Imagine getting out of high school and being faced with the grim responsibility of havingto get a job. If you’re one of the fortunate, you have the option to continue your education andpostpone the reality of growing up. Now let’s assume you’ve found that so-called dream job,paying your dues with hard work and late nights, not to mention weekends and holidays.

Aftertwenty to thirty years you’re up for retirement and it sounds inviting. Now most employers offera retirement package that allows you to stop working and still bring home seventy percent of yourcurrent income. As stated, “Five Steps to a Great Retirement” (Money Magazine 1999), “Nomatter how far you are from retirement, you know that the alternative to work is no longernapping on the verandah. Back in the days when it was, financial advisers routinely said youcould retire comfortably on seventy percent your working income – figuring you were thirtypercent dead.

” So how much money will you need when you retire? In the following pages thereis some helpful information you will need to make the “Golden Years” truly golden. Education is the single most important tool in planing for your future, the earlier thebetter. This is a validity supported by the facts stated in the article “Saving is Fundamental”(Black Enterprise 1999). “As part of it’s 1999 “Time to Save Education” campaign, MerrillLynch polled 500 boys and girls, ages twelve to seventeen, about how they obtain, save and investtheir money.

The survey found that seventy percent of them currently have savings accounts (upfrom sixty five in 1998) and eleven percent own stock (vs. seven percent last year). Nearly onethird of the teens consulted parents or relatives for guidance. Fifty six percent (vs.

forty four in1998) of the students had taken a class on saving or investing.” The article also points out,“Despite the fact that teens who take such classes are more likely to manage their money wisely,the number of states offering personal finance, dwindled from fourteen in 1989 to only seven lastIt is essential that children take these classes. Sixty percent of high school students haveaccess to these personal finance programs but a meager twenty-one percent have signed up. Eventhough some schools offer these personal finance type classes, if you were to compare the kidswho haven’t taken the classes to those who have, you would discover that they have theinformation needed, yet their spending habits, are very similar.

Considering that nearly thirtypercent rely on credit card budgets, this could pose a problem. Considering that most of the cardholders carry a debt from month to month.”As a direct result, Arthur Levitt, Chairman of the Securities and Exchange Commission, is sendingregulators into classrooms nationwide to “Get students and young adults excited about saving fortomorrow.” Some find it hard to believe that one lecture from a expert will have any impact onthe kids today.

The kids want to learn but who is going to teach them? Hence, this is whereparents must education their children. What better way to teach your children then by example. We all know that kids learn more by doing rather than listening. Fortunately, there are some basicfundamentals you can teach your kids.

In “Kids and Money” (Money Magazine 1999), byfollowing these guidelines you can instill the skills so many Americans lack today. (1) “Set aregular payday.” An allowance should come the same day every week to help kids budget. (2)“A chance to earn more.

” Other than everyday chores to earn some extra money. (3) “Set up abank account.” Many banks still have low minimum-balance passbooks accounts which allowsyour kids to see the interest grow. (4) “Room to stumble.

” Kids need to learn that money isfinite. That is why, when they blow their budget, and they will, you need to be strong enough notIn the article named “Five steps to a Great Retirement” by Lisa Really Cullen, BeverlyGoodman, and Henry Weil (Money Magazine 1999). “There is helpful information from gettingstarted to withdrawing wisely. Let us take an overview of the suggested five steps involved inplanning your retirement.

Step one is to see where you stand. To figure out where you’re goingyou need to know where you are. It’s not always easy to keep track of your retirement stake,even if you collect account statements like your kids hoard Poke`mon cards. It makes sense toadd up your retirement assets once a year, no more, no less.

The markets are volatile and yourtotals can jump from week to week. But obsessing over every blip in the market could drive younuts. All that you need to know is that your on course.” The article goes on to explain, “First, round up the accounts clearly labeled for use in retirement namely, your4O1 or other employer sponsored options: Individual RetirementAccounts and any accounts for self-employed individuals, add the stocks, bonds and mutual fundsin accounts that aren’t tax protected but that you’ve earmarked for retirement.

