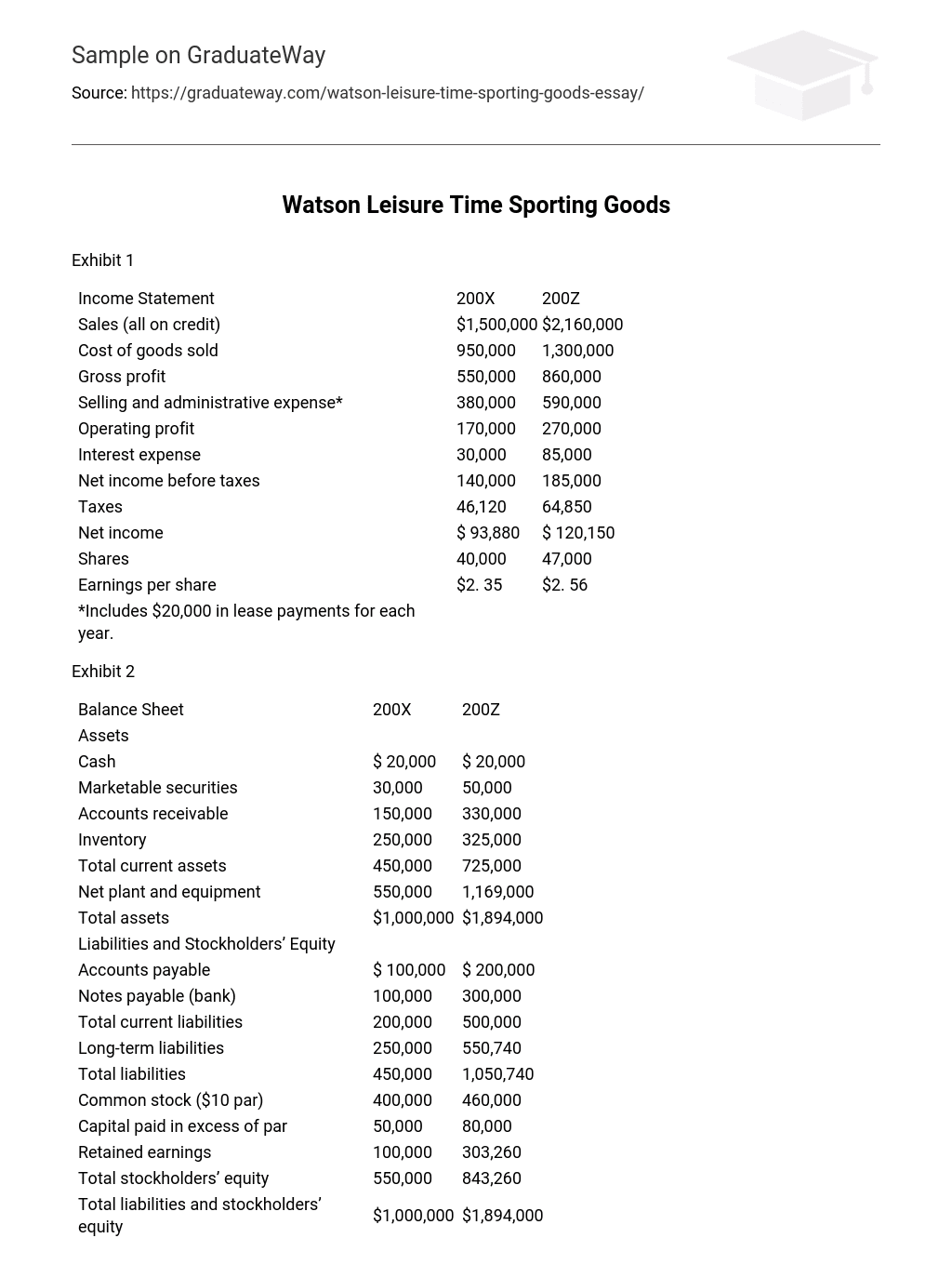

Exhibit 1

| Income Statement | 200X | 200Z | |

| Sales (all on credit) | $1,500,000 | $2,160,000 | |

| Cost of goods sold | 950,000 | 1,300,000 | |

| Gross profit | 550,000 | 860,000 | |

| Selling and administrative expense* | 380,000 | 590,000 | |

| Operating profit | 170,000 | 270,000 | |

| Interest expense | 30,000 | 85,000 | |

| Net income before taxes | 140,000 | 185,000 | |

| Taxes | 46,120 | 64,850 | |

| Net income | $ 93,880 | $ 120,150 | |

| Shares | 40,000 | 47,000 | |

| Earnings per share | $2. 35 | $2. 56 | |

| *Includes $20,000 in lease payments for each year. |

Exhibit 2

| Balance Sheet | 200X | 200Z | |||

| Assets | |||||

| Cash | $ 20,000 | $ 20,000 | |||

| Marketable securities | 30,000 | 50,000 | |||

| Accounts receivable | 150,000 | 330,000 | |||

| Inventory | 250,000 | 325,000 | |||

| Total current assets | 450,000 | 725,000 | |||

| Net plant and equipment | 550,000 | 1,169,000 | |||

| Total assets | $1,000,000 | $1,894,000 | |||

| Liabilities and Stockholders’ Equity | |||||

| Accounts payable | $ 100,000 | $ 200,000 | |||

| Notes payable (bank) | 100,000 | 300,000 | |||

| Total current liabilities | 200,000 | 500,000 | |||

| Long-term liabilities | 250,000 | 550,740 | |||

| Total liabilities | 450,000 | 1,050,740 | |||

| Common stock ($10 par) | 400,000 | 460,000 | |||

| Capital paid in excess of par | 50,000 | 80,000 | |||

| Retained earnings | 100,000 | 303,260 | |||

| Total stockholders’ equity | 550,000 | 843,260 | |||

| Total liabilities and stockholders’ equity | $1,000,000 | $1,894,000 |

Exhibit 3

| Selected Industry Ratios | 200X | 200Z | |||

| Growth in sales | — | 10. 02% | |||

| Profit margin | 5. 75% | 5. 81% | |||

| Return on assets (investment) | 8. 22% | 8. 48% | |||

| Return on equity | 13. 26% | 14. 16% | |||

| Receivable turnover | 10X | 10. 1X | |||

| Average collection period | 36 days | 35. 6 days | |||

| Inventory turnover | 5. 71X | 5. 84X | |||

| Fixed asset turnover | 2. 75X | 2. 20X | |||

| Total asset turnover | 1. 43X | 1. 46X | |||

| Current ratio | 2. 10X | 2. 15X | |||

| Quick ratio | 1. 05X | 1. 10X | |||

| Debt to total assets | 38% | 40. 1% | |||

| Times interest earned | 5. 00X | 5. 26X | |||

| Fixed-charge coverage | 3. 85X | 3. 97X | |||

