, with GDP growing of around 8 % and the consumer monetary value index rose about 4.8 % . Economic Development of the full air power industry is merely get downing in China. In add-on, universe oil monetary values besides affected the cost of winging. The cost of fuel is the biggest cost in CEA.

Social influences include altering civilizations and demographics. In this instance, due to altering life styles and values, aircrafts have become one of indispensable transit in China. More and more clients are taking aircraft as transit because it is efficient and convenient. The development of the air power industry, particularly the inexpensive air hose industry, is a important chance. More significantly, the air ticket is no long luxury, but besides more civilians.

Technological influences refer to invention. The information engineering makes it easier for riders to purchase tickets on-line reserve. This technological betterment helps house to increase the figure of air travellers.

The aircraft makers, airdrome installations, information engineering impact on air power industry proficient environmental. Bettering airdrome installations, such as a rider check-in desk, baggage installations, shuttle vehicles, etc. , which increasing client satisfaction and advancing the development of the full industry.

Environmental bases specifically for ‘green’ issues. The company improved the aircraft type, flight paths and route optimisation enhance DOC ( direct operating costs ) control and environment direction, harmonizing to the flight program accurate refueling and other agencies to salvage our fuel ingestion. It non merely reduced the fuel cost, but besides reduced the C emanation to protect the environment. Not merely that, the CEA besides cut down the disposable supplies and the figure of magazines. ( CEA, 2014 )

Legal embracings legislative restraints or alterations. The chief issues are discriminatory airdrome rights for some bearers and limitations on amalgamations for the air hose industry. For illustration, CEA hopes to set up bases in Beijing but there are multiple barriers from other air hose company and local authorities.

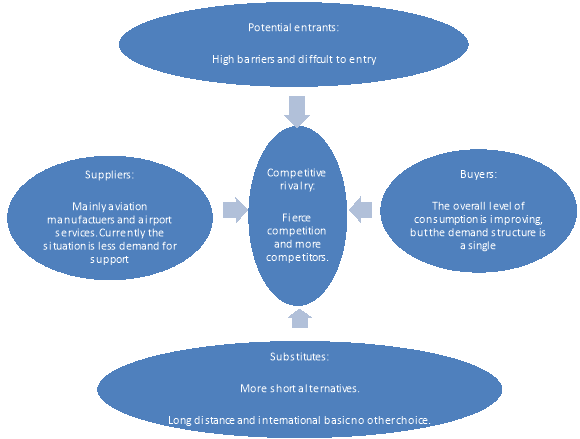

Five Forces Analysis

Porter’s five forces model impacting the industry attraction is: the menace of entry, the menace of replacements, the power of purchasers, the power of providers and the extent of competition between rivals. Through the five forces, the company will cognize their external environment and understand which portion needs to better. The five forces indicate that the advantages and disadvantages in the whole environment.

Internal Analysis

Enterprise Resource Analysis

CEA chiefly engaged in public air conveyance, general air power operations and sale of air transit and related merchandises and so on. ( CEA, 2014 ) . In add-on, CEA besides involved in a broad scope of import and export of air power, fiscal services, air power nutrient, travel fining, hotel, existent estate belongings, publicizing media, machinery fabrication and other industries, has formed a new form diversify. CEA flights include Airbus A300, A320, A330, A340, Boeing 737, Boeing 767, MD-90 and CRJ-200, ERJ-145, a sum of 238 aircraft, the chief operating base for the Shanghai Hongqiao International airdrome and Shanghai Pudong International airdrome, there are other of import base Kunming International airdrome, Xi’an Xianyang International Airport and so on.

Enterprise Capability Analysis

The CEA as the hub of air hoses chief income comes from the rider and cargo conveyance, CEA began to concentrate on running the web paths. Presently, CEA has about 250 aircraft, 293 domestic paths and 80 direct international paths. Rely on web operators, CEA will direct path between the bing metropolis criss-crossing associate, run into the conveyance demands of the market and travellers. CEA explore the potency and usage of bing resources, which achieve maximal benefit.