”Furthermore the reading states, “Despite all the scary talk about the system goingbankrupt, you’ll probably get money from Social Security and perhaps from a traditional definedbenefit pension provided by your employer. To get an estimate of how much your pension will beworth, ask your benefice office if you haven’t received a mailing detailing your projected SocialSecurity benefit, request a copy of your personal earnings and benefits estimate from1(800)772-1213 or on the Internet at www.ssa.gov.

Finally, you’ll probably heard that fewerretirees are actually retiring these days according to the Bureau of Labor Statistics more than halfof men age sixty two still work last year.”“Step two: Set The Right Goal. Today the Bureau of Labor Statistics says that the moremoney you live on while you’re employed, the more you’re likely to spend when you retire. Onceyour free from the office, you’re likely to spend more than ever on entertainment, hobbies andtravel.

Obviously, no single formula for planning a retirement budget works for everyone. Financial advisors report that nearly all retirees need to revise their budgets twelve months afterthe quit work what they had anticipated. Your best bet in planning is to start by figuring thatyou’ll need today. Let’s say you want your money to last for twenty years, which is the averagelife expectancy at Sixty five.

If you keep earning an after tax return of seven percent on yourportfolio while you’re tapping it you can spend about nine percent of your initial stake every year. Step Three: Shape your strategy, the article goes on to say. You know where you are and whereyou’re trying to go. Now all you need to do is figure out is how to get there, for road maps, lookno further than the Internet.