| Growth in EPS | — | 9. % |

Exhibit 4

| Selected Industry Ratios | 200X | 200Z | ||

| Growth in sales | —- | 44% | ||

| Profit margin | 6. 3% | 5. 6% | ||

| Return on assets | 9. 4% | 6. 3% | ||

| Return on equity | 17% | 14. 2% | ||

| Receivable turnover | 10X | 6. 5X | ||

| Average collection period | 36 days | 55 days | ||

| Inventory turnover | 6X | 6. 6X | ||

| Fixed asset turnover | 3. 33X | 3X | ||

| Total asset turnover | 1. 5X | 1. 1X | ||

| Current ratio | 2. 25X | 1. 45X | ||

| Quick ratio | 1X | . 8X | ||

| Debt to total assets | 45% | 55. 5% | ||

| Times interest earned | 5. 7X | 3. 2X | ||

| Fixed-charge coverage | 3. 8X | 2. 8X | ||

| Growth in E. P. S. | —- | 8. 9% |

After comparing your calculations to the industry ratios presented in Exhibit 3, and after reviewing the ratio trends of Watson Leisure Time Sporting Goods, what comments and recommendations do you offer to Mr. Thomas? Financial ratio analysis is the calculation and comparison of ratios which are derived from the information in a company’s financial statements. The level and historical trends of these ratios can be used to make inferences about a company’s financial condition, its operations, and attractiveness as an investment. The financial analysis will consist of the 13 most significant ratios plus the growth in sales and E. P. S- [ (Block, Hirt, & Danielsen, 2009) ] After taking a really close look at the financial ratio analysis and comparing it to a similar firm in the industry here is the explanation to what it we have found. Watson Leisure Time Sporting Goods had a great increase in sales; their sales grew 44 percent from the previous year. When analyzing profitability ratios, we found that Watson Leisure Time Sporting Goods shows a higher return on the sales dollar (6. percent) than the industry average of 5. 75 percent the previous year; but on the current year the return on the sales dollar it’s actually lower (5. 6 percent) than the industry 5. 81 percent. Same with its return on assets (investment) of 9. 4 percent exceed 8. 22 percent of the industry in the previous year. In the current year its returns on assets is actually lower (6. 3 percent) compare to the industry 8. 4 percent. This is because the industry has a more rapid turnover of assets than generally found within the firm.

