Introduction

The building sector is an important solid waste generator. In Brazil, recent economic and political relations growth has quickly encouraged further development and investment in the building sector. However, such rapid growth of Brazil’s building has brought elevated concern and attention to the waste problem and its management for a developing country like Brazil (Nagalli, 2012).

Like in Europe, Brazil has a mandatory ordinance on building projects to reduce construction and demolition waste. National laws obligate builders to be responsible for the waste from their work. It is legally mandated and requires builders to take a proactive stance in planning waste management (Nagalli, 2012). The municipalities are responsible for waste management in Brazil, except for private investments such as industries, private buildings, or demolitions (Baez et al., 2012).

However, only 11 out of about 5000 Brazilian municipalities have building and demolition (C&A;D) waste recycling centers, which represents only 0.25% of the total number of municipalities. Additionally, there are 13 stationary plants and recycling waste centers produced in local communities.

Therefore, it is clear that a large portion of waste is not recycled in Brazil. It is also worth mentioning that since the establishment of CONAMA in 2002 (Brazilian Environmental Protection Agency), things have improved, and all Brazilian local governments are now obligated to prepare and follow strategies for sustainable management of C&A;D waste (MMA, 2002).

All investors are obligated to produce feasibility studies and plans for the production and use of building and demolition (C&A;D) waste materials for each project. However, very few studies have been conducted to demonstrate the feasibility of building and demolition (C&A;D) waste recycling centers.

Professional inquiries have illustrated that private projects that produce 20 tons per hour (t/h) or less of C&A;D waste processing flow will likely not be financially viable due to low productivity and lack of manufactured product prices, as the use of manufactured products is still not widespread. Therefore, investing in recycling on a large scale with complex installation centers will not be cost-efficient.

Feasibility Analysis

Many studies and researches have taken place to develop plans for the feasibility survey of complex projects and (C&A;D) waste recycling centers in Brazil. One of these studies was by UNIDO (1987), which presented a structural model for feasibility studies for complex projects, including huge investments from different sources of support and simplified the survey and structure by adding control elements described by another important study from Kohler (1997). The following main stages were identified in preliminary feasibility studies for building and destruction (C&A;D) waste recycling centers as follows:

- Analysis of market demands and the amount of existing competition from different sources. This depends on the geographical location of the center.

- Assessment and estimation of waste generation. This also depends on the geographical location of the center.

- The estimated income and cost from the building and destruction waste.

- Investment analysis in the building and destruction waste field.

Market and Competition Survey Analysis

There are abundant resources for civil construction uniting several elements in Brazil. The main consumer building and destruction waste centers are located in areas with good and convenient quality of different reserves.

According to DNPM (2003), “sand and gravel are low in price and produced in large quantities. Transportation costs correspond to around 2/3 of the end price of the product, which makes it necessary to produce sand and gravel as close as possible to the consumer market, which is the urban agglomerates.”

In Brazil, which is one of the developing countries, the rate of consumption is estimated at about 2 tons/inhabitant a year (Sindipedras, 2004). Comparing that figure with European countries, we found that Brazil has low consumption, where the average consumption in Europe ranges from 8 to 10 tons/inhabitant a year.

Taking into account that the population in Brazil is about 180 million (IBGE, 2000), the total consumption is estimated at about 270 million tons a year, or about 175 million cubic meters.

Table no. 1: The rate of building aggregate prices without transportation. (SINDIBRITA, 2004)

Aggregate Ratings

Prices (excl. taxes)

Prices (incl. taxes)

| ( diameter in millimeter ) | ( GBP $ /m? ) | ( GBP $ /t ) | ( GBP $ /m? ) | ( GBP $ /t ) | |

| Littorals | & lt ; 5.0 | 3.10 | 1.80 | 4.00 | 2.35 |

| Rock pulverizations | & lt ; 5.0 | 3.10 | 2.00 | 4.00 | 2.55 |

| Gravel 0, 1, 2, 3 | from 5.0 to 75.0 | 3.80 | 2.60 | 4.85 | 3.36 |

| Mixed Gravel | from 5.0 to 55.0 | 3.10 | 1.75 | 4.00 | 2.27 |

Estimated Production of C&A;D Waste

We need to know the productivity and collection of C&A;D waste to determine the needs and interest in developing and establishing recycling centers. Table 2 below presents estimates for the production and collection of construction and demolition (C&A;D) waste in some of the main Brazilian cities:

Table 2: Estimates for production/collection of C&A;D waste in some Brazilian cities (Nunes, 2004)

| Cities | Estimative of C & A ; D waste | Year- | Population

( IBGE, |

Production per dweller

( kg/inhab.day ) |

Collection per

dweller |

|

| Produced | Collected | 2000 ) | ( kg/inhab.day ) | |||

| Riode Janeiro | n/a | 1,100 | 2003 | 5,850,000 | n/a | 0.20 |

| Salvador | n/a. | 2,750 | 2000 | 2,450,000 | n/a | 1.15 |

| Sao Paulo | 16,000 | 3,400 | 2001 | 10,440,000 | 1.55 | 0.40 |

| Ribeirao Preto | 1,100 | 200 | 2003 | 505,000 | 2.00 | 0.55 |

| Sao Jose | 740 | n/a | 1995 | 540,000 | 1.50 | n/a |

| Piracicaba | 635 | n/a. | 2003 | 330,000 | 1.88 | n/a |

| Vinhedo | n/a. | 10 | 2003 | 48,000 | n/a | 0.32 |

| Guarulhos | n/a. | n/a. | – | 1,100,000 | n/a | n/a |

| Ribeirao Pires | n/a. | n/a. | – | 105,000 | n/a. | n/a |

| Sao Jose do Rio Preto | 690 | n/a. | 1996 | 360,000 | 1.92 | n/a |

| Santo Andre | 1,000 | n/a | 1996 | 650,000 | 1.56 | n/a. |

| Belo Horizonte | n/a. | 2,300 | 2000 | 2,240,000 | n/a | 1.05 |

| Londrina | 1,300 | n/a | 2003 | 450,000 | 2.86 | n/a |

| Brasilia | n/a. | n/a | – | 2,055,000 | n/a | n/a |

| Macae | – | 40 | 2003 | 133,000 | n/a | 0.34 |

| Florianopolis | 635 | n/a | 2001 | 286,000 | 2.23 | n/a |

Averages 2,000.65

The Rio de Janeiro city estimates a collection of 1,100 tons/day (0.20 kg/inhabitant/day), an amount below the average in other cities under survey. The reason that some municipalities have less than the average for the disposal of waste is the illegal and calculated inclusion within the general waste in official statistical tables. (IBGE, 2000)

Estimated Revenues and Costs:

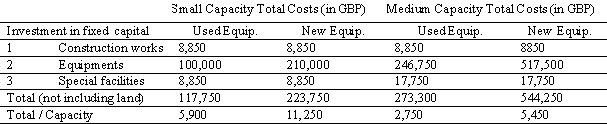

In Brazil, the equipment used in the (C&D) waste recycling center requires large investment. Most equipment used in the excavation sector, which is one of the largest and powerful sectors in Brazil, was taken into account when analyzing or estimating the incomes and benefits of investment.

Table 3 below shows the form of the fixed capital investment required for (20) tons/hour which we can call a small center and (100) tons/hour as a medium center depending on the size of the production and the new or used equipment. It’s possible to add some cost with equipment and site, the costs with site acquisition, transportation, and the manner of disposal of the recycling center waste. (Nunes, 2004)

Through consultations with many professionals, it was found that the minimum size of a site for a recycling center would be: (a) 6,000m² the appropriate area for the (20) tons/hour recycling centers; (B) 30,000m² area for the (100) tons/hour recycling centers.

Table 3: Investment in fixed capital and the operational costs (summary). (SINDIBRITA, 2004).

Operational Costss

Fixed Costss

| 1 | Labor | 26,250 | 26,250 | 56,500 | 56,800 |

| 2 | Other fixed costs | 65,450 | 76,000 | 280,250 | 307,400 |

| Variable Costss | |||||

| 3 | Variable costs | 24,000 | 24,000 | 94,000 | 94,000 |

| Entire | 115,750 | 126,300 | 430,000 | 457,100 | |

Conclusion

Brazilian civil construction materials are available in a broad range with good quality and proximity to urban consumer centers. It is worth mentioning that both natural and recycled construction materials prices have been low for some time. To attract more customers and better attention to the industry, the prices of recycled materials must be competitive with natural materials.

Meanwhile, the response to (C&A;D) waste and the recycling centers must compete with landfills. According to the Brazilian state-of-art, large amounts of inert material are typically needed to cover landfill cells and build access roads and guiding areas for waste collection trucks. Therefore, inert landfills pose a significant competition to recycling centers for the response to (C&A;D) waste.

Therefore, it is recommended to analyze two different recycling center projects to capitalize and boost the industry forward: a small-scale one (20 t/h) and a midsize one (100 t/h). Due to the lack of such an industry tradition and the absence of (C&A;D) waste recycling projects in the country, the feasibility of future private recycling centers will initially be somewhere between the two aforementioned capacities, and they should assume the use of processed products.

References:

- Andre Nagalli (2012), “Quantitative Method for Estimating Construction Waste Generation.”

- Baez AG, Saez PV, Merino MR, Navarro JG (2012), Waste Management.

- MMA (Ministry of the Environment) (2002), CONAMA Resolution no. 307.

- UNIDO (United Nations Industrial Development Organization) (1987).

- Kohler, G. (1997), Practice of Recycling: Construction Materials.

- CONAMA 2002 (Brazilian Environmental Protection Agency).

- Angulo, S. C. (2002) (Development of new markets for the recycling of C&A;D waste).

- DNPM (National Department for Mineral Research) (2006).

- Sindipedra (Federation of the Gravel Mining Industry of the State of Sao Paulo) (2004).

- IBGE (Brazilian Institute of Geography and Statistics) (2000).