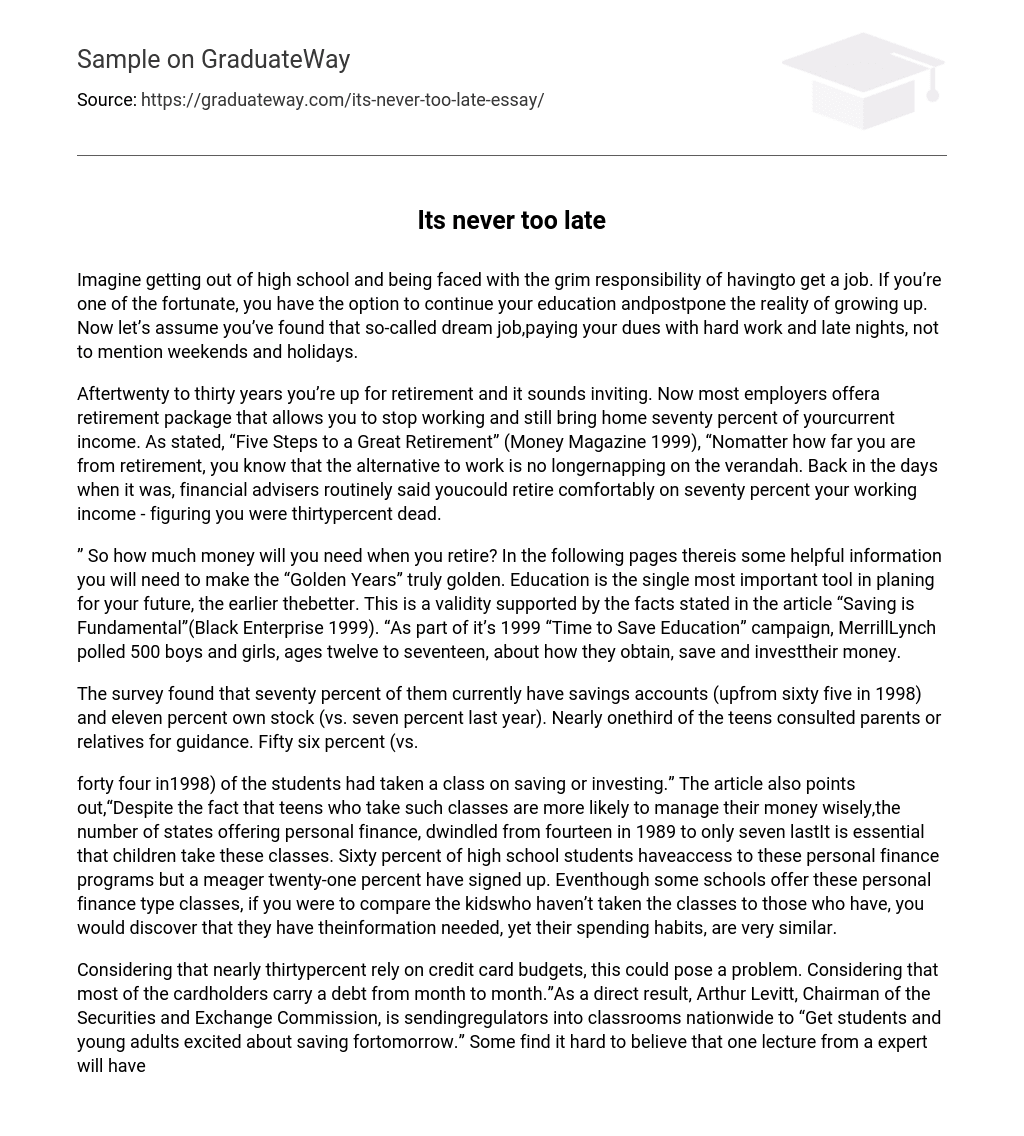

Thanks to some new, easy to use online tools, the task of devising aretirement strategy has become much easier. If “getting online” ranks just under “retirement planning” on your list of things to do before theNext Millennium, sweat not– real, live financial planners offer similar services, as do brokers and “One strategy used by many financial professionals use to help the average person fordeciding where to put your money to obtain the full earning potential is to use the “Rule ofThis rule states that you take the average return percentage of your investment and divide thatnumber into seventy two. This will give you the amount of years it will take for your money todouble. For example if the return of a $10,000 investment is at six percent, take that number anddivide it into seventy two, you would end up with twelve.

This means that every twelve years theinvestment will double to $20,000. At this rate, the initial investment will reach $80,000. Soundsgood doesn’t, not if you compare it to the return at twelve percent. Which will mean that theinvestment will double every six years.

Where the return after thirty six years is $640,000 on theinitial $10,000 investment.” (See Diagram Below) 72 DIVIDED BY THE INVESTMENT DOUBLING PERIOD = INVESTMENT DOUBLING PERIOD DOUBLING PERIOD YEARSDOUBLING PERIOD YEARSYR 0$10,000YR 0 $ 10,000 YR 12$ 20,000YR 6 $ 20,000YR 24$ 40,000YR 12$ 40,000YR 36$ 80,000YR 18$ 80,000 DIFFERENCE: $560,000 The article goes on to state that you must make your money work for you. “When itcomes to investing your retirement stash, you’ve often heard about the critical importance of assetallocation, the task of spreading your money among several different types of investments toincrease your returns and reduce your risks.” “Only stocks can give you the growth you need to stay ahead of inflation and taxes.

Andwhile stocks are subject to wild swings, most retirement investors have the time to ride outmarket downturns and reap the long-term rewards that equities promise.” The article goes on to say that the last step is to spend your money wisely. When possibleuse cash instead of credit. This will allow you to use your money to accumilate interest ratherTo finalize what I have written, retirement is something that is a must! When we reachage 65 we must have enough money to live comfortably on.

If we don’t, we will end up infinancial destitution. Parents need to begin to take control of their spending patterns so that theirkids will begin to learn the basic fundamentals of saving money. Once children begin to save theirmoney as they earn, they will create a pattern in their mind that will continue on for the rest oftheir lives. When these children have children they will instill in their minds the same philosophy,save money for retirement! One of the most interesting quotes to substantiate this claim comesform the book The Richest Man in Babylon.

It says “proper preparation is the key to oursuccess.” Another quote from this great novel says “a mans wealth is not in the purse he carries. A fat purse quickly empties if there is no golden stream to refill it.” People who work today anddo not make it a point to save for tomorrow are digging their own financial grave.

Suppose afamily makes a great deal of money and have a high consumption lifestyle and no savings, thehusband loses his job and now the family’s income is cut in half. Because the family hasn’t saved