If Giulia bought the foundry business, would the business be profitable? Support your answer with both quantitative analysis and qualitative reasoning.

Giulia seems to be excited about the opportunity to own her own business doing something that she loves. There is a high level of uncertainty herein whether or not Giulia would make a profitable business. It seems that there is room for improvement in the current operations since all 6 workers were cross-trained and they were currently only busy for about one week worth of labor time per month. Giulia does have an MBA and may be able to recognize ways to use the resources more efficiently and keep production costs down. Giulia will need to practice her strategic thinking to determine how to balance the resources on hand to make this situation work. If she can offer the units for $11.70 or higher, she may be able to maintain the business but she will need to drive down the production costs to sustain profits. If any equipment needs repairs or the building needs renovations, those costs are not going to be covered under her current pricing plan. Also, if production increases, variable costs may also increase so it will be important for Giulia to pay close attention to this.

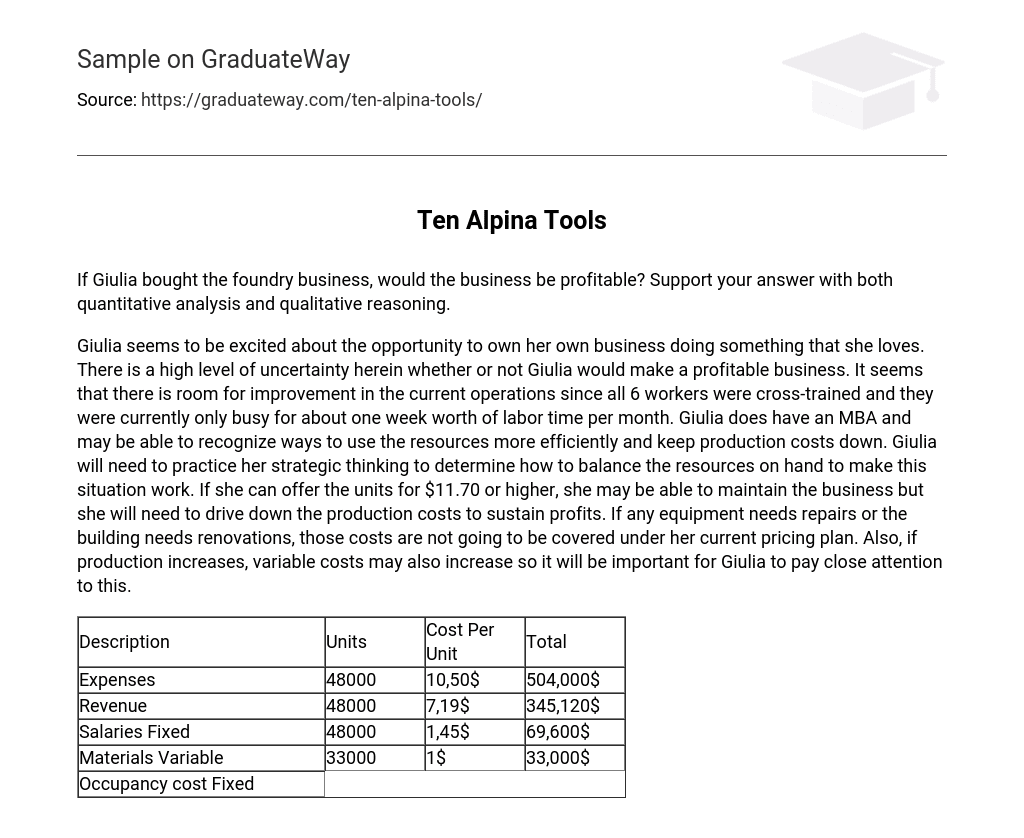

| Description | Units | Cost Per Unit | Total |

| Expenses | 48000 | 10,50$ | 504,000$ |

| Revenue | 48000 | 7,19$ | 345,120$ |

| Salaries Fixed | 48000 | 1,45$ | 69,600$ |

| Materials Variable | 33000 | 1$ | 33,000$ |

| Occupancy cost Fixed | 48000 | 1,91$ | $91,680 |

| Utilities variable | 1 | 14,355$ | 14,355$ |

| Depreciation for the previous year fixed | 12 | 600$ | 7,200$ |

| Administrative fixed | – | – | 560,955$ |

| Total Operating Costs | – | – | 56,955$ |

| profit(loss) | – | – | 100,000$ |

| Purchase Price | 48000 | 11,70$ | 561,600$ |

Breakeven Price would need to be at least $11.70

What are the relevant risks for Giulia in this situation? What role does the quantitative analysis play in assessing those risks?

After reading the case we identified the following risks;

- Graduate School/ MBA: The case takes place as Giulia is returning from summer break after her first year. Given the intense workload of an MBA program and the workload requirements of a startup/expansion, we have to question if she can do both effectively. Quantitative Analysis: LOW…. This is more of a time and lifestyle concern.

- Loss of the single customer contract: Anytime a business is relying on a single customer it’s a risk. Giulia is using the cash flow from this customer to support the new venture. There is not a strong history here for her to count on and lack of data increases risk. In addition, she also is highly at risk should her customer go out of business or find another supplier; she would be hard-pressed to meet her monthly burn rate. In fact there is no evidence in the case that her business could survive without that contract. Quantitative Analysis: HIGH….. The key issue here is that the business is running on very thin margins and the cash flow from this customer is critical for Giulia to cover her fixed and variable costs. There is no evidence that she has cash reserves or any access to investors.

- Employee/Operations issues: Giulia has no experience in this industry and we have no evidence that she has ever managed people or managed a manufacturing process. Due to her thin margins, any interruption in production would be devastating. Quality is a huge concern here and although her team is “cross-trained” on all the equipment it’s reasonable to assume that there will be employee turnover. She will need to replace them and we don’t know what the training cycle is and how it will impact production and quality. Qualitative Analysis: HIGH…… Production ties directly to the ability to fulfill the contract. This contract is key to her cash flow and the margins are small. Giulia needs to determine the new employee training cycle and factor that into production and cash flow projections.

- Increased Costs: If Giulia experiences an increase in production or fixed costs she is in a very risky situation. Her margins are thin and we have no evidence of cash reserves. Qualitative Analysis: HIGH….. Any increase in costs cuts into margins. Giulia is not in a position to handle such increases.

- Renegotiation or delays on the single contract: The single customer could ask for a lower price point, lower volume, or attempt to renegotiate payment terms. Qualitative Analysis: HIGH….. As we have seen a key concern, in this case, is the margins. Any decrease in price or payment schedule will have a direct impact on Giulias ability to cover her costs