Compared to the industry this year, Watson Leisure Time Sporting Goods not only has earned less on each sale dollar but also their asset turnover is lower, but just looking at the firm’s ratios their key to satisfactory returns on total assets is a rapid turnover of assets this demonstrates efficient use of the assets on the balance sheet. Now with their return on equity, we see that previous and current year Watson Leisure Time Sporting Goods return on equity is higher than the industry. The current year the firm’s return on equity is 14. 2 percent, versus the industry’s 14. 16 percent.

The firm has been able to turn low return on sales (profit margin) into a good return on asset and a higher relative return on equity, with a high debt-to-assets ratio (. 44 percent) can sometimes indicate risks. Asset utilization ratios will show us why a firm can turn over its assets more rapidly than another. Watson Leisure Time Sporting Goods and the industry collected their receivables the same. I the current year there is a big difference, the industry collected their receivable faster 10. 1 time versus 6. 5 times for the firm and in daily terms by the average collection period of 35. days, which is 19. 4 days faster than the firm norm. The firm turns over its inventory the previous and current year faster than the industry. The previous year with 6 times and current year with 6. 6 times per year as of the industry average of 5. 71 times for their previous year and 5. 84 times for the current year. This shows that Watson Leisure Time Sporting Goods generates more sales per dollar of inventory than the average company in the industry; by this, we can tell the firm has efficient inventory-ordering and cost-control methods.

Now the firm maintains a higher ratio of sales to fixed assets than the industry for both previous and current years (3. 33 and 3 versus 2. 75 and 2. 20). Once again the firm’s slow turnover of total assets for the current year is indicated with a 1. 1 time for the firm versus 1. 46 times for the industry. Knowing the profitability and asset utilization for the firm what we need to analyze now is the liquidity of the firm. Watson Leisure Time Sporting Goods’ liquidity ratios fare well in comparison with the industry.

Now analyzing the firm’s debt utilization ratios compared to the industry’s shows that Watson Leisure Time Sporting Goods debt was being well managed for the previous year but totally different for the current year. The firm’s time interest earn obligation (5. 7 times versus 5 times) for the previous year shows the strength in the interest-paying ability of the firm, which lower for the current year (3. 2 times versus 5. 26 times). The firm’s ability to meet all fixed obligations rather than interest payments alone was the same for the previous year compared to the industry.

Again for the current year, the firm’s ability to meet all fixed obligations went down to 2. 8 times versus 3. 97 times for the industry.

The firm did very well the previous year, and it would have been a beneficial investment during that year’s vice this year. The firm’s profit margin is below average as well as their return on assets due to low total turnover. Their return on equity is good which means they have a high debt-to-assets ratio. Their current and quick ratio is below average and they have more debt than average industries. With their debt possibility becoming unmanageable could be a reason for their need for Mr.Thoma’s investment. With Mr. Thomas’s primary interest in profitability, I believe this will not be a good investment for him.

Capital Budgeting

Watson Leisure Time Sporting Goods has an opportunity, based on the improved operations they have accomplished over time, to invest in the purchase of new equipment that will be used over a six-year period for the amount of $320,000.

They have processed a capital budgeting analysis including the Net present value (NPV) method that determined if the investment was going to be beneficial for the business. The Net Present Value (NPV) is used in capital budgeting to analyze the profitability of an investment to the firm. By taking the total present value of outflows, this is the total value of the investment which is $320,000 and subtracting it to the present value of inflows, this is the cash the investment will bring which is $318,538.

The NPV of the investment for Watson Leisure Time Sporting Goods came out negative which means is not a good idea to make the investment. The NPV for the investment is -$1,462; based on this, investing $320,000 in new equipment will actually not bring enough profit to the business to cover the money that will be invested in the equipment.

References

- Block, S. B., Hirt, G. A., & Danielsen, B. R. (2009). Ratio analysis. In Foundations of Financial Management (pp. 55-66).

- McGraw-Hill. http://www.finpipe.com/equity/finratan.htm. (n. d. ). Retrieved July 23, 2009, from Financial Pipeline.