VRIO Analysis

The VRIO model determines the competitory power of a company’s resources and capablenesss.

The overall competitory power trial is moderate for CEA because the resource and capableness is the moderate value ; the resource and capableness are rare ; the resource and capableness is non difficult to copy ; the firm’s policies and processs are organized to back up the development. The CEA resources are limited in China, other companies hard to acquire their resources, but the low-priced air hose is impacting on the other air hose companies and sharing the market portions.

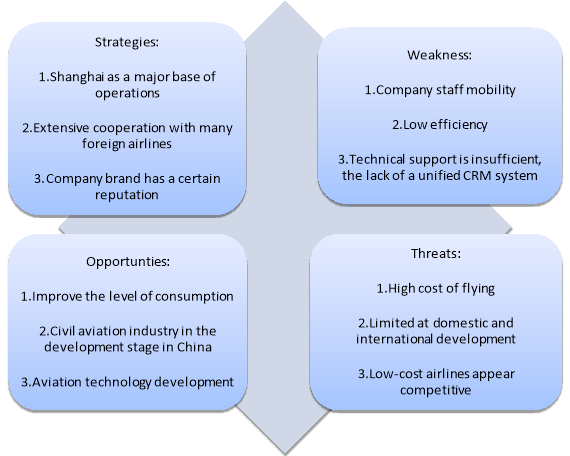

SWOT Analysis

SWOT summaries the strengths, failings, chances and menaces likely to impact on scheme development. Through the SWOT, it can clearly bespeak that the strategy’s strengths, failings, chances and menaces, which will assist companies to cognize themselves schemes.

There are many strategic issues in CEA. The major issues are the cost is excessively high, and limited at domestic and international development, which is hard to develop.

Strategic Options

Concerted Scheme

Horizontal integrating. CEA and Shanghai Airlines completed amalgamation in 2010. This is a successful process for CEA. It non merely consolidated their fastness of CEA, CEA besides made them more competitory in the last old ages. The amalgamation has two advantages. On the one manus, CEA can acquire local market portion and construct a base. On the other manus, CEA can acquire more resources in a short clip and heighten its fight. Therefore, CEA can unify another lol air hoses concern, like as merge the Shanghai Airlines.

Vertical integrating ( Equity fuel supply companies ) Fuel costs are a major constituent of air hose costs, for illustration, 40 % of the entire fuel costs in CEA whole cost. If fuel monetary values continue to lift, it will further increase the cost of force per unit areas air hoses.

The China ‘s fuel supply companies are big state-owned endeavors, the CEA can non unify the fuel supply. However, CEA can see equity engagement ; it besides can assist CEA to cut down the fuel cost. Because CEA can bask price reductions when CEA purchase flight fuel. It will do the CEA more competitory in today ‘s high fuel monetary values.

In concerted scheme, perpendicular integrating will cut down cost and horizontal integrating will assist CEA to develop the domestic and international market. The cost of fuel is the biggest cost for an air hose company, therefore, cut down the cost of fuel is the most of import in a company. If the CEA cooperate with the fuel supply, it will cut down more money on the cost of fuel. The amalgamation is a good manner to research a new market and consolidate an old market. It will assist companies to acquire more market portions and better consciousness.

Cost-leadership schemes

Cost-leadership scheme involves going the low-priced organisation in a sphere of activity. ( Johnson, et al. , 2012, p. 112 ) . Low-cost suppliers must hold the resources and capablenesss to maintain costs below those of rivals.

Input signal costs are of import in cost leading. For illustration, CEA cut down the types of aircraft. CEA has seven sorts of theoretical accounts, 1050 paths, which will necessarily take to higher costs of the immense assortment of aircrafts. Kinds of civil air power fleet are the nucleus of air power hardware resources. Too many sorts of aircrafts will take to high cost of care. Complex theoretical accounts of aircrafts are the chief cause of the high cost air hoses. Therefore, CEA should follow a individual theoretical account and short scope, high-density paths, which provides equal fiscal security. China ‘s civil air power aircraft use is really low, with an norm aircraft use rate in the advanced universe air hoses around 9.8 hours. Improved aircraft use, it non merely cut down the demand for the figure of aircraft, but besides cut down the figure of occupied capital in order to efficaciously cut down costs.

In add-on, the rational usage of regional aircraft is of import to the CEA path web betterment. CEA can utilize the mid-size aircraft as regional aircraft in order to vouch equal attender fortunes and give full drama to the little regional aircraft consequence.

In the cost-leadership scheme, to cut down the sorts of aircraft will cut down the cost and to utilize the mid-size aircraft to wing regional air hoses, which will acquire more net income for a company. These two schemes will do the CEA profitable.

Best-cost scheme

Best-cost suppliers must hold the resources and capablenesss to integrate upscale merchandise or service properties at a lower cost than challengers. CEA can supply the cheaper air hose tickets and publicity tickets. Through this manner, CEA could supply the same monetary value tickets as the low cost air hose, every bit good as supply the best service. The consumers must purchase CEA tickets because it provides the best service with the low monetary value.

This scheme will better attending in each air hose, it will acquire more net income. In the interim, the cheaper tickets will assist CEA acquire more market portions in their new paths because clients will be take the cheaper tickets in the same paths.

Recommended Scheme

For any company, it owns the limited resource and energy for a certain period, and it can non take more schemes to run together. Therefore the execution of the scheme should foremost be necessary to elect from alternate schemes. Therefore, I consider that the cost-leadership scheme is the best scheme for CEA now.

Concerted Strategy is a perfect scheme, but amalgamation need for a long clip to run. At the short clip, it difficult alterations for anything for a company, and it needs to incorporate for a long clip. Best-cost scheme besides is a good scheme, but it is non a long-run scheme.

The cost-leadership scheme is to take advantage of the endeavor avoid or extenuate the impact of external menaces. Through the amalgamation, CEA received a immense of resources ; nevertheless, these resources are non truly playing a function. If CEA can non full usage of these resources, these resources will impact the development of endeavors. These resources as indoors restricted demand to go the outside strength. In add-on, company staff mobility, and operational confusion, CEA has been to optimise the internal direction of the development scheme.

Decision

China ‘s air power market entered a rapid development period ; the public presentation of the air hose has been the turning point. With a high degree of CEA actively promote strategic cooperation will assist CEA and better their direction, operations and profitableness.

CEA is one of the three major air hose company in China, which shouldering duty for the development of the air power industry in China.

Through this analysis, we can clearly see the CEA have strengths, failings, chances and menaces, every bit long as the Eastern able to take the right scheme, I consider that China Eastern Airlines will be able to a leader in the Middle East air power industry for a long clip.

Reference List

- Anon. , n.d. , About China Eastern, China Eastern Airlines, [ Online ] Available at: hypertext transfer protocol: //easternmiles.ceair.com/about/zjdh/t2013812_11832.html. [ Accessed 14 April. 2014 ]

- Anon. , 2014, China Eastern Social Responsibility Report on 2013. China Eastern Air Company, [ Online ] Available at: hypertext transfer protocol: //pdf.dfcfw.com/pdf/H2_AN201403260005322096_1.pdf. [ Accessed 14 April. 2014 ]

- Johnson, G. , Whittington, R. & A ; Scholes, K. ( 2012 ) :Fundamentalss of Strategy, 2neodymiumedition, England: Pearson Education.

- World Economic Outlook, 2014, International Monetary Fund, [ Online ] Available at: hypertext transfer protocol: //www.imf.org/external/pubs/ft/weo/2014/update/01/pdf/infographic.pdf. [ Accessed 14 April. 2014 ]